What is Direct TT Financial?

Direct TT Financial, abbreviated for Direct Trading Technologies Ltd, claims over two decades of industry experience. Operating as a brokerage firm registered in the United Kingdom, it boasts a global presence with ten branch offices primarily situated in the Middle East. The company offers a range of financial instruments, including Forex, Precious Metals, Energies, Indices, Exchange Traded Stocks, CFDs, and Crypto Exchange services to clients.

However, doubts have emerged regarding its legitimacy, particularly regarding its suspected FCA and VFSC clone status. This raises concerns about the reliability and credibility of Direct TT Financial, heightening investment risks for those involved.

In the upcoming article, we will comprehensively analyze this broker's attributes from various angles, delivering clear and well-organized information. If you find this topic intriguing, we encourage you to continue reading. At the conclusion of the article, we will provide a concise summary to offer you a quick grasp of the broker's key features.

Pros & Cons

Pros:

Direct TT Financial offers several advantages to traders, including risk-free practice through demo accounts, multiple account types catering to different trading preferences, and a diverse selection of assets for investment. Moreover, the segregation of client funds ensures enhanced security and protection of traders' capital.

Cons:

However, concerns arise due to the broker's suspicious regulatory status with the FCA and VFSC. Additionally, the absence of the popular MT4/MT5 trading platform limits some traders' options. Lack of information on spreads and a report of withdrawal issues on WikiFX further detract from the broker's reliability. The high minimum deposit at $500 requirements could deter interested investors seeking lower entry points.

Is Direct TT Financial Legit or a Scam?

When considering the safety of a brokerage like Direct TT Financial or any other platform, it's important to conduct thorough research and consider various factors.

Regulatory sight: The authenticity of Direct TT Financial's licenses, including the FCA (Financial Conduct Authority) license with number 795892 and the VFSC (Vanuatu Financial Services Commission) license with number 40169, is under suspicion to be fake clone. Such concerns cast doubt on the broker's adherence to regulatory standards and its commitment to ensuring customer protection.

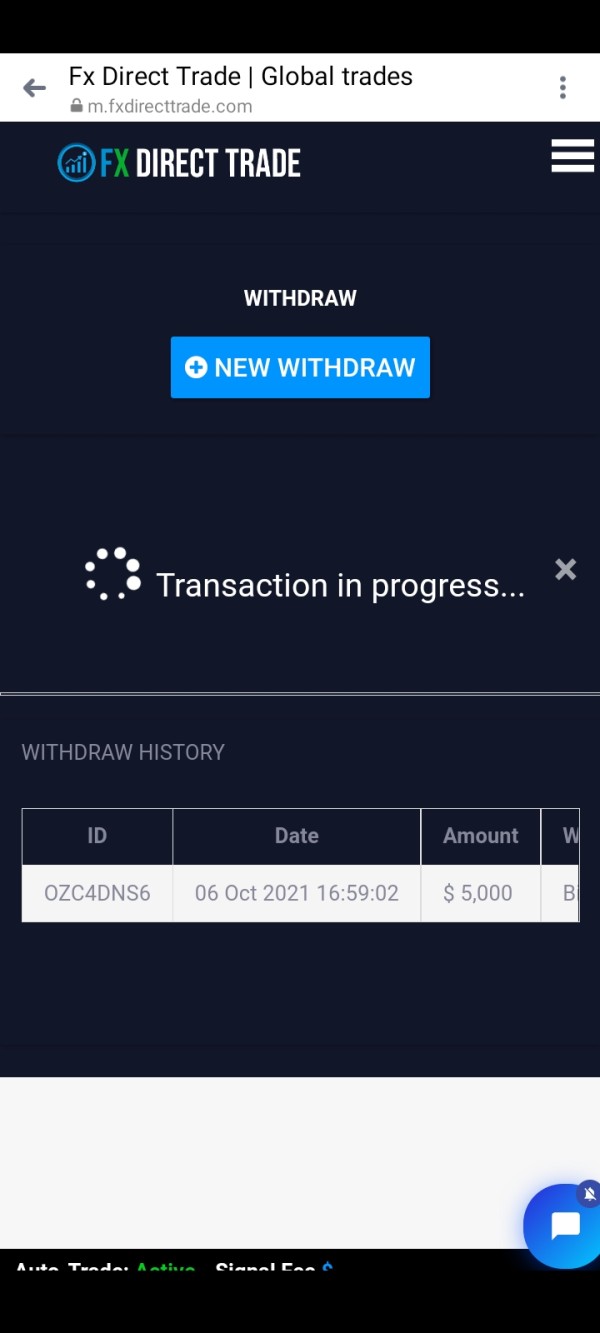

User feedback: WikiFX has flagged a significant red flag associated with Direct TT Financial, particularly with a report concerning funds being unable to withdraw. This warning underscores the importance of extreme caution for traders considering utilizing the broker's services.

Security measures: Direct TT's security measures include a robust privacy policy safeguarding client data, strict adherence to Anti-Money Laundering (AML) protocols, comprehensive Know Your Customer (KYC) procedures, and encryption technologies, ensuring the confidentiality, integrity, and safety of financial transactions and personal information. Moreover, Direct TT ensures client fund security through segregated accounts, keeping trader funds separate from the company's operational funds.

Ultimately, the choice to trade with Direct TT Financial is a personal decision. It is important to thoroughly assess the risks and benefits before arriving at a conclusion.

Market Instruments

Direct TT provides a wide array of more than 100,000 financial products catering to diverse investment preferences.

In the Forex market, clients can trade more than 100 currency pairs, taking advantage of liquidity and volatility for potential profit.

Exchange Traded Stocks offer access to a range of equities from global markets, allowing investors to diversify their portfolios.

Precious Metals, such as gold and silver, serve as a hedge against economic uncertainty and inflation, providing stability and long-term value.

Indices represent baskets of stocks, providing exposure to specific sectors or regions of the market, allowing investors to track broader market trends.

CFDs (Contracts for Difference) offer the opportunity to speculate on price movements of various financial instruments without owning the underlying asset, providing flexibility and leverage.

Energies, including oil and natural gas, present opportunities for trading based on supply and demand dynamics and geopolitical factors, offering potential for profit in volatile markets.

DTTCoins, the cryptocurrency exchange platform, enables traders to engage in buying, selling, and storing digital assets securely. With over two decades of Fintech expertise, DTTCoins tries to provide a seamless experience for crypto investors, empowering them to navigate the complexities of the digital economy confidently.

Accounts

Direct TT offers a range of account types tailored to meet the diverse needs of traders across various financial markets.

Firstly, Direct TT provides a demo account for risk-free practice trading. Traders can access virtual funds and simulate live market conditions to test strategies and familiarize themselves with the platform. With features mirroring live accounts, including Forex, CFDs, and Exchange Traded Stocks, the demo account is invaluable for enhancing skills and confidence before transitioning to live trading.

For FX/CFD trading, retail clients can choose from four account options: Mini, Standard, VIP, and ECN. The Mini account requires a minimum deposit of $500, while the Standard account requires $2000. For more advanced traders, the VIP and ECN accounts offer access to premium features and services, with minimum deposits of $10,000 and $15,000, respectively.

For those interested in trading Exchange Traded Stocks (DTT Shares), Direct TT offers three retail account options: Standard, VIP, and Platinum. The Standard account requires a minimum deposit of $2,000 USD, providing access to a range of stocks from global markets. For more experienced and high-volume traders, the VIP and Platinum accounts offer enhanced features and benefits, with minimum deposits of $10,000 USD and $100,000 USD, respectively.

These account types cater to traders of all experience levels and investment sizes for accessibility and flexibility while providing opportunities for growth and success in the financial markets.

How to Open an Account?

To open an account with Direct TT, you have to follow below steps:

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

Leverage

Direct TT offers leverage up to 1:200 for FX/CFD Real Accounts, enabling traders to amplify their trading positions. Leverage magnifies both profits and losses, making it essential for traders to be at utmost caution. While higher leverage can increase potential returns, it also heightens risk exposure. Thus traders should carefully manage leverage, considering their risk tolerance and implementing proper risk management strategies to protect their capital and mitigate potential losses.

Spread & Commission

Direct TT offers competitive spread and commission structures across its FX/CFD Real Accounts and Exchange Traded Stocks (DTTShares) accounts.

For FX/CFD Real Accounts, Mini, Standard, and VIP accounts feature zero commissions, while ECN accounts incur a commission of $10 per lot.

Exchange Traded Stocks accounts (Standard, VIP, Platinum) have a fixed commission of 0.0199.

Spread information is explicitly provided for each account type except for ECN, which is advised to have no markup. Traders seeking precise spread details should contact Direct TT directly.

Trading Platforms

Direct TT offers the web-based DTT PRO Trading Platform, designed to meet the needs of traders with institutional-grade execution and user-friendly interfaces. This platform provides an ultimate trading experience, equipped with intelligent tools and indicators to enhance decision-making.

Trading Tools

Direct TT offers a suite of powerful trading tools to enhance the trading experience for its users. These tools include Historical Volatility, which allows traders to analyze past price movements to better understand market behavior and anticipate future trends.

The Pip Calculator simplifies risk management by accurately calculating pip values, aiding traders in determining position sizes and potential profits or losses.

Additionally, the Trend Catcher tool is designed to identify and capitalize on market trends, providing valuable insights for informed decision-making.

Deposit & Withdrawal

Direct TT offers a variety of convenient funding methods for its clients, including Visa/Mastercard, crypto, bank wire, and the exclusive Direct TT Debit Visa Card. This card, available exclusively to Direct TT clients, offers unique benefits such as instant withdrawals directly to the card. Clients can also use the card for transactions at any point of sale or ATM, providing flexibility and accessibility to their funds.

However, it's noteworthy that the Direct TT Debit Visa Card is not available to UK clients.

User Exposure on WikiFX

The existence of a report on WikiFX concerning withdrawal issues serves as a significant red flag. We strongly urge all traders to conduct thorough research and meticulously analyze available information before engaging in any trading activities.

Our platform is dedicated to serving as a comprehensive tool to assist traders in making informed decisions. If you've experienced financial fraud or encountered similar issues, we encourage you to share your experiences in our 'Exposure' section. Your contribution is invaluable, and rest assured, our dedicated team is steadfast in addressing challenges and continually seeking effective solutions for complex situations.

Customer Service

Direct TT Financial offers various channels for customer support in over 20 languages, including an addresses for physical correspondence, email for inquiries, phone for direct communication, a contact us form on their website, and presence on social media platforms like Facebook, Twitter, Telegram and LinkedIn. This multi-channel approach ensures accessibility and responsiveness to client queries and concerns.

Address: 76 Cannon Street, City of London EC4N 6AE.

Tel: +44 20 3535 5815.

Email: info@dttfs.co.uk.

For details regarding its branch offices, you can visit https://www.dttmarkets.com/en/contact_us#offices.

Educational Resources

Direct TT prioritizes the education and development of its traders by offering a comprehensive range of educational resources. These include free weekly live webinars conducted by leading financial experts, catering to both beginners and advanced traders.

Covering a wide array of topics such as trading basics, platform usage, strategy formation, and market analysis, these webinars provide valuable insights and knowledge essential for successful trading across Forex, Stocks, CFDs, and Cryptocurrencies.

Available in English, Arabic, and Spanish, Direct TT's educational offerings ensure accessibility and inclusivity, empowering traders to learn, grow, and make informed investment decisions at their own pace.

Conclusion

Direct TT Financial, headquartered in the United Kingdom with 10 branch offices primarily in the Middle East, provides trading services across various asset classes, including Forex, Precious Metals, Energies, Indices, Exchange Traded Stocks, CFDs, and Crypto Exchange. However, its suspicious VFSC and FCA clone status raises concerns about investor protection. Regulation is crucial for financial oversight and client safeguarding.

Therefore, individuals considering Direct TT Financial should be extreme cautious and explore regulated alternatives prioritizing transparency, security, and client protection.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.