简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Determines the Price of a Forex Broker?

Abstract:When you trade forex, you're betting on the future direction of currencies, taking a long ("buy") or short ("sell") position based on your speculation of rising or falling of a currency pair. You try to profit from exchange rate fluctuations of currency by betting on whether the value of one currency, example the Japanese yen, will rise or fall in respect to another, example the Australian dollar.

When you trade forex, you're betting on the future direction of currencies, taking a long (“buy”) or short (“sell”) position based on your speculation of rising or falling of a currency pair.

You try to profit from exchange rate fluctuations of currency by betting on whether the value of one currency, example the Japanese yen, will rise or fall in respect to another, example the Australian dollar.

Currency strengthening (price appreciation) or weakening (price depreciation) causes price changes in the currency market (price depreciation).

Because there is no alternative market for these transactions, your ability to open and close trades is limited to the pricing presented by your forex broker.

So here's the question...

How can you be sure that the prices you see on your broker's trading platform reflect what's going on in the “real” (institutional) forex market?

Let's take a look at one element of the older Batman-Spiderman story:

This is the mechanism for the game: Just try to forecast on the chance of GBP/USD exchange rate to rise or fall. Let's pretend the exchange rate is now 1.4000. Do you believe it will rise or fall?

Have you seen how Spider-Man just made up a price for GBP/USD?

Fortunately, Batman didn't just take Spider-word Man's for it and checked the price with a third-party source using his Batphone.

You haven't read our earlier lesson on How Forex Brokers (Kinda) Work if you aren't familiar with the story above. You are hereby recommended to study this lesson first.

You should be wondering the same thing about forex brokers just as Batman.

What is the source of the forex broker's prices? Is the pricing right?

Your forex broker will provide you two prices for specific currency pair:

· You can buy (“go long”) at a higher price (“ASK”).

· You can sell (“go short”) at a cheaper price (“BID”).

The ASK and BID prices are known as the forex broker's “price” to you when they are combined.

The spread is the difference between the lower and higher pricing.

These quotes are shown on your trading platform (also referred to as a “client terminal”). These displayed quotes are called “price stream”.

Where do the pricing come from, though?

Is it possible that the forex broker made them up?

It's conceivable.

However, this is very unlikely.

“Huh?” One might be thinking right now. Is that even possible? but…

Are you aware that your forex broker has the authority to present any amount it wants?

Retail traders are unable to trade in the institutional or “interbank” FX market, as we discussed in an earlier course when we discussed about the FX market. We've been labeled as untrustworthy (“too impoverished”). You'll need to choose a retail forex broker if you wish to speculate on exchange rates of currency.

For you to trade in, the forex broker “creates a forex market.”

If you're not in the United States, you can use CFDs, or if you are, you can use rolling spot FX contracts. Which can all be referred to as “retail FX contracts.”

There are only two parties involved in these contracts: you and the forex broker.

Because the forex broker creates these contracts, it is technically free to quote any bid and ask prices it likes. It's up to you to trade or not at those prices.

It is entirely up to the discretion of a forex broker on how and where it obtains its prices.

It may or may not display prices sourced from outside sources on its trading platform.

This means that the prices supplied by your forex broker may or may not be analogous to prices presented by other forex brokers.

What is the reason for this?

Shouldn't the forex broker's quoted rates be the same with those in the underlying (institutional) FX market?

Therein lays the issue.

There is no single “market price” in the FX market for any currency pair.

The FX market is known as a “over-the-counter” or OTC market.

There is no centralized “place” in an OTC market where all market participants can see the same SINGLE market price.

How Exchange Pricing Works

Let's compare the FX market to an exchange-based market like the US stock market to better appreciate the reason it's crucial to understand the importance of the FX market being an OTC market.

An exchange-based market must provide fair and equitable access to all participants, according to one of its foundational principles.

Quotes are published on exchanges for all to see and trade.

Let's take a quick look at how pricing works on the stock markets in the United States to better grasp this:

When a transaction takes place, the exchange conveys the transaction to the SIP (Securities Information Processor), which disseminates the information.

The NYSE, for example, reports a trade to a SIP when it conducts a transaction to purchase Apple shares.

In addition to trades, the SIP provides the public with the best bid and ask prices on several trading venues.

The SIP then adds all of the quotes together to determine the National Best Bid and Offer (NBBO).

This data consolidation happens in a flash. SIPs take roughly 17 microseconds to gather, consolidate, and distribute a transaction report on average (millionths of a second).

A human blink lasts 100 milliseconds (a 10th of a second), or 100,000 microseconds! This means pricing information is updated in less than 0.017 percent of the time it takes to blink an eye!

The NBBO is crucial because it informs traders of the price at which they can all purchase and sell at any time possible.

The Securities and Exchange Commission (SEC) passed Regulation National Market System, or RegNMS, in 2005, mandating brokers to get hold of the “best execution” for all transactions inside the NBBO.

RegNMS requires brokers to route orders to the venue that presents the cheapest pricing (which is based on NBBO).

The benefit of having combined data in the US stock market is that the NBBO provides unambiguous “reference” prices that all traders may use to know whether they received fair pricing.

The NBBO allows all people to see the highest bid and offer for any exchange-listed stock, no matter where it is traded, in less than a nanosecond after the quotes change.

This ensures that all dealers, large and small, are treated equally.

Because EVERY transaction must occur at prices no worse than the NBBO at the moment the trade was implemented, all traders are protected by the prices displayed by the exchange.

In the Forex Market, How Does Pricing Work?

There is a “single market” in an exchange-based market that allows everyone to interact at the same price as the FX market.

On the other hand, does not operate through a controlled public exchange. There is no such thing as a “single market,” which means there is no single “market price.”

There is no counterpart to SIP, a data feed that consolidates all trades and the best bid/ask prices that are quoted.

This means the forex market lacks the equivalent of an NBBO for each currency pair, which would offer a clear “reference” price to which all forex brokers must abide.

Where Do Retail Forex Brokers Get Their Prices From?

Reputable forex brokers will normally center their pricing on the institutional FX market's prices, which are mainly banks and other non-bank financial institutions (NBFIs).

Liquidity providers are market participants who provide liquidity to the market (LPs).

A liquidity pool is a crew of liquidity providers (LPs).

The forex broker employ these values as the REFERENCE price for an underlying currency pair. Or, at the very least, should be.

As earlier stated, a forex broker will provide you with two price quotes for a currency pair: the bid and ask price.

These quotes are shown on your trading platform (also referred to as “client terminal”). The arrival of these quotes is called “price stream.”

The price you see is based on prices obtained from these liquidity providers by your broker.

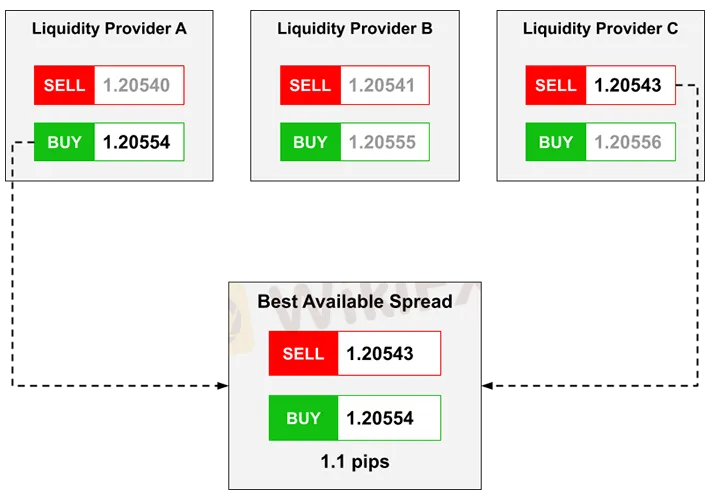

The broker receives pricing on the many currency pairs it presents from a pool of many LPs.

To get the best possible bid and ask price, the forex broker aggregates or collects these prices in real time.

Both prices don't have to come from the same record. For example, one LP may have the best available bid price, while another LP may have the best available ask price.

The gathered prices are fed into a “pricing engine,” which sends prices to your trading platform (your “price stream”).

Unless you're paying commission, the price you see will almost always include a markup.

Theoretically, this should all be an automatic process in which the broker has no control over the selection of the best available price from a pool of liquidity providers (LPs) or the ability to manually intervene to alter any prices streamed to the trading platform (apart from adding a markup).

For the reason that two traders use the same broker does not mean they see the same bid and ask prices in their price streams.

Different pricing may be quoted to different clients.

It relies on how brokers profile their consumers and whether the price engine is set up to differentiate prices based on profile. This referred to as “price discrimination.” Inquire with your broker about price discrimination amid clients.

Providers of Liquidity

Every credible forex broker will show you “their” price, which is based on the liquidity they have.

Their liquidity providers determine what liquidity they have access to (LPs).

Forex brokers with a prime broker (PB) have access to a variety of liquidity providers, including Tier-1 banks, ECNs, and aggregators.

Large banks with specialized FX departments presents most of the global FX liquidity and are called “Tier-1” liquidity providers.

Bank of America, Barclays, BNP Paribas, Citi, Commerzbank, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, J.P Morgan, Nomura, Société Générale, and UBS are part of the “Tier 1” liquidity providers.

These larger forex brokers can enhance their prices by connecting to many LPs and presenting their customers the best available bid and ask prices from amid the LPs.

How?

The broker's “price engine” picks the optimal bid and ask price from multiple liquidity providers, resulting in the best possible spread.

Theoretically, the broker's customers' combined trading volume fosters pricing competition amid the LPs.

Because each LP is vying to be the forex broker's hedging counterparty, it has the power to demand better terms.

Multiple liquidity providers are also essential under unusual market situations, an example is during the periods of excessive volatility, when certain liquidity providers may decide to expand spreads or stop quoting prices entirely.

This is critical for A-Book brokers because their implementation approach is completely reliant on liquidity providers being able to provide high-quality liquidity even in turbulent or illiquid market situations.

Smaller forex brokers get their pricing from an aggregated liquidity feed provided by a Prime of Prime (“PoP”), and occasionally from other non-bank liquidity providers (“NBLPs”) known as “electronic market makers.”

XTX Markets, Citadel Securities, Virtu Financial, Global Trading Systems, HC Technologies, and Jump Trading are some of the electronic market makers involved in the FX markets.

Prime broker (PB) connections with major banks enable PoP providers to collect prices from many LPs and deliver them to smaller FX brokers.

Do you see bank logos on the websites of forex brokers?

Don't believe the hype if you see the logos of big banks (Barclays, Citi, UBS, etc.) on a retail FX broker's website. Because of their diminutive stature, most retail forex brokers do not have a direct linkage to these “Tier 1” liquidity providers. This can only be claimed by the major forex brokers with PB ties. The rest must rely on a PoP, and the bank logos should be displayed by the PoP rather than the broker.

Keep an eye out for price manipulation.

The lack of transparency in the price of FX market contracts might lead to potential conflicts of interest.

It's difficult to tell whether the pricing is tied to an underlying market because it's not always obvious.

Your forex broker may set its pricing by quoting third-party prices, but it is under no duty to do so or to do so in the future.

Some forex brokers may even demand that their clients understand that the reference prices used to calculate the value of the underlying asset (for example, currency pairs) may differ from the market price.

As a result, traders most of the time struggle to check the authenticity of the prices displayed on the broker's trading platform.

For example, you can see the rates that your broker quotes on your trading platform, but comparing quotes is difficult unless you have other trading platforms open from other brokers.

Any open or pending positions are therefore prone to price manipulation.

Traders have complained, for example, about forex brokers changing prices at their discretion to cancel winning transactions to escape payout or liquidate trades to recover customer losses.

Volatile market conditions are ideal for price manipulation and “stop hunting,” which is when a broker terminates a trader's position in order to benefit.

Because the broker knows exactly where your stop-loss and take-profit orders are, it can manipulate its so-called “market price” to hit or miss your stop-loss or take-profit price. This indicates that the broker makes a profit or avoids a loss.

While not as famous as before, dodgy brokers operating in uncontrolled or marginally regulated countries and regions continue to engage in this business.

It can be difficult to prove if a broker operates under a regulatory jurisdiction with little (or no) transaction reporting requirements, which is why it persists today.

Another issue is brokers who engage in asymmetric slippage practices.

When the price at which an order is implemented differs from the price quoted (for a market order) or the price demanded, this is referred to as “slippage” (for stop-loss or take-profit orders).

During breaking news or the release of a large economic data report, a considerable amount of slippage might occur.

A broker can use “asymmetric” slippage in order execution, which means that if the price favours the broker, the order will be implemented. If it doesn't, the price is slipped and requoted at a more desirable price for the broker.

And if the market swings in your favor, the broker will not carry out your order at the new price.

How Can You Confirm You're Getting a Fair Price?

We expect the listed prices to closely track the underlying market as retail traders.

However, the extent to which these values resemble those of the “market” is determined by the forex broker.

Price setting by forex brokers is done with some discretion, especially during periods of significant market volatility.

Some retail FX and CFD trading platforms feature an imprecise and confusing pricing system due to this use of discretion.

A forex broker's pricing method is the process or approach it uses to determine the prices to show its customers.

Customers of certain forex brokers have filed formal complaints with regulatory organizations in the past over unfair pricing practices.

The following are some examples of complaints:

· How prices were not established correctly, and customers were shown prices that were nowhere near the current market price at the time a trade was completed!

· How the forex broker abused its discretion in closing down its customers' positions, resulting in realized losses!

The main problem with prices is that they are difficult to verify since the process through which retail forex brokers and CFD providers display pricing to their customers lacks transparency.

Here are some online tools you may use to see how close your forex broker's prices are compared to prices presented by others:

· OCX Integral

· LMAX Exchange

· FXCM

· TradingView

Because the FX market is an over-the-counter market, there is no single pricing. So, while price may not be alike, they should only differ by a small amount. Depending on the currency combination, a pip or less.

How can you be sure you're getting the greatest transaction possible and that your broker isn't rigging the market?

Can the broker provide you with EVIDENCE that you are trading prices directly generated from their liquidity providers?

Retail forex and CFD trading platforms should be able to properly explain how they calculate their prices, which should include:

· How it gets its rates from non-affiliated third-party liquidity providers (LPs)

· How it employs externally verifiable, independent price sources to ensure that LP prices closely reflect market prices

· How any spread or markup is applied.

Pricing and spreads should be determined by a price war amid several liquidity providers (LPs).

That's not all, though.

Inquire with your broker about the frequency with which they examine their price sources.

Brokers should compare the pricing presented by their liquidity suppliers to external price sources, both in terms of quality and quantity.

Actual prices are updated in real time, and average prices are updated at least once a week.

This helps to ensure that the pricing quoted to clients does not deviate significantly from “market prices.”

When a price falls outside of acceptable specified criteria, the broker should be notified immediately so that it can investigate and take action.

Make certain to find out about these “acceptable predefined parameters.”

Finally, the forex broker should be able to provide you with a written policy that explains its pricing approach and how it honestly and fairly opens and ends CFDs (or rolling spot FX contracts).

Any scenarios in which the company's prices depart from its stated pricing approach should be covered by the policy.

Look for another broker if the one you have can't give you with their pricing process.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator