简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Withdraw Money from E*Trade?

Abstract:Owned by Morgan Stanley, E*Trade is an online broking platform providing both individual and institutional clients with a whole range of trading and investment services. Established in 1982, the platform offers via both online and mobile trading platforms, access to stocks, options, ETFs, mutual funds, futures, currency, and other financial products. For both new and seasoned traders, E*Trade is well-known for its simple interface, strong research tools, and reasonable pricing policy.

Owned by Morgan Stanley, E*Trade is an online broking platform providing both individual and institutional clients with a whole range of trading and investment services. Established in 1982, the platform offers via both web and mobile trading platforms access to stocks, options, ETFs, mutual funds, futures, currency, and other financial products. For both new and seasoned traders, ETRADE is well-known for its simple interface, strong research tools, and reasonable pricing policy.

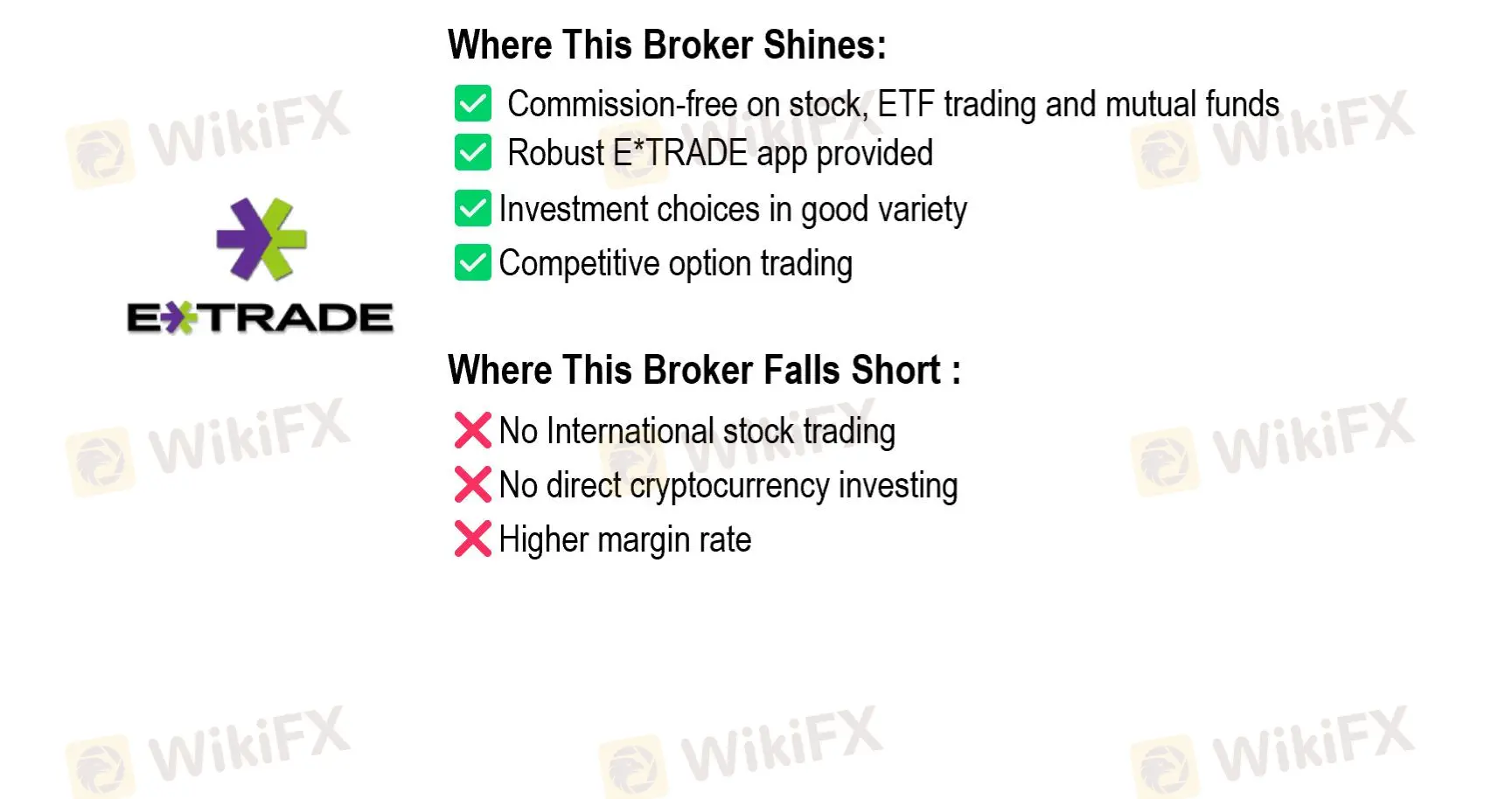

E*Trade shines with commission-free stock and ETF trades and comprehensive research tools, it's not without nuanced trade-offs. Its strengths include competitive pricing, feature-rich mobile app, and rich educational resources that targets both novices and seasoned investors. Conversely, some drawbacks emerge in higher options contract fees, limited international stock trading, and account maintenance charges for smaller balances. Overall E*Trade represents a solid, though not perfect, online trading solution in a competitive marketplace.

E*trade Withdrawal Options and Costs to Explore

On the E*trade platform, you have the option to withdraw funds using three different methods: ACH, Wire Transfer, or Check. The lowest withdrawal amount is $10 and the maximum withdrawal amount ranges from $100,000 to $250,000. All three withdrawal alternatives may incur costs. The processing period can range from one to five business days.

E*TRADE's withdrawal ecosystem has notable strengths, particularly its competitive fee structure and relatively quick processing times. Bank transfers and debit card withdrawals stand out for being cost-free, while wire transfers provide expedited fund movement at modest fees. However, limitations exist, such as higher international wire transfer charges and lower daily limits for overseas transactions.

| Withdrawal Method | Fees | Processing Time | Min Withdrawal | Max Withdrawal Limit |

| Bank Transfer (ACH) | $10 | 1-3 business days | $25 | $100,000 per day |

| Domestic Wire Transfer | $25-$35 | 1-2 business days | $100 | $250,000 per day |

| International Wire Transfer | $45-$50 | 2-3 business days | $100 | $50,000 per day |

| Paper Check | $5-$10 | 5-7 business days | $50 | $100,000 per transaction |

What Are Requirements to Withdraw Funds from E*Trade?

Prior to making a withdrawal from E*Trade, investors are required to complete a comprehensive account verification process. This involves providing valid government-issued identification, confirming personal details, and linking a verified bank account. The platform requires precise matching between the E*Trade account holder's name and the linked bank account to ensure secure transactions.

To qualify for a withdrawal, your account status is vital. Funds must be fully settled, typically requiring two business days after a trade execution. Investors need an active trading account with sufficient available balance and no outstanding trading restrictions. Besides, withdrawal amounts must comply with daily and transaction limits, and the account should have complete documentation. Potential barriers include pending trades, regulatory holds, or recent account openings that might trigger additional verification steps. While these requirements might seem stringent, they're designed to protect investors and maintain the platform's financial integrity.

How to Withdraw Funds from E*trade: A Comprehensive Guide

Generally, withdrawing funds from E*TRADE is not troublesome work, and this platform has simplified its withdrawal to a large extent. The whole withdrawal process involves 6 steps that guide clients from initiating the withdrawal to successfully receiving their funds.

