Broker Information

FOREXFAIRS COMPANY LTD

Forexfairs

No Regulation

Platform registered country and region

Saint Vincent and the Grenadines

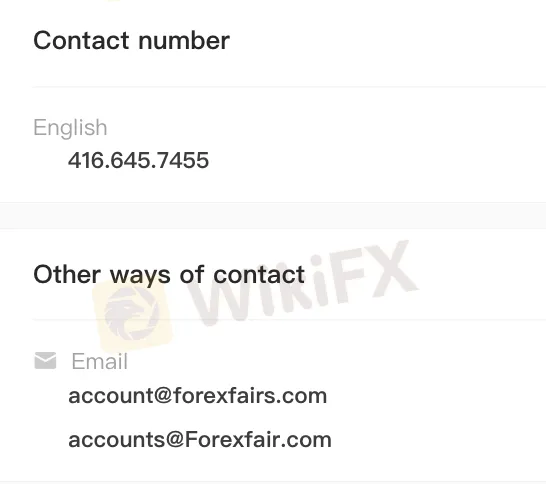

416.645.7455

--

--

--

--

--

--

--

--

--

account@forexfairs.com

accounts@Forexfair.com

Company Summary

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://www.forexfairs.com/

Website

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

| Aspect | Information |

| Company Name | Forexfairs |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2006 |

| Regulation | Unregulated |

| Market Instruments | Forex, commodities, index, cryptocurrencies |

| Account Types | Standard, Premium |

| Minimum Deposit | Standard: $250, Premium: $1,000 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 0.3 pips |

| Trading Platforms | MT4, MT5 |

| Customer Support | Contact number (416.645.7455) for English-speaking users. Email via account@forexfairs.com and accounts@Forexfair.com |

| Deposit & Withdrawal | Bank Transfers, Credit Cards, MasterCard, and E-wallets |

Founded in 2006 in Saint Vincent and the Grenadines, Forexfairs offers a platform with multiple payment methods, competitive spreads starting from 0.3 pips, and high leverage options up to 1:500. Operating without regulatory oversight, the platform poses potential risks for users, and reports of account freezing and unresponsive customer support raise dissatisfaction about service reliability.

Despite its extensive trading asset options and utilization of popular MT4 and MT5 platforms, the absence of regulatory backing and user-reported issues underscore the importance of careful consideration for traders evaluating Forexfairs.

Forexfairs operates without regulatory oversight, exposing users to potential risks. The absence of regulatory scrutiny means there are no established standards or safeguards, leaving traders vulnerable to fraudulent activities. Investors lack recourse mechanisms, and the platform lacks transparency and accountability.

The unregulated nature of Forexfairs heightens the likelihood of financial malpractices, making it imperative for users to consider alternative, regulated platforms for secure and transparent trading experiences.

| Pros | Cons |

| Multiple Payment Methods including Bank Transfers, Credit Cards, MasterCard, and E-wallets | Unregulated |

| Competitive Spreads starting from 0.3 pips | Reports of Account Freezing |

| Utilizes MT4 and MT5 trading platfom | Unresponsive Customer Support |

| High Leverage Options up to 1:500 | Delayed Issue Resolution |

| Lack educational resouces |

Pros:

Multiple Payment Methods:

Users can choose from various payment methods, including bank transfers, credit cards, MasterCard, and e-wallets, providing flexibility in funding their trading accounts.

2. Competitive Spreads starting from 0.3 pips:

Forexfairs offers competitive spreads, with starting points as low as 0.3 pips for major currency pairs. This can potentially contribute to cost-effective trading for users.

3. Utilizes MT4 and MT5 Trading Platform:

The platform employs the widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, offering a range of tools and features for efficient trading and analysis.

4. High Leverage Options up to 1:500:

Forexfairs provides users with the option of high leverage, allowing them to control larger positions with a relatively smaller amount of capital.

Cons:

Unregulated:

Forexfairs operates without regulatory oversight, exposing users to potential risks. The absence of regulation can impact user protection and financial security.

