Score

China Tonghai Securities

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://www.tonghaisec.com/index

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:Quam Securities Limited

License No. AAC577

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Hong Kong

Hong KongUsers who viewed China Tonghai Securities also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

oceanwsec.com

Server Location

Hong Kong

Website Domain Name

oceanwsec.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2017-07-05

Server IP

47.89.57.138

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Key Information | Details |

| Company Name | China Tonghai Securities |

| Years of Establishment | 15-20 years |

| Headquarters | Hong Kong |

| Office Locations | 5/F, Wing On Centre, 111 Connaught Road Central, Hong Kong |

| Regulation | SFC |

| Tradable Assets | Agricultural, Commodities, Energy, Forex, Indices, US Bonds |

| Deposit/Withdrawal Methods | N/A |

| Trading Platforms | SP Trader, QPlus |

| Customer Support | Email, Phone |

| Educational Content | Available |

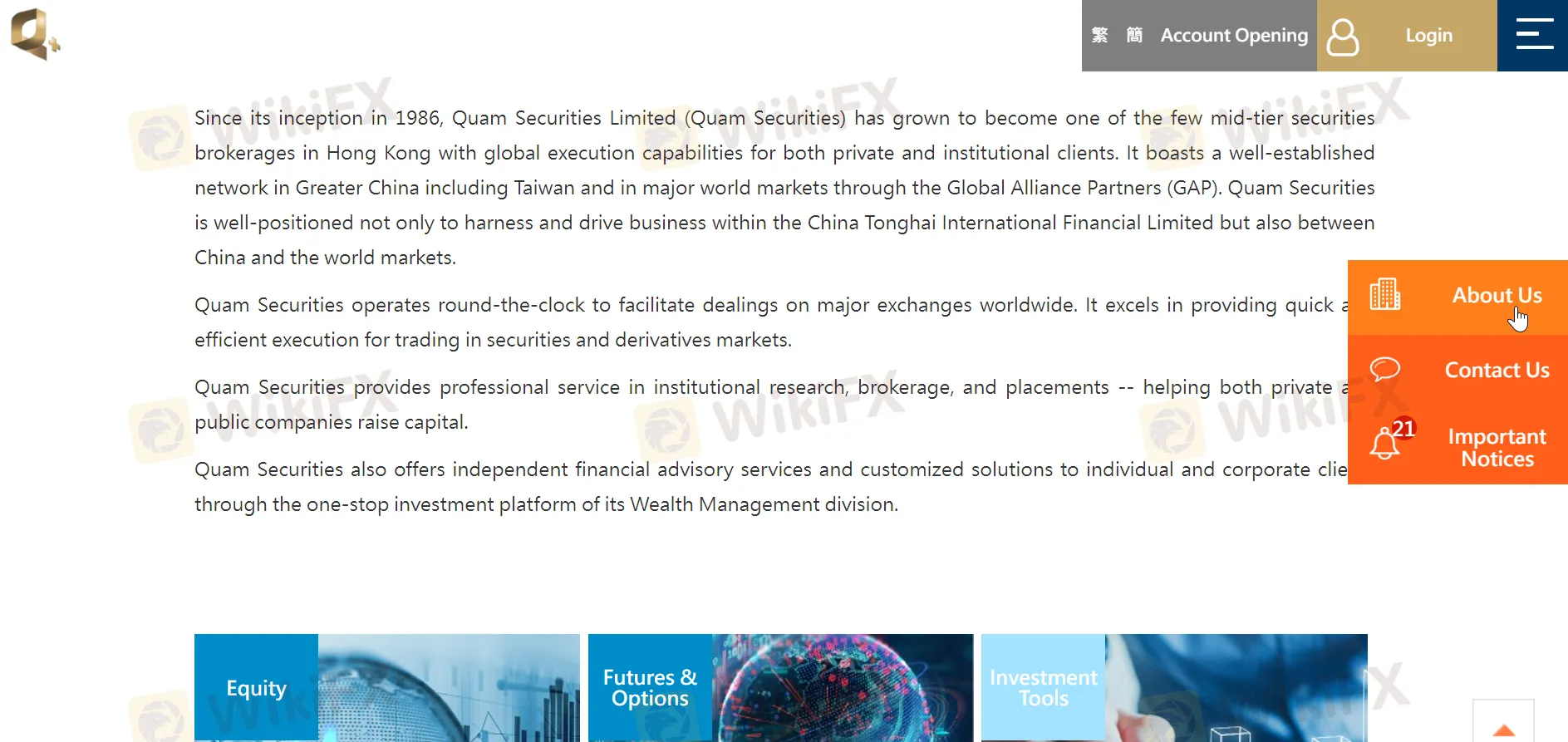

Overview of China Tonghai Securities

China Tonghai Securities is a brokerage company operating in Hong Kong for approximately 15-20 years. It is regulated by the Securities and Futures Commission of Hong Kong under the license type of dealing in futures contracts. The company offers trading services in various market instruments, including agricultural commodities, energy, forex, indices, and US bonds, through its trading platforms, SP Trader and QPlus.

China Tonghai Securities provides customer support through email and phone, including a Hong Kong hotline and a PRC toll-free hotline. They also offer educational content such as market newsletters and a trading date calendar. The company's investment tool guides aim to assist clients in making informed decisions, covering various aspects of the investment process. However, specific details regarding account types, minimum deposits, leverage, spread, and deposit/withdrawal methods are not available due to the appointment-based account creation process.

Regulation

China Tonghai Securities operates under the regulation of the Securities and Futures Commission of Hong Kong, which grants them the license to deal in futures contracts. The license number for this brokerage is AAC577. This specific license permits China Tonghai Securities to engage in trading futures contracts, allowing their clients access to various futures markets and instruments.

Dealing in futures contracts is a regulated license status that authorizes a brokerage to facilitate transactions in futures contracts on behalf of its clients. A futures contract is a standardized agreement to buy or sell a certain asset at a predetermined price and date in the future. The advantage of this regulation is that it enables the brokerage to offer its clients exposure to a wide range of futures markets, including agricultural commodities, energy, and financial indices. By obtaining this license, China Tonghai Securities can provide its customers with opportunities for potential profit and risk management through futures trading.

Pros and Cons

China Tonghai Securities is a brokerage firm that has been operating in Hong Kong for around 15-20 years, which comes with a level of implied professionalism from the duration of activity. They are regulated by the Securities and Futures Commission of Hong Kong, which grants them the license to deal in futures contracts. This enables them to provide their clients with access to various futures markets, including agricultural commodities, energy, forex, indices, and US bonds. The company offers trading services through their SP Trader and QPlus platforms, allowing clients to execute trades from two different platform, giving variety in the case of technical issues. Moreover, China Tonghai Securities offers customer support through email and phone, with dedicated hotlines for both Hong Kong and PRC clients. They also provide educational content, such as market newsletters and a trading date calendar, to help clients stay informed about market trends and opportunities. The appointment-based account creation process ensures a personalized approach for account setup.

One limitation of China Tonghai Securities is the lack of detailed information available about their account types, minimum deposit requirements, leverage ratios, spread, and deposit/withdrawal methods. This could be inconvenient for potential clients who prefer transparency regarding these important aspects before making an informed decision. Perhaps the biggest downside of China Tonghai Securities would be that in order to create an account, the individual is required to have a valid resdiency card for China and a passport, completely exluding foreign traders.

| Pros | Cons |

| Regulated | Limited information about account details |

| Various futures markets | Required Chinese Residency |

| Two different trading platforms | |

| Educational content available | |

| Personalized account setup |

Market Instruments

In summary, China Tonghai Securities provides a comprehensive selection of market instruments, including agricultural commodities, energy, forex, indices, and US bonds. The specifics are as follows:

Agricultural Commodities: China Tonghai Securities offers trading opportunities in various agricultural commodities, allowing investors to participate in the global agricultural markets. Clients can trade contracts related to essential crops such as Wheat, Corn, Soybean, Cocoa, Coffee, Cotton, and Rubber. These commodities are influenced by factors like weather conditions, supply and demand dynamics, geopolitical events, and government policies. Traders can take advantage of price fluctuations in these commodities to speculate or hedge their positions.

Precious Metal Commodities: The company provides access to a range of commodities beyond agricultural products. Clients can trade contracts linked to precious metals such as CNH Gold, USD Gold, Silver, and Platinum. Additionally, they can engage in transactions related to industrial commodities like Iron. Commodity trading can be attractive to investors seeking diversification and exposure to global economic trends and geopolitical developments.

Energy: China Tonghai Securities allows clients to trade energy contracts, including Crude Oil and Natural Gas. These energy commodities play a crucial role in global markets and are influenced by factors such as supply and demand dynamics, geopolitical tensions, and economic conditions. Energy trading offers investors the opportunity to speculate on price movements and manage risks related to energy prices.

Forex: Foreign exchange (Forex) trading is a significant component of China Tonghai Securities' offerings. Clients can participate in the world's largest financial market, trading major currency pairs and crosses. Forex trading involves buying one currency while simultaneously selling another, and its popularity stems from the high liquidity, 24-hour trading availability, and the potential for profit in both rising and falling markets.

Indices: The brokerage allows clients to trade contracts based on various indices, such as the CES China 120 Index, Micro E-mini Nasdaq-100, and HKD 50 x Index. Index trading allows investors to gain exposure to a basket of underlying assets, representing a specific sector, region, or market. It enables clients to speculate on broader market movements without the need to trade individual stocks.

US Bonds: China Tonghai Securities offers the opportunity to trade US Bonds, which are debt securities issued by the US government. These bonds are considered relatively safer investments and play an important role in the global financial system. Clients can participate in the bond market and potentially benefit from interest rate fluctuations and economic trends.

The following table compares China Tonghai Securities to competing brokerages, OctaFX, FXCC, Tickmill, and FxPro, in terms of available market instruments:

| Broker | Market Instruments |

| China Tonghai Securities | Agricultural Commodities, Commodities, Energy, Forex, Indices, US Bonds |

| OctaFX | Forex, Cryptocurrencies, Metals, Indices, Energies, Agriculture, and Shares |

| FXCC | Forex, Indices, Commodities, and Metals |

| Tickmill | Forex, Indices, Commodities, Bonds, and Cryptocurrencies |

| FxPro | Forex, Shares, Indices, Futures, Metals, Energies, and Cryptocurrencies |

