Score

Global Next Trade

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://www.globalnexttrade-en.com/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

GNTCapital-Live

Influence

D

Influence index NO.1

Mexico 2.60

Mexico 2.60MT4/5 Identification

MT4/5 Identification

Full License

United States

United StatesInfluence

Influence

D

Influence index NO.1

Mexico 2.60

Mexico 2.60Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Global Next Trade also viewed..

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- Global Business

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

globalnexttrade-en.com

Server Location

United States

Website Domain Name

globalnexttrade-en.com

Server IP

185.230.63.107

globalnexttrade.com

Server Location

United States

Website Domain Name

globalnexttrade.com

Server IP

185.230.63.107

gntcapital.com

Server Location

United States

Website Domain Name

gntcapital.com

Server IP

104.26.12.169

Company Summary

| Global Next Trade Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Cayman Islands |

| Regulation | No regulation |

| Market Instruments | Forex, commodities, indices, cryptocurrencies |

| Demo Account | ❌ |

| EUR/USD Spread | From 1.8 pips (Standard account) |

| Leverage | Up to 1:300 |

| Trading Platform | MT5, CQG |

| Copy Trading | ✅ |

| Min Deposit | $200 |

| Customer Support | Tel: (+52) 8111341890 |

| Email: support@gntcapital.com | |

| Address: Av. Ricardo Margain Zozaya 315, Col. Santa Engracia, San Pedro Garza, N.L. , 66263, México | |

| Registered address: Two Artillery Court, 2nd Floor, 161 Shedden Road, George Town, PO Box 799, KY1-1103, Cayman Islands | |

Global Next Trade Information

Global Next Trade was registered in Cayman Island while actually operates in Mexico. The company mainly deals in trading in forex, commodities, indices and cryptoscurrencies. It offers three live trading accounts, with a minimum deposit of $200, and tight spreads from 1.8 pips on the Standard account. The advanced MT5 platform is available to enhance customer experiences.

In addition, the broker allows copy trading to follow successful investors and offers PAMM accounts, so you can entrust your trading to experienced money managers for better profit allocation.

However, the broker currently operates without valid regulation from authority bodies, which degrade its legitimacy and reliability.

Pros and Cons

| Pros | Cons |

| Diverse tradable asset classes | No regulation |

| Tiered live accounts | WikiFX complaints about poor earnings |

| Commission-free accounts offered | High minimum deposit |

| Flexible leverage ratios | |

| Copy trading | |

| Popular payment options |

Regulatory Status

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of Global Next Trade, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

What Can I Trade on Global Next Trade?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Fees

Global Next Trade offers four different live accounts: Standard, Silver and Platinum accounts, with increasing minimum deposit requirements of €200, €10,000 and €5,000 respectively.

Spreads are from 1.8 pips for standard account and 0 pip for silver/platinum accounts. However, there's no commission for standard account, while the silver account charges a commission of $5 per side per lot and the platinum account $3.5 per side per lot.

| Account Type | Min Deposit | Spread | Commission |

| Standard | $200 | From 1.8 pips | ❌ |

| Silver | $1 000 | From 0 pips | $5 per side per lot |

| Platinum | $5 000 | From 0 pips | $3.5 per side per lot |

Leverage

Global Next Trade offersa leverage level of up to 1:300 for standard account while 1:200 for silver and platinum accounts, which means you can control a larger position of up to 300 times of your initial deposit.

However, you should always be very prudent to use such tool since leverage not only amplify profits, but losses will be augmented at same level as well.

| Account Type | Max Leverage |

| Standard | 1:300 |

| Silver | 1:200 |

| Platinum |

Trading Platform

The broker offers multiple trading platforms: the advanced MetaTrader 5 with Android and iOS versions, a proprietary Pro Next Trade platform available on both Windows and MacOS, as well as the CQG platform with advanced analysis and charting tools.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ❌ | / | Beginners |

| MT5 | ✔ | Android, iOS | Experienced traders |

| Pro Next Trade | ✔ | Windows, MacOS | Beginners |

| CQG | ✔ | Web | Advanced traders |

Deposit and Withdrawal

Global Next Trade accepts payment through Bitolo (SPEI), Wirebit, and Match2pay (Crypto), as well as the option for domestic and international bank transfers. Additionally, VISA cards are also available for withdrawing profits.

Keywords

- 5-10 years

- Suspicious Regulatory License

- MT5 Full License

- Regional Brokers

- High potential risk

Comment 7

Content you want to comment

Please enter...

Comment 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Andres70739

Colombia

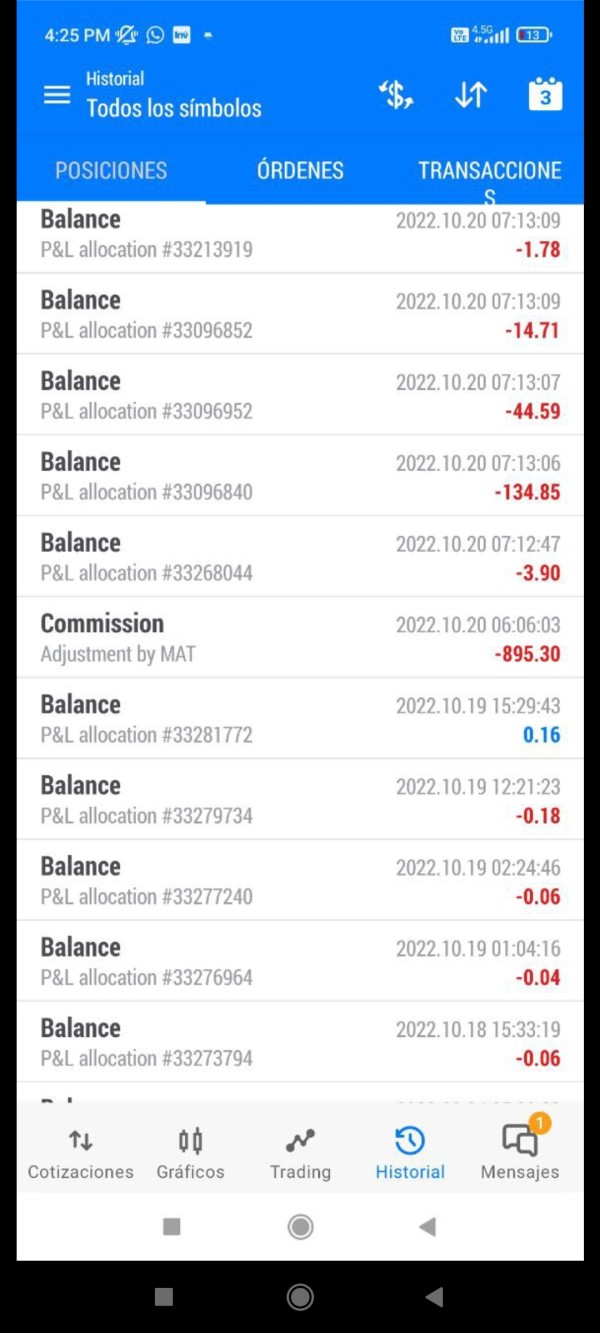

This broker is a fraud and a thief, they stole 895 dollars from my account, with a concept, a so-called commission adjustment. When I complained about the arbitrary withdrawal of the 895 dollars from my account, they told me to talk to my manager and logically the manager does not have access to my account and even less to my money. They are thieves and continue to operate as if nothing, to withdraw, they put obstacles and delay the withdrawal as much as they can. In the image you can clearly see the date and the withdrawal for 895 dollars, made directly by the broker. Any additional information with pleasure.

Exposure

2023-04-26

FX6283185592

Argentina

I have a problem with this broker. The service is terrible and the assistants are all online, but they do not respond to me. They had already been asked for several withdrawals, but they keep making excuses, always postponing the withdrawal day. Be very careful when investing in this GLOBAL NEXT TRADER broker

Exposure

2021-12-20

Lamerbeauty

Mexico

Trading with Global Next Trade has its advantages and drawbacks. On the positive side, the broker provides a range of trading instruments, and the diverse account options allow for customization. The G-Trader platform is user-friendly, and I appreciate the availability of a demo account. However, the lack of regulatory oversight is a significant concern, and the absence of educational resources is a drawback for beginners.

Neutral

2023-12-05

kinkill

Portugal

Global Next Trade has been my trading partner for over a year now, and I appreciate the variety it offers. The multiple trading platforms, including MT5 and Gtrader, give me the flexibility I need. The diverse account options cater to different trading styles.

Neutral

2023-12-04

快到碗里来98689

Singapore

Scammers of the age no withdrawals charts manipulation. No reply from the support team. Worst experience with this broker. They are broke. They are thieves.

Neutral

03-20

FX1099203112

Spain

Ay dios mío. Mi amigo y yo mencionamos este broker Global Next Trade y le eché un vistazo y descubrí que no tiene absolutamente ninguna información reglamentaria. Para colmo, su sitio web no se puede abrir. ¡Creo que pueden haberse fugado con dinero!

Neutral

03-20

Konner

Japan

Global Next Trade offers super tight spreads that really help in keeping costs low and maximizing profits. And their maximum leverage options are pretty generous, allowing traders to make the most of their capital. Overall, I'm quite happy with their trading conditions and would definitely recommend them to other traders.

Positive

2024-07-09