简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is a Range-Bound Market, and how does it work?

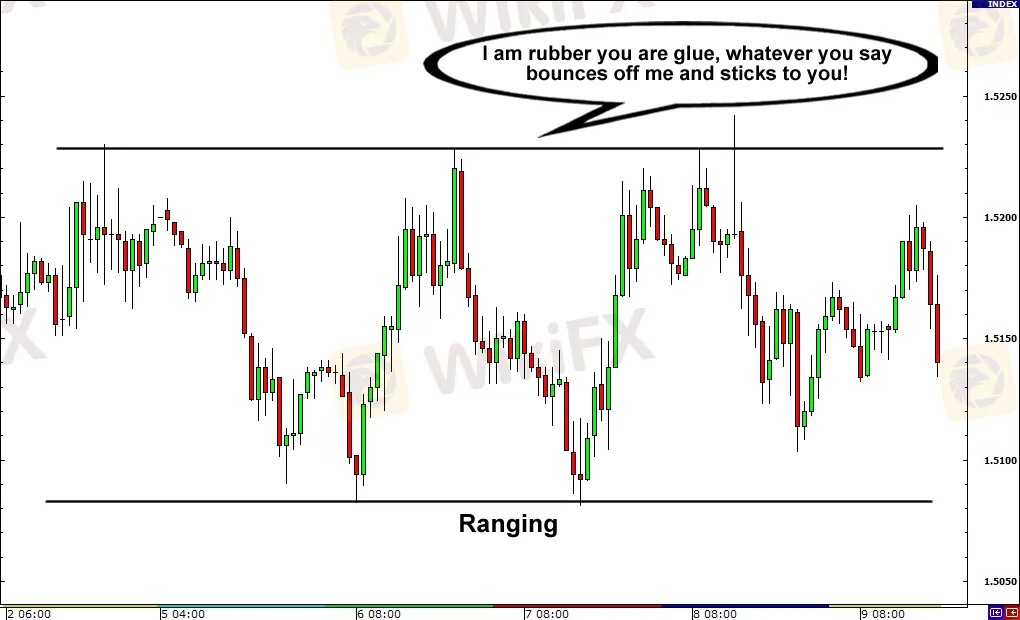

Abstract:A range-bound market is one in which prices bounce back and forth between a specified high and low. The high price works as a key resistance level that the price is unable to overcome.

What is a market that is range-bound?

A range-bound market is one in which prices bounce back and forth between a specified high and low.

The high price works as a key resistance level that the price is unable to overcome.

Similarly, the low price functions as a significant support level, which the price does not seem to be able to break through.

Horizontal, range, or sideways market movement can all be characterized.

It's often referred to as a “choppy market” or simply “choppy.”

The polar opposite of a surging market is a choppy market. It's similar to rough ocean waves.

There is no clear direction in a choppy market, and the price simply “chops around” or “chops up and down,” trading within a relatively tight range.

In bumpy markets, trend traders are prone to become “chopped up.”

What is a range-bound trader's favorite food?

Chop suey is a type of chop suey.

Let's get back on track now. Chop, chop, chop

In a market that is fluctuating, the ADX is useful.

Using the same ADX as stated in the ADX lecture is one approach to evaluate if the market is ranging.

When the ADX falls below 25, the market is said to be ranging.

Remember that the lower the ADX score, the weaker the trend.

In a fluctuating market, Bollinger Bands are useful.

Volatility is minimal and there is less volatility when the bands are thin and constricted.

Bollinger Bands, in essence, constrict when the market is less volatile and expand when the market is more volatile.

Bollinger Bands are a fantastic tool for breakout strategies because of this.

Volatility is low when the bands are thin and contracted, and there should be little price movement in one direction.

When bands begin to widen, however, volatility rises, and more price movement in one direction is probable.

In general, range trading environments will have narrower bands than wide bands and will form horizontally.

The Bollinger Bands are contracted in this scenario, as the price is only moving inside a narrow range.

A range-bound strategy is based on the concept that a currency pair has a high and low price that it generally trades between.

The forex trader hopes to benefit by buying at the low price and selling near the high price.

The trader hopes to benefit by selling around the high price and buying near the low price.

Channels, such as the one seen above, and Bollinger Bands, are popular tools to utilize.

Oscillators, such as the Stochastic or the RSI, can assist you pinpoint a turning point in a range by identifying possibly oversold and overbought levels.

Here's an example utilizing the GBP/USD currency pair.

Currency crosses are the ideal pairs for trading range-bound methods.

Crosses are currency pairs that do not include the US dollar as one of the currencies.

EUR/CHF is one of the most well-known currency pairs for trading ranges.

The EUR/CHF currency rate is largely constant due to the European Union's and Switzerland's similar growth rates.

The AUD/NZD pair is another option.

Conclusion

Whether you're trading a pair that's trending or ranging, you should feel confident that you can profit regardless of the situation.

Learn how to identify market tops and bottoms in both trending and range markets.

You'll be able to utilize a specific technique if you understand what a trending environment and a range-bound environment are and how they look.

“Only a fool dips his cookies in habanero salsa!” exclaims the wise old guy in Central Park.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator