Overview of Cerex Ltd.

Cerex Ltd is an unregulated brokerage based in China, established within the last 1-2 years. As an unregulated entity, they offer a variety of market instruments for trading, including Forex, Precious Metals, Energy, Index, Hong Kong/US stocks, agricultural products, and cryptocurrency. Their trading platform, the Cerex Trading Platform, caters to different account types: Standard Account, Advanced Account, and Professional Account. As for trading information goes, minimum deposits start from $200, leverage can go up to 1:500, and the company offers spreads as low as 0.28, varying per market instrument. They provide customer support through phone and email.

Additionally, Cerex Ltd does not provide specific information about its office locations and deposit/withdrawal methods. As an unregulated entity, it lacks oversight from any regulatory authority, which may raise concerns for some investors about the level of protection and security offered by the company.

Regulation

Cerex Ltd operates as an unregulated broker, the absence of regulation can result in a lack of formal monitoring and supervision of the company's activities. The lack of specific guidelines or requirements imposed on the company by a regulatory authority may leave clients with limited recourse or protection in case of disputes or issues. Additionally, the unregulated status may raise concerns about the transparency of the broker's operations and the safety of client funds. As an unregulated entity, Cerex Ltd is not subject to the same regulatory standards and compliance measures that regulated brokers must adhere to, potentially increasing the level of risk for investors.

Pros and Cons

Cerex Ltd offers a diverse range of market instruments for trading, encompassing Forex, Precious Metals, Energy, Index, Hong Kong/US stocks, agricultural products, and cryptocurrency. The availability of different account types, including Standard Account, Advanced Account, and Professional Account, provides investors with flexibility to choose based on their investment preferences and risk tolerance. The low minimum deposit requirement of $200 for the Standard Account makes it accessible for those who wish to start trading with a relatively small initial investment. Moreover, the company provides leverage of up to 1:500, allowing traders to potentially amplify their positions in the market. Additionally, Cerex Ltd offers spreads for various assets, with precious metals having a minimum floating spread as low as 0.32, which could be advantageous for cost-conscious traders.

One significant concern with Cerex Ltd is its unregulated status. Being an unregulated broker means that the company operates without oversight from any regulatory authority, potentially leaving clients with limited protection and redress in case of disputes or fraudulent practices. The lack of transparency associated with an unregulated entity may raise doubts about the company's operations and financial practices. Moreover, the absence of information about the company's office locations and deposit/withdrawal methods may lead to uncertainty and discomfort among potential clients. Additionally, the limited educational content and bonus offerings provided by Cerex Ltd might be considered a disadvantage for traders seeking additional resources and incentives to enhance their trading experience.

Market Instruments

Cerex Ltd offers a wide range of market instruments, including Forex, Precious Metals, Energy, Index, Hong Kong/US Stocks, Agricultural Products, and Cryptocurrency. Specifics are as follows:

Forex: Cerex Ltd offers trading in major currency pairs, including EUR/USD and USD/JPY, allowing investors to speculate on the exchange rate fluctuations between the Euro and the US Dollar, as well as the US Dollar and the Japanese Yen.

Precious Metals: Cerex Ltd facilitates trading in spot gold and spot silver, providing clients with opportunities to invest in these precious metals and potentially benefit from their price movements in the global market.

Energy: Cerex Ltd enables investors to trade US crude oil and natural gas, allowing them to take positions in the energy sector and capitalize on price fluctuations in the oil and gas markets.

Index: Cerex Ltd provides trading in American TECH100 and Zhonghua 300, allowing investors to participate in the performance of these stock market indices and gain exposure to the technology sector in the US and the Chinese market.

Agricultural Products: Cerex Ltd offers trading in corn, wheat, and coffee, providing investors with opportunities to speculate on price movements in the agricultural commodity markets.

Hong Kong/US Stocks: Cerex Ltd facilitates trading in individual company stocks like AAPL (Apple), AMZN (Amazon), and 09988 Alibaba-SW (Alibaba Group). This market instrument allows investors to invest in specific companies listed on the Hong Kong and US stock exchanges and potentially benefit from their performance.

Cryptocurrency: Cryptocurrency trading with Cerex Ltd includes digital assets like Bitcoin, Ethereum, and other popular cryptocurrencies, allowing investors to participate in this rapidly growing market and potentially capitalize on price movements in digital assets.

The following is a table that compares Cerex Ltd to competing brokerages:

Account Types

Cerex Ltd offers three account types - Standard Account, Advanced Account, and Professional Account. The specifics are as follows:

Standard Account: Cerex Ltd offers a Standard Account, which is an entry-level option for traders looking to start with a minimum deposit of $200. This account type provides access to 200+ global hot products, including Forex, Precious Metals, Energy, Index, Hong Kong/US stocks, agricultural products, and cryptocurrency. The minimum floating spread for precious metals is 0.32, while for crude oil and forex, it is 6 and 1.7, respectively. Leverage of up to 1:500 is available, enabling traders to potentially amplify their positions in the market.

Advanced Account: The Advanced Account is a step up from the Standard Account, requiring a minimum deposit of $1,000. Traders with this account type benefit from cost-effective trading with great discounts, which can be advantageous for those seeking lower trading costs. Similar to the Standard Account, the Advanced Account also offers access to 200+ global hot products, and the minimum floating spread for precious metals, crude oil, and forex are 0.3, 5, and 1.5, respectively. The leverage for this account is also up to 1:500, providing the same potential for amplified positions in the market.

Professional Account: The Professional Account is the top-tier option provided by Cerex Ltd, requiring a minimum deposit of $5,000. This account type is geared towards experienced traders and investors looking for premium features and benefits. With the Professional Account, traders can enjoy the lowest cost trading products, and the minimum floating spread for precious metals, crude oil, and forex are 0.28, 5, and 1.3, respectively. The leverage of up to 1:500 is also available for this account, offering the same potential for higher leveraged positions in the market.

The following is a table that compares the different account types offered by Cerex Ltd:

How to open an account?

The first step would be to navigate to the Cerex Ltd. Website and find the “open an account” button at the top right of the page.

Click the middle of the browser console and solve the capcha.

Next, the user will be transferred to the information input page.

After inputting a valid e-mail, the user will be sent a verification code which will be used to confirm the main e-mail for the account.

Finally, confirm the terms and agreement below the “Next Step” button and then press said button to continue to create the account and pick the account type.

Minimum Deposit

Cerex Ltd offers different minimum deposit rates for its account types, providing options that cater to various levels of investment capital. The Standard Account requires a minimum deposit of $200, making it an accessible choice for traders looking to start with a relatively small investment. For those seeking more cost-effective trading with added benefits, the Advanced Account requires a higher minimum deposit of $1,000. The top-tier option, the Professional Account, has a minimum deposit of $5,000 and is designed for experienced traders and investors seeking premium features.

Leverage

Cerex Ltd offers leverage as a tool to potentially amplify traders' positions in the market. The company provides leverage of up to 1:500, allowing investors to trade with a higher position size than their initial capital. This higher leverage ratio can potentially lead to increased profit potential, but it also comes with increased risk exposure.

Spread

Cerex Ltd offers various spreads for different market instruments, providing clients with insights into the costs associated with trading. The company's spreads for precious metals, crude oil, and forex vary across its account types. For precious metals, the spreads range from 0.32 for the Standard Account, 0.3 for the Advanced Account, to 0.28 for the Professional Account. For crude oil, the spreads are 6 for the Standard Account, 5 for the Advanced Account, and 5 for the Professional Account. Lastly, for forex, the spreads are 1.7 for the Standard Account, 1.5 for the Advanced Account, and 1.3 for the Professional Account.

Trading Platforms

Cerex Ltd offers its proprietary trading platform, the Cerex Trading Platform. This platform provides clients with access to a user-friendly interface, allowing for efficient trade execution and analysis of the market. With the Cerex Trading Platform, investors can trade a variety of market instruments, including Forex, Precious Metals, Energy, Index, Hong Kong/US stocks, agricultural products, and cryptocurrencies.

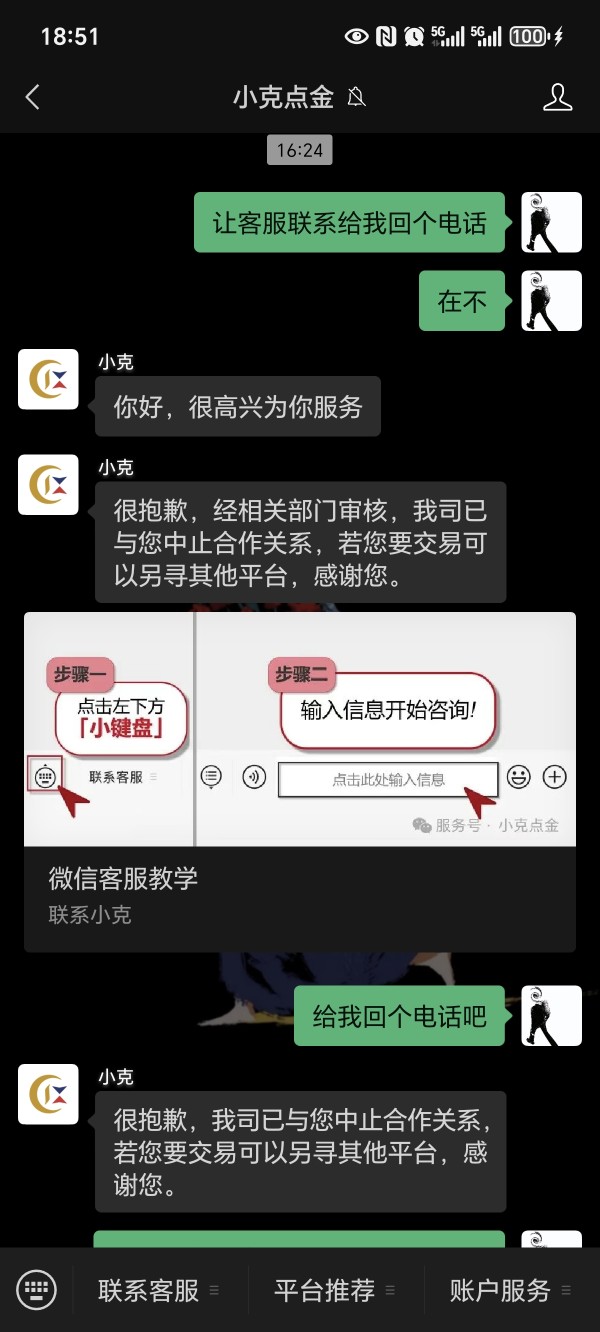

Customer Support

Cerex Ltd offers two customer support options, phone support, and email support, providing clients with direct communication channels to address their inquiries or concerns. Specifics are as follows:

Phone Support: Cerex Ltd provides phone support for customer inquiries, and clients can reach them by calling 4008423985. This direct communication channel allows for real-time assistance and prompt resolution of issues.

Email Support: For written inquiries and support, customers can reach Cerex Ltd's email support team at cs@crx6868.com. This option provides a convenient way for clients to communicate their concerns or seek assistance via email.

Conclusion

In conclusion, Cerex Ltd is a relatively new, unregulated company based in China, operating in the financial markets for approximately 1-2 years. As an unregulated entity, it provides a range of market instruments, including Forex, Precious Metals, Energy, Index, Hong Kong/US stocks, agricultural products, and cryptocurrencies, through its proprietary Cerex Trading Platform. Cerex Ltd provides support to its clients through phone and email channels, offering timely assistance for inquiries and concerns.

The company offers three distinct account types, catering to investors with varying levels of capital and trading preferences, with minimum deposits starting at $200. With leverage of up to 1:500, traders have the potential to amplify their positions in the market, but the unregulated status may raise concerns about the lack of formal oversight and transparency.

FAQs

Q: What is Cerex Ltd's main focus on the financial markets?

A: Forex, Precious Metals, Energy, Index, Hong Kong/US stocks, agricultural products, and cryptocurrencies.

Q: How long has Cerex Ltd been operating in the financial industry?

A: Cerex Ltd has been in operation for approximately 1-2 years in the financial markets.

Q: Does Cerex Ltd fall under the oversight of any regulatory authority?

A: No, Cerex Ltd operates as an unregulated broker.

Q: What are the available account types offered by Cerex Ltd?

A: Standard Account, Advanced Account, and Professional Account, each with different minimum deposit requirements and benefits.

Q: How can customers seek assistance from Cerex Ltd?

A: Customers can contact Cerex Ltd's support team through phone support at 4008423985 or via email at cs@crx6868.com.

Q: What is the minimum deposit required to start trading with Cerex Ltd?

A: The Standard Account requires $200.