Score

Yuheng Capital

United Kingdom|2-5 years|

United Kingdom|2-5 years| http://www.yuhengfx.com/enindex.html

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed Yuheng Capital also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

yuhengfx.com

Server Location

Singapore

Website Domain Name

yuhengfx.com

Server IP

43.224.154.236

Company Summary

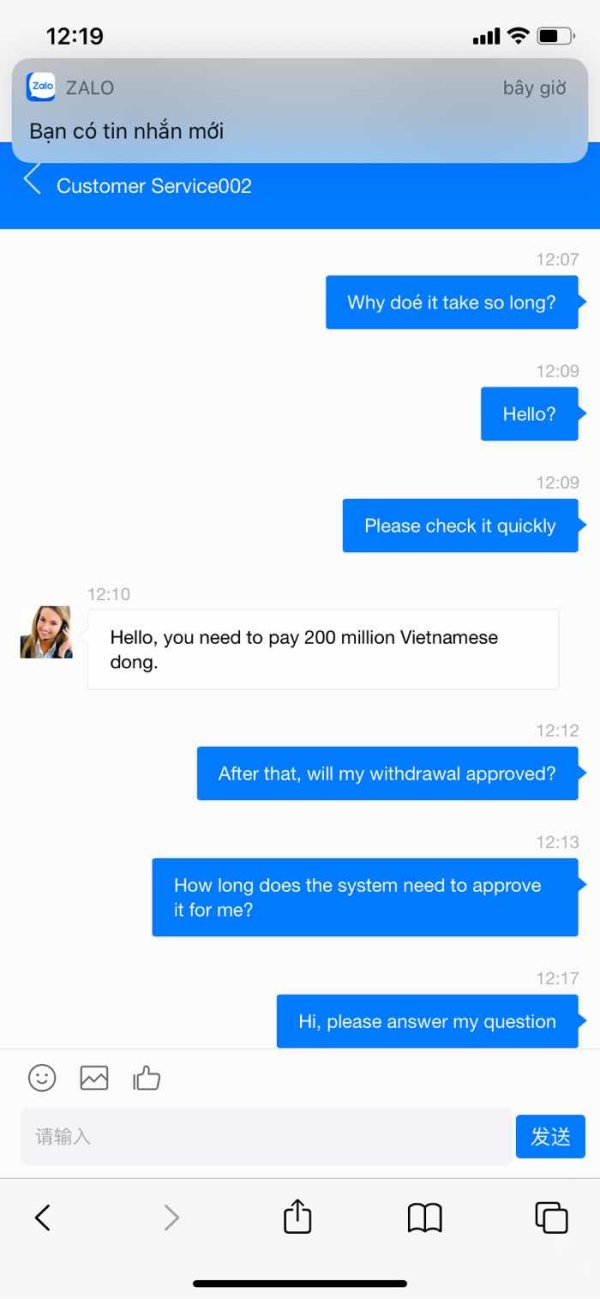

Note: Yuheng Capital's official website: http://www.yuhengfx.com/enindex.html is currently inaccessible normally.

Yuheng Capital Information

Yuheng Capital is an unregulated brokerage company registered in the United Kingdom. The broker engaged in spot FX, commodities, and CDFs on indices and stocks. Due to the closure of the official website of this broker, traders cannot obtain more security information.

Is Yuheng Capital Legit?

After a Whois query, we found that this company's domain name is for sale, which shows that this company has not registered it securely.

Downsides of Yuheng Capital

- Unavailable Website

Yuheng Capital's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since Yuheng Capital does not explain more transaction information, especially fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

Wealth Global claims to be regulated by the NFA in the United Kingdom. However, it appears that these claims are unauthorized and potentially misleading.

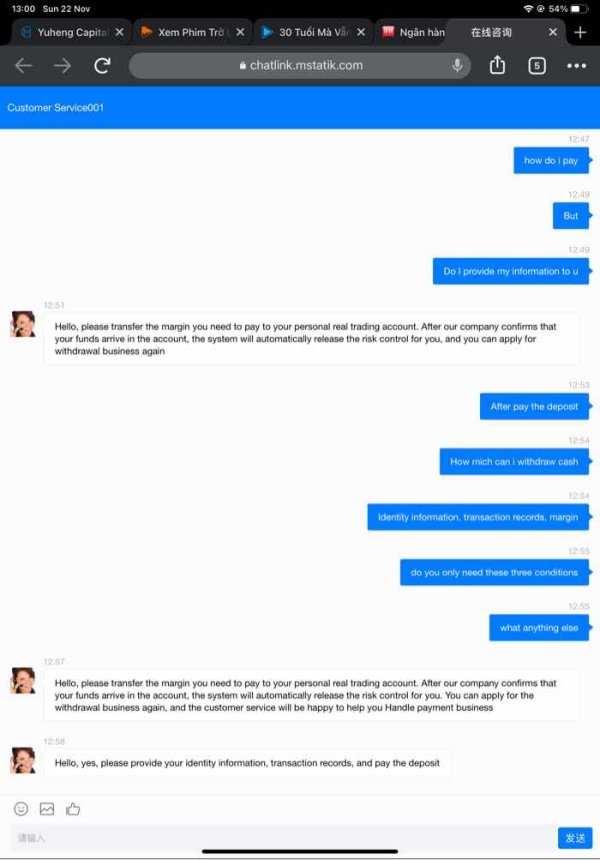

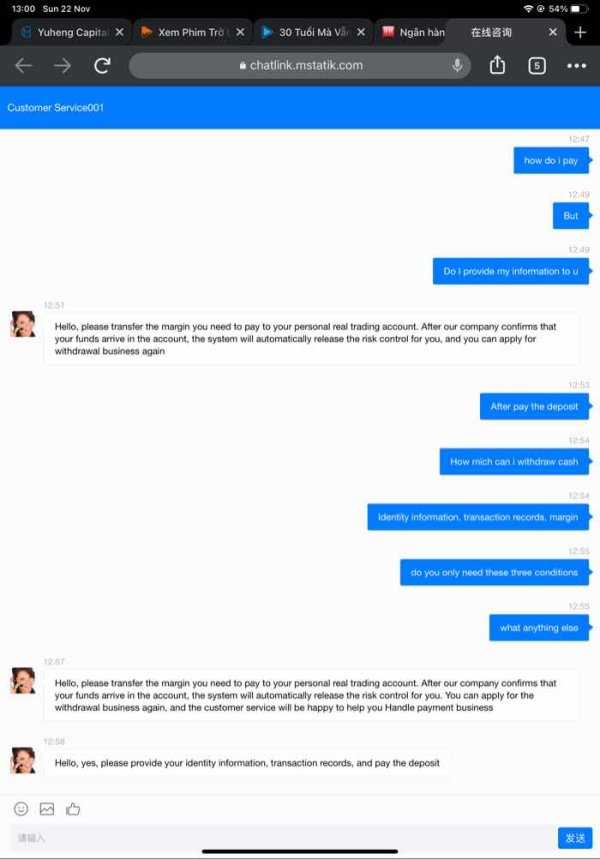

- Withdrawal Difficulty

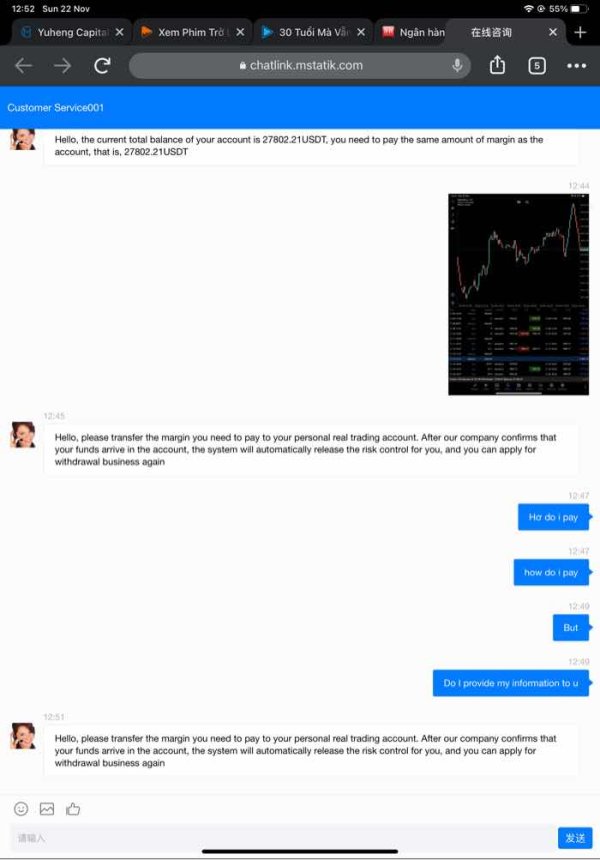

According to a report on WikiFX, traders encountered significant difficulties with fund withdrawals and scams. The issue remained unresolved despite the request being pending for a long time.

Negative Yuheng Capital Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there are 15 pieces of Yuheng Capital exposure.

Exposure. Cannot withdraw & scam

| Classification | Unable to Withdraw & scam |

| Date | 2020-2021 |

| Post Country | Hong Kong, China/South Korea |

Some users could not withdraw and others held the view that suspect Yuheng Capital was a swindler-provided investments scam, and these comments were still pending. You may visit: https://www.wikifx.com/en/comments/detail/202101069312596095.html.

Conclusion

Trading with Yuheng Capital may pose security risks as they are listed as “Unauthorized” by FCA, despite their claims of regulation. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards. When selecting a trading platform, prioritize those supervised by recognized regulatory bodies for enhanced security and peace of mind.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 15

Content you want to comment

Please enter...

Review 15

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX2397463938

South Korea

Do you know the Yuheng Capital platform[3f] Search it and it is reported that a large number of people have been swindled. It is now closed and inaccessible. It is related to the Yuheng Capital. I was swindled out of Yuheng Capital because I couldn't get a large amount of money out of it was fraudulent. At that time, a person I met on a dating app site that introduced yuheng capital introduced this place as well. And if you search well on Google, you will find that it is related to each other.

Exposure

2021-01-06

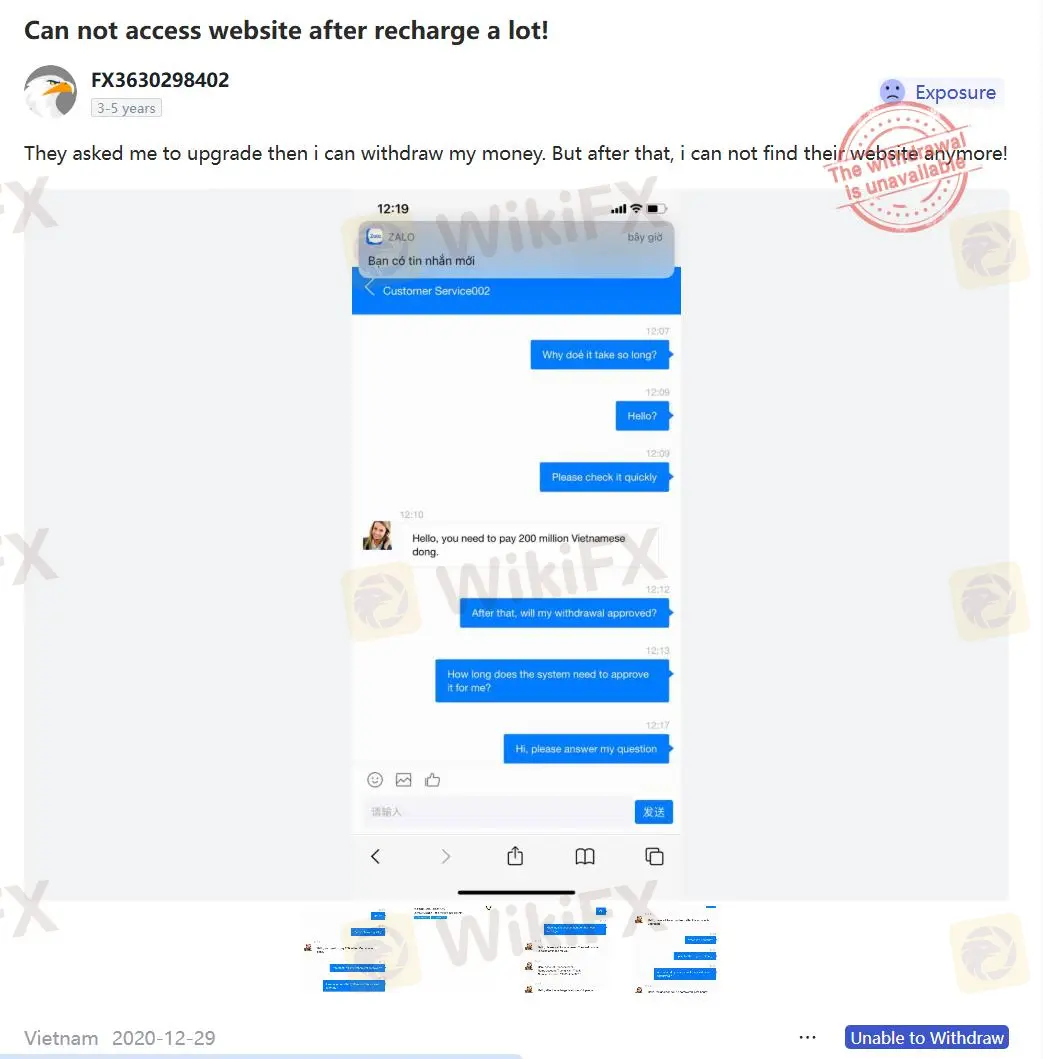

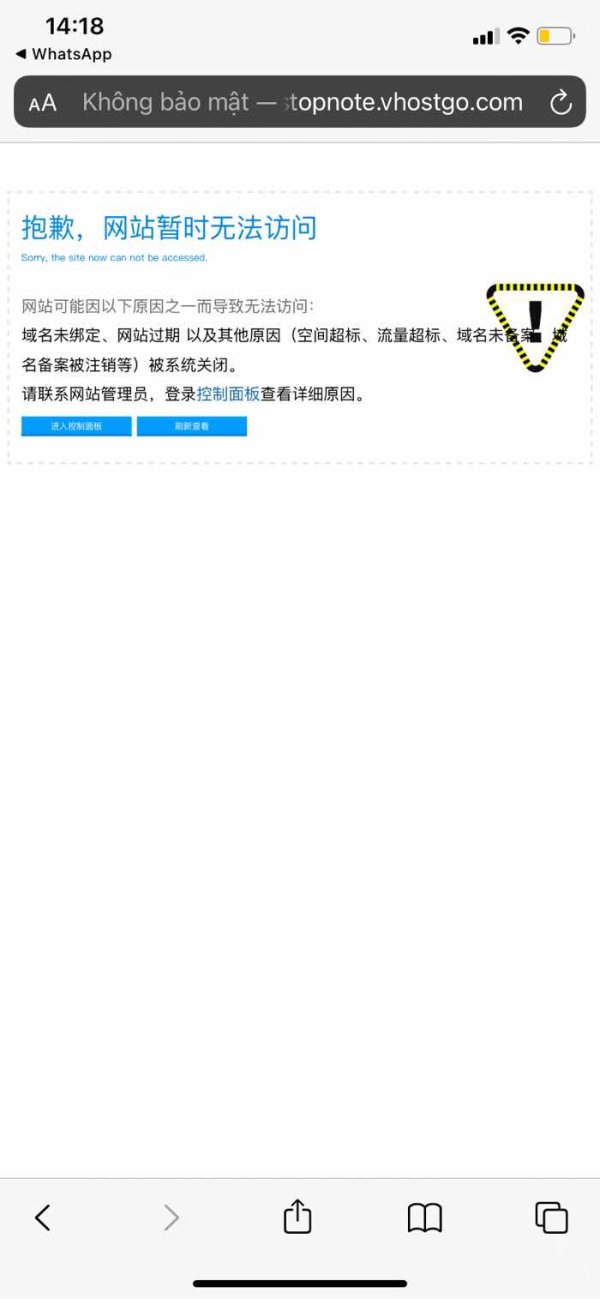

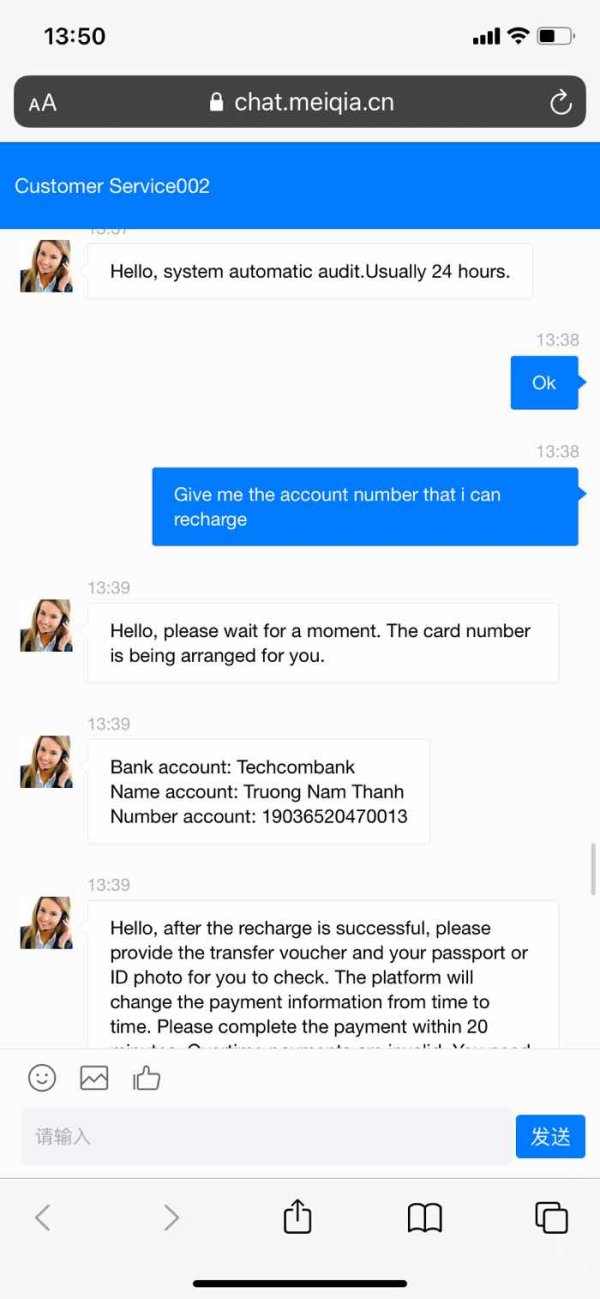

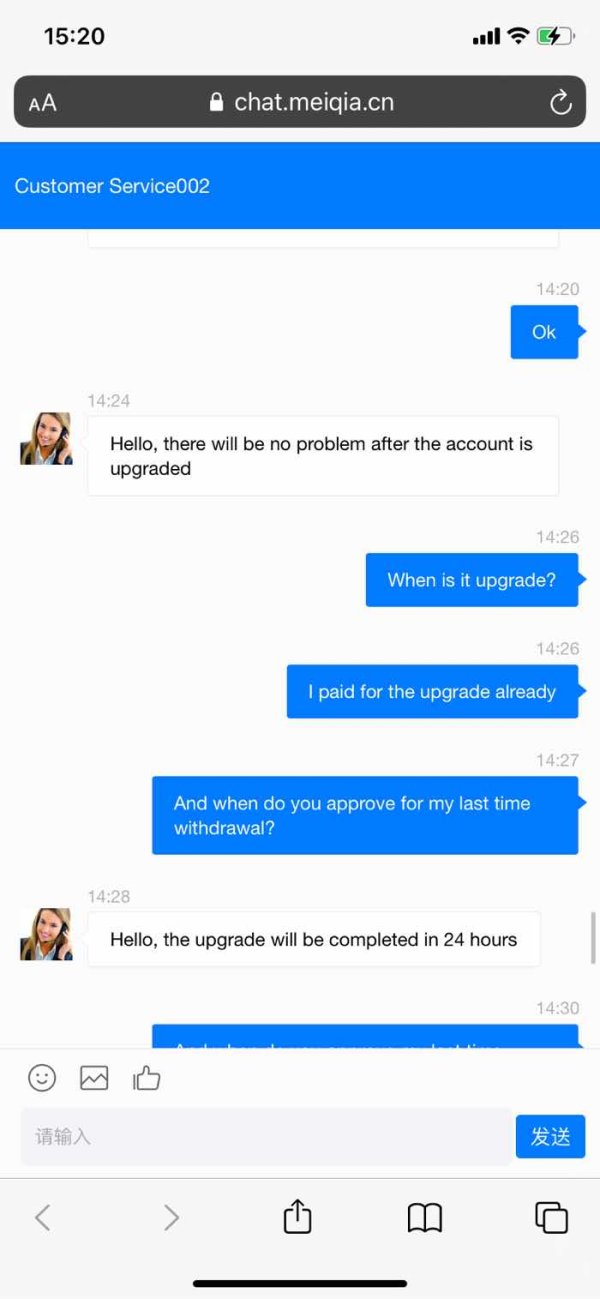

FX3630298402

Vietnam

They asked me to upgrade then i can withdraw my money. But after that, i can not find their website anymore!

Exposure

2020-12-29

FX1319538246

Cambodia

We cant withdraw cash with a lot of reason differently

Exposure

2020-12-09

燕子98256

Cambodia

You have to deposit money first or you can’t withdraw money and your account will be closed

Exposure

2020-12-04

FX1319538246

Cambodia

They told me to deposit the exact amount I had in my account so I could withdraw cash While i trade normal without anything. These are ridiculous They will close my account and withdraw the amount if I don't deposit the correct amount I am going to request an international investigation

Exposure

2020-12-01

FX2397463938

South Korea

They refused to accept withdrawals if had deposited the investment in a plurality. He said, "If you deposit 3,9881.43 USDT, you will be approved for withdrawal." When deposited 39881.43 USDT, changed my words that had to deposit 50% of my total amount again so that could withdraw after the membership. reservation is completed. He's an obvious swingler am going to request an international investigation.

Exposure

2020-11-29

燕子98256

Cambodia

Scam! The regulator should stand out and handle it! Fraud platform

Exposure

2020-11-28

FX1319538246

Cambodia

They told me to deposit the exact amount I had in my account so I could withdraw cash While i trade normal without anything. These are ridiculous They will close my account and withdraw the amount if I don't deposit the correct amount I am going to request an international investigation

Exposure

2020-11-25

燕子98256

Cambodia

Ask you to add funds everyday. It's said that you can deposit after depositing! But they said I deposited wrong! Fraud company

Exposure

2020-11-23

燕子 ゎ

Cambodia

The customer service said I have to deposit 5,000 USDT to open a channel of CNY to withdraw funds. I deposited 5043USDT but the customer service said the deposit should be 5,000 USDT. I feel like that it's a fraud platform with no regulator!

Exposure

2020-11-22

燕子98256

Cambodia

Unable to withdraw. Have to pay money all the time. Don't be cheated

Exposure

2020-11-22

FX2397463938

South Korea

They refused to accept withdrawals if I had deposited the investment in a plurality. He said, "If you deposit 3,9881.43 USDT, you will be approved for withdrawal." When I deposited 39881.43 USDT, I changed my words that I had to deposit 50% of my total amount again so that I could withdraw after the membership reservation is completed. He's an obvious swindler. I am going to request an international investigation.

Exposure

2020-11-21

燕子98256

Cambodia

You have to open channel to withdraw funds with $5,000 after application

Exposure

2020-11-21

FX1949272992

Hong Kong

The broker doesn't give access to withdrawal. Sometimes they said the amrgin should be paid for false operation, sometimes they said I should pay for tax. In the end, I was asked to pay $5,000. When I bought positions, I deposited $5,040 but they said I have to pay $5,000

Exposure

2020-11-16

FX6928726620

Thailand

I invested in a Chinese platform. It’s easy to deposit and withdraw at first. Later, I added funds but I can’t withdraw. It still exists and embezzled customers’ money. I asked the customer service, he said there were lots of withdrawals so I have to wait.

Exposure

2020-10-27