简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Tumbled as Haven Demand Ebbed, Asia Stocks May Climb

Abstract:The US Dollar suffered as an improvement in sentiment sapped the appeal of haven assets. Nikkei 225 is still at risk to a bearish reversal

Asia Pacific Market Open Talking Points

US China trade talk optimism bets send Emerging Markets, S&P 500 higher as USD declines

Temporary pause in US government shutdown fails to further lift sentiment, JPY depreciates

Nikkei 225 still at risk to a bearish reversal pattern. AUD/USD faces falling resistance line

See our study on the history of trade wars to learn how it might influence financial markets!

The US Dollar had one of its worst days since January 9th. This was despite a rally in local front-end government bond yields as 2019 Fed rate hike expectations improved. According to Fed funds futures, the probability of a hike in June rose from 20.4% to 24.4%. Simultaneously, global benchmark stock indexes soared as sentiment improved, sapping the appeal of haven assets.

On Wall Street, the S&P 500 rallied about 0.75% while the MSCI Emerging Markets Index climbed 1.32% as it closed at its highest since October 2018. The sentiment-linked Australian and New Zealand Dollars rose while the anti-risk Japanese Yen and Swiss Franc weakened. Most of the gains occurred during the European and early US trading session.

This suggests that market-wide optimism was not due to a temporary end in the partial US government shutdown which occurred later. The stopgap funding bill would allow the government to run until February 15th. US President Donald Trump said that if a budget for a border wall is not reached, the government would shut down. Chances of another one down the road are not necessarily completely off the table.

What seemed to be the main driver for risk appetite were perhaps hopes of a positive outcome on trade negotiations between the world‘s largest economies. China’s Vice Premier Liu He will be visiting Washington DC ahead. It should also be noted that stock markets generally rallied last week despite mixed cues from the White House. Commerce Secretary Wilbur Ross mentioned that the two nations were ‘miles and miles’ apart.

Monday‘s Asia Pacific Trading session is lacking notable economic event risk in a week filled with key statistics from the US. As such, the focus in the interim will likely remain on sentiment. It won’t be too surprising to see the Nikkei 225 aim higher. Such an outcome may further weaken JPY. The Japanese index still remains within a bearish reversal pattern that has been brewing for some time. Meanwhile AUD/USD needs to clear a critical descending resistance line.

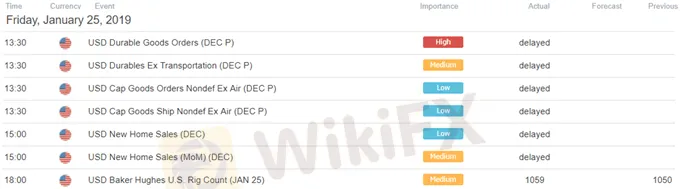

US Trading Session

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

See how equities are viewed by the trading community at the DailyFX Sentiment Page

Join a free Q&A webinar and have your trading questions answered

See our free guide to learn what are the long-term forces driving US Dollar prices

See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Market Developments: Bond Market Interventions, Tech Stock Rebounds, and Rising Geopolitical Tensions

Global markets are navigating through significant shifts. China intervenes in the bond market to curb speculation, while Japan's Nikkei rebounds after historic losses. Elon Musk's increasing political involvement and General Motors' strategic shifts in China reflect broader economic and geopolitical trends. Rising tensions in the Middle East and U.S. labor market volatility add further complexity, influencing global currencies and stock movements.

Global Market Insights: Key Economic Events and Their Impact

Global Market Insights: Key Economic Events and Their Impact

What's happening with the US Dollar? Why do countries ditch USD?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world’s major emerging economies have agreed to ditch USD for trade!

What's happening with the US Dollar? Is it losing its dominance?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world's major emerging economies have agreed to ditch US dollar for trade!

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

Currency Calculator