2. Reports of Account Freezing:

Users have reported instances of their accounts being frozen, indicating potential operational issues that disrupt the trading experience.

3. Unresponsive Customer Support:

Some users have experienced unresponsiveness from customer support channels, including chat, support tickets, and phone calls, leading to frustration and dissatisfaction.

4. Delayed Issue Resolution:

Complaints suggest a significant delay in addressing user complains, raising questions about the platform's ability to promptly resolve issues and support its user base.

5. Lack of Educational Resources:

The platform lacks comprehensive educational resources, potentially limiting the learning and skill development opportunities for traders. A lack of educational materials can hinder users in making informed trading decisions.

Forexfairs offers a range of tradable assets, serving traders with various interests and risk appetites.

Major Currency Pairs: Forexfairs provides access to the heavily traded majors like EUR/USD, USD/JPY, GBP/USD, and AUD/USD, allowing traders to capitalize on global economic trends and central bank decisions.

Minor Currency Pairs: For those seeking higher volatility and potentially unique trading opportunities, Forexfairs features a selection of minor currency pairs. Examples include EUR/NZD, GBP/CAD, and USD/SEK.

Exotic Currency Pairs: For experienced traders comfortable with higher risks, Forexfairs offers exotic currency pairs involving emerging market currencies like BRL/USD, TRY/USD, and ZAR/USD.

Precious Metals: Gold (XAU/USD) and Silver (XAG/USD) are available for trading, enabling investors to hedge against market volatility and diversify their portfolios.

Commodities: Forexfairs offers contracts for difference (CFDs) on popular commodities like Brent Crude Oil (USOIL) and Natural Gas (NATGAS). This allows traders to speculate on price movements without taking physical delivery of the underlying asset.

Indices: Major stock market indices like the S&P 500 (US500) and the Euro Stoxx 50 (EU50) are available for CFD trading, providing exposure to broad market movements.

Cryptocurrencies: Bitcoin (BTC/USD), Ethereum (ETH/USD), and other popular cryptocurrencies can be traded on the Forexfairs platform.

Forexfairs offers two distinct account types, namely Standard and Premium, each tailored to specific user preferences and trading styles.

The Standard account is suitable for traders seeking a straightforward approach. With a maximum leverage of up to 1:500, it provides ample flexibility for those comfortable with higher risk levels. The average spreads, such as EUR/USD at 0.7 pips, are competitive for users who prioritize cost-effective trading.

The minimum deposit requirement of $250 makes this account accessible for individuals starting with a modest capital. Additionally, the Standard account offers a 30-day demo period on the widely used MT4 and MT5 trading platforms, allowing users to familiarize themselves with the system.

On the other hand, the Premium account accommodates more seasoned traders with a minimum deposit of $1,000. It maintains the same leverage of up to 1:500 but distinguishes itself with significantly lower spreads, such as EUR/USD at 0.3 pips. This account type is suitable for traders who value tighter spreads and are willing to commit a higher initial investment.

The absence of commission on major pairs aligns with the preferences of traders looking to optimize their cost structure. Additionally, the Premium account comes with the benefit of an unlimited duration for the demo account, providing ample time for users to refine their strategies on the MT4 and MT5 platforms.

| Account Types | Standard | Premium |

| Leverage (Max) | Up to 1:500 | Up to 1:500 |

| Spreads (Avg.) | EUR/USD: 0.7 pips | EUR/USD: 0.3 pips |

| Commission | $0.05 per share, $1.50 minimum | No commission on major pairs |

| Minimum Deposit | $250 | $1,000 |

| Demo Account | Yes, 30 days | Yes, unlimited duration |

| Trading Platform | MT4, MT5 | MT4, MT5 |

Visit the Forexfairs Website:

Go to the official Forexfairs website using a secure web browser.

2. Registration:

Click on the “Sign Up” button to initiate the account creation process. Provide the required information, including your full name, email address, and a secure password.

3. Account Type Selection:

Choose between the available account types, such as Standard or Premium, based on your trading preferences and financial commitment.

4. Verification:

Complete the identity verification process by submitting the necessary documents, such as a government-issued ID and proof of address. This step is crucial for compliance with regulatory standards.

5. Deposit Funds:

After your account is verified, proceed to deposit funds into your trading account. Forexfairs typically specifies a minimum deposit requirement, and you can choose from various payment methods provided by the platform.

6. Access Trading Platform:

Once your account is funded, log in to the platform using the credentials you created during registration. You can now access the trading interface, choose your preferred assets, and start executing trades on the Forexfairs platform. Familiarize yourself with the available tools and features to make informed trading decisions.

Forexfairs offers a maximum leverage of up to 1:500 for both its Standard and Premium account types. This level of leverage allows traders to control a larger position size with a relatively smaller amount of capital. For example, with a 1:500 leverage, a trader could control a position valued at $50,000 with a margin requirement of only $100.

Forexfairs offers competitive spreads and commissions across its account types.

The Standard account features average spreads, such as EUR/USD at 0.7 pips, and a commission structure of $0.05 per share with a minimum of $1.50.

In contrast, the Premium account distinguishes itself with significantly lower spreads, for instance, EUR/USD at 0.3 pips, and it does not impose commissions on major pairs.

For traders prioritizing cost-effectiveness, the Standard account is suitable, as it provides a balance between reasonable spreads and a commission structure. The $0.05 per share commission, with a minimum of $1.50, appeal to those looking for a straightforward fee arrangement. This account type is accessible with a minimum deposit of $250, making it suitable for individuals starting with a modest capital.

Forexfairs utilizes the widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms to facilitate its trading services. Both platforms offer a comprehensive range of tools and features for traders. MT4 and MT5 provide a user-friendly interface, enabling traders to execute orders, analyze market data, and implement various trading strategies efficiently.

These platforms support a variety of order types, including market orders, limit orders, and stop orders, allowing users to implement various trading approaches. Traders can access real-time price quotes, historical data, and customizable charts for technical analysis. The availability of automated trading features, such as Expert Advisors (EAs), appeals to algorithmic traders seeking to automate their strategies.

Additionally, MT4 and MT5 offer a selection of technical indicators and charting tools to assist in market analysis. The platforms support mobile trading, allowing users to monitor and execute trades on-the-go through their smartphones.

Forexfairs provides users with a range of payment methods for deposits, including bank transfers, credit cards, MasterCard, and e-wallets.

Traders can opt for the convenience of bank transfers, allowing them to transfer funds directly from their bank accounts to their trading accounts. Credit card payments, including MasterCard, offer a quick and widely accepted method for depositing funds.

E-wallets provide an additional option for depositing funds into Forexfairs accounts. These electronic wallets offer a secure and efficient means of transferring money, appealing to users who prefer digital payment solutions. The availability of multiple payment methods aims to accommodate the various preferences of traders.

The minimum deposit requirement for Forexfairs varies based on the chosen account type. For example, the Standard account has a minimum deposit of $250, while the Premium account might require a higher initial investment, such as $1,000.

Forexfairs offers customer support through various channels, including a contact number (416.645.7455) for English-speaking users.

Additionally, users can reach out via email to account@forexfairs.comfor general inquiries andaccounts@Forexfair.com for account-related matters.

While the platform provides multiple contact options, the effectiveness of customer support is crucial for user satisfaction. Traders should consider the accessibility and responsiveness of these channels to ensure prompt assistance and issue resolution, enhancing their overall experience on the platform.

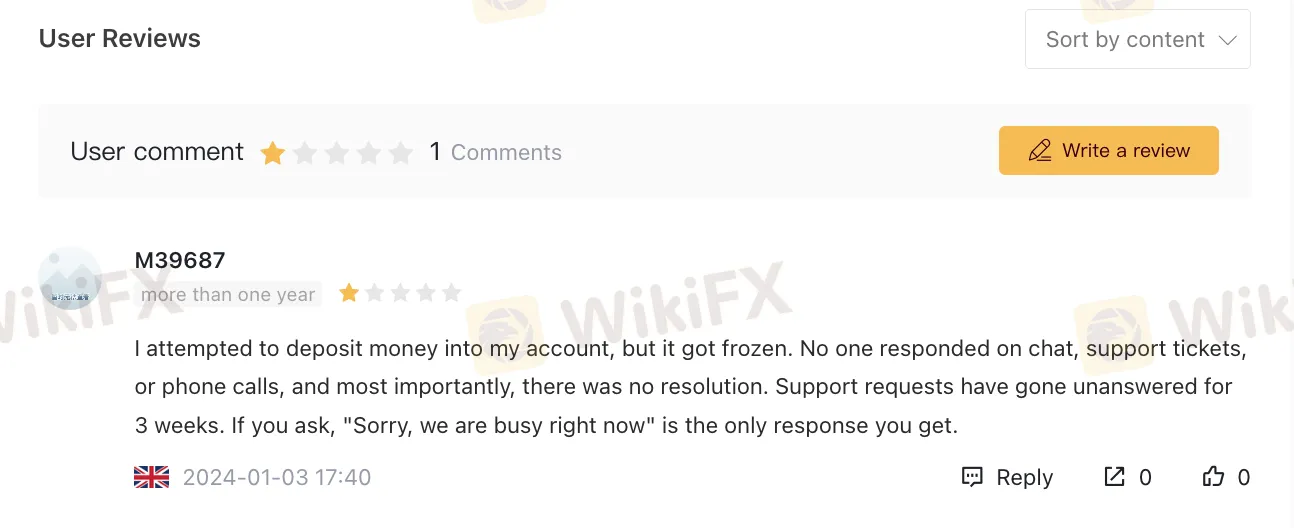

The user expressed dissatisfaction with their attempt to deposit money into their account on the platform, highlighting a significant issue of account freezing.

The user reported encountering unresponsiveness across various support channels, including chat, support tickets, and phone calls. The lack of resolution and unanswered support requests over a period of three weeks indicate a substantial delay in addressing user dissatisfaction. The response received, “Sorry, we are busy right now,” suggests a potential understaffing or service capacity issue.

Such a user experience can significantly impact the trading environment on the platform, creating frustration and eroding user confidence.

In conclusion, Forexfairs offers traders a wide range of trading assets, competitive spreads, and high leverage options through the widely-used MT4 and MT5 platforms.

However, the absence of regulatory oversight raises questions about user protection and financial security. Reports of account freezing and unresponsive customer support further highlight potential operational challenges, impacting the platform's reliability.

On the positive side, multiple payment methods provide flexibility for users, and the availability of different account types accommodate varying trading preferences. The high leverage options up to 1:500 can appeal to traders seeking increased control over their positions. Nevertheless, the platform's disadvantages, coupled with its unregulated status, emphasize the importance for traders to carefully assess the associated risks and consider alternative platforms with more robust regulatory frameworks.

Q: What is the minimum deposit required on Forexfairs?

A: The minimum deposit is $250 for the Standard account and $1,000 for the Premium account.

Q: Are there educational resources available on Forexfairs?

A: While the platform lacks comprehensive educational resources, traders can access various market instruments and utilize the MT4 and MT5 platforms.

Q: Is Forexfairs regulated?

A: No, Forexfairs operates without regulatory oversight, posing potential risks for users.

Q: What payment methods can I use on Forexfairs?

A: Forexfairs supports multiple payment methods, including bank transfers, credit cards, MasterCard, and e-wallets.

Q: What is the maximum leverage offered by Forexfairs?

A: Forexfairs provides a maximum leverage of up to 1:500 for both Standard and Premium accounts.

FOREXFAIRS COMPANY LTD

Forexfairs

No Regulation

Platform registered country and region

Saint Vincent and the Grenadines

416.645.7455

--

--

--

--

--

--

--

--

--

account@forexfairs.com

accounts@Forexfair.com

Company Summary

No comment yet

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now