简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

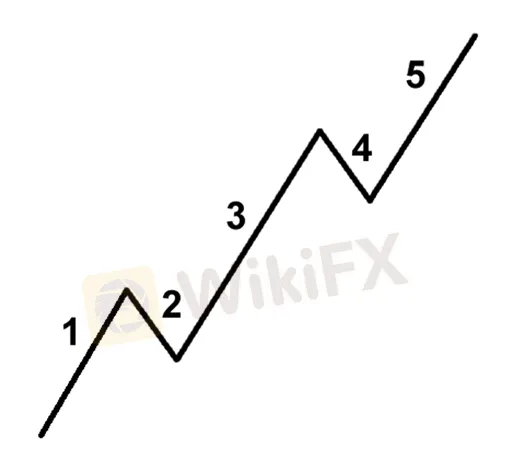

Impulse Waves

Abstract:Impulse waves are the first five-wave pattern. Corrective waves are the last three waves of the pattern.

Mr. Elliott explained that a trending market follows a 5-3 wave pattern.

Impulse waves are the first five-wave pattern.

Corrective waves are the last three waves of the pattern.

Waves 1, 3, and 5 are motive in this pattern, meaning they follow the overall trend, while Waves 2 and 4 are corrective.

Waves 2 and 4 should not be confused with the ABC corrective pattern (covered in the next lesson).

Take a look at the 5-wave impulse pattern first. It's easier to understand if you think of it as a picture:

That still seems to be a bit perplexing. Let's give this bad boy some color.

We admire colors, thus each wave has been color-coded along with its wave count.

Here's a quick rundown of what happens in each wave.

We'll use stocks as an example because that's what Mr. Elliott used, but it doesn't matter what you use. It might be anything from currencies to bonds to gold to oil to Tickle Me Elmo dolls.

The crucial thing to remember is that the Elliott Wave Theory may be applied to the foreign currency market as well.

1st Wave

The stock makes its first upward swing.

This is often produced by a small number of people who suddenly (for a variety of authentic or imagined causes) believe that the stock price is low and that now is a good time to buy. As a result, the price rises.

2nd Wave

At this time, enough people who were part of the first wave of investors believe the stock is expensive and have taken profits.

The stock drops as a result of this. The stock, though, will not return to its former lows before being called a bargain once more.

3rd Wave

The longest and most powerful wave is usually this one. The stock has piqued the interest of the general public.

As word spreads about the stock, more people want to buy it. As a result, the stock's price continues to rise. The high created at the end of wave 1 is often exceeded by this wave.

4th Wave

Traders profit since the stock has become more expensive.

Because there are usually more people who are still bullish on the market and are waiting to “buy on the dips,” this wave is usually weak.

5th Wave

This is when the majority of individuals buy the stock, and it is fueled by hysteria.

The CEO of the corporation is generally featured on the front page of major magazines as the Person of the Year.

Traders and investors start making up ludicrous reasons to buy the stock, and if you disagree, they try to choke you.

This is the point at which the stock is the most overvalued. The ABC pattern is started when contrarians start shorting the stock.

Waves with a Longer Impulse

You should also be aware that one of the three impulse waves (1, 3, or 5) will always be “stretched” according to Elliott Wave Theory.

Simply put, regardless of degree, one wave will always be longer than the other two.

According to Elliott, the fifth wave is usually the one that gets extended.

As time passed, this old school method of wave labeling evolved as more people began to mark the waves.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator