Overview

Bloom Forex is a financial services provider based in Australia, offering services that include RMB remittance, foreign currency exchange, and international payments and transfers. The company operates without regulatory oversight, which may raise concerns about investor protection. They provide a transparent pricing model and offer various deposit methods, including checks, wire transfers, and in-person cash deposits with proper documentation and verification. Customers can choose between cash withdrawals or bank transfers. Bloom Forex provides customer support through WeChat, phone, email, and physical locations. Potential users are cautioned to exercise due diligence due to the lack of regulatory oversight and are recommended to consider regulated Forex brokers for a safer trading environment. The company also complies with anti-money laundering regulations.

Regulation

Bloom Forex is a Forex trading platform that operates without regulatory oversight. While the platform may offer various financial products and services related to foreign exchange trading, the absence of regulatory supervision can raise significant concerns for potential investors and traders. Regulatory bodies in the financial industry are responsible for ensuring fair and transparent practices, safeguarding the interests of investors, and maintaining the integrity of the market. When a Forex broker or platform is not regulated, it means that there is no external authority monitoring its operations, which can potentially expose traders to higher risks, such as fraud, lack of transparency, and inadequate protection of their investments.

Pros and Cons

Bloom Forex operates as an unregulated Forex trading platform, which presents both advantages and disadvantages for potential users. While it offers flexibility and convenience in trading, the absence of regulatory oversight raises concerns about investor protection and transparency.

Using Bloom Forex offers flexibility and convenience in trading and offers a transparent fee structure. However, the absence of regulatory oversight poses significant risks, including potential fraud and inadequate protection of investments. Traders should exercise caution and conduct thorough due diligence when considering this platform. It is generally recommended to opt for Forex brokers and platforms regulated by reputable authorities to ensure a safer and more secure trading environment.

Services

Bloom Forex offers a range of financial services, primarily aimed at serving the Chinese community and business professionals, including:

RMB Dual-Direction Remittance Services:

Provides both cash and transfer payment options.

Offers the convenience of conducting transactions via phone or email.

Ensures transaction security through a dedicated customer service team.

Foreign Currency Exchange Services:

Covers 11 major circulating currencies, including AUD, USD, EUR, JPY, NZD, SGD, GBP, HKD, PHP, and MYR.

Facilitates currency exchange for customers.

International Payment and Transfer Services:

Utilizes their extensive network and payment systems.

Operates branches worldwide to facilitate quick and secure fund transfers.

Assures customers of efficient service regardless of the remittance amount.

Fees

The fee structure for remittances with your company is as follows:

RMB Remittance to China: For sending Chinese Yuan (RMB) to China, there is a fixed fee of 19.8 AUD per transaction. This fee applies when you transfer RMB to a Chinese account.

Australian Dollar Remittance to Australia: When remitting Australian Dollars within Australia, there is a fee of 9.9 AUD per transaction. This fee is for transferring AUD to an Australian account.

Remittance of US Dollars and Other Foreign Currencies to Australia: If you are sending US Dollars or other foreign currencies to Australia, there is a fee of 19.8 AUD per transaction. This fee applies to incoming foreign currency transfers to an Australian account.

Remit Australian Dollars and Other Foreign Currencies to China and Overseas Areas Except Australia: For remitting Australian Dollars or other foreign currencies to China or overseas areas outside Australia, there is a fee of 29.8 AUD per transaction. This fee applies when transferring funds in AUD or foreign currencies to accounts located in China or other international destinations.

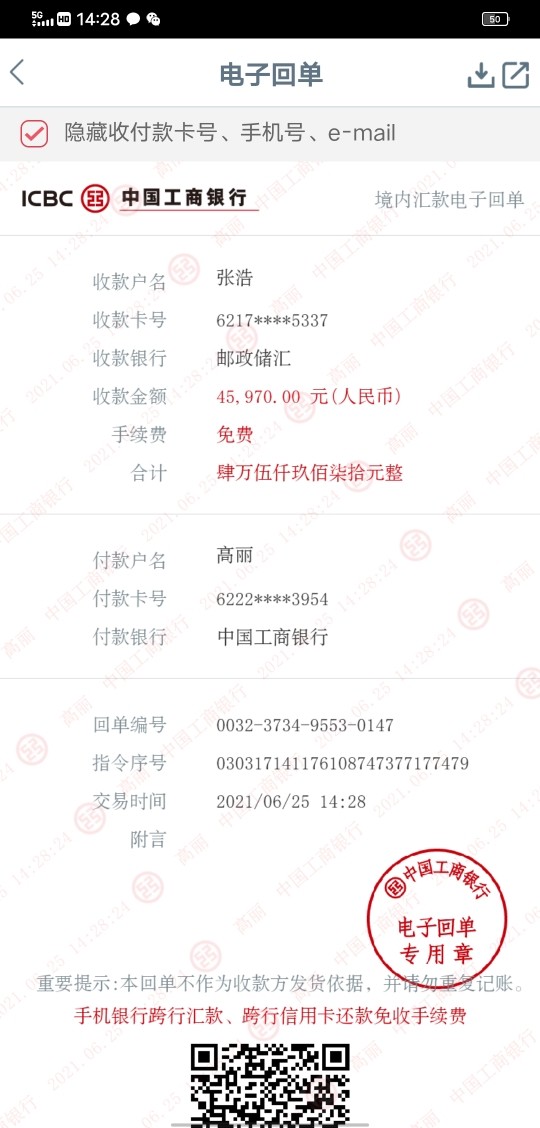

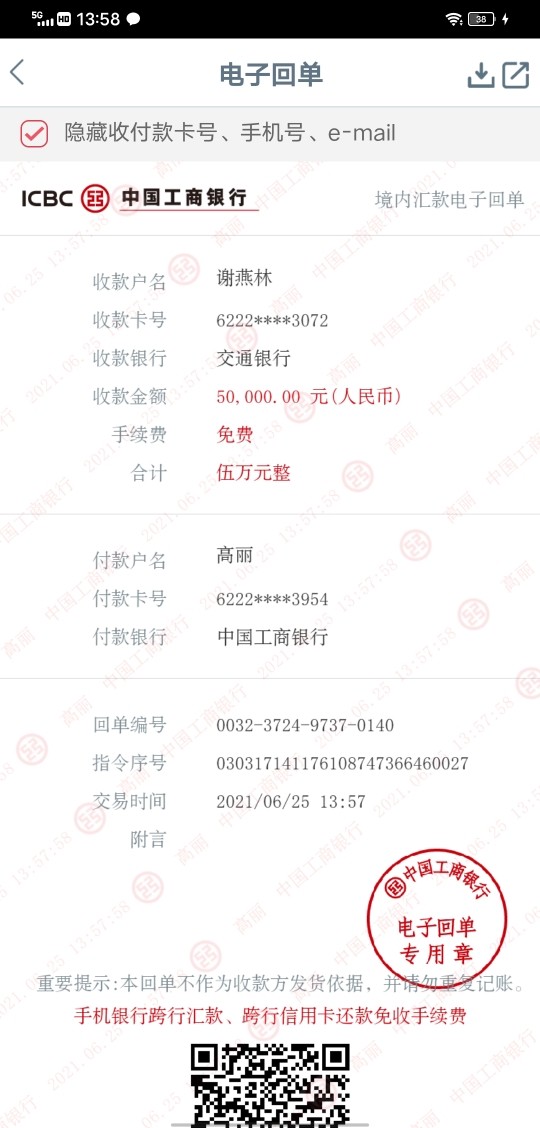

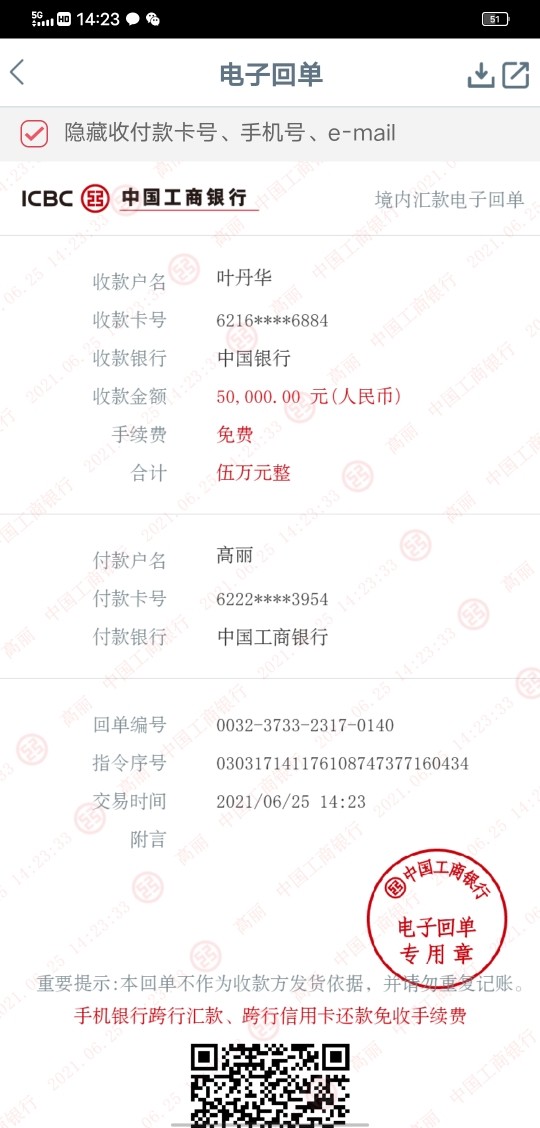

Deposit & Withdrawal

Deposit Methods:

Transfer Deposit:

Customers have the option to deposit RMB, Australian dollars, or other foreign currencies into the company's account.

Deposits can be made via check or bank wire transfer.

Cash deposits are accepted but need to be made in person at the company's counter.

Prior to making a deposit, customers are advised to inquire with company staff for the day's account number.

For cash deposits of 10,000 Australian dollars or more, compliance with Australia's anti-money laundering regulations is required. Customers must verify the source of funds and provide relevant proof.

Cash Deposit:

Cash deposits can be made by visiting the company's store counter.

First-time remitters need to bring all necessary account opening information (as specified in the account opening instructions column).

Customers must fill out an account opening application form at the counter and provide payment account information.

For cash deposits exceeding 10,000 Australian dollars, compliance with Australia's anti-money laundering regulations is mandatory. Customers must verify the source of funds and provide relevant proof.

Withdrawal:

After completing the currency exchange, customers can choose between two withdrawal options: cash withdrawal or bank transfer.

Bank transfers typically take 1-2 working days to process and transfer funds to the customer's designated account.

For cash withdrawals, customers can visit the company's sales office at any time. However, for significant cash withdrawals, it is advisable to contact the sales department in advance to schedule an appointment.

This comprehensive deposit and withdrawal process ensures flexibility and compliance with regulatory requirements, particularly in handling cash deposits in accordance with anti-money laundering regulations. Customers have the choice to transact in various currencies and access their funds conveniently through either cash or bank transfers.

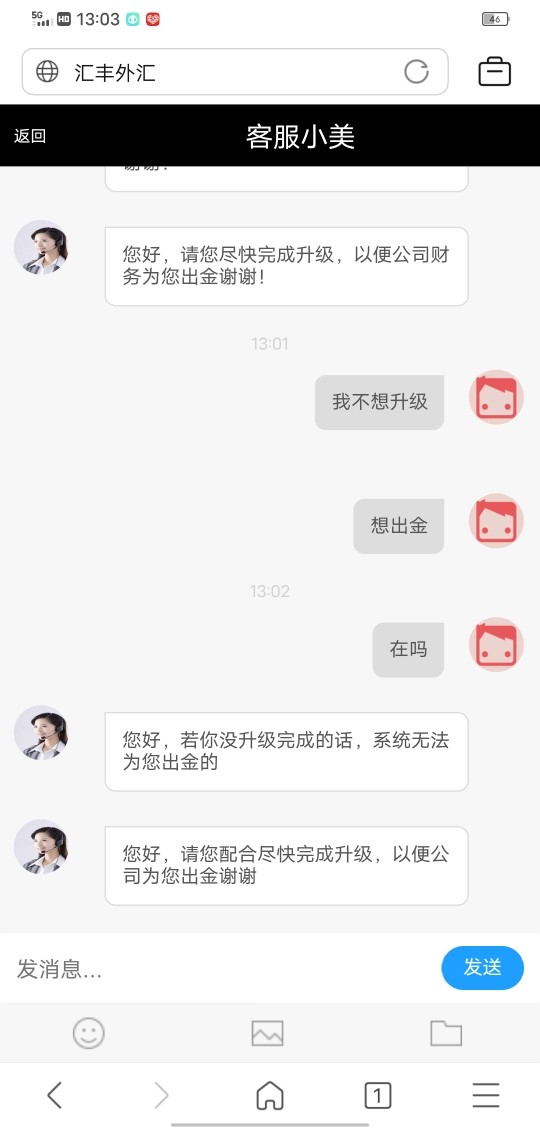

Customer Support

WeChat: You can reach out to Bloom Forex via their WeChat account, which is accessible at “bloomforex” on the WeChat platform.

Phone: For direct contact, you can call them at +61 499 016 123. This phone number is provided for customer inquiries and assistance.

Email: Bloom Forex offers two email addresses for customer support:

chatswood@bloomforex.com.au

Chinatown@bloomforex.com.auCustomers can use these email addresses to communicate with the company regarding their queries, concerns, or requests.

Website: You can visit their official website athttp://www.bloomforex.com.au to access additional information about their services, rates, and other relevant details. The website may also provide resources and contact options.

Physical Address (Haymarket, NSW): Bloom Forex has a physical location at:

Shop 1, Ground Floor, 389-391 Sussex St

Haymarket, NSW 2000

Customers can visit this address for in-person support or to conduct transactions directly at the store.

Physical Address (Chatswood, NSW): Another physical location is available at:

455 Victoria Ave

Chatswood, NSW 2067

This is an additional branch where customers can visit for assistance and transactions.

Summary

Bloom Forex is an unregulated Forex trading platform, which can be a concern for potential investors due to the lack of regulatory oversight in the financial industry. This absence of oversight may expose traders to higher risks, including fraud and inadequate protection of their investments. On the other hand, Bloom Forex offers a range of financial services, including RMB dual-direction remittance, foreign currency exchange, and international payment and transfer services. They have a transparent fee structure for various remittance transactions, and their deposit and withdrawal processes are comprehensive, adhering to anti-money laundering regulations. Customer support is accessible through WeChat, phone, email, and physical locations in Haymarket and Chatswood, NSW. However, it's important for customers to be cautious when considering trading with unregulated entities like Bloom Forex, and to conduct thorough due diligence.

FAQs

Q1: Is Bloom Forex regulated?

A1: No, Bloom Forex operates without regulatory oversight, which can raise concerns about investor protection.

Q2: What services does Bloom Forex offer?

A2: Bloom Forex provides RMB dual-direction remittance, foreign currency exchange, and international payment services, catering to the Chinese community and business professionals.

Q3: How can I deposit funds with Bloom Forex?

A3: You can deposit funds through bank wire transfers, checks, or in cash at their store counters, but larger cash deposits require source verification.

Q4: What is the fee for remitting RMB to China with Bloom Forex?

A4: The fee for RMB remittance to China is a fixed 19.8 AUD per transaction.

Q5: How long does it take for bank transfers with Bloom Forex?

A5: Bank transfers typically take 1-2 working days to process and transfer funds to your designated account.