简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Explained: Maximum Drawdown and Drawdown

Abstract:So we know that risk management will help us make money in the long run, but now we'd want to show you the other side of the story. What would happen if risk management guidelines were not followed?

So we know that risk management will help us make money in the long run, but now we'd want to show you the other side of the story.

What would happen if risk management guidelines were not followed?

Consider the following scenario:

Assume you start with $100,000 and lose $50,000. How much of your bank account have you lost?

The correct answer is 50%.

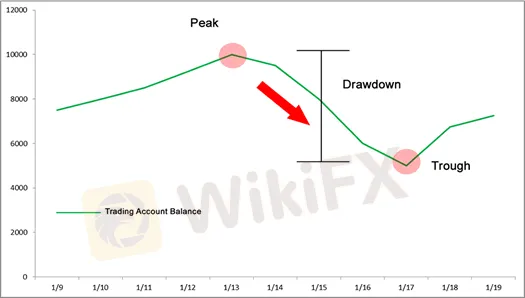

A drawdown is the term used by traders to describe this situation.

A drawdown occurs when one's capital is depleted as a result of a sequence of losing trades.

This is usually computed by subtracting a relative high in capital from a relative dip in capital.

Traders usually keep track of this as a proportion of their whole trading account.

Streak of Loss

We are continuously looking for an EDGE in trading. That is why traders create systems in the first place.

A 70 percent profitable trading system sounds like a great advantage to have. But, just because your trading technique is 70 percent profitable, does that mean you'll win 7 out of every 10 deals you make?

Certainly not! How can you know which 70 trades out of 100 will be profitable?

You don't, as it turns out.

You might lose the first 30 deals in a row before winning the next 70.

Even though you'd still be in the game if you lost 30 deals in a row, you have to ask yourself, “Would you still be in the game if you lost 30 trades in a row?”

It is for this reason that risk management is so critical. You will ultimately have a losing run, no matter what system you apply.

Even professional poker players who make a living from the game have bad losing streaks, yet they still manage to make a profit.

Because good poker players understand that they will not win every tournament they enter, they exercise risk management.

Instead, they risk only a little portion of their whole bankroll in order to endure losing streaks.

As a trader, this is what you must do.

Trading entails a certain amount of risk.

The key to becoming a successful forex trader is devising a trading strategy that allows you to weather these periods of significant losses.

Risk management rules are also an element of your trading strategy.

To survive your losing streaks, only risk a modest percentage of your “trading money.”

Remember that if you follow precise money management guidelines, you will become the casino, and “you will always win” in the long run.

We'll show you what happens when you utilize good risk management versus when you don't in the next part.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator