简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Investors Hedge a Stock Doomsday With Record Fixed-Income Inflows

Abstract:Investors are amassing an expensive insurance policy against market doomsday.

Investors are amassing an expensive insurance policy against market doomsday.

“Fears of worsening economic momentum coupled with geopolitical uncertainties and corporate earnings revisions that appear to have limited upside has triggered a rush for safety,” said Antoine Lesne, head of SPDR ETF Strategy & Research for Europe at State Street Global Advisors. “Fixed income is thus a good place to be relative to higher potential drawdowns in equity portfolio.”

After climbing up along with stocks, Treasury yields reversed course mid-January, signalling the bond market is prepping for slower growth and inflation.

A rally in German bonds pushed benchmark 10-year yields below 0.1 percent Monday morning to a two-year low on the heels of dimming economic projections.

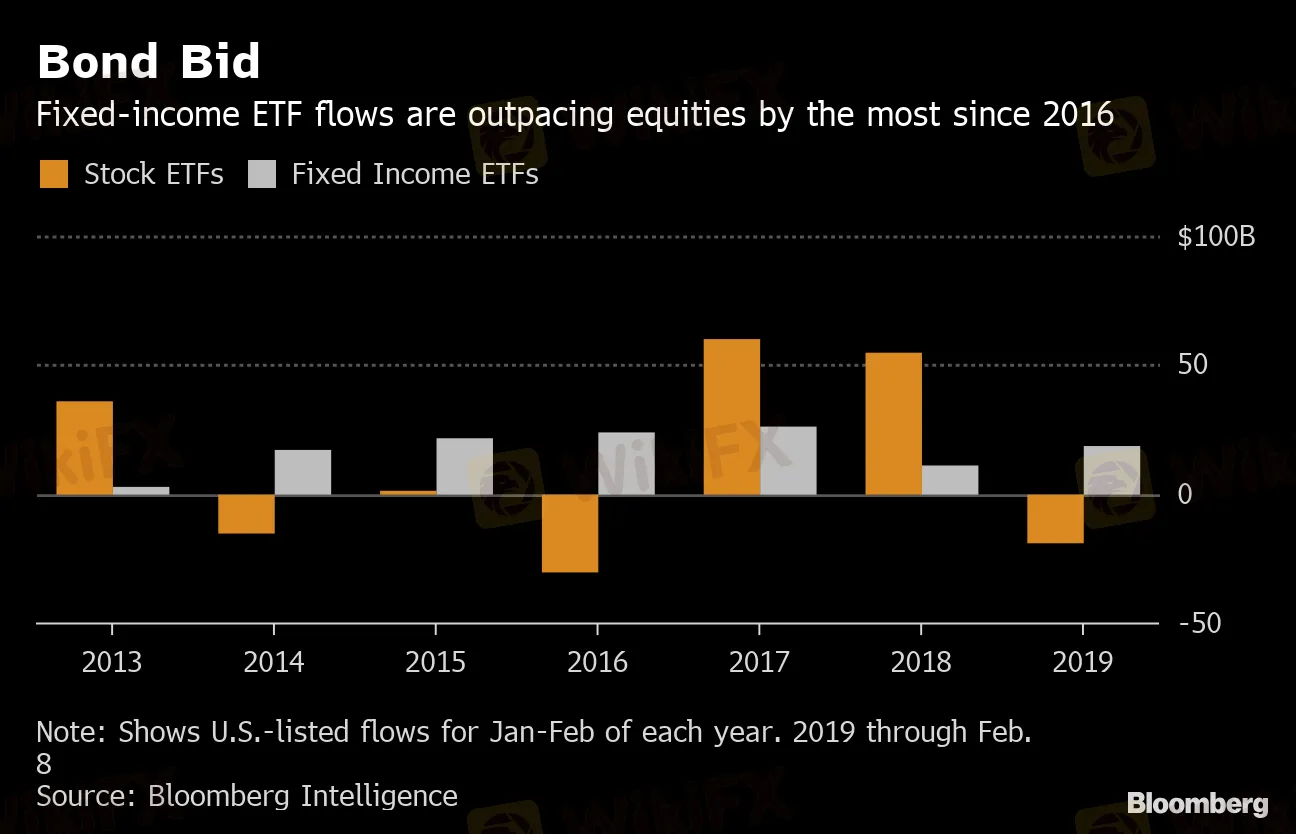

Investors have added $18.4 billion into U.S.-listed fixed-income funds this year, nearly as much as they‘ve pulled from equity funds -- $18.9 billion -- according to data compiled by Bloomberg. Though some of those outflows may be down to tax-loss harvesting, it’s the most lopsided relationship between the two asset classes since 2016.

Bond Bid

Fixed-income ETF flows are outpacing equities by the most since 2016

Source: Bloomberg Intelligence

Note: Shows U.S.-listed flows for Jan-Feb of each year. 2019 through Feb. 8

Bonds arent rejecting risk altogether, of course: Strong inflows into U.S. high-yield credit persist, even though high corporate debt loads look vulnerable in an economic slowdown.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator