简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Relationship Between Margin and Leverage

Abstract:You use margin offered by your broker to create leverage. Therefore Leverage is the increased “trading power” that is available when using a margin account.

We have previously explained what margin is, as simply the sum or the amount of funds expected from a trader's account for them to open a new position or to maintain the ongoing. When trading forex on margin, you only need to pay a percentage of the full value of the position to open a trade. Also Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone.

Looking at the definition of the two, the margin and leverage seems to be related in some way.

What is the relationship between Margin and Leverage?

You use margin offered by your broker to create leverage. Therefore Leverage is the increased “trading power” that is available when using a margin account.

Leverage allows you to trade positions higher than the amount of money in your trading account.

Forex traders often use leverage to profit from relatively small price changes in currency pairs. Leverage, however, can amplify both profits as well as losses. It can be indicated as a ratio.

Leverage is the ratio between the amount of money you really have and the maximum amount of money you can trade. It is usually demonstrated with an “X:1” format.

For instance, if you intended to trade 1 standard lot of USD/JPY and did not apply margin, you would need $100,000 in your account.

But including a Margin Requirement of just 1%, you would only to deposit $1,000 in your account.

The leverage provided for this trade would be 100:1.

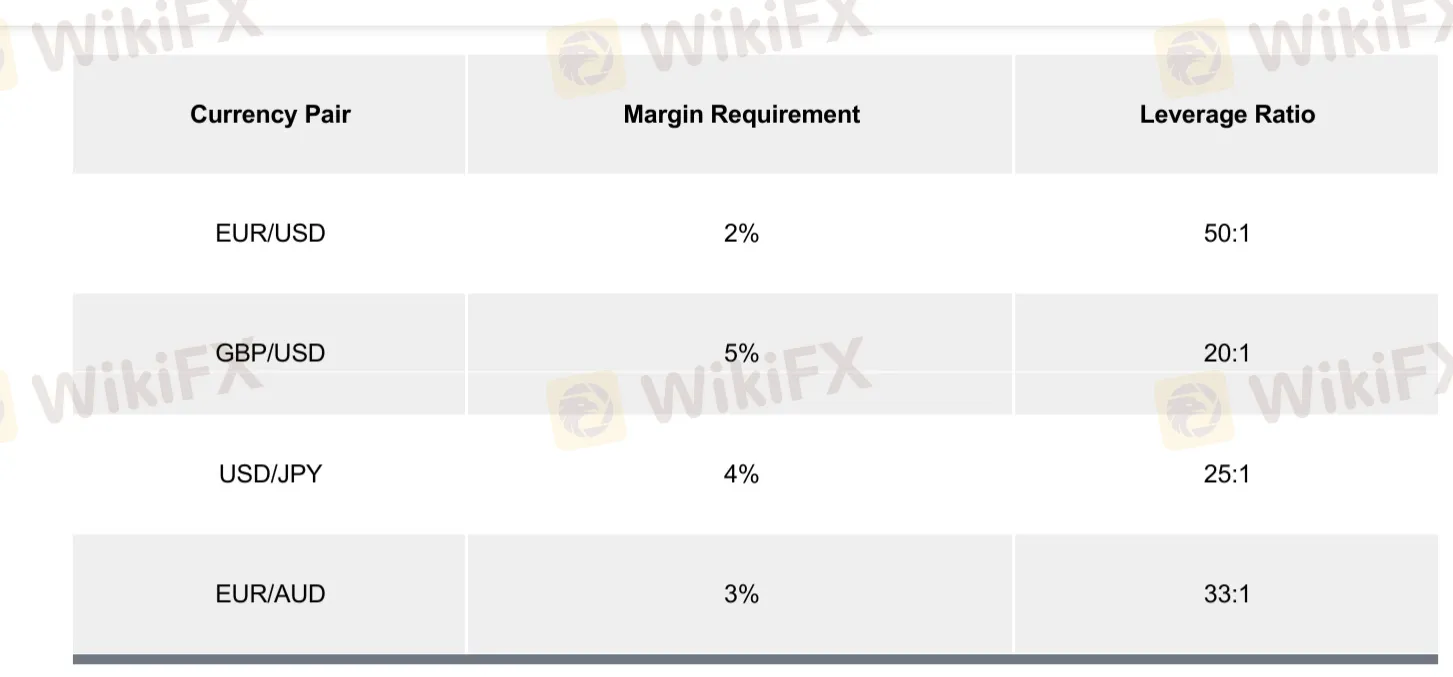

Below are some examples of Leverage Ratios depending on the Margin Requirement

Check the steps below on how to calculate Leverage:

Leverage = 1 / Margin Requirement

Another example when the Margin Requirement is 2%, heres how to calculate leverage:

50 = 1 / .02

The leverage is 50, which is expressed as a ratio, 50:1

Now let's show how to calculate the Margin Requirement based on the Leverage Ratio:

Margin Requirement = 1 / Leverage Ratio

Whil, with the Leverage Ratioas 100:1, heres how to calculate the Margin Requirement.

0.01 = 1 / 100

The Margin Requirement is 0.01 or 1%.

You can observe from the given examples , leverage has an inverse relationship to margin.

Therefore “Leverage” and “margin” refer to the same concept, just from a slightly different angle. When a trader opens a position, they are required to put up a fraction of that positions value “in good faith”. In this scenario, the trader is said to be “leveraged”.

While The “fraction” part which is simplified in percentage terms is known as the “Margin Requirement”. For example, 2%. And we also known The actual amount that is required to be put up is known as the “Required Margin”.

For example, 2% of a $100,000 position size would be $2,000. The $2,000 is the Required Margin to open this specific position.

As you are able to trade a $100,000 position size with just $2,000, your leverage ratio is 50:1.

Leverage = 1 /Margin Requirement

50 = 1 / 0.02

Forex Margin Compared to Securities Margin

Forex margin and securities margin are two very different things. Understanding the difference is important.

Securities Margin Financing is a business service that uses funds or other assets as collateral to get loans. Investors is required to pay loan interest, obtain additional funding for target stocks. This practice is often referred to as “buying on margin”.

Therfore if you‘re trading stocks on margin, you’re borrowing money from your stockbroker to purchase stock. Basically, a loan from the brokerage firm.

Unlike in security, In the forex market, margin is the amount of money that you must deposit and keep on hand with your trading platform when you open a position. No need of selling of buying anything, just the agreement to buy or sell are exchanged, so borrowing is not needed.

In both aspects margin can be seen at as a good faith deposit or collateral thats used to assure each party (buyer and seller) can meet their obligations of the agreement.

The word “margin” is used across multiple financial markets. However, there is a difference between how margin is used when trading securities versus when trading forex as we have elaborated above. It is therefore essential to Understand this difference prior to trading forex.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator