Overview of Foxi

Established in the Cayman Islands in 2023, Foxi offers traders a diverse range of trading assets, spanning Forex, Precious Metals, Energies, and Indices. Despite being a relatively new entrant, Foxi stands out with competitive spreads, a variety of account types, and a user-friendly trading platform called FOXITrader.

However, the regulatory designation as a “Suspicious Clone” by the Financial Conduct Authority (FCA) introduces significant implications for traders on the Foxi platform. The FCA's classification serves as a red flag, urging traders to exercise due diligence, evaluate potential risks, and scrutinize the legitimacy of the platform before engaging in financial activities on Foxi.

Is Foxi legit or a scam?

Foxi, identified as a “Suspicious Clone” by the Financial Conduct Authority (FCA) in the United Kingdom, operates with a payment license. The FCA, as a reputable regulatory authority, plays a crucial role in ensuring the fair and secure operation of financial entities within its jurisdiction. The label of “Suspicious Clone” suggests that Foxi may be attempting to replicate the identity of a legitimate financial institution, possibly engaging in activities that warrant suspicion.

For traders on the Foxi platform, the regulatory status as a “Suspicious Clone” by the FCA can have profound implications. It signals potential risks and uncertainties about the platform's adherence to regulatory standards, potentially jeopardizing the security of traders' funds and transactions. Traders are likely to approach Foxi with increased caution, given the regulatory skepticism surrounding its operations. The FCA's designation serves as a warning for traders to exercise due diligence, consider the potential risks involved, and assess the legitimacy of the platform before engaging in financial activities on Foxi.

Pros and Cons

Pros:

Variety of Trading Assets: Foxi offers a diverse range of trading assets across Forex, Precious Metals, Energies, and Indices, providing traders with multiple options to diversify their portfolios.

2. Diverse Account Types: The platform offers various account types, namely VIP 2, VIP 1, and Standard. This allows users to choose an account that aligns with their trading goals and risk tolerance.

3. User-Friendly Trading Platform: FOXITrader provides a user-friendly interface, making it accessible for both novice and experienced traders. The platform's design and features aim to enhance the overall trading experience.

4. Multiple Payment Methods: Foxi supports various payment methods, including credit cards, e-wallets, and SEPA transfer, offering flexibility for users to fund their accounts based on their preferences and geographic location.

5. Competitive Spreads and Commissions: The platform provides competitive spreads and commissions across different account types, allowing traders to manage their trading costs efficiently.

6. Maximum Leverage: Foxi offers a maximum leverage of up to 1:500 for all account types, providing traders with the opportunity to amplify their positions. Higher leverage can potentially lead to increased profits.

Cons:

Regulatory Designation as a “Suspicious Clone” by FCA: The platform's regulatory classification as a “Suspicious Clone” by the Financial Conduct Authority (FCA) poses significant challenges to its legitimacy and adherence to financial regulations. This could undermine the trust and confidence of potential users.

User Exposure Challenges: Instances of withdrawal difficulties and allegations of fraud in user exposure reports underscore potential operational issues within the platform. Traders may encounter obstacles in withdrawing funds, impacting their overall trading experience.

Legitimacy Issues: Doubts have been raised regarding the legitimacy and reliability of Foxi as a trading platform. These legitimacy issues have implications for the platform's credibility in the eyes of users.

Market Instruments

Foxi offers an extensive array of trading options with over 500+ instruments spread across four main categories:

Forex: Immerse yourself in a diverse selection of major, minor, and exotic currency pairs, totaling over 70 options. Whether you are a seasoned trader or just starting, Foxi provides a variety of pairings to suit your preferences.

Indices: Navigate the market with a broad range of global and regional indices, exceeding 50 options. From well-established giants like the S&P 500 to regional indices such as the Nikkei 225.

Commodities: Craving dynamic market movements? Foxi presents a menu featuring energy commodities like crude oil and natural gas, as well as precious metals like gold and silver, totaling over 30 options. Spice up your portfolio with agricultural commodities like coffee and corn.

Stocks: Indulge in individual companies with access to stocks from major global exchanges, offering over 400 options. Whether you're a tech enthusiast or a value investor, Foxi provides a diverse selection to match your stock preferences.

Account Types

Foxi offers three distinct account types, each tailored to meet the varying needs and preferences of traders.

The VIP 2 account is designed for seasoned traders or those with a higher level of experience and financial commitment. With a substantial minimum deposit requirement of $20,000, traders opting for VIP 2 can benefit from the maximum leverage of up to 1:500, providing a significant potential for capital amplification. The minimum spread is impressively tight, starting from 0.1, offering favorable trading conditions. Additionally, the VIP 2 account supports Expert Advisors (EAs), enabling automated trading strategies.

The VIP 1 account is suitable for traders with a moderate level of experience and a willingness to commit a reasonable initial deposit of $5,000. This account type shares the same maximum leverage of up to 1:500 as the VIP 2 account, providing ample trading flexibility. While the minimum spread is slightly wider, starting from 0.6, it still offers competitive conditions. Like the VIP 2 account, VIP 1 supports Expert Advisors, allowing for automated trading strategies.

For entry-level or more conservative traders, the Standard account provides an accessible option with a lower minimum deposit requirement of $500. The maximum leverage remains up to 1:500, offering flexibility to traders with varying risk appetites. The minimum spread is wider, starting from 1.4, but it still provides reasonable conditions for those who prioritize lower initial investment. Similar to the VIP accounts, the Standard account supports Expert Advisors, allowing traders to utilize automated trading strategies based on their preferences and expertise.

How to Open an Account?

Opening an account with Foxi is a straightforward process. Here are the concrete steps you can follow:

Visit the Official Foxi Website:

Navigate to the official Foxi website using your web browser.

2. Locate the “Register” Button:

3. Fill Out the Registration Form:

Click on the registration button, and you will be directed to a registration form.

Provide accurate personal information, including your full name, contact details, and address.

Create a secure password for your account.

4. Select Your Preferred Account Type:

Foxi offers different account types such as VIP 2, VIP 1, and Standard.

Choose the account type that aligns with your trading experience and preferences.

5. Verify Your Identity:

After completing the registration, you may be required to verify your identity.

Follow Foxi's instructions for document submission, which may include a government-issued ID (passport, driver's license) and proof of address (utility bill, bank statement).

6. Fund Your Account:

Log in to your newly created Foxi account.

Navigate to the “Deposit” or “Fund Your Account” section.

Choose your preferred deposit method (bank transfer, credit card, e-wallet) and follow the instructions to transfer funds.

Ensure that you meet the minimum initial deposit requirement based on your chosen account type.

Once these steps are completed, you should have a verified and funded Foxi trading account, ready to explore the diverse range of trading instruments and features offered by the platform.

Leverage

Foxi offers a maximum leverage of up to 1:500, allowing traders to control positions with a nominal value up to 500 times the amount of their deposited capital.

This high leverage can amplify both potential profits and risks in trading. Traders should carefully consider their risk tolerance and use leverage responsibly, as it can significantly impact the dynamics of their trades. While higher leverage offers the potential for increased returns, it also magnifies the potential for losses.

Spreads & Commissions

Foxi provides competitive spreads and commissions across its different account types. The spreads represent the difference between the buy and sell prices and play a crucial role in the overall cost of trading.

In the VIP 2 account, traders can benefit from exceptionally low spreads, starting from as low as 0.1 pips. This account type is designed for more advanced traders or those who prioritize tight spreads and are willing to commit a higher initial deposit of $20,000. The lower spreads in the VIP 2 account contribute to a potentially more cost-effective trading experience.

Moving to the VIP 1 account, the spreads remain competitive, starting from 0.6 pips. While slightly higher than the VIP 2 account, the VIP 1 account offers a more accessible entry point with a minimum deposit requirement of $5,000. This makes it suitable for traders seeking a balance between cost-effective trading conditions and a lower initial investment commitment.

For the Standard account, the spreads begin from 1.4 pips. This account type is geared towards entry-level traders or those who prefer a more relaxed approach to trading. With a minimum deposit requirement of $500, the Standard account offers a cost-effective solution for traders with smaller budgets.

In terms of commissions, Foxi charges $6 per lot traded for both the VIP 2 and VIP 1 accounts. The Standard account, on the other hand, incurs a slightly higher commission of $10 per lot. Traders should consider their trading preferences, experience level, and budget when choosing an account type. The VIP accounts with lower spreads and a lower commission per lot may be more suitable for experienced traders, while the Standard account provides a cost-effective option for those starting in the trading world with a smaller initial investment.

Trading Platform

FOXI provides a comprehensive trading experience with its FOXITrader, accessible on both mobile and PC platforms.

The availability of a mobile app for iOS and Android allows traders to stay connected and execute trades on the go, providing flexibility and convenience. The platform boasts cutting-edge features tailored for advanced analytics, ensuring that users have access to sophisticated tools to make informed trading decisions.

One notable feature of FOXITrader is its advanced charts, providing traders with the same charting tools available on the web and desktop versions. This consistency allows for a seamless transition between different devices, promoting a unified trading experience. Additionally, FOXI integrates a news feed directly into the platform, offering daily updates on financial news and analytical articles. This feature not only keeps traders informed but also provides inspiration for new trading strategies based on the latest market developments.

FOXITrader includes an economic calendar that is instantly updated and accessible directly through the mobile app. This feature enables users to stay abreast of crucial economic events that may impact their trading positions.

Furthermore, FOXI incorporates market sentiment analysis, allowing traders to gauge the direction of the market by observing the most bought and sold instruments on a daily basis.

FOXI also provide scanning tools, including heatmaps for both stocks and forex, a comprehensive stock scanner, sentiment analysis, and top movers lists. These tools empower traders with insights into market trends and opportunities. The platform also offers free daily updates on relevant trading news and ready-made technical analysis, providing support for traders who may be uncertain about their trading choices.

For traders who appreciate data-driven insights, FOXITrader provides visualized trading statistics, offering information on average trade duration, profitable trades sequence, and more. This emphasis on analytics allows users to measure and evaluate key aspects of their trading performance. The platform further supports technical analysis with over 500 available instruments.

Deposit & Withdrawal

Foxi provides a variety of payment methods to facilitate deposits, offering flexibility to users based on their geographic location. Traders can fund their accounts conveniently using credit cards, e-wallets, or SEPA transfers.

In terms of the minimum deposit requirement, Foxi adopts an inclusive approach, allowing traders to get started with a relatively modest investment.

The minimum deposit for the VIP 2 account stands at $20,000, providing an option for traders seeking a higher-tier account with potentially enhanced features and benefits. The VIP 1 account requires a minimum deposit of $5,000, offering a middle-ground choice, while the Standard account allows entry with a minimum deposit of $500, making it accessible to a broader range of traders with varying risk appetites and financial capacities.

Customer Support

FOXI offers customer support through multiple channels.

For email inquiries, users can reach out to support@foximarkets.com, ensuring prompt and detailed responses to their queries.

Additionally, for direct assistance, FOXI provides a phone contact at +66983332853, offering a convenient avenue for immediate support.

The inclusion of a physical address, located on Sukhumvit Road in Bangkok, Thailand (Phra Khanong, Khlong Toei, Bangkok 10110), adds transparency and establishes a tangible connection with users.

Educational Resources

Foxi provides educational resources through its blog, offering traders a platform to access valuable insights and information related to the financial markets. The blog covers a range of topics, including market analysis, trading strategies, and updates on economic events. While the educational content is primarily delivered through the blog, it serves as a resource hub for traders looking to enhance their knowledge and stay informed about market developments.

Traders can benefit from the blog's content by gaining insights into different trading approaches, understanding market trends, and staying updated on relevant news that may impact their trading decisions. The blog, although limited in its format, contributes to the overall educational support provided by Foxi, assisting traders in making more informed and strategic decisions in their trading journey.

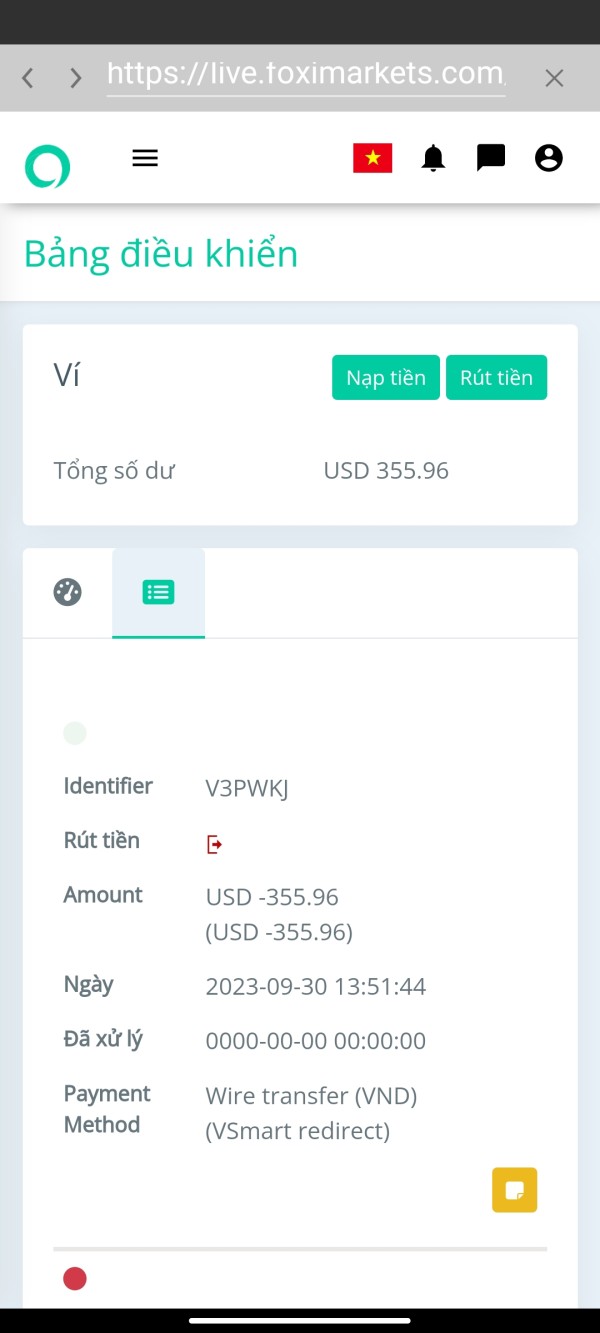

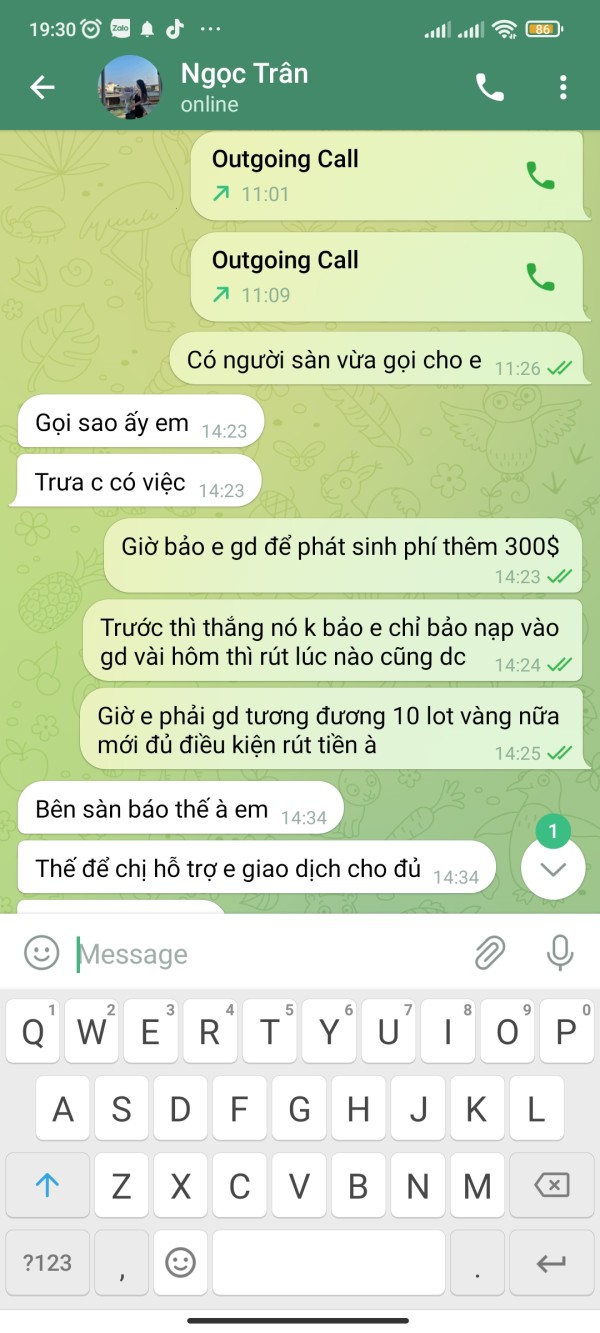

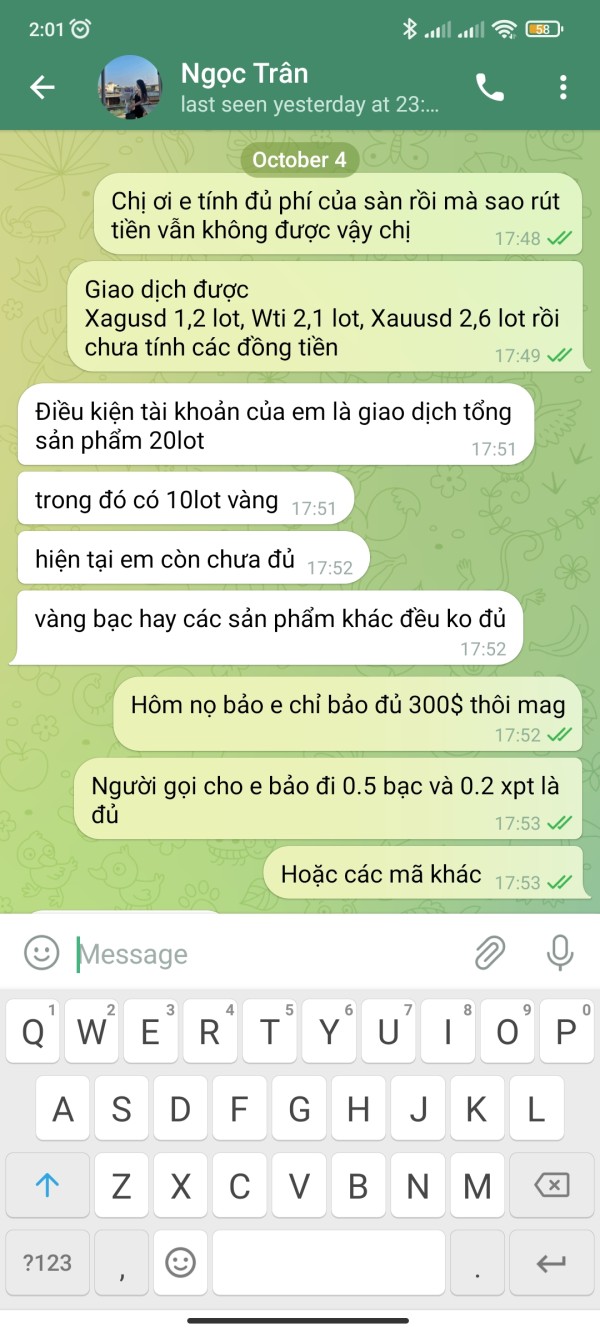

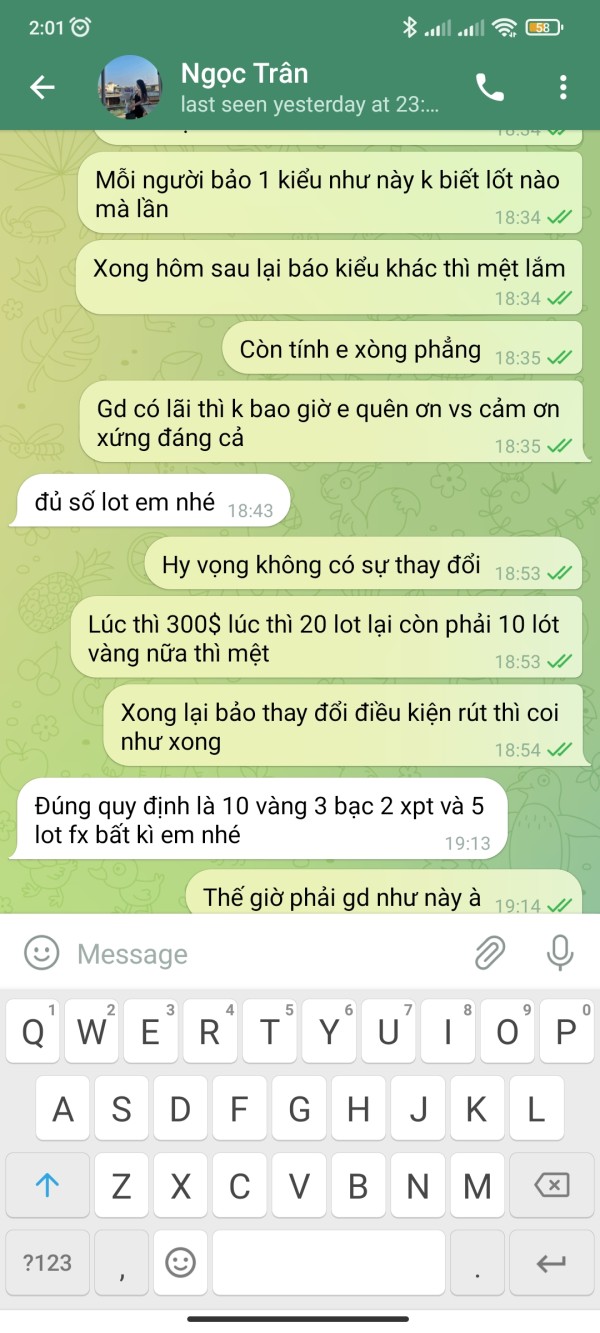

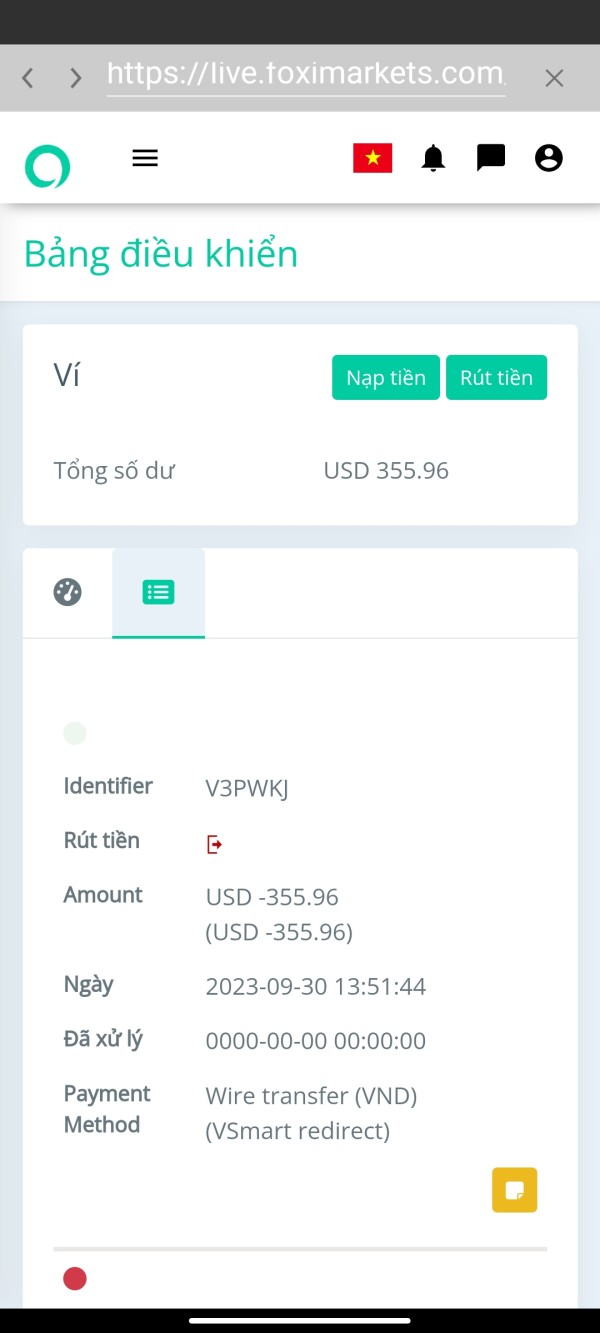

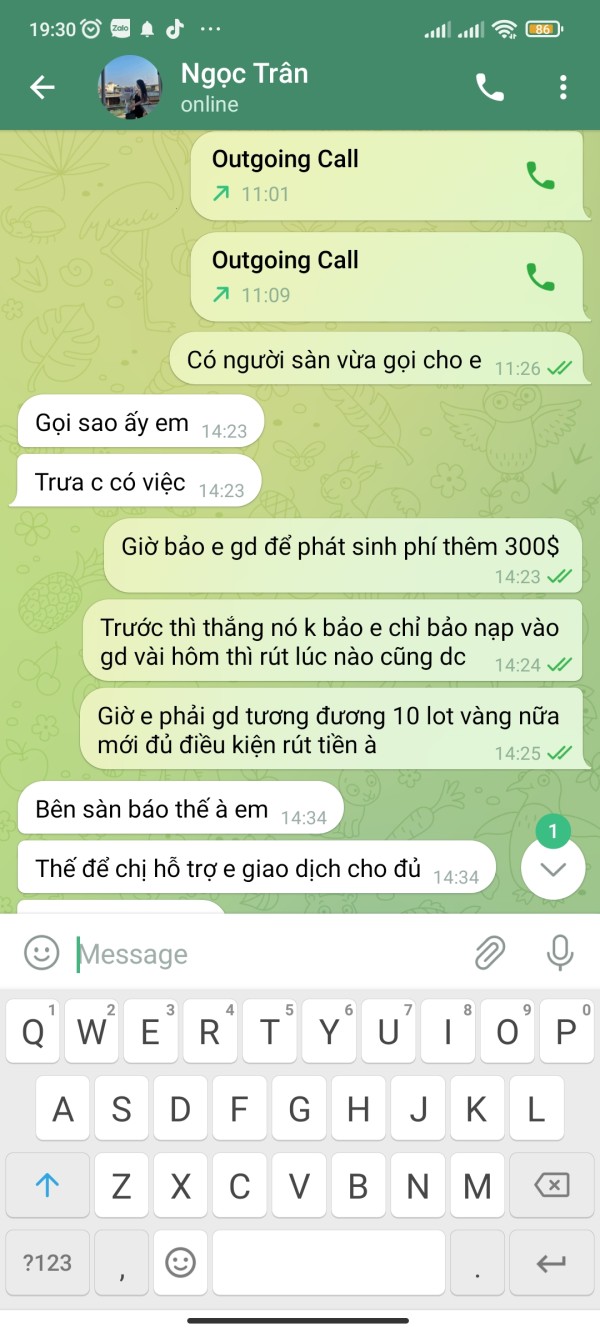

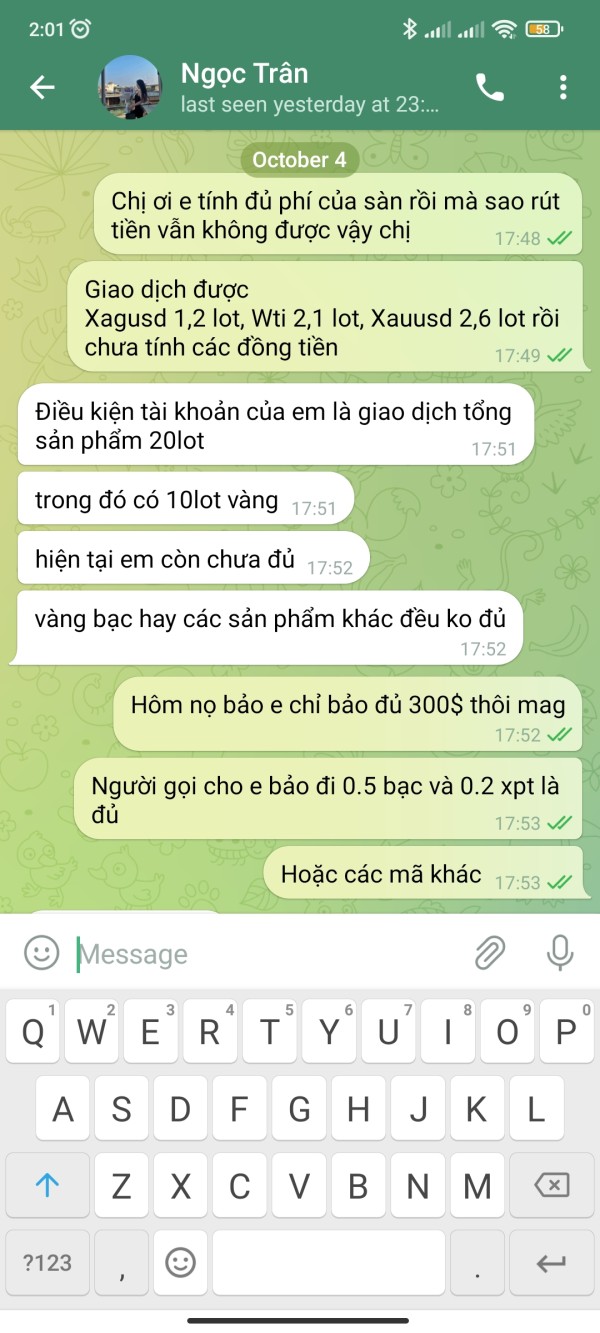

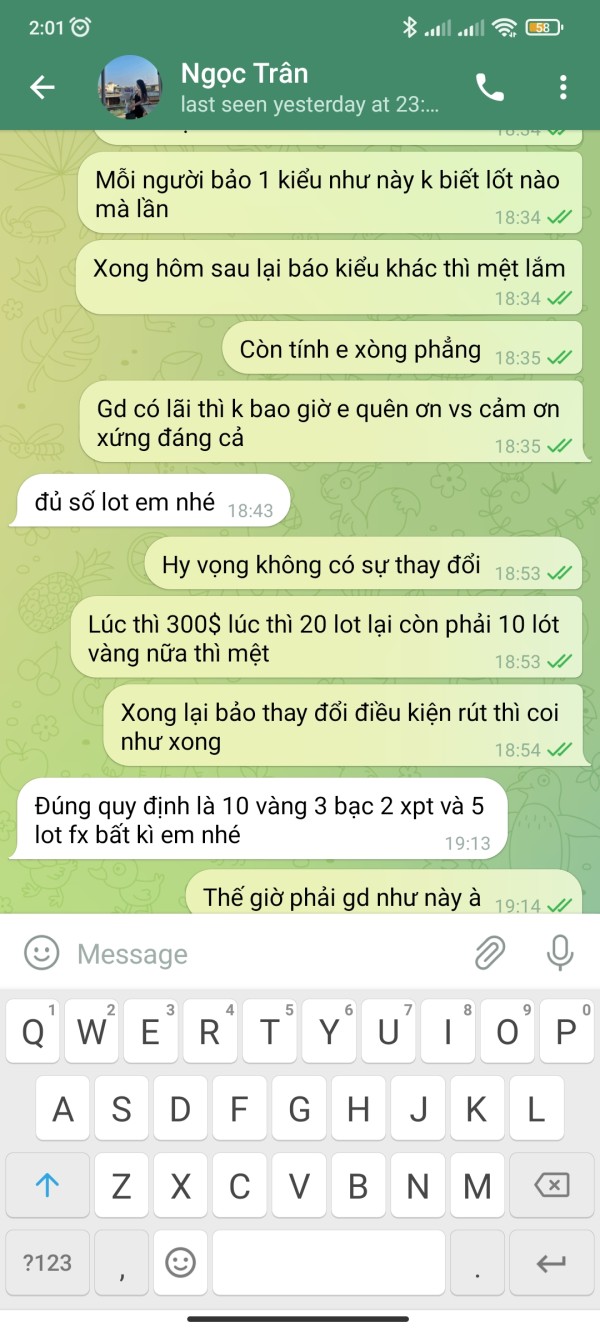

Exposure

Foxi has faced exposure issues, including reported complaints related to a pyramid scheme and withdrawal difficulties. Users have voiced frustration, raising questions about the platform's legitimacy and ethical practices.

One complaint revolves around allegations of a pyramid scheme, indicating deceptive practices that may impact the overall trustworthiness of the platform. Another user exposure incident involves challenges with withdrawing funds, where withdrawal orders are reportedly pending for an extended period. Traders have encountered difficulties in the withdrawal process, experiencing changing conditions and requirements, including the completion of specific trading lots.

Conclusion

In conclusion, Foxi offers a diverse trading experience with a broad range of assets, including Forex, Precious Metals, Energies, and Indices. Its strengths lie in providing a user-friendly platform, FOXITrader, with advanced analytics, competitive spreads, and a variety of account types. Multiple payment methods further enhance accessibility.

However, challenges emerge, primarily concerning legitimacy, stemming from its regulatory classification as a “Suspicious Clone” by the Financial Conduct Authority (FCA).

While the platform's maximum leverage of up to 1:500 can be appealing, especially for experienced traders, user exposure reports, including withdrawal difficulties and fraud accusations, cast a shadow on Foxi's reliability. Traders should exercise caution and conduct thorough research before engaging in financial activities on this platform. The disadvantages underscore the importance of vigilance in navigating the potentially risky landscape presented by Foxi, emphasizing the need for transparency and enhanced regulatory clarity to instill confidence among traders.

FAQs

Q: What trading assets does Foxi offer?

A: Foxi provides a diverse range, including Forex, Precious Metals, Energies, and Indices.

Q: What are the advantages of Foxi?

A: Foxi offers competitive spreads, diverse account types, and a user-friendly trading platform, FOXITrader.

Q: Is Foxi regulated?

A: No, Foxi has a regulatory status as a “Suspicious Clone” by the Financial Conduct Authority (FCA).

Q: What is the minimum deposit for a Foxi account?

A: Minimum deposits vary by account type, ranging from $500 to $20,000.

Q: Does Foxi support automated trading?

A: Yes, all account types, including VIP 1, VIP 2, and Standard, support Expert Advisors (EAs).

Q: What is the maximum leverage on Foxi?

A: The maximum leverage for all account types on Foxi is up to 1:500.