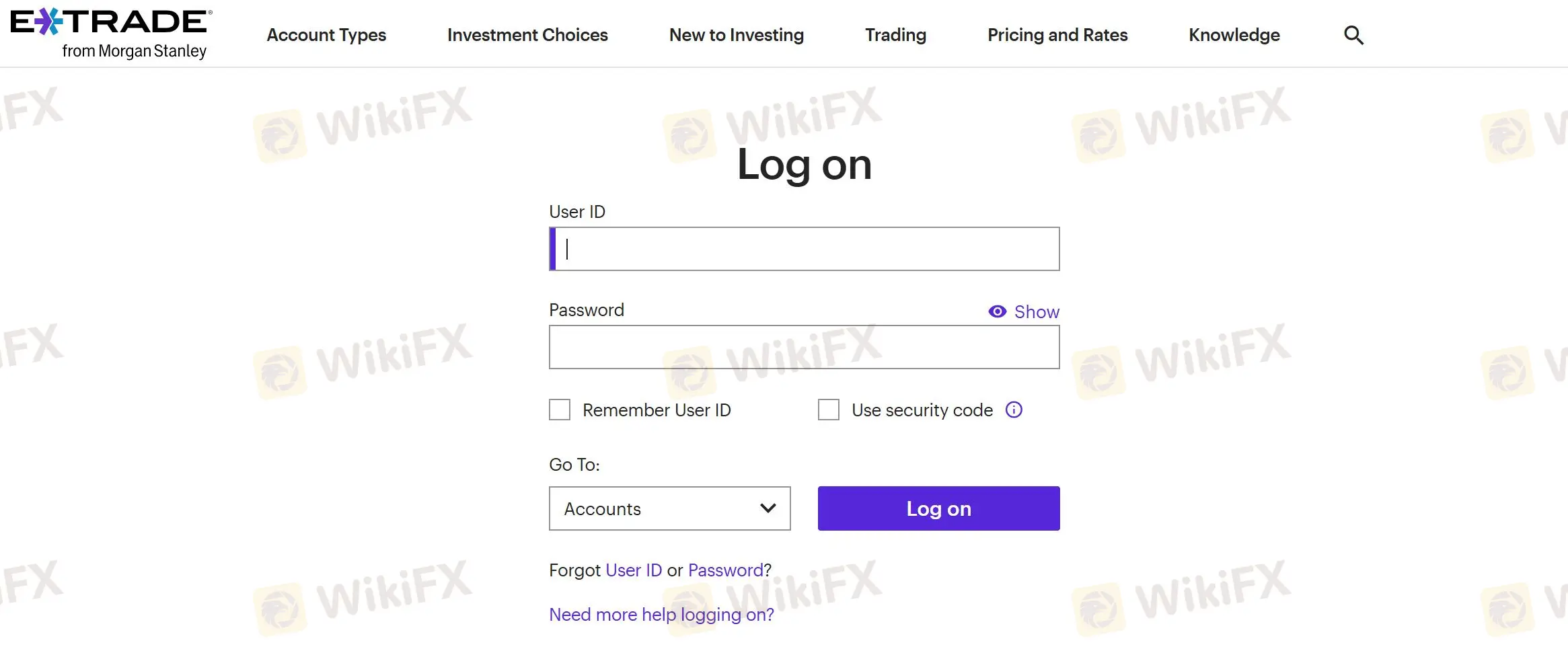

Step 1: Log on to Your E*TRADE Account

Logging into your E*trade account to acquire the required features for starting a withdrawal marks the first phase in taking money out of this platform. First go to the E*TRADE website and log on using your username and password, a simple step.

Step 2: Select ‘Transfer Money’ Option

Then, log in to your E*TRADE account and then go to the 'Transfer' option. From there, you'll find the fund transfer tools you need. The 'Transfer' page is where you may start moving money around in your E*TRADE account. You can locate the 'Transfer Money' option among the many transfer features. To initiate the procedure, select this option.

Once you've clicked “Transfer Money,” a series of prompts will appear. Pick the account you want to transfer the funds to, input the amount you want to transfer, choose a date and frequency, and finally, complete the transaction.

Step 3: Choose Withdraw Money Option

To withdraw funds from your E*TRADE account, select the 'Withdraw Money' option after choosing the 'Transfer Money' option.To guarantee a successful withdrawal, be sure to choose the “Withdraw Money” option when prompted. As a general rule, you'll need to input the withdrawal amount, choose the source account, and fill out any other necessary fields. Your E*TRADE account will be credited after the process is completed.

Step 4: Select the Account to Withdraw Your Money from

To make sure the transfer goes smoothly and accurately, choose the right account when you withdraw funds from E*TRADE. Any accounts you have connected to this page will be listed here. Pick the account you want to withdraw money from after carefully reviewing the available choices. Avoid mistakes in the transfer procedure by double-checking the account details, including the account number and routing number. Remember, this information must be verified in order to ensure that the funds are withdrawn from the correct account.

Step 5: Fill in the Withdrawal Amount

Make sure the amount you want to remove from your E*TRADE account is accurate, and then check the specifics of the transaction. Essentially, check all the details of the transaction twice before completing the withdrawal once you have inputted the desired amount, including withdrawal amount, destination account, and related costs, all in line with your plans.

Verifying the authenticity of the details is vital to avoid issues and delays caused by mistakes in withdrawal amounts.You can finish the transaction easily by going ahead and withdrawing the funds after you're sure everything is accurate.

Step 6: Confirm and Submit Request

Submit the withdrawal request to E*TRADE for processing after you've confirmed the amount and made sure the request was properly initiated.Verify the details are correct once you've submitted the withdrawal request. See to it that the quantity you asked for is equal to what's in your account.The next step is to authorise the withdrawal after you have verified the details. There are a few different ways to accomplish this, but usually it entails entering a secure verification code or providing further authentication. Please ensure that you validate the transaction promptly to prevent any processing delays.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator