简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Growth Stocks Are on the Firing Line in the Trade War

Abstract:Some of the countrys biggest companies, which generate much of their revenue overseas, are under increasing stress.

The bull market is in their hands.

Photographer: Saul Loeb/AFP/Getty Images

Photographer: Saul Loeb/AFP/Getty Images

Investors in U.S. growth stocks have been richly rewarded in recent years, but their fortunes are set to turn if President Donald Trump cant resolve his trade disputes.

Bloomberg News reported on Wednesday that China and the U.S. had wrapped up three days of trade talks and “expressed optimism that progress had been made.” For Trump, thats a clear departure from his usual tough talk on trade.

That shouldn‘t be surprising. As I pointed out recently, the president fancies himself a champion of American business and gauges his success by the level of the stock market. The market’s steep drop in December signaled that the country‘s biggest companies, which dominate market barometers such as the Dow Jones Industrial Average and the S&P 500 Index, are under increasing stress. They generate much of their revenue overseas, so Trump’s trade disputes are an obvious concern.

If the president was hesitant to connect those dots, Kevin Hassett, chairman of the White House Council of Economic Advisers, was not. He told CNN last week that “There are a heck of a lot of U.S. companies that have sales in China that are going to be watching their earnings being downgraded next year until we get a deal with China.” That was a day after Apple Inc. cut its revenue outlook, blaming in part weaker demand in China.

But Trump‘s trade policies don’t affect all companies equally. Growth companies, or those that are expected to grow faster than average, sell more of their products overseas than slower-growth value companies. That means they have more to gain from free trade and, of course, more to lose during a trade war.

Consider that, on a weighted average basis, companies in the S&P 500 Growth Index generated 58 percent of their revenue from foreign sources, according to numbers compiled by Bloomberg based on the most recent financial statements. That compares with 48 percent for companies in the S&P 500 Value Index.

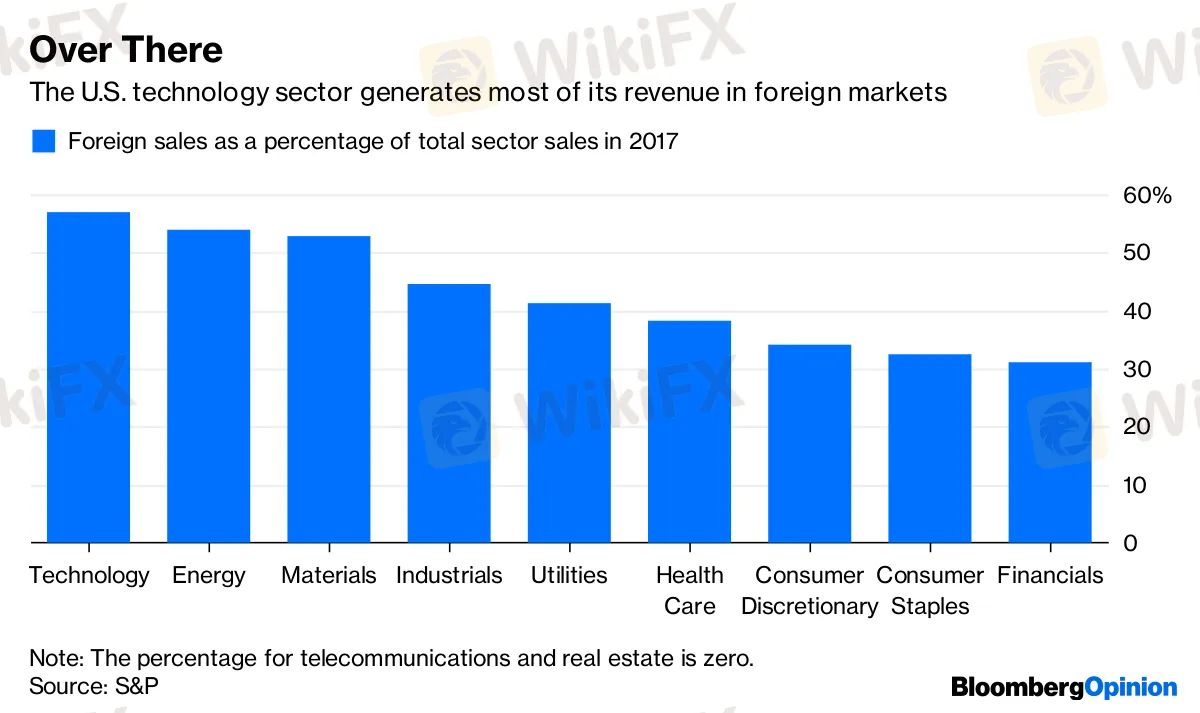

A big part of that difference can be attributed to technology companies such as Apple. According to the most recent S&P 500 global sales report, technology companies generated 57 percent of their sales outside the U.S. in 2017, more than any other sector. And technology stocks tend to be growthy. They account for 25 percent of the growth index, compared with just 15 percent of the value index.

Over There

The U.S. technology sector generates most of its revenue in foreign markets

Source: S&P

Note: The percentage for telecommunications and real estate is zero.

The market has been gently signaling the danger to growth stocks. The S&P 500 is up 9.9 percent since Christmas, when Trump sought to reassure the market by telling reporters he has confidence in the Federal Reserve and the U.S. economy and then made conciliatory overtures to China. Tellingly, growth stocks have benefited the most. The growth index has outpaced the value index by 1.2 percentage points through Wednesday.

Growth Spurt

Growth investing has thumped value over the last decade

Source: Bloomberg

Note: Indexed to 100.

And that‘s not the first sign that trade is a big deal for growth stocks. During the recent market swoon, growth stocks bore the brunt of trade and other concerns. The growth index was down 1.4 percentage points more than the value index from the market’s recent peak on Sept. 20 to trough on Christmas.

This is a particularly risky time for growth stocks because they have more room to fall than usual. The growth index has outpaced value by 4.5 percentage points a year over the last decade through 2018, which has stretched the valuations of growth stocks relative to value. The growth indexs price-to-earnings ratio has averaged 21 since 1995, based on 12-month trailing earnings per share, compared with 16 for the value index. Those numbers are now 23 and 14, respectively.

Paying a Premium

The valuation spread between growth and value stocks is higher than usual

Source: Bloomberg

Note: P/E ratio based on 12-month trailing earnings per share.

A bull market doesn‘t die of old age; something comes along and kills it. The market is telling investors that if Trump can’t resolve his trade disputes, the bull market for growth stocks is likely to be among the casualties.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Nir Kaissar at nkaissar1@bloomberg.net

To contact the editor responsible for this story:

Daniel Niemi at dniemi1@bloomberg.net

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator