Overview of GGFX

GGFX is a well-established forex broker founded in 2005 and registered in the UK. GGFX offers a wide range of tradable assets including currencies, stocks, indices, cryptocurrencies, and commodities, catering to the varying investment preferences of its clientele. They provide multiple account types (Standard, Premium, and VIP) to cater to the needs of various traders and require a minimum deposit of just $100. GGFX utilizes renowned trading platforms such as MetaTrader 4, MetaTrader 5, and Web Trader and offers a maximum leverage of 1:500. Importantly, they offer a demo account for those who wish to learn trading without risk. GGFX stands out with their customer support, offered through 24/5 live chat, email, and phone, and deposits and withdrawals can be made through multiple means. T

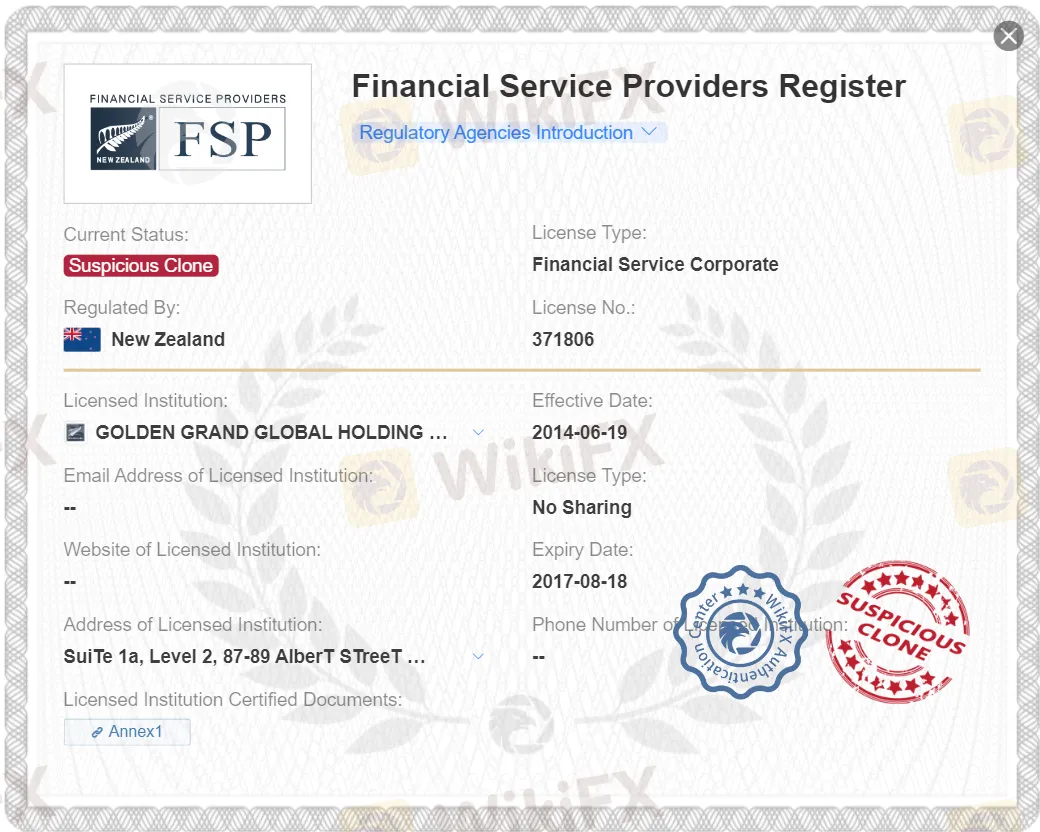

Regulatory Authority

In the Financial Service Providers Register of New Zealand, GGFX holds a license under the designation of Financial Service Corporate with License No. 371806. However, its current status is flagged as a “Suspicious Clone,” raising concerns about its legitimacy.

Similarly, according to the National Futures Association in the United States, GGFX is categorized as a “Suspicious Clone.” The license held by GGFX in the U.S. is identified as a Common Financial Service License, with License No. 0510057.

Pros and cons

Pros of GGFX Broker:

1. Wide Range of Tradable Assets: This allows traders to diversify their portfolio and choose from an array of options. Whether it's currencies, stocks, indices, cryptocurrencies, or commodities, GGFX offers it all. This flexibility is an advantage, particularly for traders who like to experiment with different asset classes.

2. Multiple Account Types: GGFX provides traders with the option to choose between a Standard account, a Premium account, or a VIP account. Such different account types are beneficial because they cater to both new traders and professional traders, offering a choice according to their trading preferences and financial capabilities.

3. Low Minimum Deposit: A minimum deposit of just $100 makes GGFX accessible even for novices or those with a lower investment starter. This can serve as an attractive feature for beginners willing to dip their toes in Forex trading.

4. Renowned Trading Platforms: GGFX uses popular platforms like MetaTrader 4 and MetaTrader 5. These platforms' widespread acceptance means that many traders would already be familiar with the interface and functionalities, making the transition smoother.

5. Demo Account Available: This provides a risk-free environment for new traders to learn and for experienced traders to test strategies. It's a valuable learning tool that adds to the overall trader experience.

6. 24/5 Customer Support: With round-the-clock customer support, GGFX ensures that their clients' trading-related queries and issues are addressed promptly.

7. Multiple Deposit and Withdrawal Methods: The broker offers various options, including credit card, debit card, bank transfers, and e-wallets, providing convenience for traders to manage their funds.

Cons of GGFX Broker:

Lacks Information about Spreads: The mentioned spreads 'from 0.6 pips' don't provide enough detail about the spreads for different asset classes. Traders might face challenges in estimating their potential trading costs.

Market Instruments

GGFX offers a vast array of market instruments and products that cater to various trading preferences. The broker's asset class range includes currencies, stocks, indices, cryptocurrencies, and commodities. This diversity ensures that traders have the flexibility to trade in multiple markets and balance their portfolio based on risk and return preferences.

Forex trading is a significant part of their offerings, with numerous currency pairs available for trading. Traders interested in cryptocurrency can also find a range of popular cryptocurrencies to trade. Stocks of major companies across different sectors and global indices like the Dow Jones, NASDAQ, and others are also available to trade.

Regarding commodities, traders can invest in precious metals like gold and silver or venture into energy commodities such as oil or natural gas. The extent of GGFX's product offering provides ample choice for both conservative and aggressive investment strategies.

Account Types

GGFX understands that each trader has unique needs and preferences, which is why they offer three distinct types of accounts: Standard, Premium, and VIP.

The Standard account is typically geared towards beginner traders or those who prefer to trade with small amounts. The main advantage of this account type is the lower minimum deposit requirement, making it accessible for new entrants. It comes standard with most features needed to start trading effectively and offers fixed spreads.

The Premium account, on the other hand, is targeted at more experienced traders. It requires a larger minimum deposit than a Standard account but offers lower spreads, indicating lower transaction costs. In addition, Premium account holders usually have access to a greater variety of services, such as advanced educational resources or dedicated customer support.

Lastly, the VIP account is tailored for high volume professional traders and often requires a significantly higher minimum deposit. The VIP account offers the lowest spreads among the three account types along with some special benefits. These may include personalized customer service, priority in withdrawals, and access to premium trading tools and resources.

How to Open an Account of GGFX?

1. Visit GGFX's Official Website: Start by going to the official website of GGFX. Look out for the 'Open a Live Account' button, typically visible on the home page.

2. Registration Form: Clicking on the 'Open a Live Account' button will usually take you to a registration form. Here, you are expected to fill in personal information such as your full name, phone number, email address, and country of residence.

3. Choose Account Type: Next, you will be prompted to select the type of account you wish to open - Standard, Premium, or VIP. Make sure you understand the benefits and requirements of each before making a decision.

4. Verify Your Email: Upon filling the registration form, an email will be sent to your registered email address. This email contains a verification link that you need to click to confirm the creation of your account.

5. Provide Additional Details: After email verification, you will be asked to provide additional details, like your employment status, financial background, and trading experience. This information helps the broker to understand more about your financial goals.

6. Document Verification: GGFX will also require the submission of identification documents for verification purposes. These typically include a copy of your passport or national ID for identity verification and a copy of utility bill or bank statement for proof of residence.

7. Make a Deposit: As soon as your account has been verified, you can now fund your trading account. GGFX provides various methods for depositing funds, including credit/debit card, bank transfer, and e-wallet services.

8. Start Trading: Once your deposit is successful, you can now start trading on your desired platform.

Leverage

GGFX offers a maximum leverage of 1:500. This is quite high and implies that for every dollar deposited, a trader can trade up to $500. Such a level of leverage amplifies the potential for profits but also increases the risk of losses. Therefore, it's crucial that traders understand the implications and risks associated with high leverage before deciding to utilize it. It's suitable for those experienced traders who have perfected their risk management strategies and are willing to take on higher risk for potential gains.

However, beginner traders should tread carefully, and consider starting with lower leverage.

Spreads & Commissions

GGFX offers competitive spreads starting from as low as 0.6 pips. Spreads can vary depending on the account type and the traded asset. Certain account types can have lower spreads offering advantage to more experienced and professional traders.

However, it is critical to understand that 'starting from 0.6 pips' does not necessarily mean that all trades will enjoy such low spreads. Factors such as market volatility, asset liquidity, and major economic releases can cause spreads to widen. Therefore, traders should always account for the potential of increased spreads in their trade planning and risk management.

Trading Platform

GGFX uses MetaTrader 4 and MetaTrader 5, two of the most widely used trading platforms in the forex industry, along with a Web Trader platform.

MetaTrader 4 is renowned for its user-friendly interface, advanced charting capabilities, numerous technical indicators, and automated trading capabilities through Expert Advisors (EAs). These features enable efficient analysis of price dynamics, allowing traders to make better-informed trading decisions.

MetaTrader 5, the successor of MT4, has all the advantages of its predecessor and brings along additional features. These include an expanded number of timeframes, better economic event integration, and an increased number of concurrent charts.

The Web Trader platform allows traders to access their trading accounts from any web browser without needing to install any software. This convenience makes it a reliable choice particularly for those who prefer to trade on-the-go or from different devices.

These platforms offer vast analytical tools for both fundamental and technical analysis, multiple order types, and customizability, ensuring a flexible trading environment catering to both novice and experienced traders alike. While GGFX provides a comprehensive trading environment through these platforms, traders should explore each platform and test it via a demo account to find one that best fits their trading needs.

Deposit & Withdrawal

GGFX offers a variety of payment methods to suit the needs of its clients, including credit and debit cards, bank transfers and e-wallet services. This range of options allows traders to choose the most convenient way to manage their funds, making transactions smoother and more flexible.

When making a deposit, transactions through credit or debit cards and e-wallet services are often processed almost instantly, allowing traders to get started as quickly as possible. Bank transfers, while reliable, can take a few business days to clear.

As for withdrawal, GGFX processes requests promptly to ensure that traders can access their funds when needed. The processing time may differ depending on the chosen method but is usually quicker through e-wallets compared to traditional bank transfers.

Regarding fees, it's crucial to note that while GGFX might not charge a fee for deposits or withdrawals, third-party service providers might levy charges. For example, banks might charge a transaction fee for wire transfers, or e-wallet services might have a percentage fee for processing the transaction.

Moreover, it's important to note that any fees relating to foreign currency conversion will be borne by the trader. Therefore, traders should familiarize themselves with the potential fees involved in depositing and withdrawing funds and consider them in their cost analysis. Always check the terms and conditions, or contact customer support for specifics about fees to avoid unpleasant surprises.

Customer Support

If you need to get in touch with GGFX, they offer multiple contact options to accommodate different language preferences.

For English speakers, the contact number is +852 3050 1794, while those preferring Traditional Chinese (HK) can use the same number.

For Chinese speakers preferring Simplified Chinese, the contact number is +852 3050 1714.

In addition to phone contact, GGFX can also be reached via QQ at 619734462.

For general inquiries and assistance, there's a dedicated customer service hotline at 800187272. This variety of contact channels underscores GGFX's commitment to providing accessible and responsive support to its users.

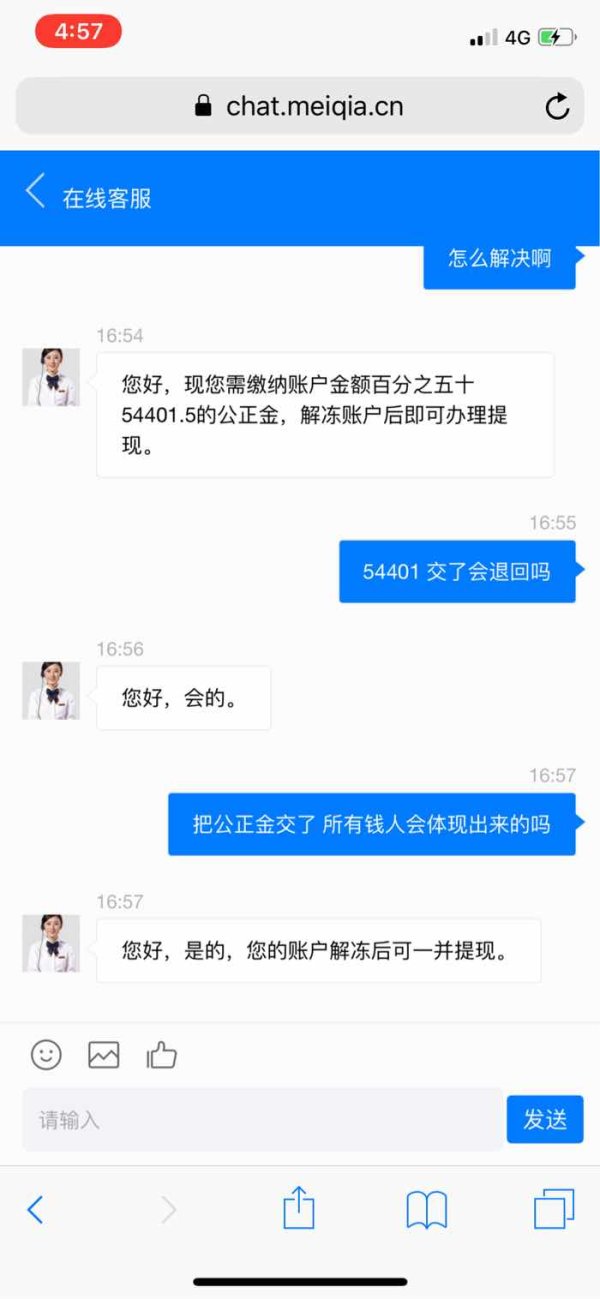

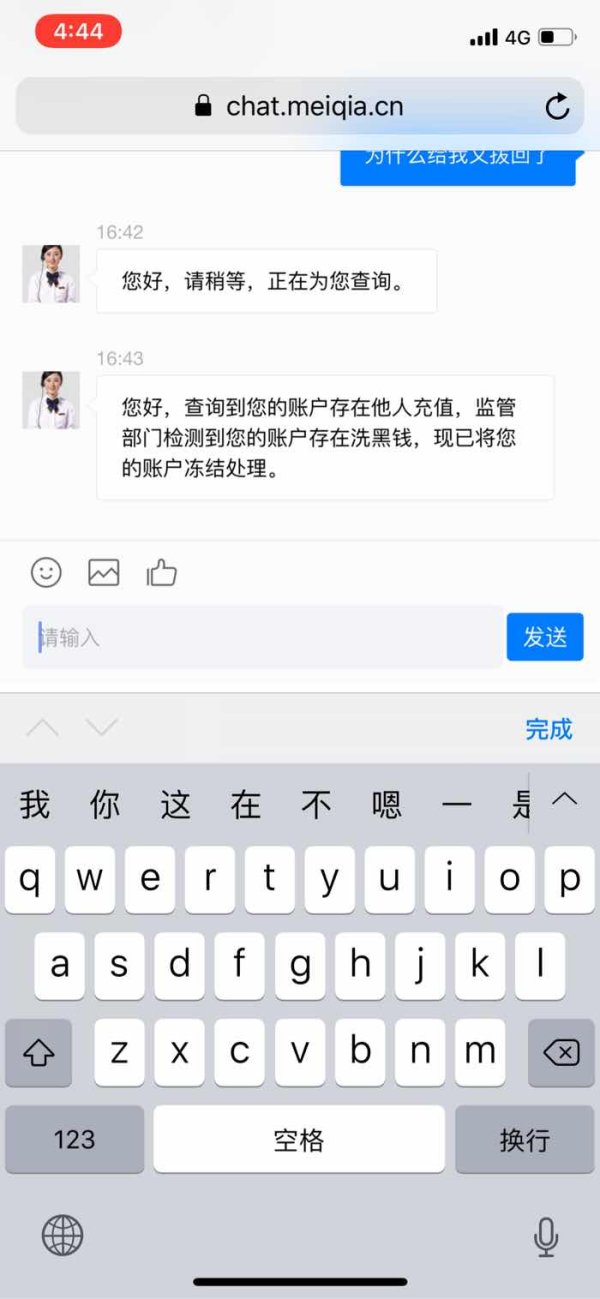

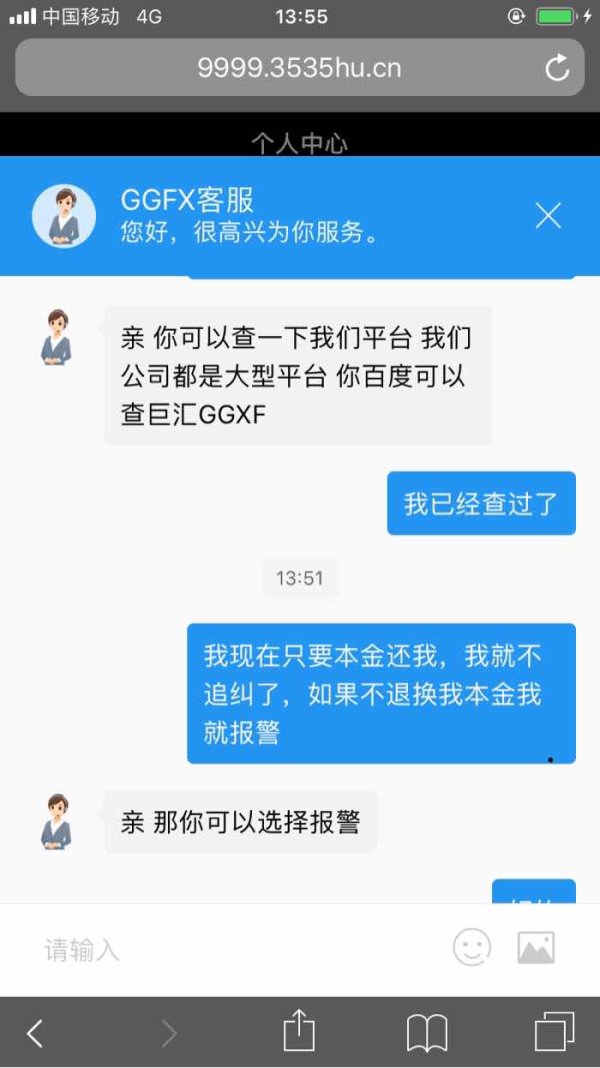

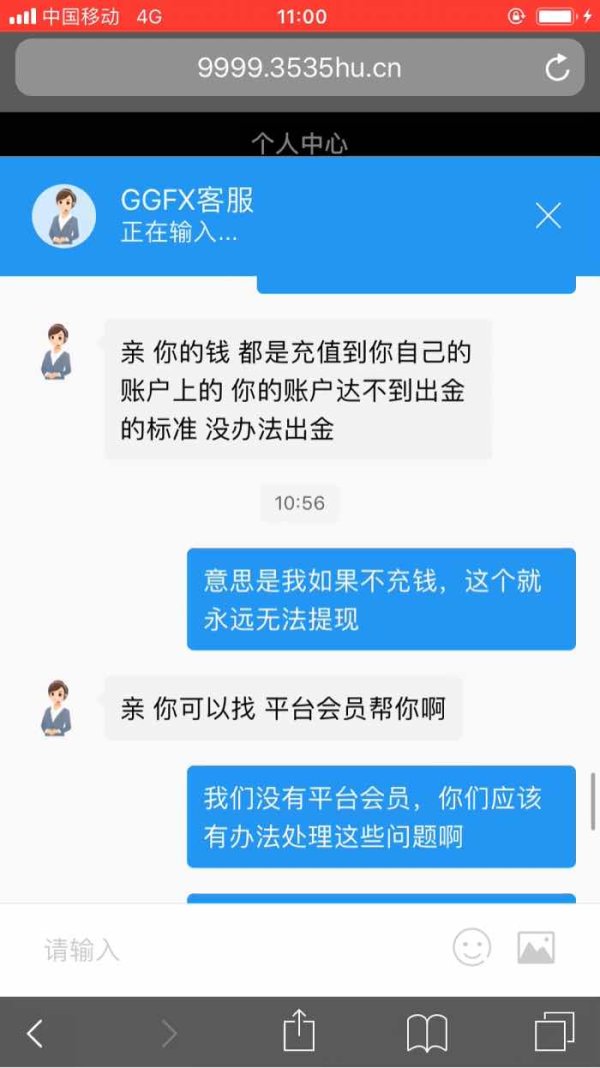

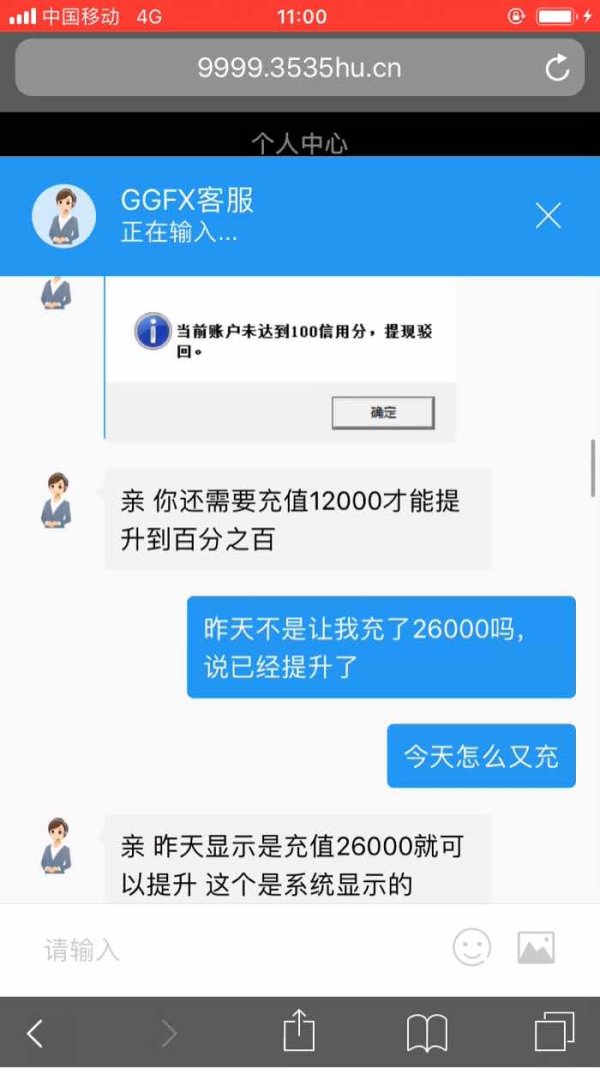

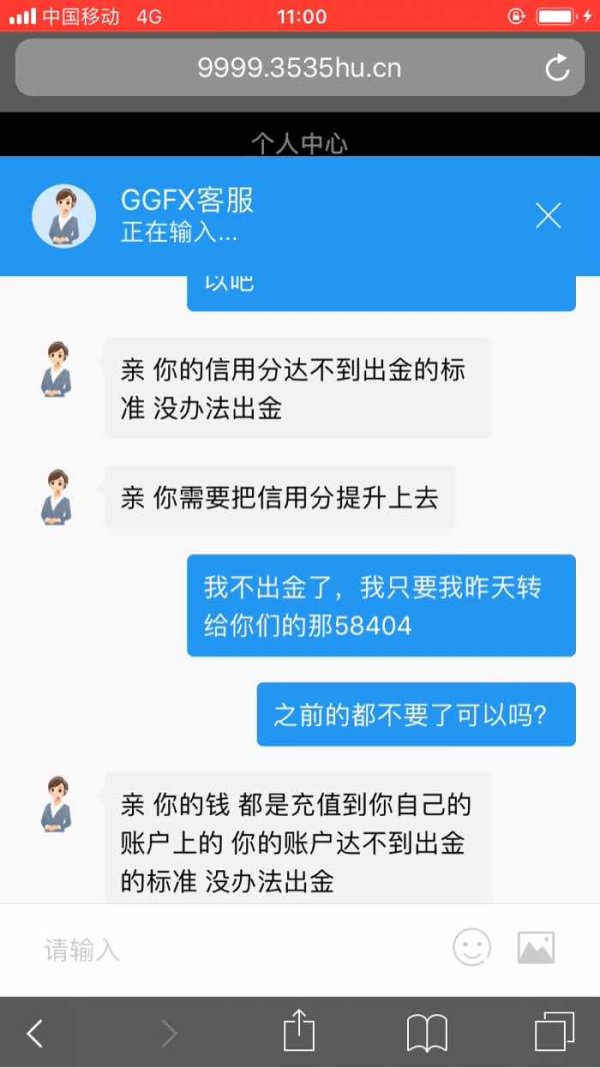

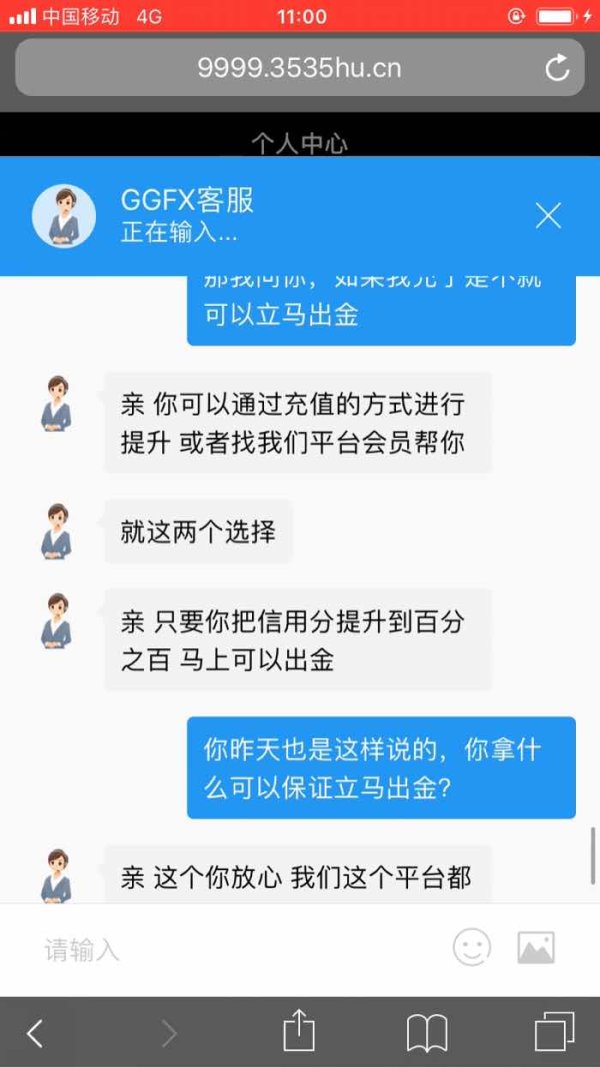

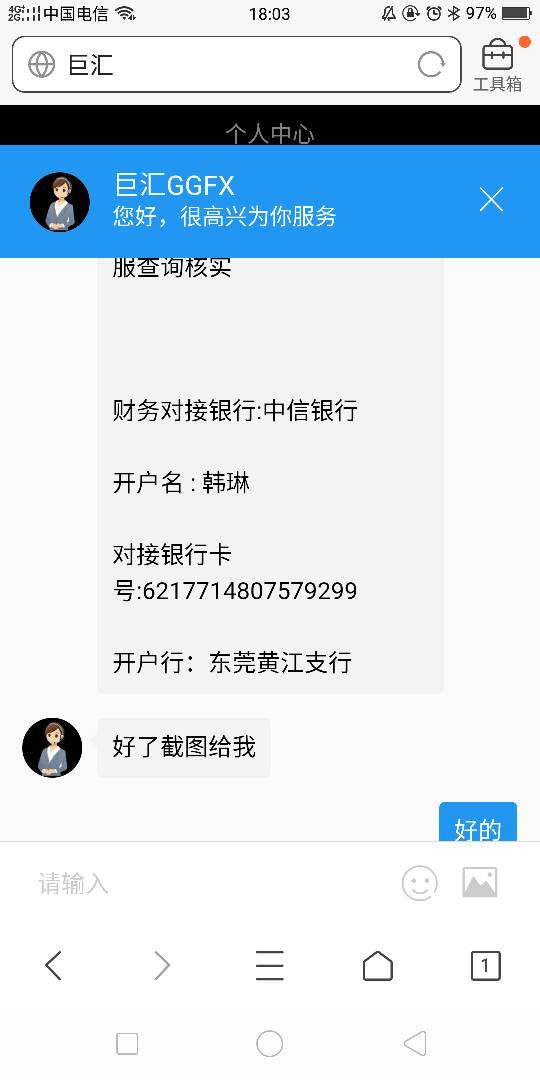

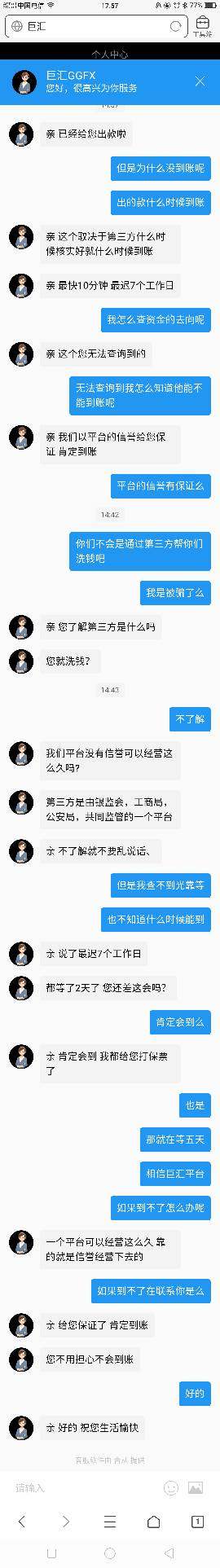

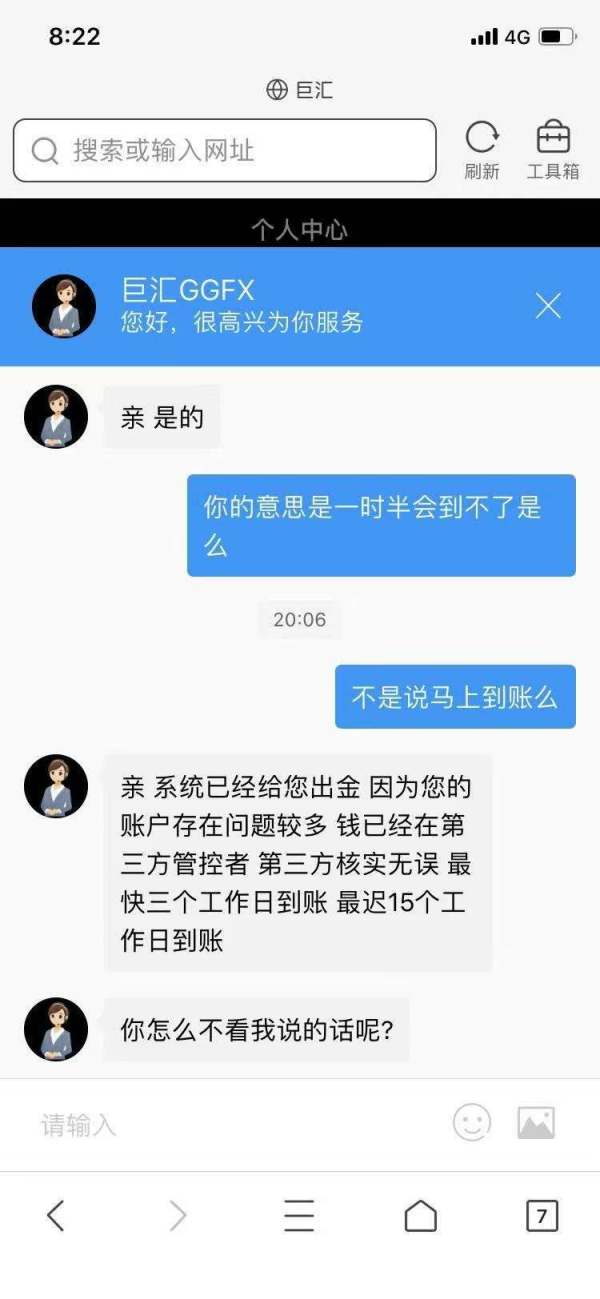

User Exposure

On our WikiFX website, there are 11 user exposures regarding GGFX. Many users have raised concerns, labeling it as a potential scam platform. Some users reported difficulties in logging in, while others expressed challenges in withdrawing funds.

Conclusion

GGFX is a Forex broker that offers a wide range of tradable assets, multiple account types, low minimum deposit, renowned trading platforms, 24/5 customer support, and numerous educational resources, making it an attractive choice for both beginners and seasoned traders. They stand out for their demo account provision and multiple deposit and withdrawal methods. However, the broker's lack of explicit mention regarding regulatory oversight, vague information on spreads, and the need to verify regulatory status can pose potential risks to traders. Therefore, while GGFX offers several strengths worth considering, potential traders should also bear in mind these noted weaknesses while making their decision.

FAQs

Q: What types of assets can I trade with GGFX?

A: GGFX provides an array of assets including currencies, stocks, indices, cryptocurrencies, and commodities, allowing traders to diversify and balance their portfolio.

Q: How many types of accounts does GGFX provide, and who are they designed for?

A: GGFX offers three types of accounts: Standard, Premium, and VIP. These are tailored to meet the needs of various traders, from novices to experienced professionals.

Q: Does GGFX support the MetaTrader platforms?

A: Yes, GGFX supports both MetaTrader 4 and MetaTrader 5 platforms, recognized extensively in the trading industry for their advanced features and user-friendly interface.

Q: What are the deposit and withdrawal methods available at GGFX?

A: GGFX provides various methods of deposit and withdrawal like credit card, debit card, bank transfers, and e-wallets for the convenience of its traders.

Q: What is the maximum leverage provided by GGFX?

A: GGFX provides the high leverage of 1:500, allowing experienced traders to amplify their exposure in the market while cautioning new traders of the associated risks.

Q: What should I be aware of regarding GGFX's regulatory status?

A: The broker doesn't clearly disclose its regulatory status, which poses a possible risk. Therefore, traders should independently verify GGFX's regulatory status before choosing to trade with them.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. Readers are strongly advised to verify updated details directly with the company before making any decisions, as the responsibility for utilizing the information herein rests solely with the reader.

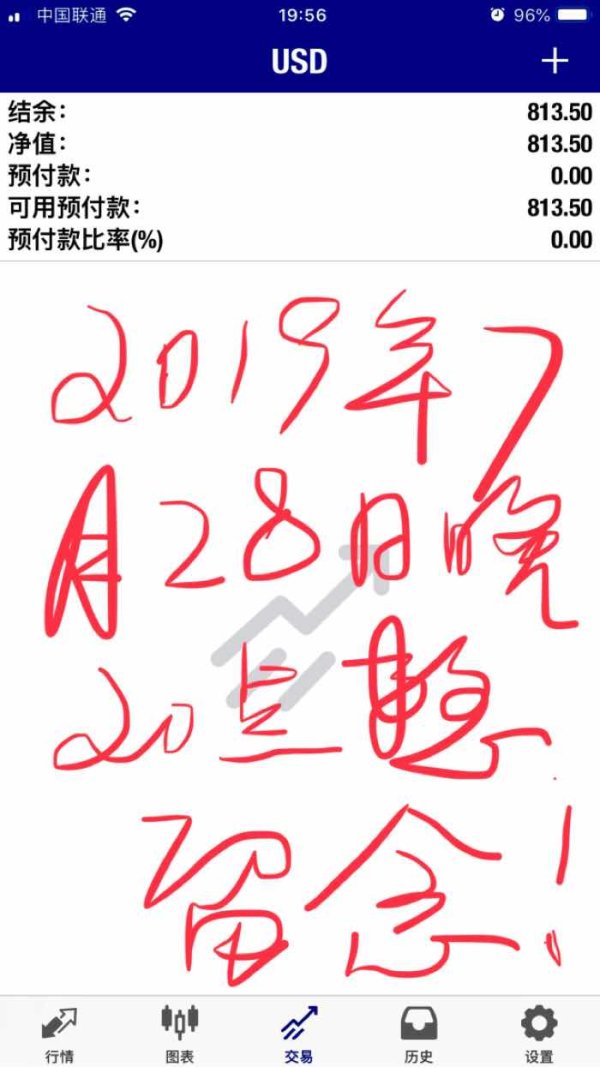

铎 益

Hong Kong

GGFXB does not allow me to withdraw funds, I hope someone can help. Now this platform has frozen my account, and they refused to reply when leaving a message to the customer service. They asked me to apply for a gold membership, but after doing so, I still couldn't withdraw cash. In the end they asked me to pay a deposit, and I realized that they were cheating on me.

Exposure

2021-02-13

大时代小访客

Hong Kong

The website www.ggfx.com is closed. Can't log in to MT4. Unable to withdraw

Exposure

2020-10-19

爱情感冒了

Hong Kong

GGFX does not let me withdraw money with various reasons, but keeps asking me to deposit. It finally deleted my account. Hope to expose this platform and recover our hard-earned money.

Exposure

2020-04-05

FX1763142763

Hong Kong

The scam GGFX gave no access to my withdrawal with grinding excuse and even froze my account.

Exposure

2020-01-15

scd94699

Hong Kong

Unable to withdraw in GGFX

Exposure

2019-12-14

FX7349786263

Hong Kong

You fraudsters defrauded all my hard-earned money.Damn it.

Exposure

2019-11-25

FX7349786263

Hong Kong

GGFX induced clients by bonus.As long as they deposited $1000, they could get $2000.Then the withdrawal will be unavailable and clients be removed off the group,just see their fund be defrauded.All customer service will disappeared.

Exposure

2019-11-25

FX7349786263

Hong Kong

The platform claimed that the funding process was at a lighting speed,while it doesn’t seem like this.It promised as long as I deposited $1000,$2000 to $3000 would be sent.Actually,the withdrawal is unavailable.All customer service has disappeared,as well as the website.The QQ group was dismissed.

Exposure

2019-11-18

FX7349786263

Hong Kong

On September 27th,2019,I applied for the withdrawal on GGFX ,which was held off by the excuse of National holiday or upgrading.Now it is even out of contact.

Exposure

2019-11-04

FX7349786263

Hong Kong

I applied for the withdrawal on September,2019,but haven’t received it yet.The customer service said that the process is unavailable during National Day.It has been no responds for one week.The broker said that it will need 2-3 weeks because of system upgrading.

Exposure

2019-10-14