Account Types

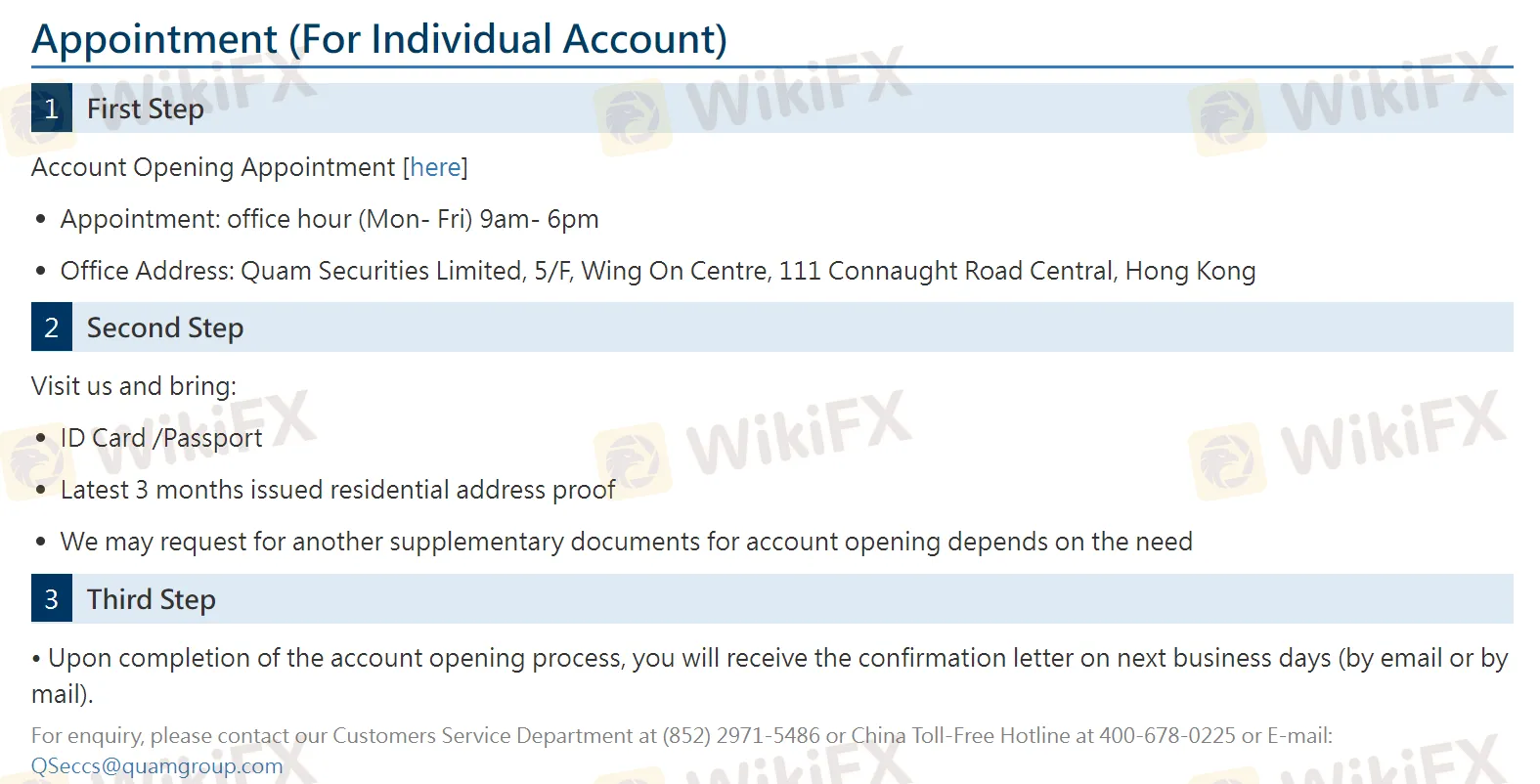

China Tonghai Securities offers Individual Account creation through appointments. The appointment-based account creation process allows for personalized attention and tailored solutions to clients' needs. It ensures that each client receives individualized assistance and guidance during the account setup process, potentially leading to a more customized trading experience.

However, the lack of searchable account types and the requirement for Hong Kong residency may be inconvenient for clients who prefer to compare account options and features easily or who are located outside Hong Kong. It can result in a less transparent and more limited approach to account access for international traders.

How to open an account?

Navigate to the “Account Opening” at the top right side of the Home Page.

As the appointment guidance states, open time during the open office hours of 9am-6pm (Monday-Friday) to visit the office, prepare an ID/Passport, and Residential Address proof.

Next, fill out the Account Appointment information in order to start contact with an agent to begin the process.

Lastly, create an appointment and continue on to create an account with a China Tonghai Securities agent.

Trading Platforms

China Tonghai Securities provides clients with two trading platforms, SP Trader, and QPlus.

SP Trader: China Tonghai Securities offers the SP Trader platform, designed to cater to traders seeking efficient and reliable execution. This platform provides access to a variety of market instruments, including agricultural commodities, energy, forex, indices, and US bonds. It allows for real-time market data, advanced charting tools, and a user-friendly interface. Traders can access multiple order types and monitor market trends.

QPlus: The QPlus platform provided by China Tonghai Securities is another trading option for clients. With QPlus, traders can access a diverse range of market instruments, similar to the offerings on the SP Trader platform. This platform offers features such as real-time data, comprehensive charting tools, and order execution capabilities.

The following table compares China Tonghai Securities to competing brokerages, OctaFX, FXCC, Tickmill, and FxPro, in terms of available trading platforms:

| Broker | Trading Platforms |

| China Tonghai Securities | SP Trader, QPlus |

| OctaFX | MetaTrader 4, MetaTrader 5, cTrader, OctaFX Trading App |

| FXCC | MetaTrader 4, Mobile Trader |

| Tickmill | MetaTrader 4, WebTrader, Mobile Trader |

| FxPro | MetaTrader 4, MetaTrader 5, cTrader, FxPro Edge, FxPro Markets |

Customer Support

China Tonghai Securities offers email and phone support as its primary customer service channels. Specifics are as follows:

Email Support: Clients can reach China Tonghai Securities' customer support through email using the address CTScs@tonghaifinancial.com. This option allows for written communication, enabling clients to address inquiries and receive responses in a timely manner.

Phone Support: The company provides phone support through two hotlines. Clients based in Hong Kong can contact the Hong Kong hotline at +852 2847-2203, while those in the PRC can use the toll-free hotline at 400-678-0225. Phone support offers direct communication with customer service representatives for real-time assistance and query resolution.

Educational Resources

China Tonghai Securities provides educational content in the form of a market newsletter, a trading date calendar, and investment tool guides.

Market Newsletter: China Tonghai Securities offers a market newsletter to its clients, providing regular updates and insights on market trends, economic developments, and potential trading opportunities. This educational content keeps traders informed about the latest market movements and events that may impact their trading decisions.

Trading Date Calendar: The company provides a trading date calendar, which serves as a tool for traders to keep track of important events and economic indicators that could influence market volatility. This educational content helps traders plan their trading strategies and be aware of potential market-moving events.

Investment Tool Guides: China Tonghai Securities offers investment tool guides covering various aspects of the investment process. These guides may provide information on trading techniques, risk management strategies, and market analysis methods, assisting traders in making informed decisions.

Conclusion

In conclusion, China Tonghai Securities is a regulated brokerage offering a range of market instruments, including agricultural commodities, energy, forex, indices, and US bonds, enabling traders to access various global markets through their SP Trader and QPlus platforms. Moreover, their educational content, such as market newsletters, trading date calendars, and investment tool guides, empowers traders with insights and knowledge to make informed decisions.

While the appointment-based account creation process ensures personalized attention and tailored solutions, the lack of searchable account types and specific regulatory advantages may require potential clients to engage directly with customer support for detailed information. Overall, China Tonghai Securities presents itself as a regulated brokerage with a commitment to providing clients with a comprehensive trading experience and educational resources to support their investment journey.

FAQs

Q: What is China Tonghai Securities' main regulatory status?

A: The company is regulated by the Securities and Futures Commission of Hong Kong.

Q: How long has China Tonghai Securities been in operation?

A: The brokerage has been operating for approximately 15-20 years.

Q: What are the available trading platforms offered by the company?

A: China Tonghai Securities provides two trading platforms: SP Trader and QPlus.

Q: What types of market instruments can clients trade with the company?

A: Clients can trade agricultural commodities, energy, forex, indices, and US bonds.

Q: How can clients reach customer support at China Tonghai Securities?

A: Customer support can be reached through email and phone with dedicated hotlines.

Q: What educational content does the company offer to traders?

A: China Tonghai Securities provides market newsletters, trading date calendars, and investment tool guides.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now