简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is the definition of a trending market?

Abstract:A trending market is one where the price is moving in one direction. The price may occasionally deviate from the trend, but a closer study of the larger time frames reveals that they were simply retracements.

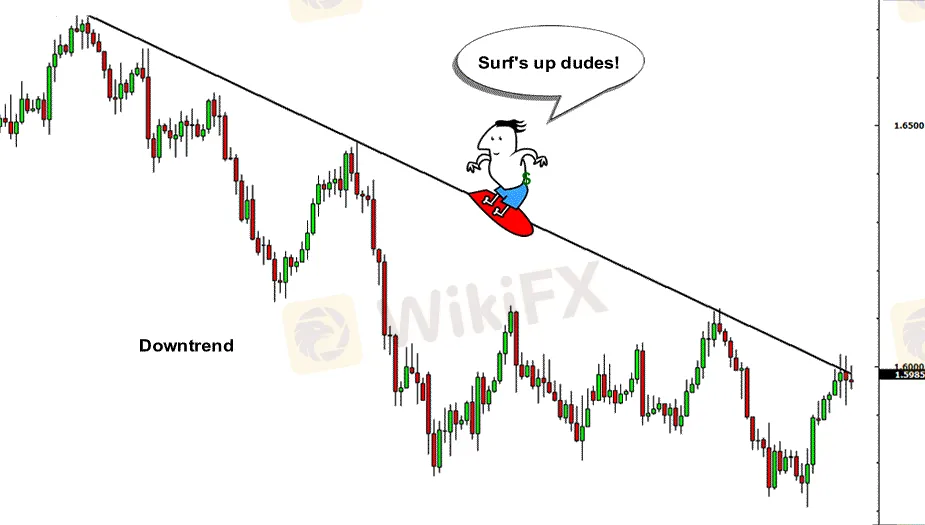

A trending market is one where the price is moving in one direction.

Sure, the price may occasionally deviate from the trend, but a closer study of the larger time frames reveals that they were simply retracements.

In an uptrend, “higher highs” and “higher lows” are often documented, while in a downtrend, “lower highs” and “lower lows” are usually noted.

Traders that uses a trend-based strategy usually use the major currencies and any other currency that uses the dollar since these pairs tend to trend and are more liquid than others.

In trend-following methods, liquidity is critical. The more liquid a currency pair is, the more movement (also known as volatility) we can expect from it.

The more movement a currency displays, the more chances there are for price to move extensively in one direction rather than bouncing around in small ranges.

You can use technical skills you acquired in last sections to find out whether a currency pair is trending or not, in addition to eyeballing price action.

In a Trending Market, the ADX

The Average Directional Index indicator, or ADX for short, can be used to detect if the market is trending.

This indicator, created by J. Welles Wilder, uses values ranging from 0-100 to determine whether the price is moving strongly in one direction, or only ranging.

Price is often moving or already in a strong trend when the value exceeds 25.

The stronger the tendency, the higher the number.

The ADX, on the other hand, is a trailing indicator, which means it does not always predict the future.

It's also a non-directional indicator, meaning it'll display a positive value regardless of whether the price is heading up or down.

Take a look at this illustration:

Despite the fact that the ADX is more than 25, the price is definitely going lower.

In a trending market, moving averages are useful.

Simple moving averages can be used instead of the ADX if you don't like it.

Take a look at this!

On your chart, draw a 7-period, 20-period, and 65-period Simple Moving Average.

Then wait until the three SMAs start to compress and fan out.

The price is going up if the 7 period SMA is above the 20 period SMA and the 20 period SMA is above the 65 period SMA.

If the 7-period SMA is below the 20-period SMA, and the 20-period SMA is below the 65-period SMA, the price is going down.

In a trending market, Bollinger Bands are useful.

Trend finding can benefit from a method that is commonly used for range-bound tactics. Bollinger Bands, or just Bands, are what we're talking about.

One thing to keep in mind about trends is that they are rather uncommon.

Contrary to popular belief, prices typically range between 70 and 80 percent of the time.

In other words, it is common for prices to fluctuate.

So, if prices stray from the “average,” they must be part of a trend, right?

What is one of the best technological techniques for measuring deviation that we addressed in earlier grades?

We give you huge kudos for effort if you said a ruler.

We'll give you cyber milk and cookies if you mentioned Bollinger Bands! Take some from here.

The standard deviation calculation is included in the Bollinger Bands. But don't worry if you're a nerd and don't know what that is.

Here's how we can use Bollinger Bands to find out what's going on! Be prepared for the unexpected.

Place a set of Bollinger Bands with a “1” standard deviation (SD) and another set with a “2” standard deviation (SD).

The sell zone, the buy zone, and “No Man's Land” are the three price zones you'll see.

The area between the two bottom bands of the standard deviation 1 (1SD) and standard deviation 2 (2SD) bands is known as the sell zone. Keep in mind that in order to be regarded in the sell zone, the price must close within the bands.

The area between the two upper bands of the 1SD and 2SD bands is known as the buy zone. To be deemed in the buy zone, the price must end within the two bands, much like the sell zone.

The area between the standard deviation bars is where the market is having difficulty finding direction.

If the price is truly in “No-Land,” Man's it will close within this range.

Price movement is largely unpredictable.

The Bollinger Bands make visual confirmation of a trend easier.

When the price is in the sell zone, downtrends can be authenticated.

When the price is in the buy zone, uptrends can be confirmed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator