Overview of TRADE.COM

TRADE.COM, headquartered in Cyprus and established in 2018, operates as a regulated brokerage firm under the oversight of multiple financial authorities, including CySEC, FCA, and FSCA. The platform offers a diverse array of market instruments, spanning Forex, stocks, commodities, cryptocurrencies, indices, and ETFs. Traders can choose from four account types—SILVER, GOLD, PLATINUM, and EXCLUSIVE—each with varying minimum deposit requirements tailored to different trading preferences. With a maximum leverage of 1:400, traders can amplify their positions, while spreads vary depending on the account type and asset, starting from as low as 0.3 pips for Gold in the EXCLUSIVE account.

TRADE.COM provides access to three trading platforms: WebTrader, MetaTrader 5 (MT5), and MT5 for macOS, ensuring flexibility and convenience for traders across different devices. The platform's customer support is accessible via email, WhatsApp, and live chat on the website during specific hours, while deposit and withdrawal processes incur no fees and offer various payment methods. Additionally, TRADE.COM equips traders with educational resources such as an Economic Calendar, Trading View, Trading Central, and WebTrader App FAQ, enhancing their trading knowledge and capabilities.

Pros and Cons

Pros:

Regulation: TRADE.COM is regulated by prominent financial authorities including CySEC, FCA, and FSCA. This regulatory oversight ensures that the platform adheres to stringent standards, providing traders with a level of trust and security.

Diverse Market Instruments: The platform offers a wide range of market instruments, including Forex, stocks, commodities, cryptocurrencies, indices, and ETFs. This diversity allows traders to access various markets and diversify their investment portfolios according to their preferences and risk tolerance.

Multiple Account Types: TRADE.COM offers multiple account types tailored to different trader preferences and experience levels. This variety enables traders to choose an account type that aligns with their trading goals, whether they are beginners or experienced investors.

Competitive Spreads and Commissions: The platform provides competitive spreads and commission structures, allowing traders to potentially maximize their profits while minimizing trading costs. This can be advantageous for traders looking to optimize their trading strategies and profitability.

Transparent Fee Structure: TRADE.COM maintains a transparent fee structure, with no deposit or withdrawal fees. This transparency ensures that traders are aware of all costs associated with their trading activities, allowing for better financial planning and decision-making.

Cons:

Suspicious Clone Status: TRADE.COM has a “Suspicious Clone” status under the FCA and FSCA regulatory bodies. While this doesn't necessarily mean the platform is fraudulent, it raises concerns about its authorization or identity, potentially impacting trader confidence.

Limited Availability of Account Types: Compared to some competitors, TRADE.COM offers a limited selection of account types. While it provides options for different trader preferences, some traders prefer more variety in account offerings to better suit their specific needs.

High Minimum Deposit Requirements: Certain account types on TRADE.COM have high minimum deposit requirements, which be prohibitive for traders with smaller initial investment amounts. This could limit accessibility for some traders who are unable or unwilling to meet the minimum deposit thresholds.

Limited Customer Support Availability: While TRADE.COM offers various channels for customer support, including email, WhatsApp, and live chat, the availability of support is limited to specific hours. This inconvenience traders who require assistance outside of the designated support hours.

Limited Leverage Options: TRADE.COM offers a maximum leverage of 1:400, which be considered relatively limited compared to some other platforms that provide higher leverage options. Traders who prefer higher leverage for their trading activities find the options on TRADE.COM to be restrictive.

Regulatory Status

TRADE.COM is regulated by multiple financial authorities, ensuring compliance with stringent regulatory standards to safeguard the interests of traders.

Firstly, it is regulated by the Cyprus Securities and Exchange Commission (CySEC), as evidenced by its license number 227/14. This regulation under CySEC signifies that TRADE.COM operates as a Market Maker (MM), adhering to regulatory guidelines set forth by the Republic of Cyprus.

Additionally, TRADE.COM holds a license from the Financial Conduct Authority (FCA) in the United Kingdom, with license number 738538. However, it's important to note that the current status under the FCA is labeled as “Suspicious Clone,” indicating potential concerns regarding its authorization or identity.

Similarly, TRADE.COM holds a license from the Financial Sector Conduct Authority (FSCA) in South Africa, with license number 47857. However, like the FCA, its current status under the FSCA is also labeled as “Suspicious Clone.”

Market Instruments

TRADE.COM offers a comprehensive selection of investment products designed to satisfy the diverse needs of investors. Their asset selection encompasses a wide range of financial instruments, ensuring opportunities for both seasoned traders and novices alike.

In the realm of Forex, they provide access to the world's most liquid market, empowering traders to engage in currency exchange with ease and efficiency. For those inclined towards equities, TRADE.COM offers stock CFDs, enabling investors to trade their favorite company stocks with flexibility and convenience.

Additionally, the platform extends its reach to commodities, covering energy, metals, and both soft and hard commodities, allowing traders to diversify their portfolios across various markets. Embracing the rise of cryptocurrencies, TRADE.COM facilitates trading with digital assets, providing opportunities to capitalize on the burgeoning crypto market.

Moreover, investors can explore global indices representing major economic regions, offering insights into broader market trends and opportunities for portfolio diversification. With over 30 ETFs available on their WebTrader platform, TRADE.COM further enhances its offering, providing investors with access to a diverse array of exchange-traded funds for comprehensive investment strategies.

Through their extensive asset selection, TRADE.COM empowers investors to navigate the financial markets with confidence and flexibility.

Account Types

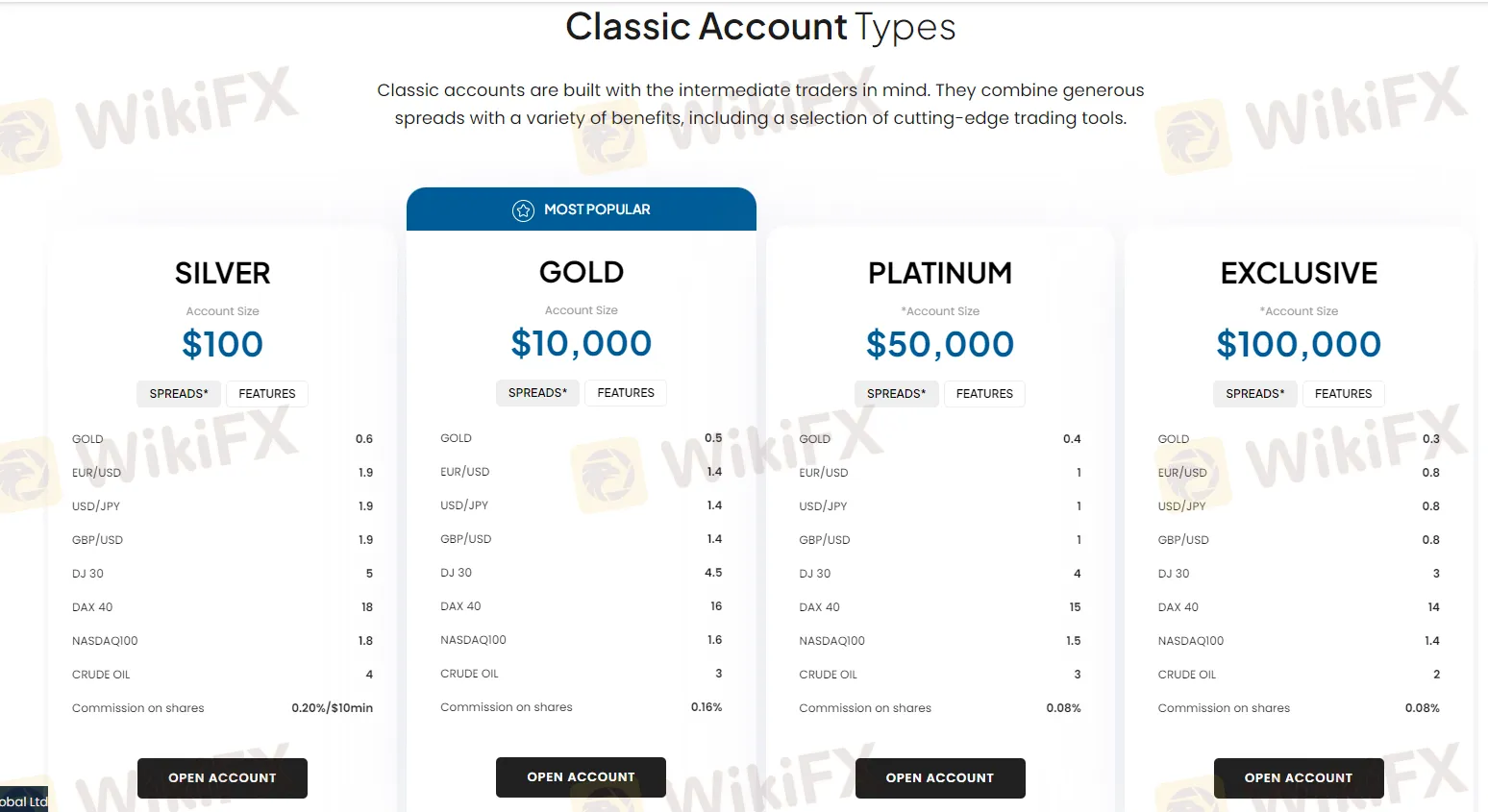

TRADE.COM offers a range of classic account types tailored to intermediate traders, blending competitive spreads with an array of benefits and sophisticated trading tools.

The SILVER account, designed for traders starting with a modest investment of $100, provides access to generous spreads, enabling traders to execute trades with flexibility. Featuring spreads such as 0.6 pips on Gold, 1.9 pips on EUR/USD, USD/JPY, and GBP/USD, along with competitive figures on indices like DJ 30, DAX 40, and NASDAQ 100, this account offers a solid foundation for traders seeking to explore the financial markets. Additionally, with a commission structure of 0.20% per share with a minimum of $10, traders can engage in share trading with ease.

Moving up the ladder, the GOLD account satifies traders with a more substantial investment, starting at $10,000. This account type enhances trading conditions with tighter spreads, enabling traders to capitalize on market movements with greater precision. With spreads as low as 0.5 pips on Gold and 1.4 pips on major currency pairs like EUR/USD, USD/JPY, and GBP/USD, along with competitive figures on indices and commodities, the GOLD account provides a stepping stone for traders looking to elevate their trading strategies. Moreover, with a reduced commission structure of 0.16% on shares, this account type offers enhanced affordability and potential for profit maximization.

For traders seeking premium trading conditions, the PLATINUM account presents an attractive option, requiring an account size of $50,000. This elite account type delivers unparalleled trading benefits, featuring razor-thin spreads and a comprehensive suite of trading tools. With spreads starting at 0.4 pips on Gold and 1 pip on major currency pairs, along with highly competitive figures on indices and commodities, the PLATINUM account empowers traders with superior execution and precision. Furthermore, with a commission structure of 0.08% on shares, traders can optimize their trading strategies while minimizing costs, making this account ideal for experienced traders and investors.

For the most discerning traders seeking the pinnacle of trading excellence, the EXCLUSIVE account sets the standard, requiring a minimum account size of $100,000. This prestigious account type offers unmatched trading conditions, featuring ultra-tight spreads and premium trading tools designed to elevate the trading experience. With spreads starting at a mere 0.3 pips on Gold and 0.8 pips on major currency pairs, along with highly competitive figures on indices and commodities, the EXCLUSIVE account provides unparalleled access to the financial markets. Additionally, with a commission structure of 0.08% on shares, traders can execute their strategies with maximum efficiency and precision, cementing their position at the forefront of the trading landscape.

How to Open an Account?

Opening an account with TRADE.COM is a straightforward process, and here are the concrete steps to guide you through:

Visit the TRADE.COM Website: Navigate to the official TRADE.COM website (https://cfd.trade.com/en/global/) using your preferred web browser.

Click on the “Open Account” Button: Look for the “Open Account” button prominently displayed on the homepage or in the navigation menu, and click on it to begin the account opening process.

Select Account Type: Choose the account type that best suits your trading needs and financial goals. Options include SILVER, GOLD, PLATINUM, or EXCLUSIVE accounts. Click on the respective option to proceed.

Fill Out Personal Information: Complete the registration form with accurate personal details, including your full name, email address, phone number, and residential address. Ensure all information is entered correctly to expedite the verification process.

Verify Identity: As part of the account opening process, you be required to verify your identity and residency. This typically involves providing a copy of your government-issued ID (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement). Follow the instructions provided by TRADE.COM to submit the necessary documents securely.

Review and Agree to Terms and Conditions: Carefully review TRADE.COM's terms and conditions, privacy policy, and any other relevant legal agreements. Make sure you understand and agree to all the terms before proceeding.

Fund Your Account: Once your account has been successfully verified, it's time to fund it. TRADE.COM typically offers various payment methods, including bank wire transfer, credit/debit cards, and online payment platforms. Choose your preferred payment method and follow the instructions to deposit funds into your trading account.

Download Trading Platform (Optional): If you prefer to trade using a downloadable platform, TRADE.COM provide a trading software that you can download and install on your computer or mobile device. Follow the instructions on the website to download and set up the trading platform.

Start Trading: With your account funded and verified, you're now ready to start trading! Log in to your account using the credentials provided during registration, and begin exploring the available trading instruments, placing trades, and managing your portfolio.

Spreads & Commissions

TRADE.COM offers a diverse range of classic account types tailored to various trader preferences, each accompanied by competitive spreads and commission structures.

The SILVER account, designed for traders starting with a modest investment of $100, offers flexibility with spreads as low as 0.6 pips on Gold and a commission structure of 0.20% per share with a minimum of $10. Moving up, the GOLD account satisfies traders with a $10,000 investment, providing tighter spreads starting at 0.5 pips on Gold and a reduced commission of 0.16%. For traders seeking premium conditions, the PLATINUM account, requiring a $50,000 investment, offers even tighter spreads starting at 0.4 pips on Gold and a commission of 0.08% on shares. Finally, the EXCLUSIVE account, with a minimum investment of $100,000, presents ultra-tight spreads starting at 0.3 pips on Gold and maintains a commission structure of 0.08% on shares.

Below is a table summarizing the spreads and commissions for each account type:

Leverage

TRADE.COM offers varying maximum leverage levels depending on the financial instrument and regulatory requirements. Leverage allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and losses. However, it's important to note that higher leverage also entails higher risk.

The maximum leverage available at TRADE.COM typically ranges from 1:20 to 1:400, depending on the asset class. For example, major currency pairs in the Forex market offer higher leverage, often up to 1:400, allowing traders to magnify their positions significantly. Meanwhile, leverage for other assets such as stocks, indices, commo

Trading Platform

TRADE.COM offers a versatile and comprehensive trading platform designed to satify the diverse needs of traders across all experience levels.

Their WebTrader platform represents the latest generation of online trading, boasting compatibility with mobile devices and featuring over 2,100 assets for traders to explore. With built-in tools and intuitive functionality, WebTrader provides a trading experience accessible from any internet-connected device.

For those seeking more advanced features, TRADE.COM offers MetaTrader 5 (MT5), an advanced charting platform that serves as the next evolution in multi-asset CFD trading. MT5 is renowned for its speed, efficiency, and user-friendly interface, making it suitable for beginners, advanced traders, and even institutional investors. With superior charting capabilities, a robust strategy tester, and innovative features like market depth, MT5 empowers traders to gain deeper insights into the markets and execute trades with precision. Additionally, the platform supports auto trading through the new MQL5 language and offers access to an extensive range of order types, providing traders with unparalleled flexibility and control over their trading strategies.

For Mac users, MT5 for macOS allowing traders to download, install, and run the platform effortlessly on their devices. With TRADE.COM's cutting-edge trading platforms, traders can access the financial markets with confidence, convenience, and sophistication.

Deposit & Withdrawal

TRADE.COM offers a variety of convenient payment methods to accommodate the diverse needs of its users. These methods include traditional options such as bank wire transfers and credit/debit card payments, providing a familiar and reliable way to fund trading accounts. Additionally, TRADE.COM supports online payment platforms for instant deposits, allowing traders to fund their accounts efficiently.

TRADE.COM provides a transparent and straightforward payment system with various methods available for deposits and withdrawals, coupled with clear fee structures.

Overnight charges, also known as swap fees, are applied to positions left open overnight. Conversion fees are levied in situations where the account currency differs from the quoted currency of the traded asset, encompassing profit/loss, overnight rollover (swaps), CFD rollover, dividend conversion, and split conversion, all at a rate of 2%. An inactivity fee is imposed if no trading activity occurs for over 90 days, with a monthly charge of $50 for inactive accounts exceeding 12 months.

However, TRADE.COM does not impose any deposit or withdrawal fees, covering all related costs for its users. Furthermore, the platform does not apply additional charges such as live price data feeds or account documentation fees. This transparent fee structure ensures that traders can focus on their trading strategies without unexpected charges impacting their profitability.

Customer Support

TRADE.COM offers accessible and responsive customer support to assist traders with any inquiries or issues they encounter. The support team can be reached via email at support@trade.com, with availability from Sunday 22:00 until Friday 22:00 GMT. This provides traders with the convenience of reaching out via email during specified hours for assistance with account-related queries, technical issues, or general inquiries. Additionally, traders can engage with the support team directly through WhatsApp, offering another convenient channel for communication. By starting a chat via WhatsApp, traders can receive real-time assistance and guidance from the support team. .

Furthermore, TRADE.COM provides an option to start a chat directly on their website, allowing traders to quickly connect with support representatives for immediate assistance. With multiple avenues for contacting customer support and responsive service during specified hours, TRADE.COM ensures that traders have access to the assistance they need to navigate the platform and optimize their trading experience.

Educational Resources

TRADE.COM provides an array of educational resources to empower traders with the knowledge and tools necessary for informed decision-making.

The Economic Calendar serves as a vital resource, offering insights into key economic events and their potential impact on the financial markets. This calendar allows traders to stay informed about important announcements such as interest rate decisions, GDP releases, and employment reports, helping them anticipate market movements and adjust their trading strategies accordingly.

Trading View offers comprehensive charting tools and technical analysis resources, enabling traders to visualize market trends and identify potential trading opportunities with precision. Additionally, Trading Central provides expert market analysis and research, offering valuable insights and actionable trading ideas to traders of all levels.

Lastly, the WebTrader App FAQ section serves as a valuable resource for users of TRADE.COM's WebTrader platform, providing answers to frequently asked questions and offering guidance on platform navigation and functionality. These educational resources collectively empower traders with the knowledge and tools needed to navigate the financial markets confidently and effectively.

Conclusion

In conclusion, TRADE.COM presents a reputable platform regulated by prominent financial authorities, offering traders a diverse array of market instruments and competitive spreads. While its transparent fee structure and multiple account types satisfy various trader preferences, concerns over its “Suspicious Clone” status under the FCA and FSCA deter some potential users.

Additionally, high minimum deposit requirements and limited leverage options could pose challenges for traders with smaller capital or those seeking higher leverage ratios. Despite these drawbacks, TRADE.COM's commitment to regulatory compliance, transparent fees, and extensive market offerings make it a compelling option for traders looking for a regulated brokerage with a wide range of trading opportunities.

FAQs

Q: What regulatory authorities oversee TRADE.COM?

A: TRADE.COM is regulated by multiple financial authorities, including CySEC, FCA, and FSCA, ensuring compliance with strict regulatory standards to protect traders' interests.

Q: What account types does TRADE.COM offer?

A: TRADE.COM provides traders with a choice of four account types—SILVER, GOLD, PLATINUM, and EXCLUSIVE.

Q: Are there any fees associated with deposits and withdrawals on TRADE.COM?

A: No, TRADE.COM does not impose any deposit or withdrawal fees, covering all related costs for its users and providing a transparent fee structure without unexpected charges impacting profitability.

Q: How can I contact customer support on TRADE.COM?

A: You can reach TRADE.COM's customer support team via email at support@trade.com during specified hours, through WhatsApp for real-time assistance, or by starting a chat directly on their website.

Q: What educational resources are available on TRADE.COM?

A: TRADE.COM offers various educational resources to empower traders, including an Economic Calendar, Trading View, Trading Central, and a WebTrader App FAQ section.

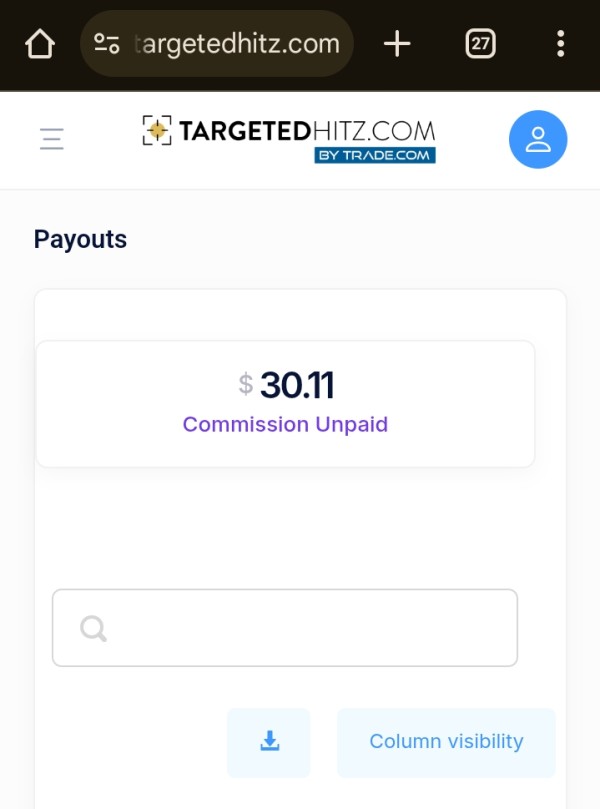

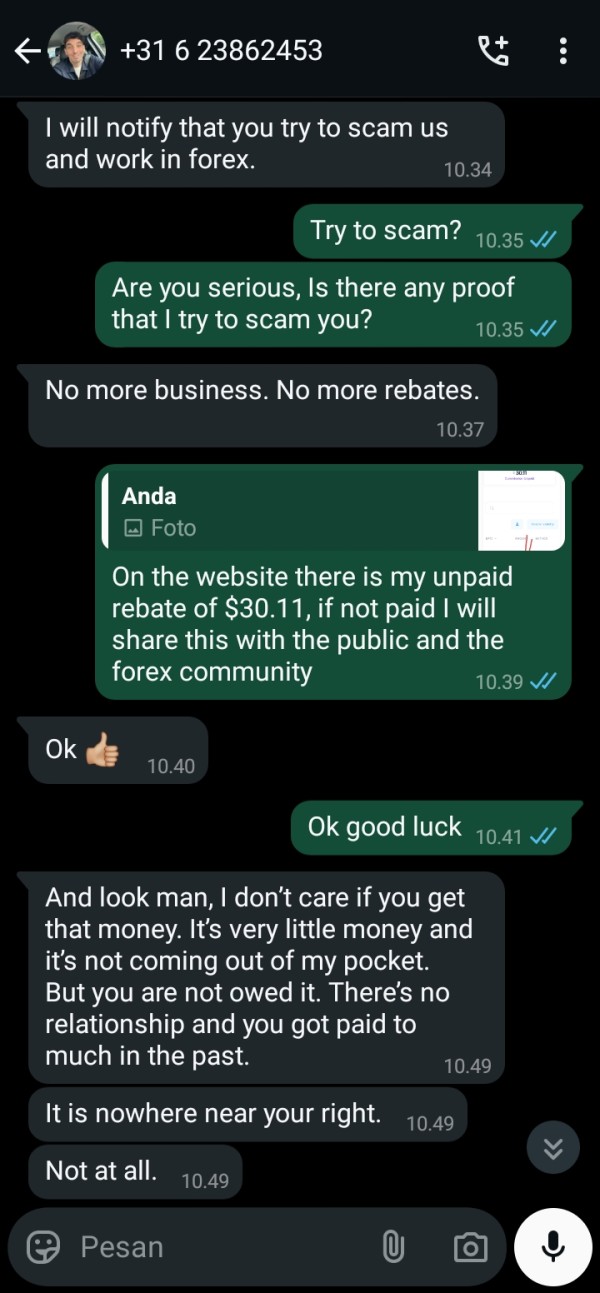

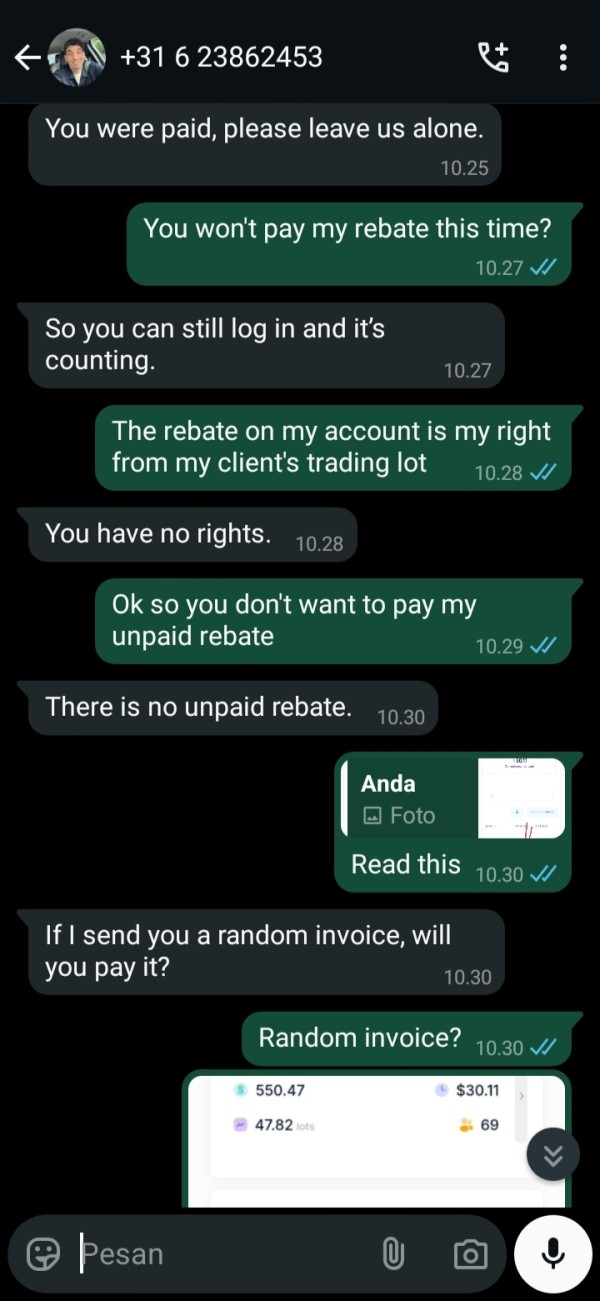

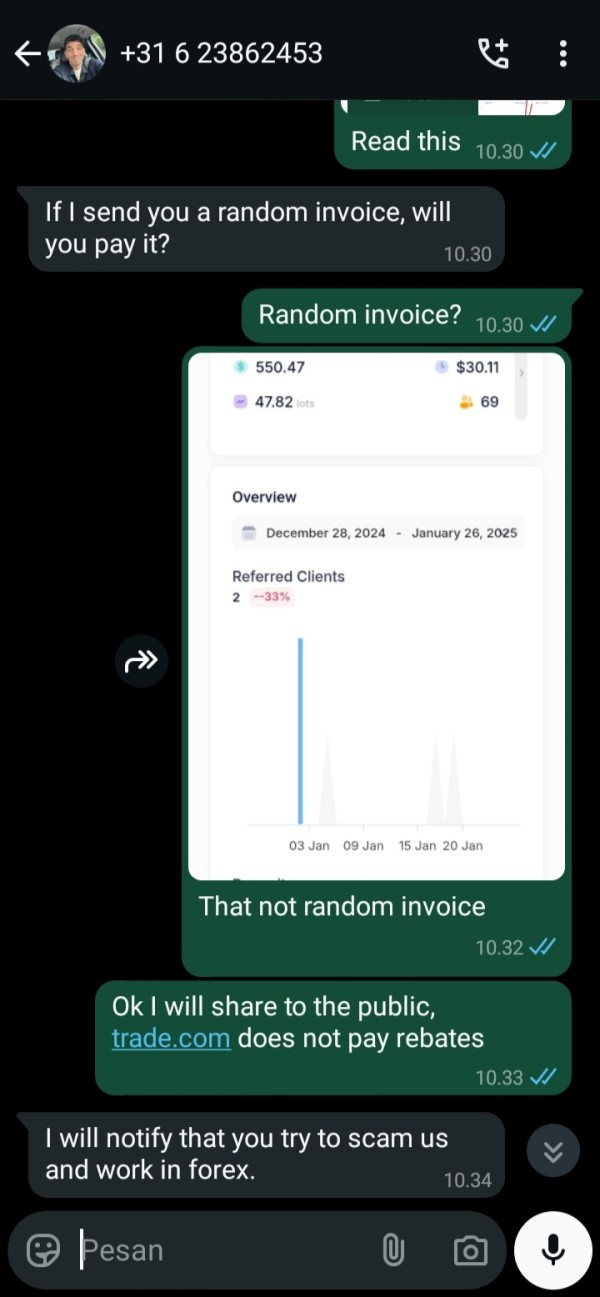

FX1610158193

Indonesia

Trade.com is a scam broker, they refuse to pay my rebate, they have many excuses, even though the rebate is not much, they still refuse to pay, SCAM BROKER

Exposure

01-26

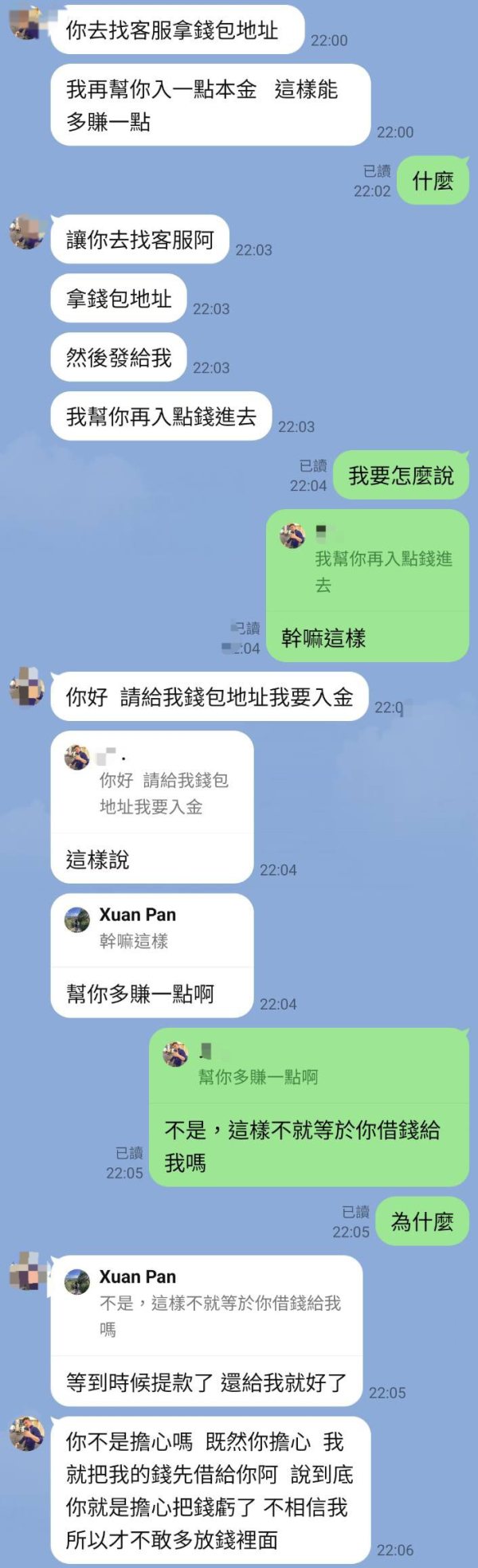

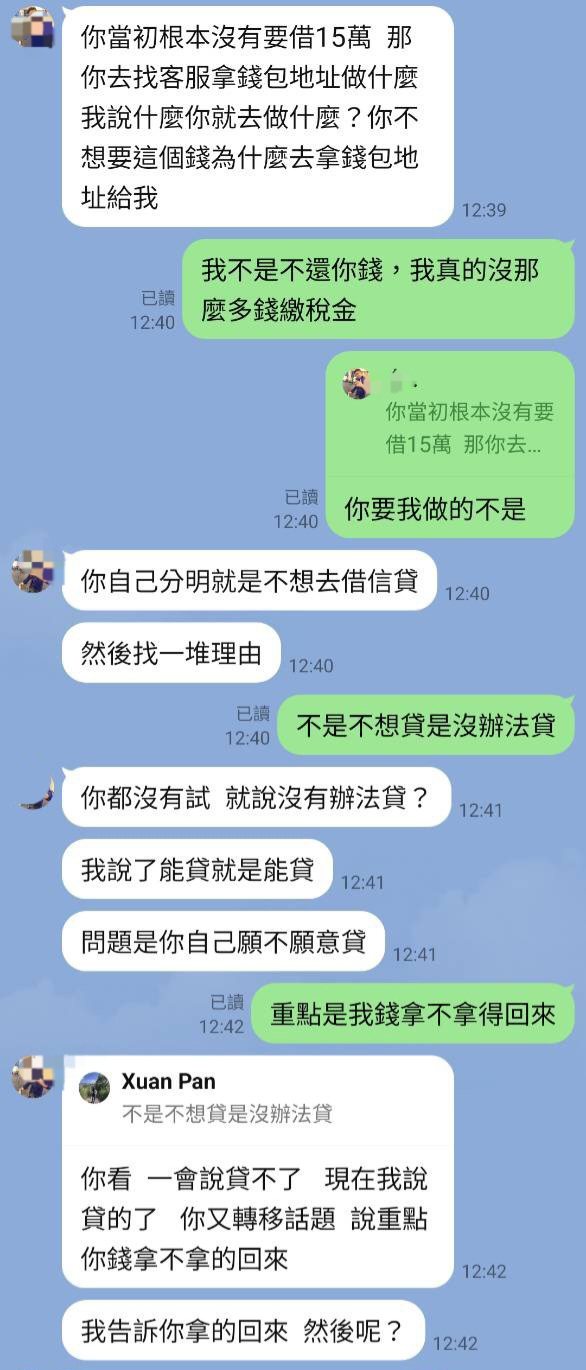

Xuan2140

Taiwan

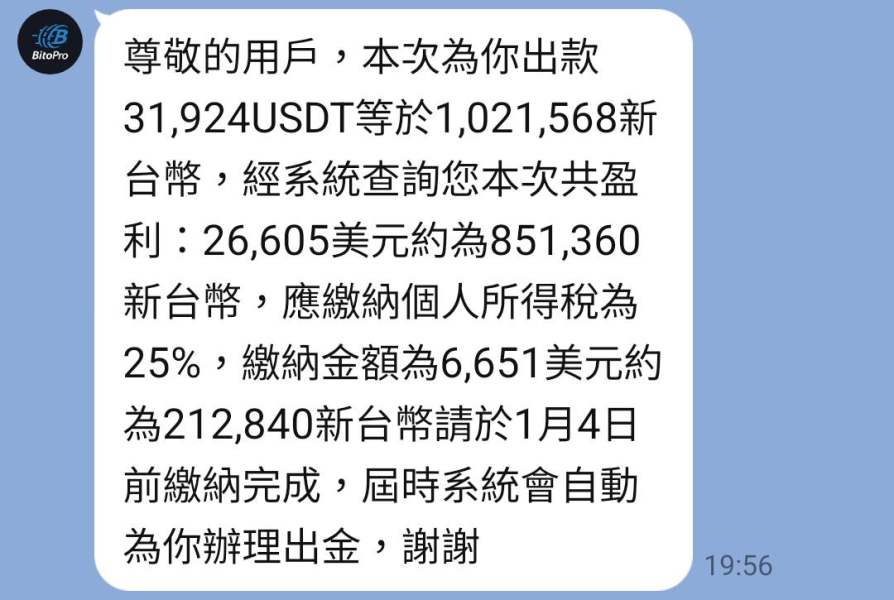

We met on a dating app before. He posted a picture of a computer screen that looked like stocks. I asked him if he had cryptocurrency. He said how could I know. I said because my friend was doing it too. We talked about this and my job. He said that cryptocurrency is a very popular way to work and you can make money with your money, so he said he would take me to do a short term because I don’t have that much money in online banking. , so I tried it with 10,000 NT dollars first, using the website he gave me. I really made an extra 2,000 NT dollars, and it was definitely credited. Later, he said that there would be a better trend in the future. If he wanted me to do it and make another deposit, I would have to use my only 12,000 to do it again. He said that he could make more money by helping me deposit more principal, so he ignored my words (I didn’t want to follow him). He meant to borrow money) and asked me to go to Lai’s customer service to get an address to deposit money. He deposited 150,000 and said he would help me earn more, but I actually did it😔. Then two days ago, he took me on a short-term basis. I made money, that is, I saw the message from the customer service that I had to pay more than 210,000 in taxes. I didn’t know what to do, so I asked friends who had done cryptocurrency, and they helped me. I want to verify that this website is really a scam website. I also went to BitoPro official website to verify that there is no requirement to pay taxes first before withdrawing money. They asked me not to deposit money to that website again. My friend was afraid that I would think too much, so he helped me blocked this people, including customer service and currency dealers.

Exposure

2024-01-03

FX1043133969

Australia

Their $10 Mini account is really attractive to me, and they also provide the industry's famous mt4 and mt5 trading platforms, so I almost opened an account on impulse. Fortunately, I calmed down and was not fooled by such perfect trading conditions on the ads. Their regulation condition seems to be very bad, and even two licenses were suspected as clones.

Neutral

2022-11-24

神鸟

Netherlands

Overall, trading fees are quite fair, they don’t overcharge you for any unnecessary things. Beginners can have a try through the mini account, while you need to put more money if you want to pursuing extreme trading environment, that’s a lot of money, and you’d better take it seriously, mt4, mt5 both supported.

Neutral

2022-11-24

cy63697

Peru

The trading platform/website is globally great but what's standing out is the amazing customer service and support through the chat. It's easy and suick to speak to an agent and every time they solve the issues and do their best to accomodate me asap. Really appreciated and I will probably stick to TRADE.COM for a while.

Positive

2024-06-14