Overview of Citibank

Citibank is a global financial institution that offers a wide range of banking and financial services to individuals and businesses. It operates in numerous countries and provides services such as banking, lending, investment management, and trading.

When it comes to trading with Citibank, they provide a comprehensive trading platform that allows customers to buy and sell a variety of financial instruments, including stocks, bonds, options, and mutual funds. Citibank offers access to major stock exchanges worldwide, enabling traders to participate in both domestic and international markets, as well as forex trading, which allows customers to trade currencies in the foreign exchange market. They provide leverage, allowing traders to amplify their trading positions, up to 1:5.

Citibank's trading platform is user-friendly, offering tools and resources for informed investment decisions. It provides real-time data, research reports, and analytical tools. Additionally, Citibank provides customer support services to assist traders with any questions or issues they may encounter during the trading process. This can include technical support, account management, and guidance on trading strategies.

Is Citibank regulated?

Citibank provides regulatory disclosures in accordance with the Basel Committee on Banking Supervision (BCBS) framework and the regulations set by the Hong Kong Monetary Authority (HKMA). These disclosures, made as of 31 March 2023, include the necessary information as required by the BCBS.

It is important to note that while Citibank adheres to the disclosure requirements and provides the relevant information, there is a lack of specific mention regarding the genuine license of regulatory oversight. Traders and customers should seek additional clarification or consult official regulatory bodies for further details on Citibank's regulatory oversight.

Pros and Cons

Citibank offers several advantages as a global financial institution. Firstly, it has a wide global presence, providing access to banking services and a diverse range of financial products across different countries. Secondly, Citibank offers a comprehensive suite of products, including banking, investments, credit cards, loans, and insurance, catering to various financial needs. Moreover, the bank leverages advanced technology, offering a user-friendly digital banking platform and mobile app for convenient account management and transactions. Citibank also boasts an extensive network of ATMs and branches, facilitating easy access to cash and in-person services. Lastly, the bank provides dedicated customer support services, ensuring assistance for banking inquiries and prompt issue resolution.

However, there are some downsides to consider. Citibank's branch network may be limited in certain regions, which can be inconvenient for customers who prefer in-person banking services. Additionally, the bank may have higher fees compared to some other institutions, particularly for services like international wire transfers or foreign exchange transactions. Some Citibank accounts also have minimum balance requirements, and failing to meet them may result in monthly maintenance fees or restrictions on account features. Furthermore, Citibank may not provide transparent information on trading costs, making it challenging for traders to accurately assess the overall expenses involved. Lastly, while Citibank adheres to regulatory requirements, the specific details of its regulatory oversight and licenses may not be readily available, potentially causing uncertainty for customers seeking detailed regulatory information.

Market Instruments

Citibank offers a diverse range of market instruments for investment. These include foreign exchange (FX) trading, bonds, mutual funds, structured products, stock trading, and portfolio financing.

With FX trading, customers can capitalize on currency fluctuations by trading major currencies and cross-currency combinations. Bonds provide regular income through interest payments and offer options like fixed-rate, zero-coupon, and floating-rate bonds. Mutual funds offer professional management and diversification, while structured products help manage risks and diversify portfolios. Stock trading services provide access to global markets, and portfolio financing options offer additional capital for investment opportunities. Citibank's market instruments cater to various investment preferences and goals, empowering customers to build well-rounded portfolios.

In addition, Citibank provides stock trading services, allowing customers to access global stock markets through their intuitive mobile platform, Citi Mobile®. Portfolio financing options are also available, such as Investment Plus and Treasury Plus, providing additional capital and leveraging investment power.

Account Types

Citibank offers a range of account types tailored to meet the diverse banking needs of its customers. Each of these account types offers distinct features and benefits, catering to different customer segments with varying financial requirements. The specific offerings and eligibility criteria may vary by location and individual circumstances, the comparison is as follows:

How to Open an Account in Citibank?

Before starting to trade with Citibank, traders need to go through the process of opening an account first. The process of opening an account in Citibank involves the following steps:

Gather the required documents, including valid identification and proof of address.

Go to the Citibank branch in person.

Fill out the application forms accurately and completely.

Submit the application forms along with the required documents.

Make an initial deposit into your new Citibank account.

Receive your account details and any associated cards.

Start accessing and managing your account through Citibank's online banking or mobile app, mainly by entering the bank card number.

It's important to note that the specific steps and requirements may vary depending on your location, the chosen account type, and Citibank's policies and procedures. It's recommended to visit the Citibank website or contact their customer service for detailed information and guidance specific to your situation.

Spreads & Commissions (Trading Fees)

Trading activities involve various fees, including corporate action fees, nominee services, stamp duty, transaction fees, securities management fees, and transfer fees, contributing to overall costs. Citibank applies fees to trading activities to cover costs and services related to facilitating trades. These fees are crucial for maintaining and enhancing Citibank's trading platforms, offering customer support, and covering operational expenses. The following table presents the fee structure details:

However, as for another important factor in the trading cost, information about spreads on Citibank's official website is lacking. This poses a challenge for traders in accurately assessing the costs associated with trading. Without clear and detailed information about spreads and commissions, individuals may find it difficult to estimate the overall expenses of their trading activities. The absence of this crucial information hampers traders' ability to make informed decisions and evaluate the potential costs involved in their trading endeavors.

Leverage

Citibank offers attractive leverage options to amplify investment power across various investment products. In their Foreign Exchange (FX) Margin Trading, customers can benefit from leverage of up to 15 times their total deposit. This means that with a relatively smaller initial investment, they have the potential to control a larger position in the FX market.

Similarly, in Foreign Currency Leveraged Investment, Citibank provides customers with the opportunity to leverage their deposits up to 5 times. This increased leverage empowers investors to increase their investment capacity and participate in the foreign exchange market with enhanced exposure. However, it's essential to recognize that leverage also amplifies the associated risks, including the possibility of incurring losses that exceed the initial investment.

Trading Platform

Citibank offers various convenient channels for accessing account information and conducting banking transactions. With Citibank Online and the Citi Mobile® App, customers have flexible and easy-to-use digital banking services. These platforms provide personalized views, quick updates on account information, access to statements, and real-time action reminders.

Additionally, CitiPhone Banking offers round-the-clock assistance for customers on the move. For in-person services, Citibank branches and ATMs, including JETCO ATMs, are available for comprehensive banking needs. The Citibank Online platform has been upgraded to offer a seamless digital banking experience, allowing customers to manage their finances easily and efficiently.

Deposit & Withdrawal

To deposit funds into your Citibank trading account, you have different options available. If you already have a Citibank account, you can directly transfer the fund to your trading account. Alternatively, you can visit a Citibank branch office to deposit funds in person, or use bank wire or remittance services to transfer funds electronically. These options provide flexibility and convenience for depositing funds into your trading account.

Citibank also offers convenient options for currency exchange and fund withdrawal. You can use Foreign Currency ATMs to withdraw major currencies or order foreign currencies online for branch pickup. The Citi Mobile® App provides 24/7 foreign exchange services with favorable rates. Whether through ATMs or the app, Citibank ensures flexibility and convenience for your currency needs.

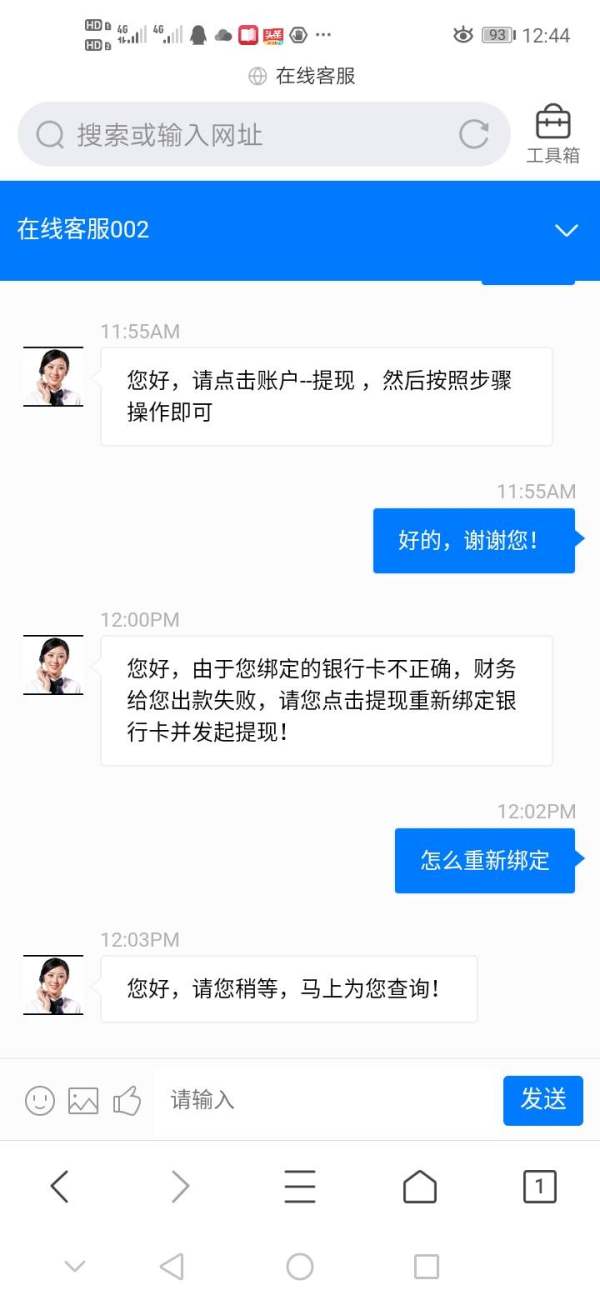

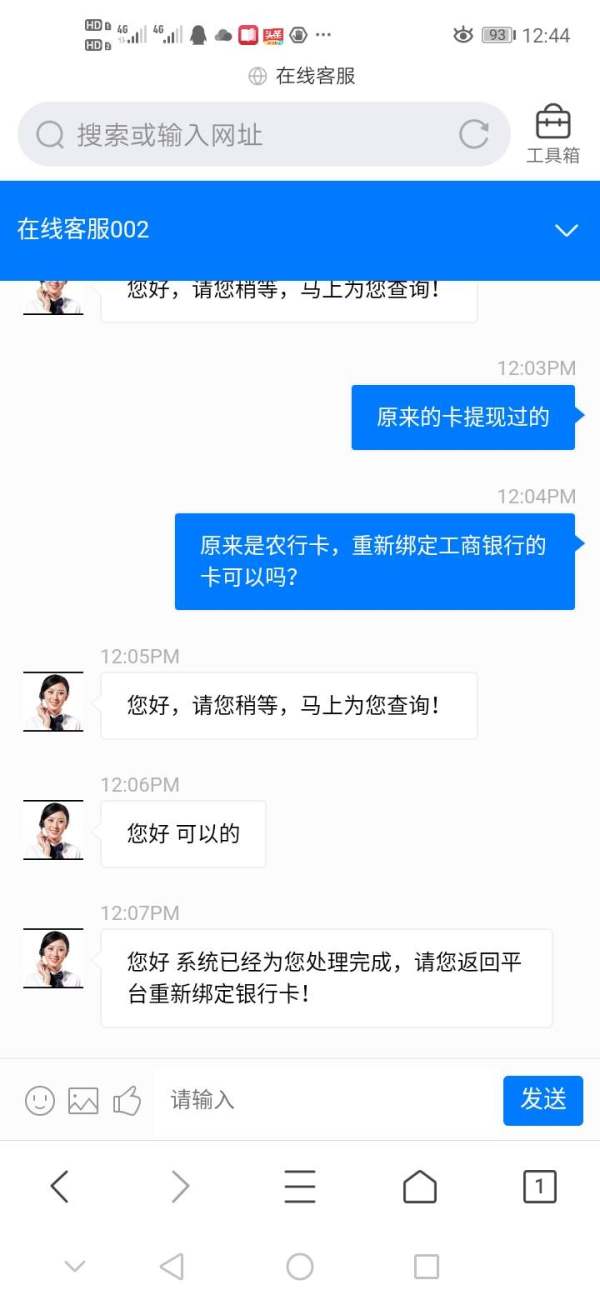

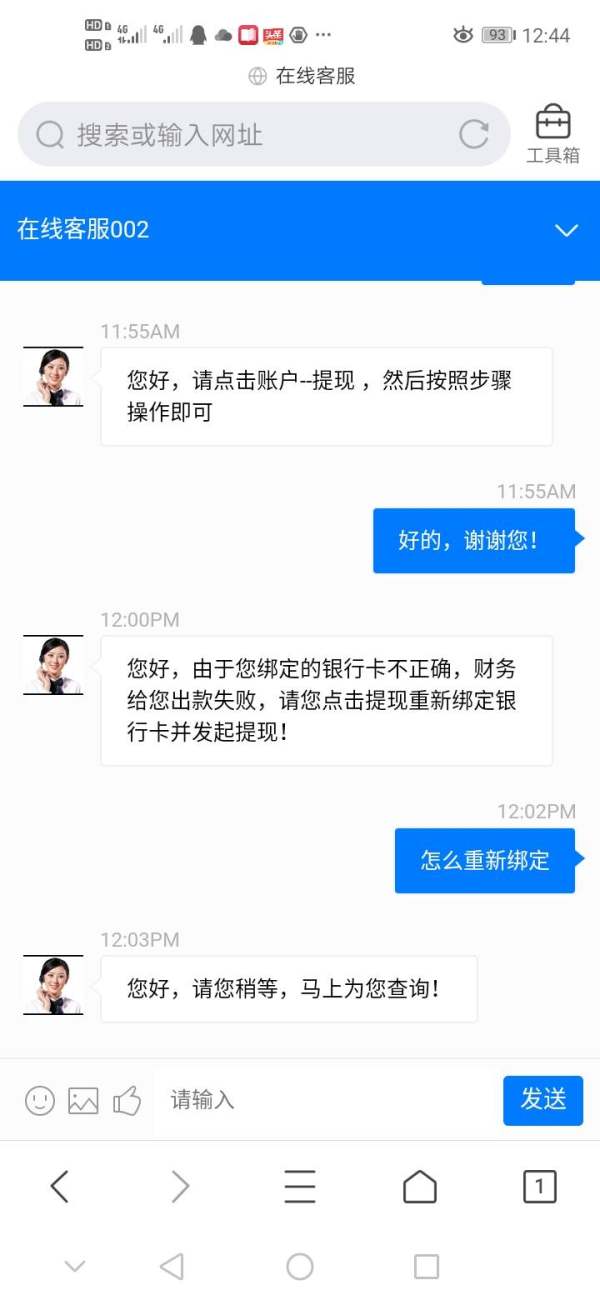

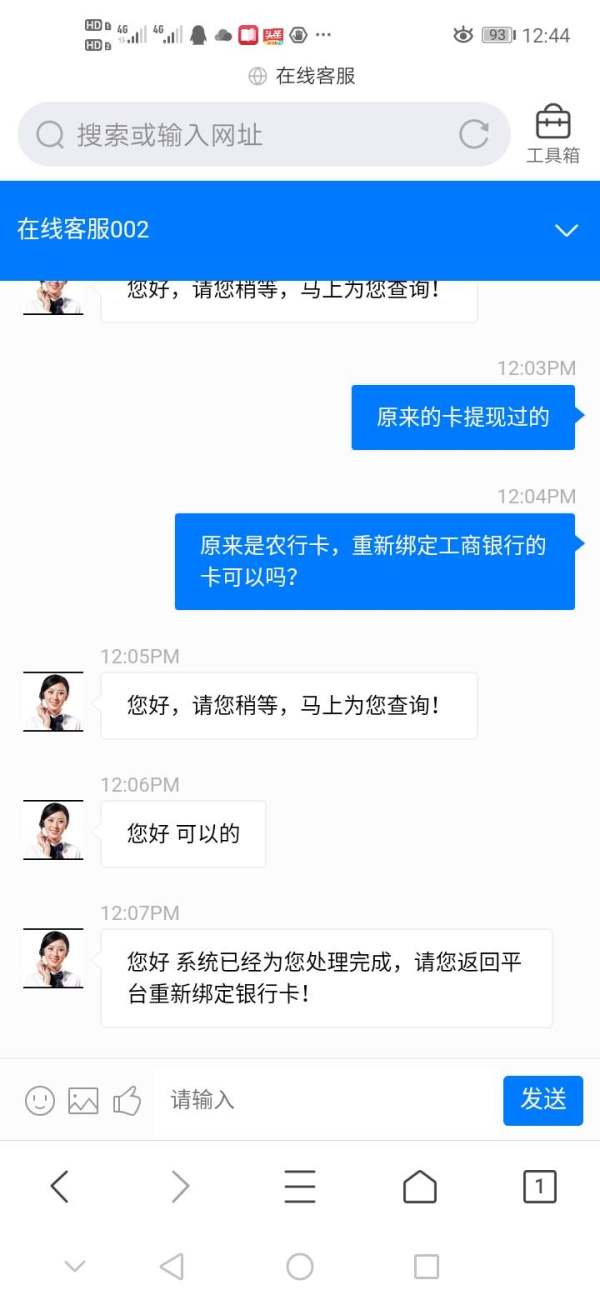

Customer Support

Citibank provides comprehensive customer support through various channels to ensure a seamless banking experience. Customers can easily contact Citibank for assistance or inquiries. For Citi Plus, Citibanking, Citi Priority, and Card customers, they can use the messaging service in the Citi Mobile® App or reach out through the Citibank hotline. Citigold and Citigold Private Client customers have the added benefit of connecting with their dedicated relationship manager through the app or via WhatsApp. Citibank's customer support channels are designed to cater to the diverse needs of their customers, providing prompt and personalized assistance.

Customers can conveniently access customer support through digital platforms and phone services. The messaging service in the Citi Mobile® App allows customers to leave messages and receive timely responses from the Citibank team. Additionally, Citibank offers dedicated hotlines for different customer segments, ensuring round-the-clock assistance for general banking, card services, Citigold, and Citigold Private Client inquiries. These customer support channels provide convenience and accessibility for customers to address their concerns and receive the necessary support from Citibank.

Educational Resources

Citibank provides a section on its official website called “Live Smart,” which offers a range of educational resources in the field of wealth management, banking, and trading. These resources aim to help individuals make informed financial decisions and improve their financial literacy.

In the Money 101 category, expert advice is provided on various financial topics such as fund fees, tax loans, credit scores, investment diversification, and more. This information helps individuals understand the costs associated with buying funds and dispels myths surrounding fund fees. It also explores the benefits and considerations of borrowing a tax loan for making a time deposit. Furthermore, expert insights are shared on market fluctuations and strategies for diversification in financial planning.

Additionally, Citibank's educational resources include topics such as improving credit scores, novices' tax return guidance, and more. These resources aim to empower individuals with the knowledge and skills necessary to make informed financial decisions and manage their finances effectively.

Conclusion

Citibank is a well-established global banking institution that offers a wide range of financial products and services. With its presence in multiple countries, Citibank provides various banking solutions including savings and checking accounts, credit cards, loans, mortgages, and investment options. Customers can conveniently manage their finances through online platforms and mobile applications offered by Citibank. The bank supports multiple currencies, facilitating international transactions and catering to a diverse customer base.

In addition, Citibank offers different account tiers such as Citibanking, Citi Priority, Citigold, and Citigold Private Client, each tailored to specific financial needs. When it comes to trading fees, Citibank provides competitive fee structures, except for the lack of details for information about spreads. Citibank provides educational resources such as fundamental concept articles and margin calculators to help traders enhance their knowledge and understanding of trading. Citibank offers customer support services through various channels such as 24-hour trading hotlines, phone numbers, email, and social media platforms. Traders can rely on these channels to seek assistance and address any queries or issues they may encounter during their trading activities.

FAQs

Q: Is Citibank a regulated brokerage firm?

A: While Citibank claims to be authorized, there is no genuine license to support these claims upon verification.

Q: What market instruments can I trade with Citibank?

A: Citibank provides access to a wide range of market instruments, including futures, options, stocks, mutual funds, trust funds, and foreign stocks.

Q: What trading platform does Citibank offer?

A: Citibank offers the Citi Mobile App and Citibank Online. These platforms provide real-time market data, charting tools, and order placement functionality for convenient and effective trading experiences.

Q: Are there educational resources available for traders?

A: Yes, Citibank offers educational resources to assist traders in enhancing their knowledge, skills, and also financial literacy.

Q: How can I contact Citibank for trading-related inquiries?

A: Traders can contact Citibank's customer support through 24-hour trading hotlines, phone numbers, email, or social media platforms.

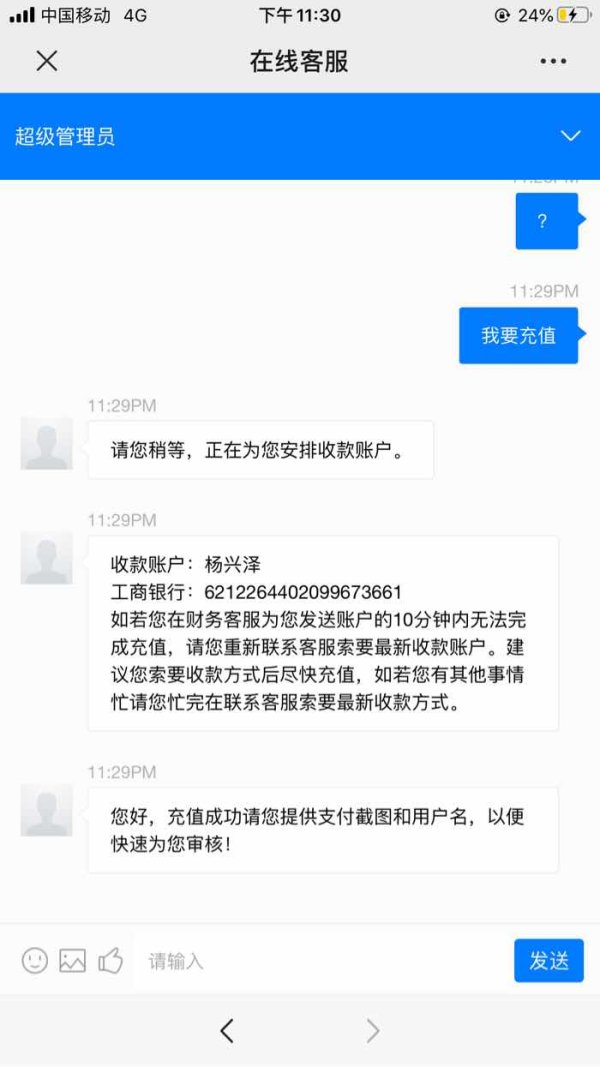

凡事不问的俗人

Hong Kong

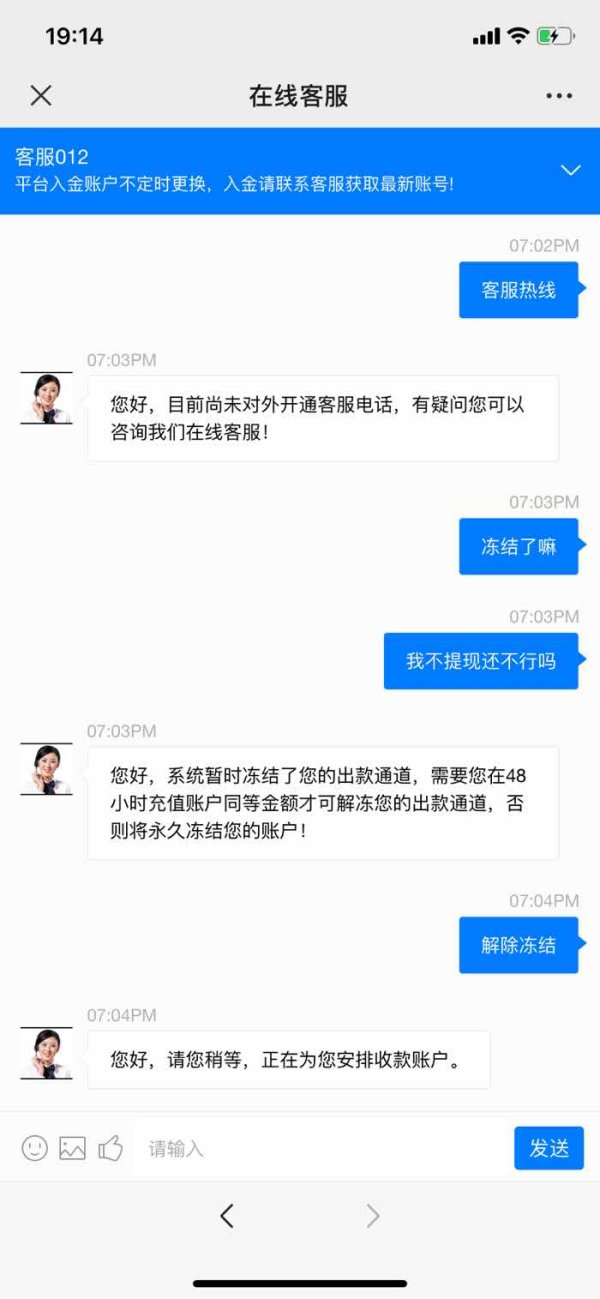

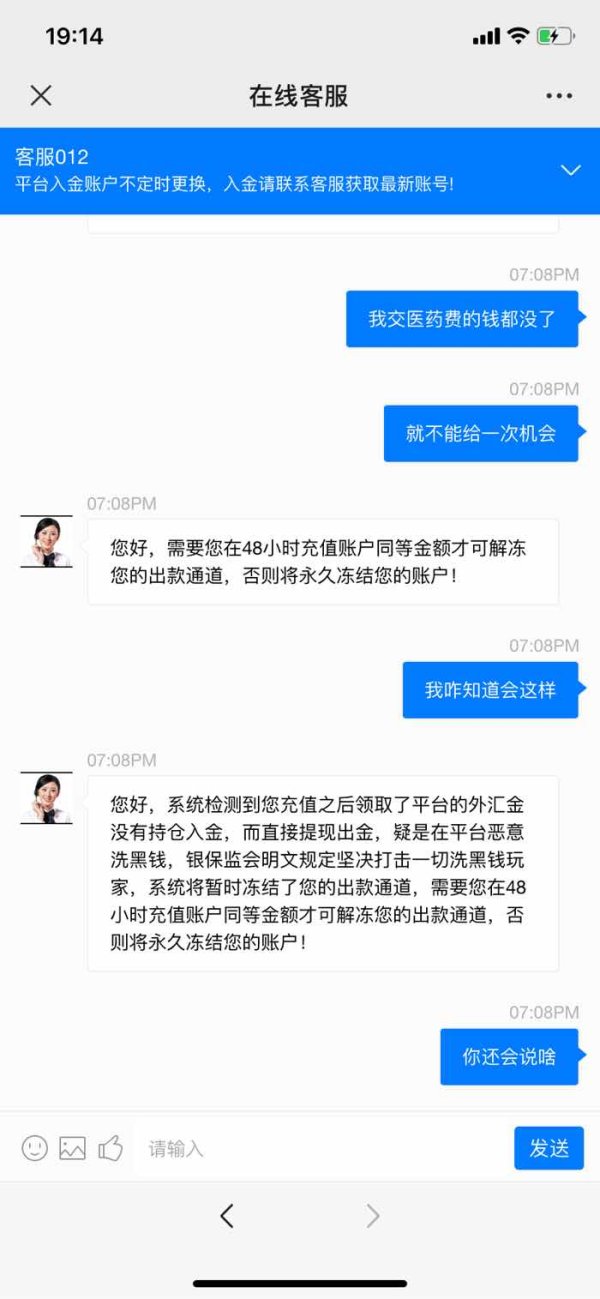

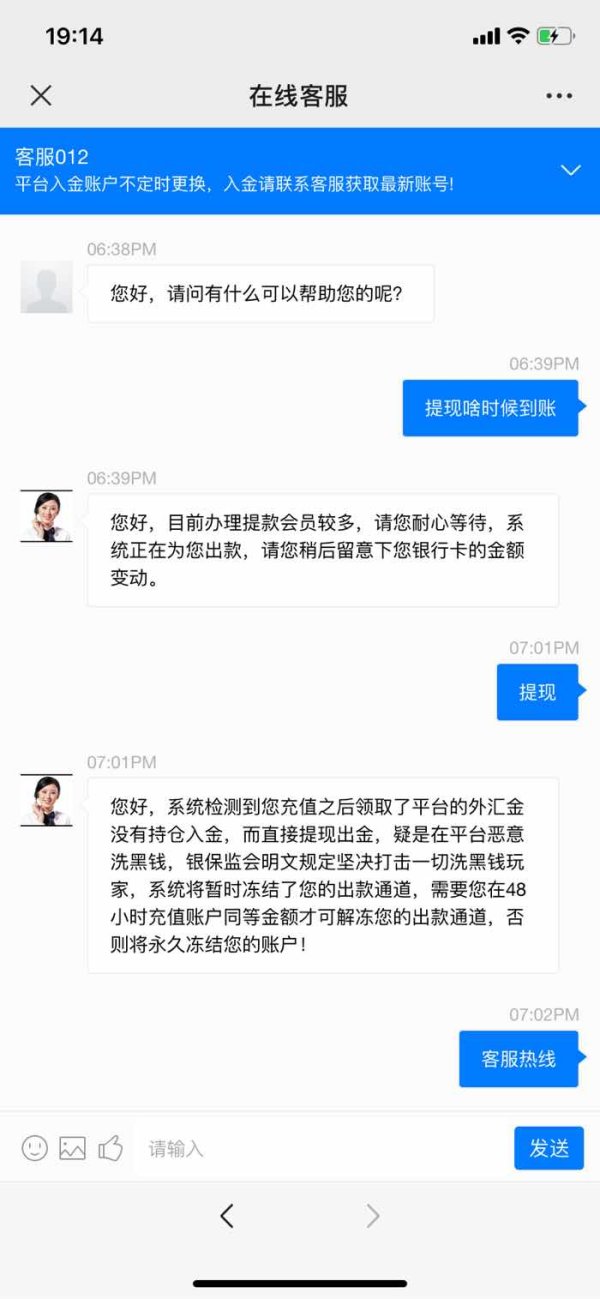

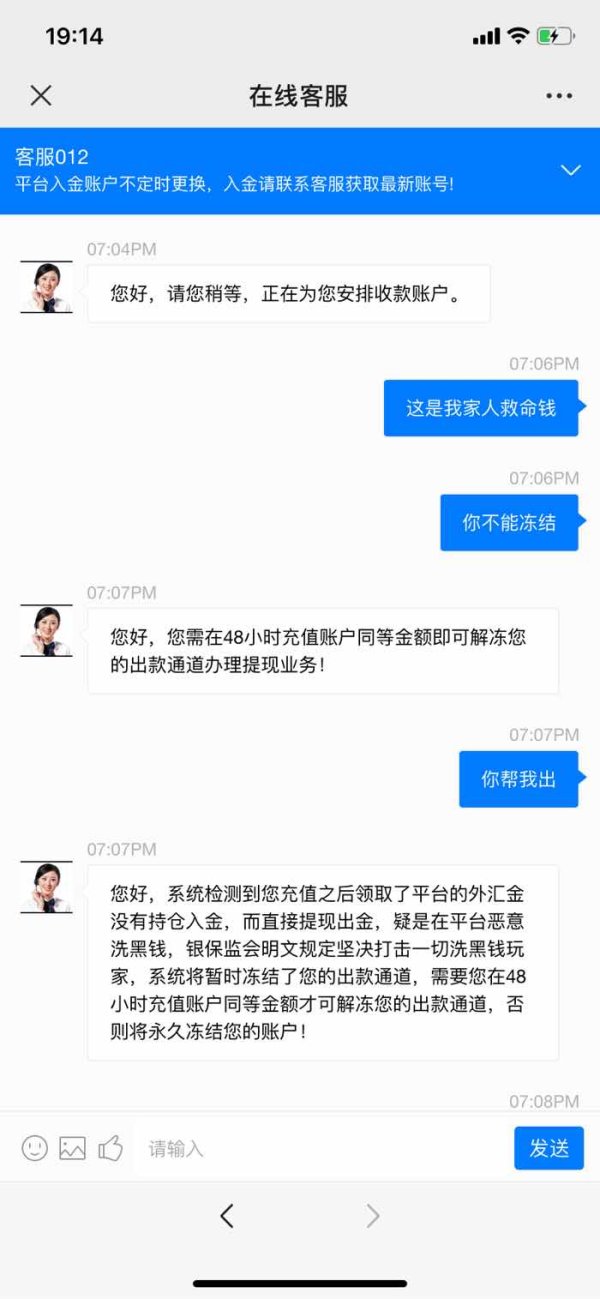

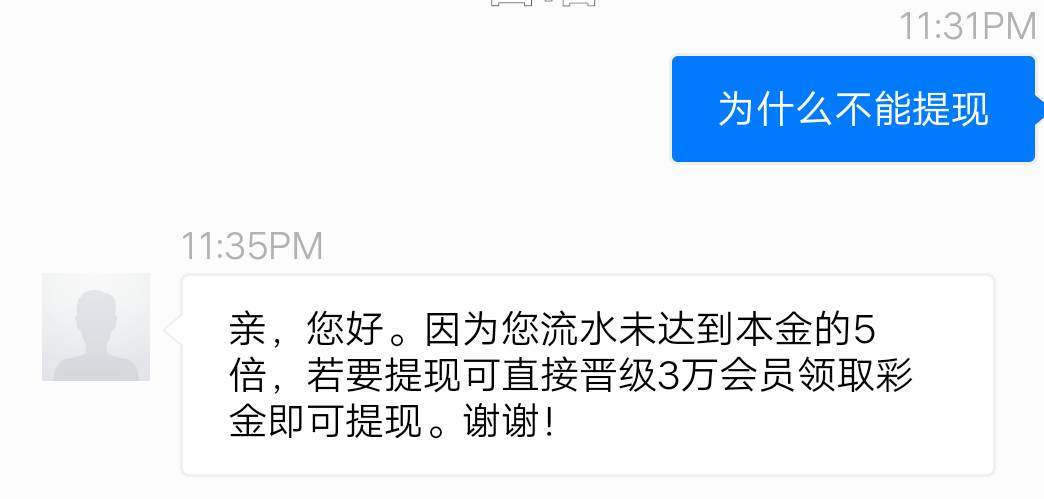

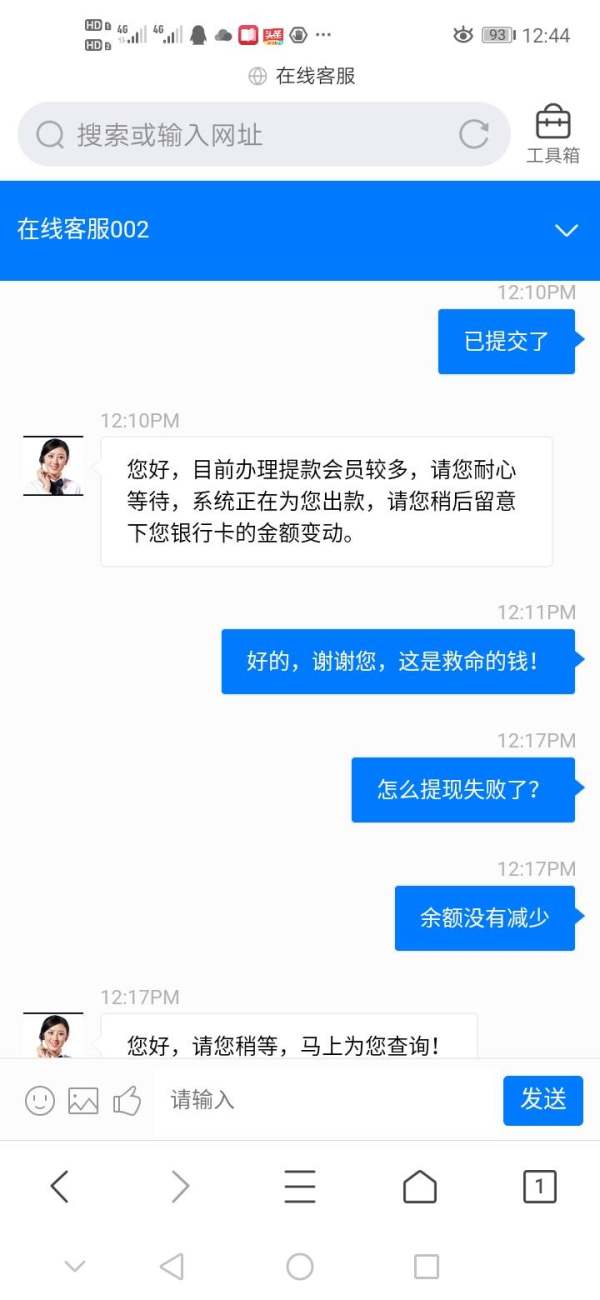

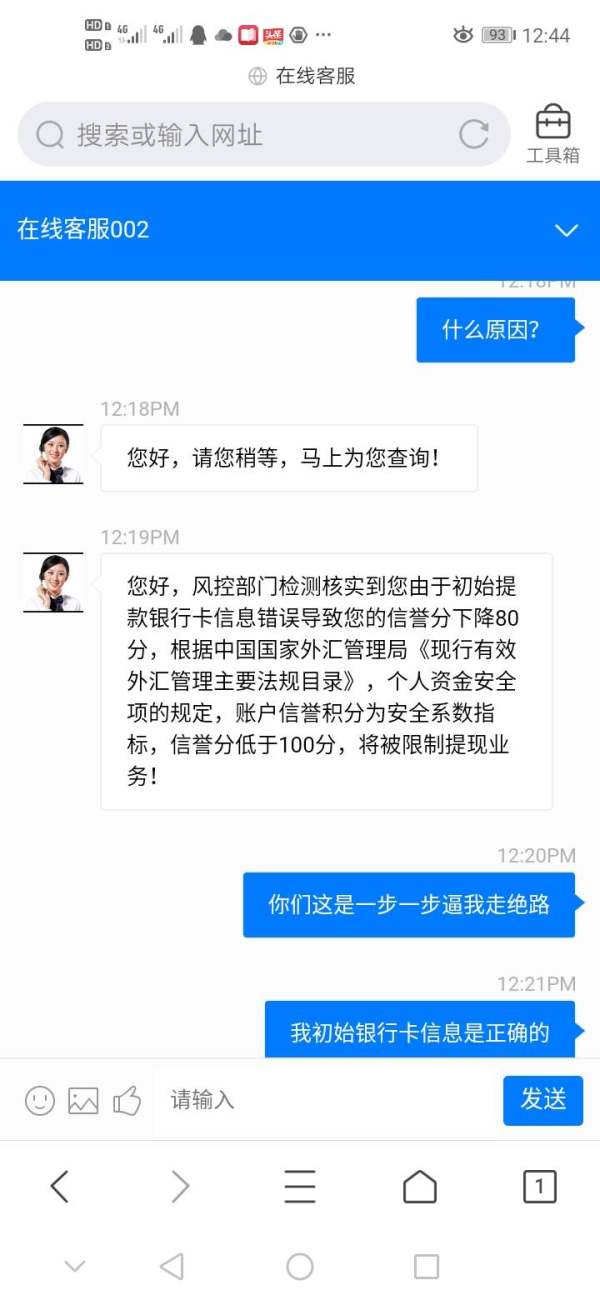

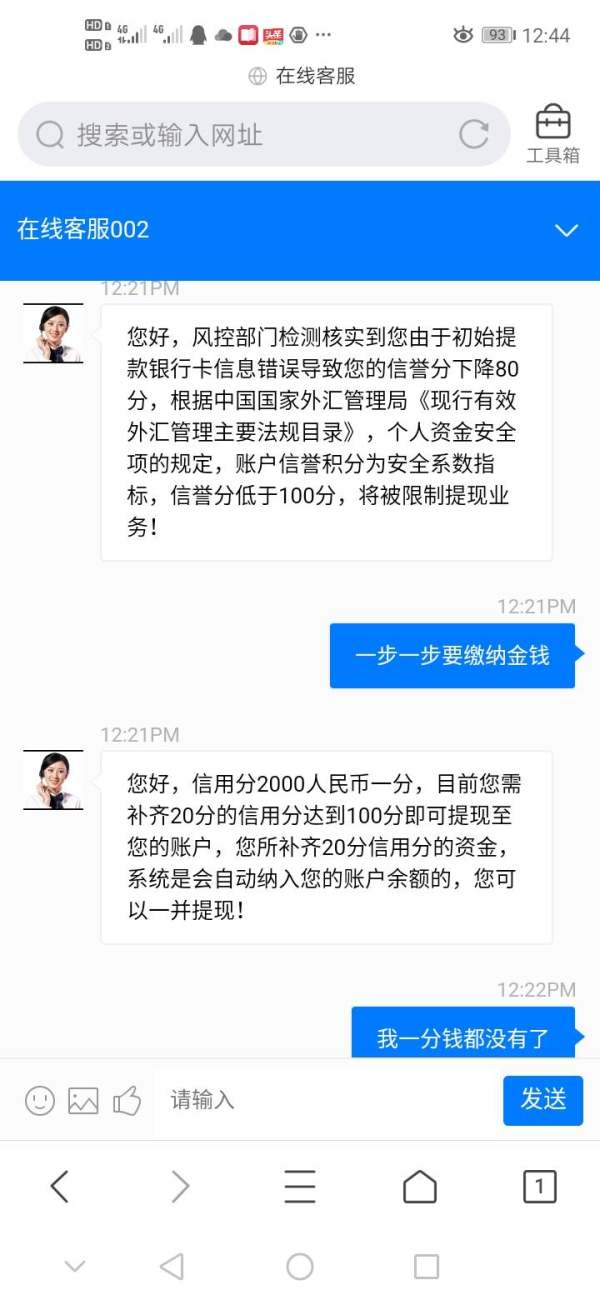

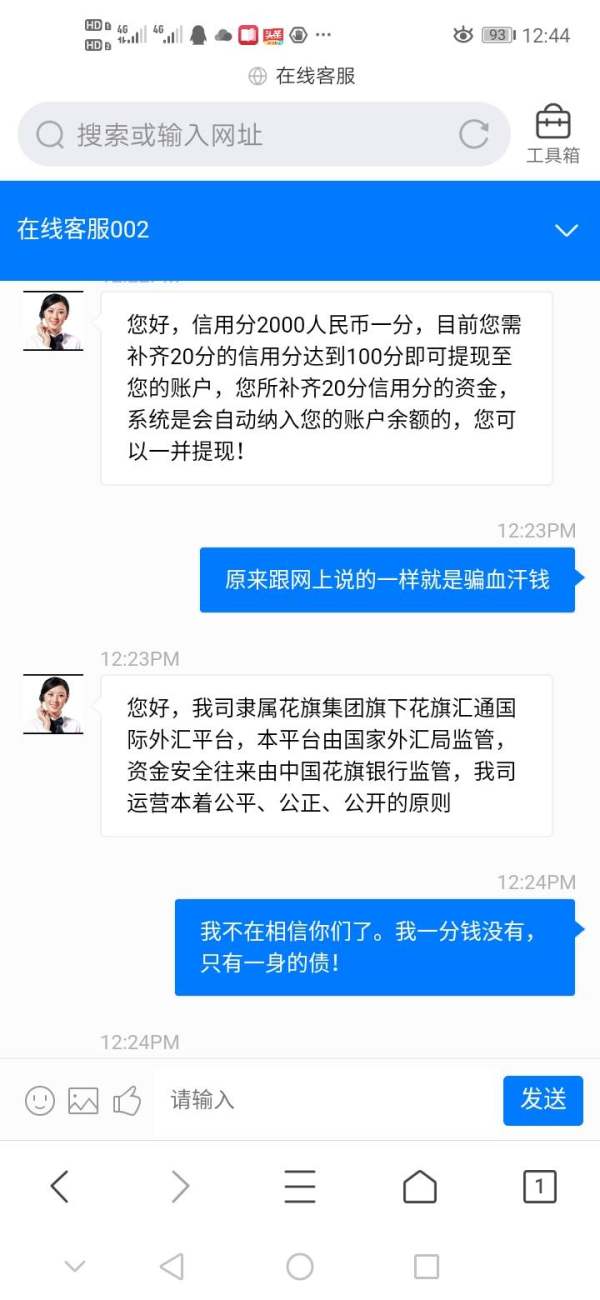

CITIBANK gave no access to withdrawal. Delay the withdrawal by locking accounts. Return my hard-earned money

Exposure

2020-09-07

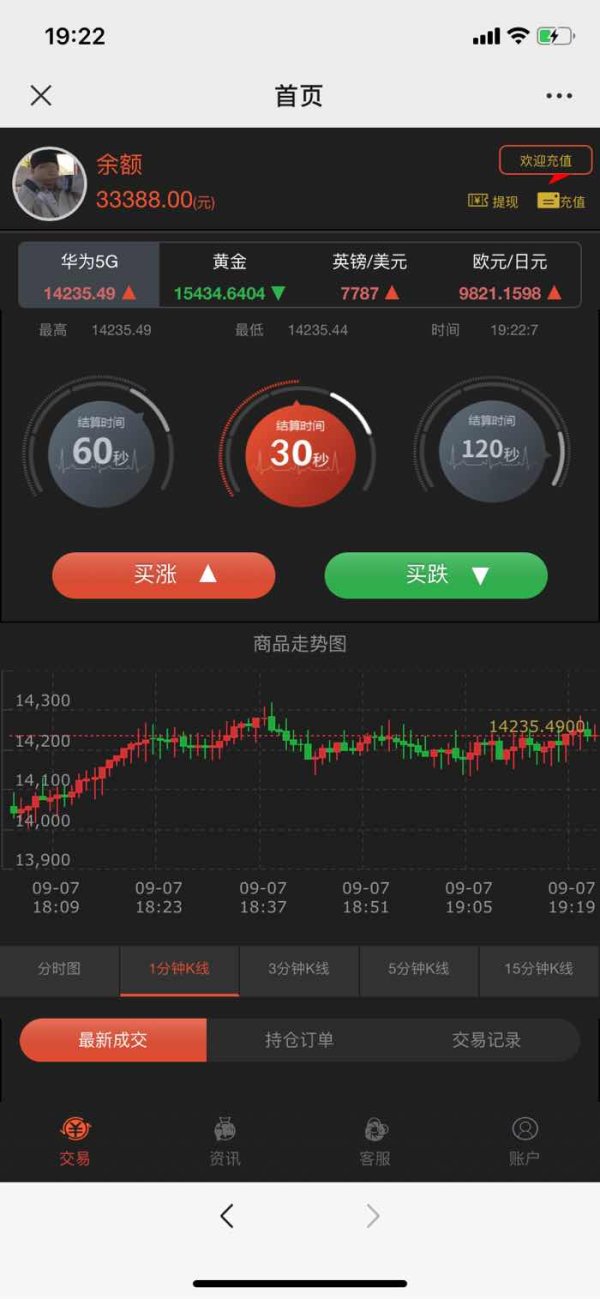

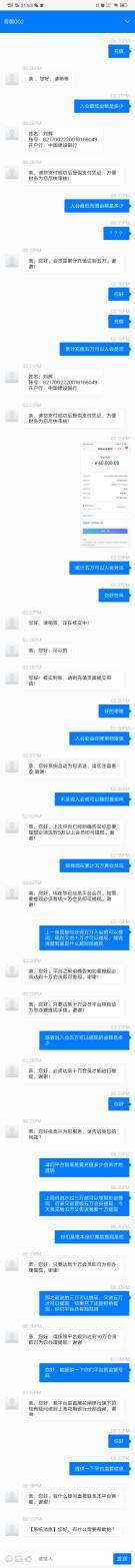

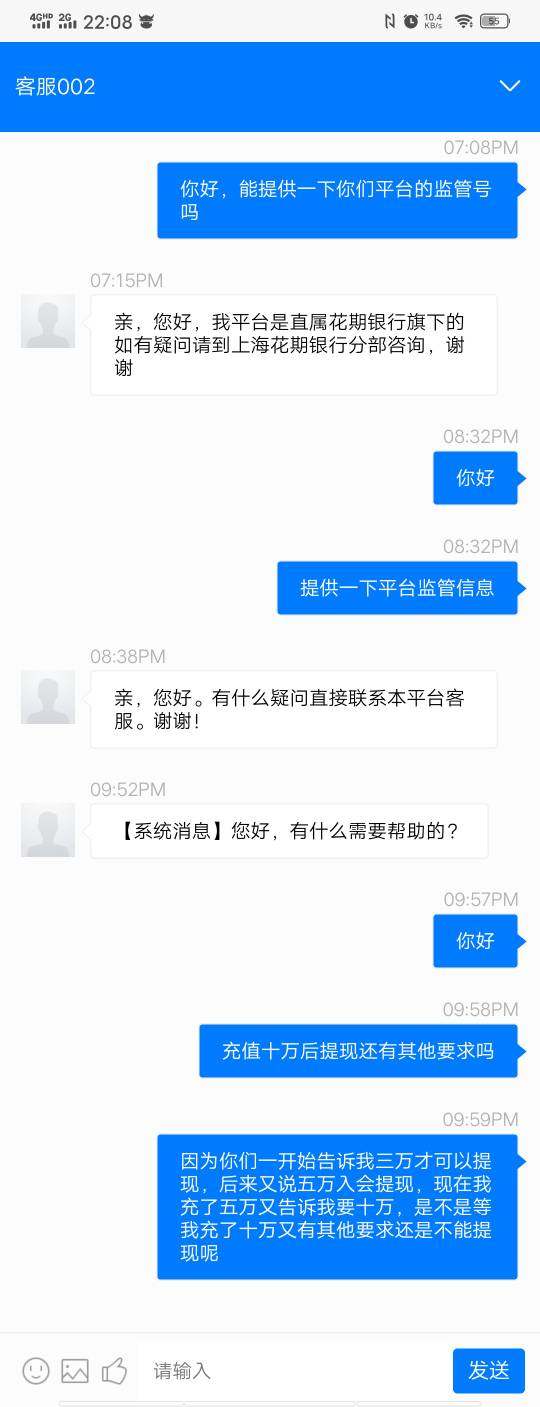

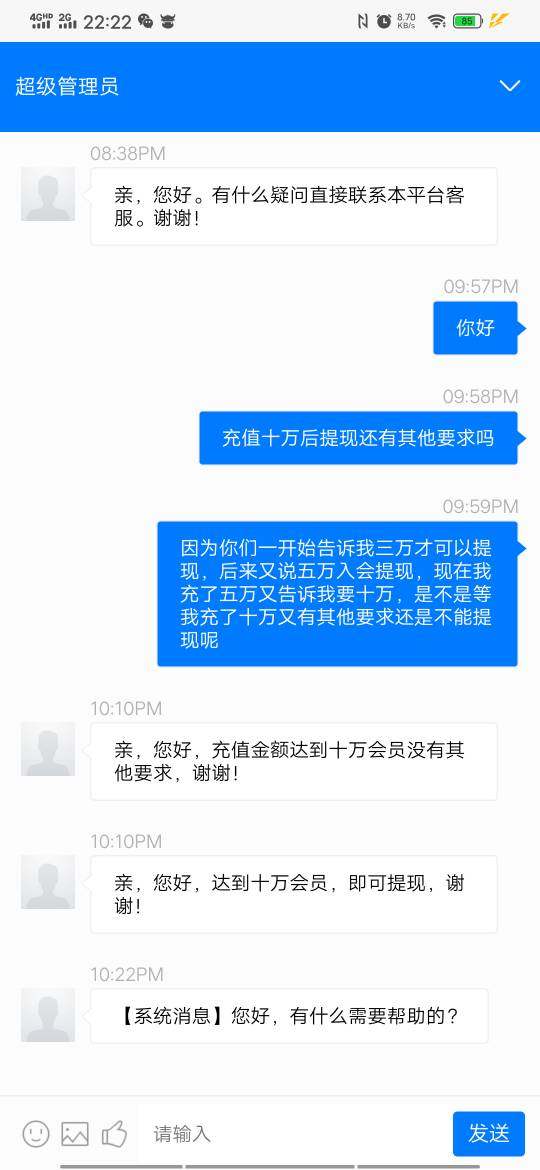

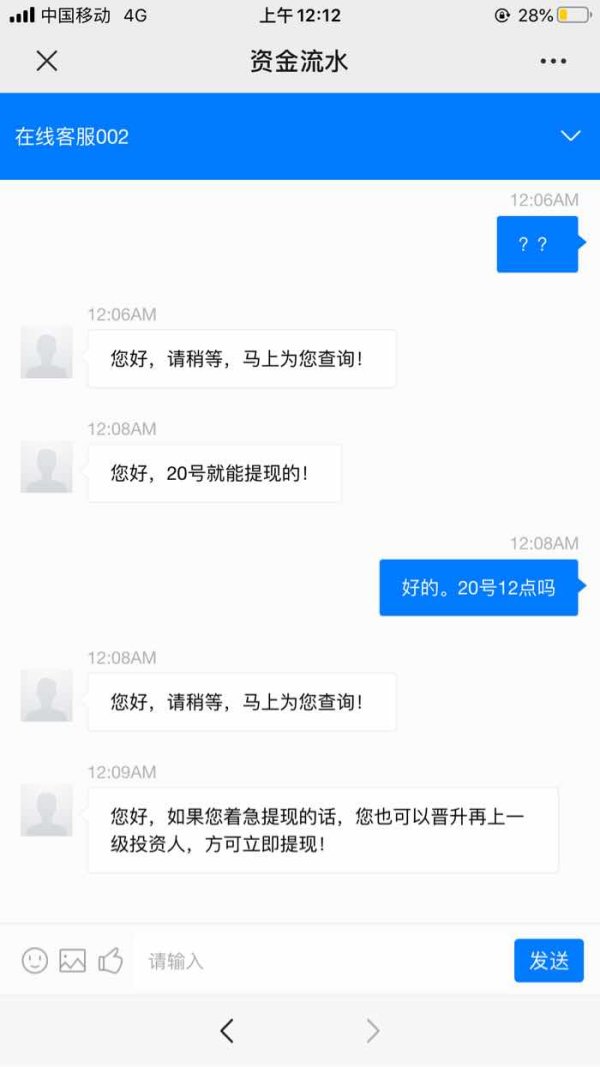

就你最离谱

Hong Kong

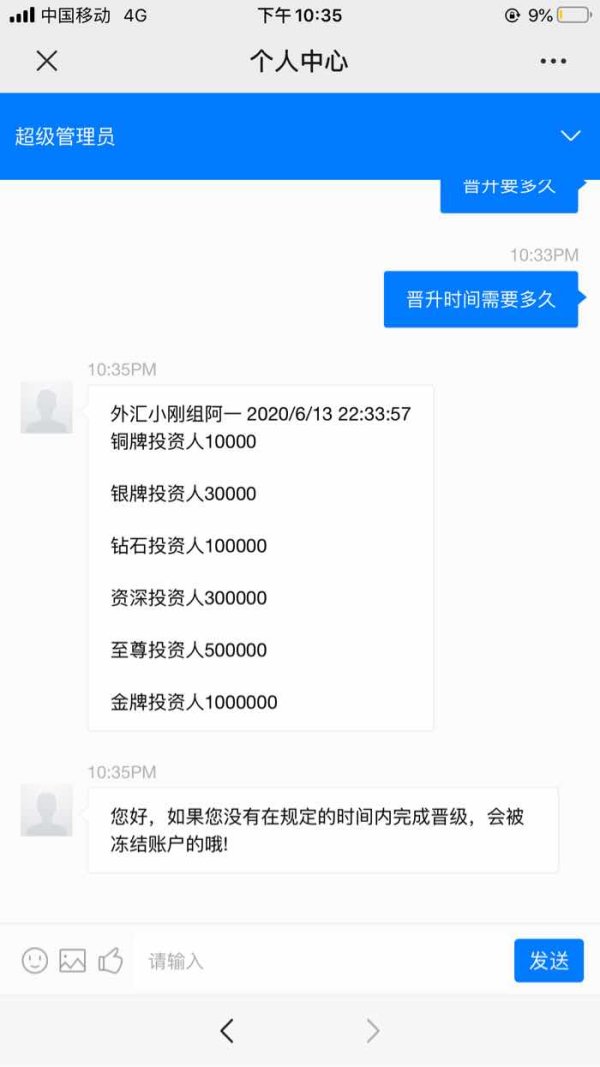

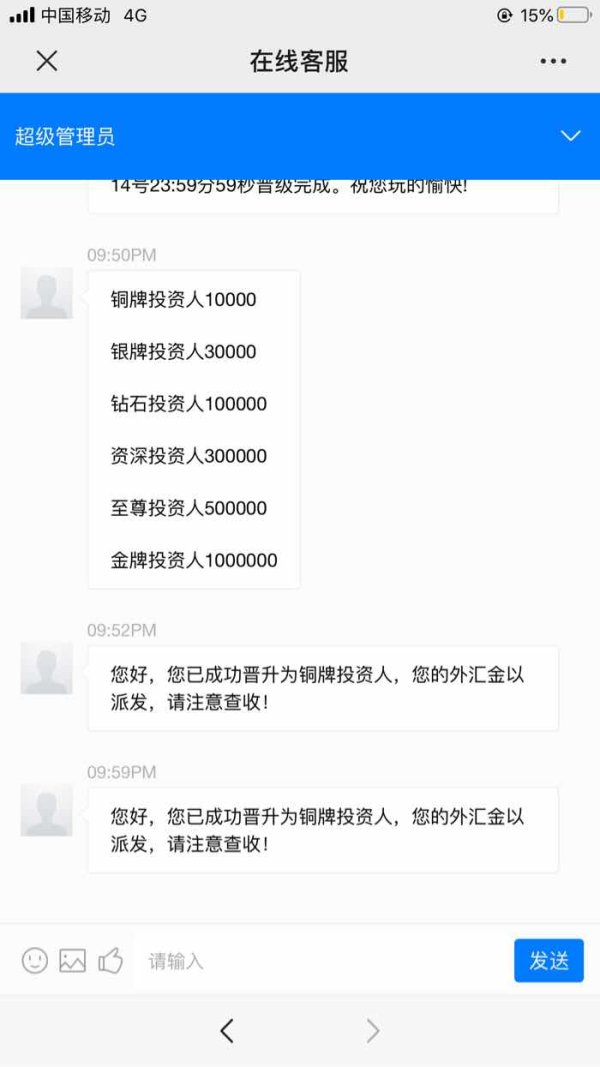

It claimed to be a subordinate platform of Shanghai Citibank and played word games time and time again. At first, they said that I could withdraw funds after my trading volume reached CNY 30,000, then CNY 50,000, and finally CNY 100,000 for membership registration to withdraw cash. I asked for regulatory information, but they don’t respond directly.

Exposure

2020-08-09

FX1942308520

Hong Kong

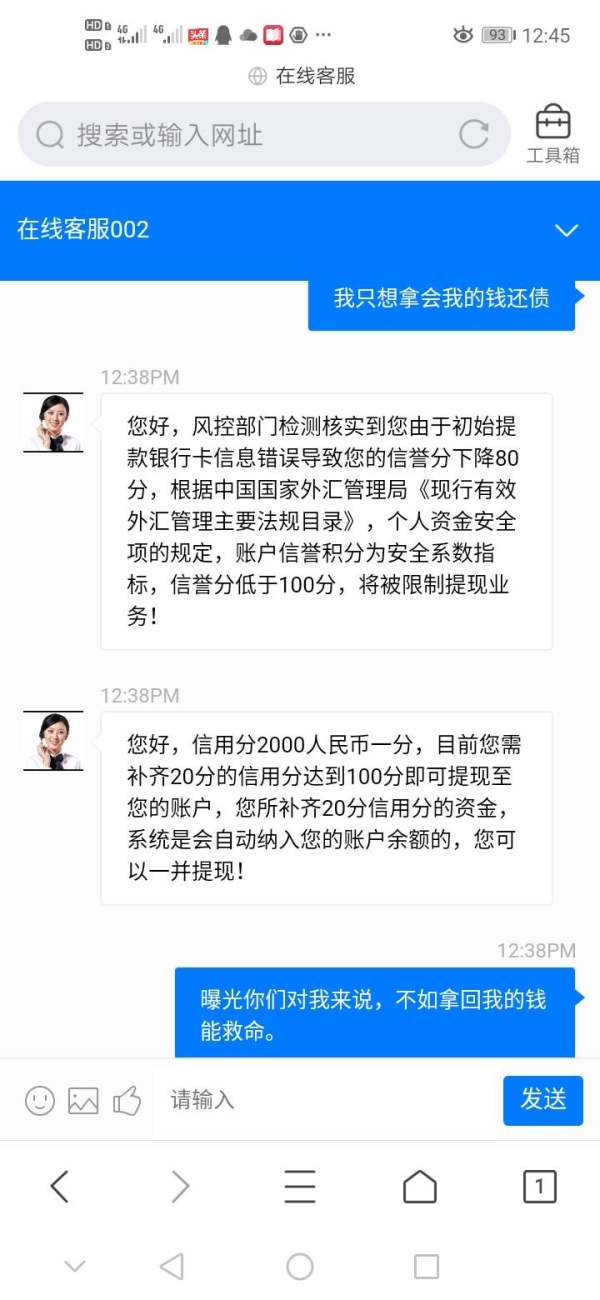

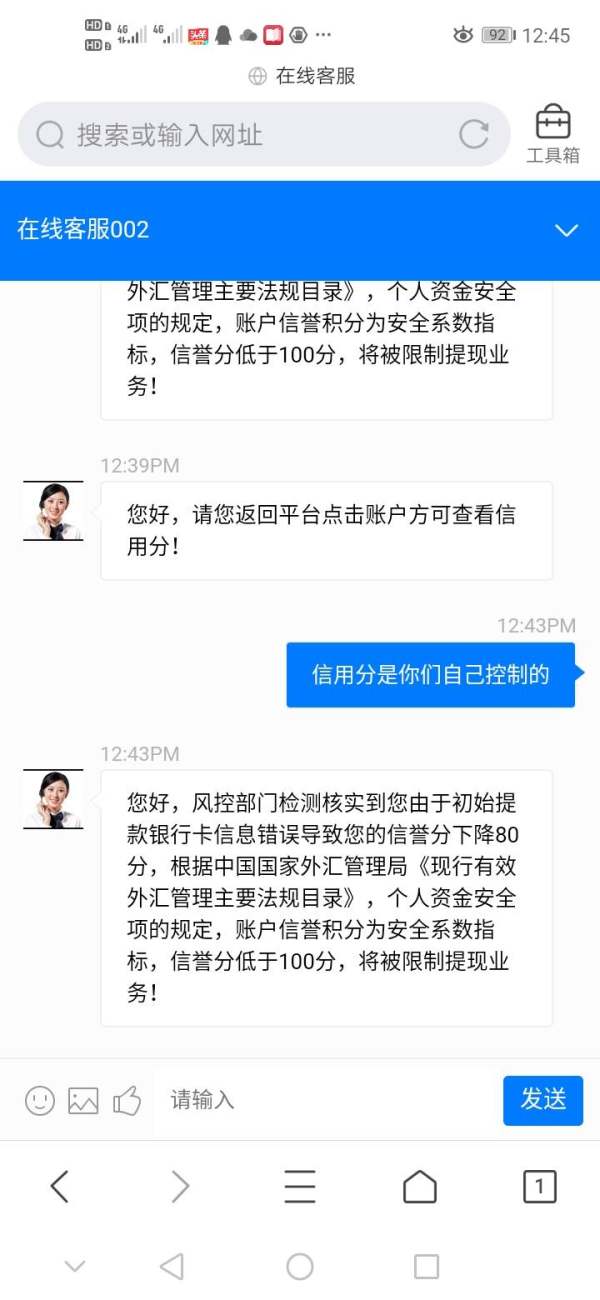

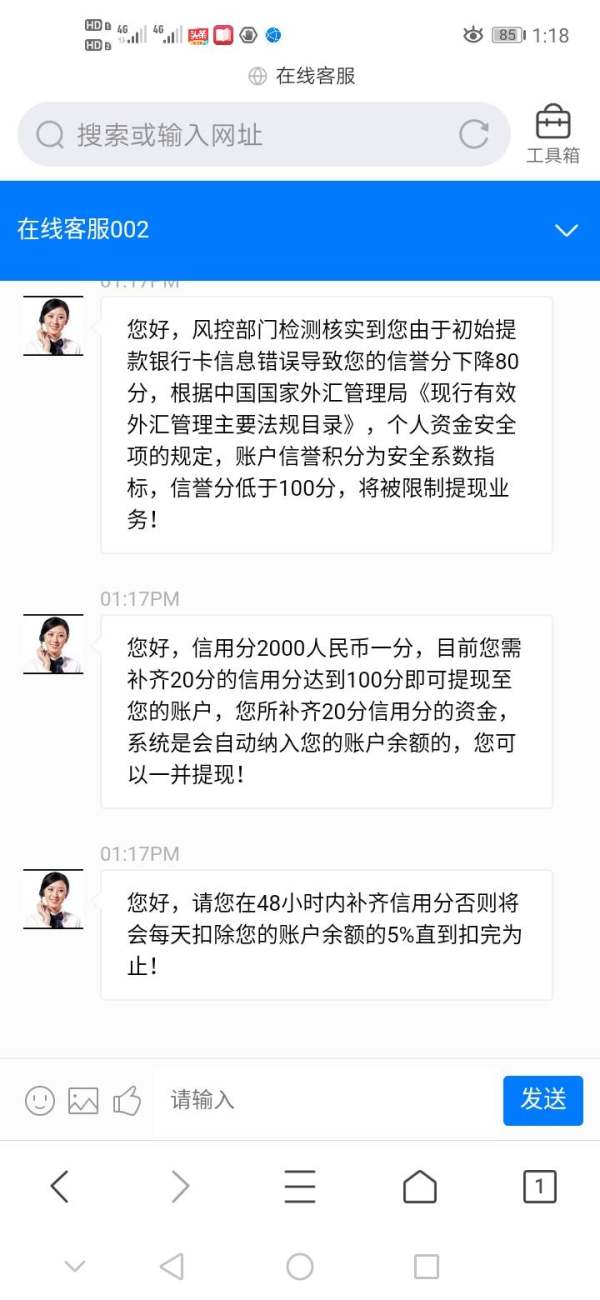

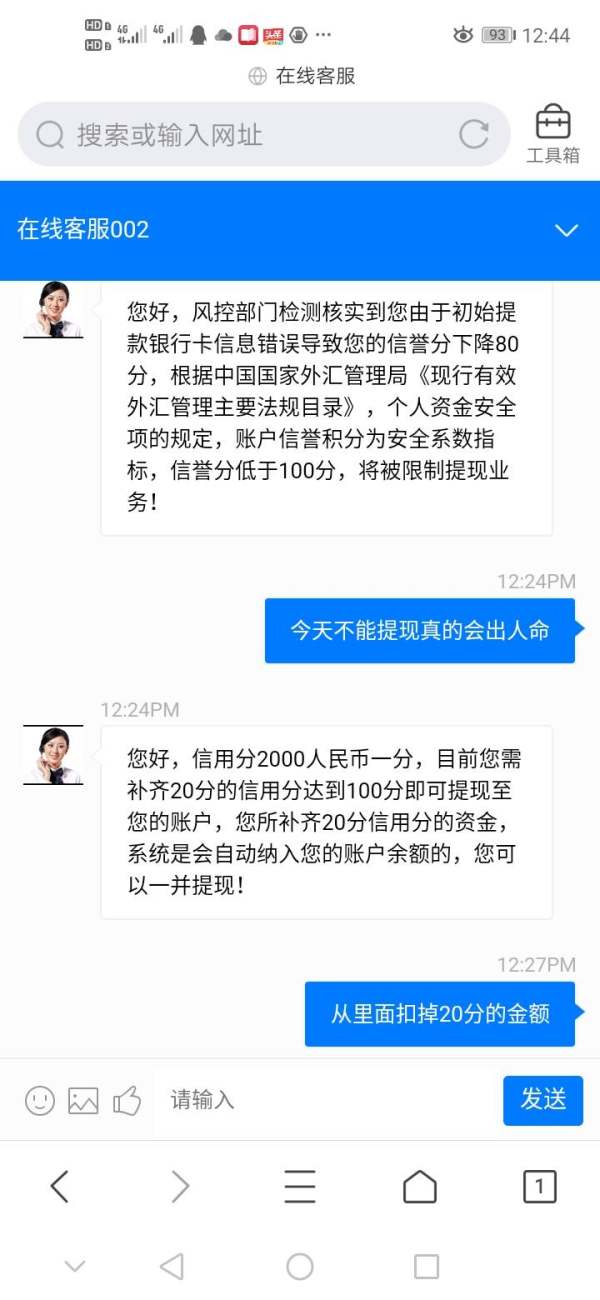

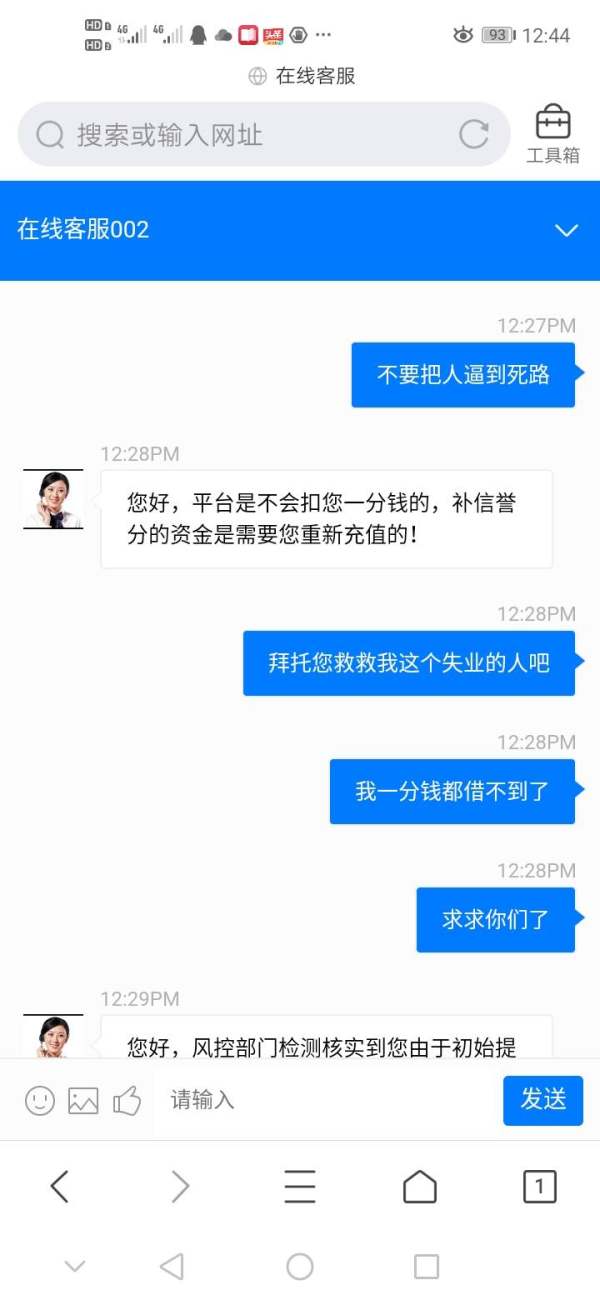

A man was finding his prey on a dating website in the name of finding a wife. He claimed that he had insider information and encouraged his dates to borrow money for investing. But, your money can’t be withdrawn when your balance exceeds ¥400,000 because it requires you to pay 20% of your balance to withdraw your money. Worse still, money can’t be withdraw if your credits do not reach 100. One credit requires ¥2,000 and 20 credits are required under this circumstance. That is how this trickster sponges on his dates for money, be careful!

Exposure

2020-08-08

FX1942308520

Hong Kong

CITIBANK induced me to deposit fund and gave no access to withdrawal! Hundreds of thousands of fund was gone! Take heed on it!

Exposure

2020-08-05

笑容太野

Hong Kong

A man on WeChat claimed to take me to trade forex. At first, I made some profits. Later, he gave no access to fund.

Exposure

2020-06-14

Joe46396

Cambodia

Feeling happy with CITIBANK. After much trepidation I stepped into the world of loans, I was however put at ease with the helpful guidance of CITIBANK. The process was seamless, quick and straightforward the money was actually in my account minutes later a wow moment. Overall it’s a good bank with good customer service and security.

Positive

2023-03-23