简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

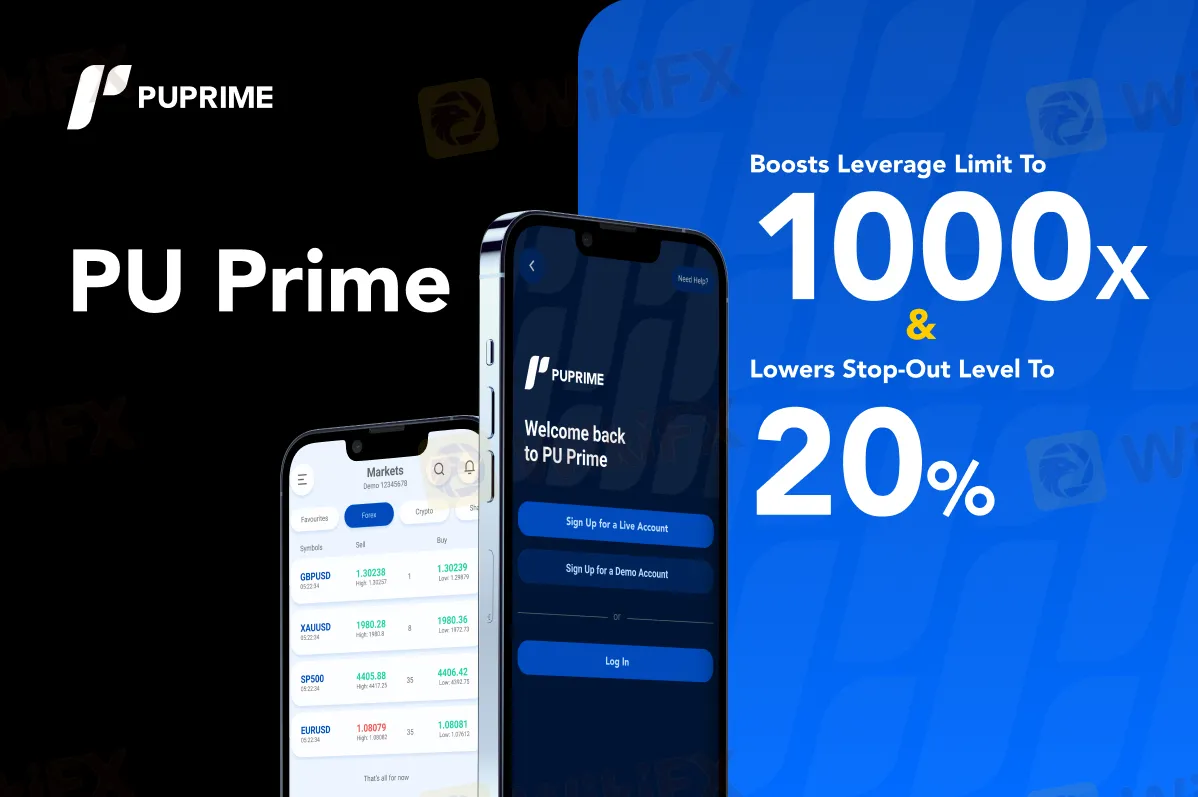

PU Prime Ups Leverage Limit, Downs Stop-out Level

Abstract:Leading broker PU Prime is shaking things up with a dual approach to enhance customer risk management and trading opportunities. Effective June 17th, 2024.

Leading broker PU Prime is shaking things up with a dual approach to enhance customer risk management and trading opportunities. Effective June 17th, 2024, they're:

Raising the maximum leverage to 1:1000:This allows traders to control larger positions with a smaller initial investment, potentially leading to bigger profits. However, remember – greater leverage equals greater risk. Tread cautiously when using such high leverage.

Lowering the stop-out level to 20%:If your account equity falls below 20% of the required margin, your positions will automatically close to limit losses. This safety net encourages responsible risk management and provides greater peace of mind while navigating the market.

PU Prime's bold move to increase the leverage limit while simultaneously reducing the stop-out level significantly alters the forex and CFD trading landscape. It empowers traders to potentially amplify their gains, but emphasizes the importance of meticulous risk management. By offering high leverage and a tighter stop-out, PU Prime aims to equip traders for safe and potentially profitable ventures.

Remember, high rewards come with high risks. Traders should be vigilant and employ smart risk management strategies, such as stop-loss orders, portfolio diversification, and detailed trade records. Utilize PU Prime's new settings thoughtfully to maximize your trading potential while minimizing risks.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Guide to Trading News Releases & Navigating Market Volatility

Understanding when key news releases occur, identifying the most impactful ones, and effectively trading them while managing risk can set you apart from the competition. This article delves into these aspects, helping you navigate the complexities of trading forex on news releases.

Is High leverage Better Than low leverage?

Leverage allows traders to amplify their market exposure beyond their initial investment, making it a pivotal factor in broker selection.

Pay Attention to These When Trading with High Leverage

In the realm of forex and cryptocurrency trading, leveraging is a common practice that allows traders to amplify their positions with borrowed capital. While high leverage can potentially lead to significant gains, it also carries inherent risks that traders should be mindful of. Understanding and managing these risks is essential for navigating the volatile markets effectively.

What Does HFX Trading Mean? Benefits, Risks, Strategies

HFX trading, also known as High-Frequency Trading, is a complex and rapidly evolving trading strategy that has gained significant traction in the financial markets over the past decade. It involves the use of sophisticated computer algorithms and high-speed internet connections to execute a vast number of trades within milliseconds, capitalizing on even the smallest market inefficiencies and price discrepancies.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Currency Calculator