简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Price May Falter as IEA Forecasts Supply Swamp

Abstract:The International Energy Agency found it may be difficult for the energy market to absorb newfound crude supply from non-OPEC members.

Crude Oil Talking Points:

The IEA found demand to be constant from the month prior, despite many agencys warning of slower growth

Other energy agencies like OPEC and the EIA have recently lowered their demand expectatio

With the two pricing factors at odds, the price of crude oil could come under pressure

Interested in trading Crude oil, Bitcoin or the Dow Jones? Learn specific trading strategies with ourDailyFX Trading Guides.

Crude oil may slide in the coming months as energy agencies continue to forecast a crude market swamped with supply at a time when demand has wavered. The International Energy Agency (IEA) reported their monthly prognosis of the oil market on Wednesday and the findings echoed concerns of recent reports from OPEC and the Energy Information Administration (EIA). While OPEC and the EIA lowered their most recent demand expectations, the IEA maintained the same figures from January at 1.4 million barrels per day.

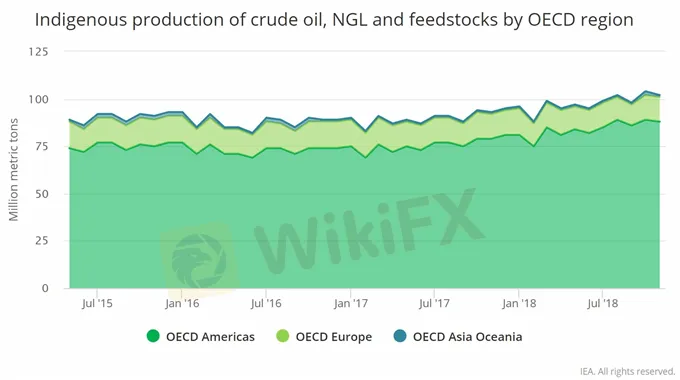

Crude Oil Supply Chart: IEA (Chart 1)

On the supply side, the agency highlighted the headline factors that may drive crude lower in the coming quarters. “The global oil market will struggle this year to absorb fast-growing crude supply from outside OPEC, even with the groups production cuts and U.S. sanctions on Venezuela and Iran,” the agency said. Despite the already considerable increase in crude production outside of OPEC, the IEA again raised its forecasts for supply from non-OPEC members in the month ahead. The estimate increased to 1.8 million barrels per day in 2019, from 1.6 million barrels per day previously.

One key uncertainty in the crude oil market is Venezuela. The OPEC member faces a multitude of sanctions from the United States and political uncertainty as the current President faces mounting pressure from the public and other countries to step down. Should the issue be resolved quickly, crude production could return to levels seen in prior years and flood the market further. On the other hand, a prolonged struggle may sap even more production from the country and drain some of the excess supply in the market. Either way, the situation will be important to watch as the struggle unfolds.

Crude Oil Price Chart: Daily Timeframe (January 2018 – February 2019) (Chart 2)

Despite the ominous report crude closed slightly higher than it opened Wednesday, marginally below $54.00. That said, Crudes price remains considerably lower than its altitude in October when it traded north of $75.00. Recent concerns of waning global growth helped to drive the price lower on the demand side, and the supply glut offered by non-OPEC members may look to keep it pressured for the foreseeable future.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Nasdaq Bullish, Encourage by Upbeat U.S. Job Data

The financial markets reacted positively to the upbeat Initial Jobless Claims data released yesterday, which came in at 233k, lower than market expectations. This eased concerns about a weakening labour market and the heightened recession risks that emerged after last Friday's disappointing NFP report. Wall Street benefited from the improved risk appetite, with the Nasdaq leading gains, surging by over 400 points in the last session.

OnEquity Empowers Traders with High Leverage Options Across Diverse Markets

OnEquity, a leading online trading platform, announces its extensive leverage options, offering traders greater control and flexibility across various markets including commodities, CFDs on stocks, indices, cryptocurrencies, oil, and precious metals.

Higher Tokyo CPI Bolsters BoJ Rate Hike Expectation

Wall Street continues to face downside risks, with the Nasdaq and S&P 500 sliding in yesterday's session while the Dow Jones eked out a marginal gain.

Dollar Dip on Dovish Fed’s Beige Book

The dollar continues to tumble, trading at its lowest level since April, below the $104 mark. The U.S. Beige Book suggests economic growth has moderated and inflation shows signs of easing, strengthening the likelihood of a September rate cut. Improved risk appetite in the market propelled the Dow Jones up nearly 300 points in the last session, breaking its all-time high.

WikiFX Broker

Latest News

SquaredFinancial offers Trump & Melania meme coins

What is the Best Time to Trade Forex?

Win Rewards & Celebrate Lunar NY with JustMarkets

BBC World Service to axe 130 jobs in bid to save £6m

Crypto.com Delists USDT and 9 Tokens to Comply with MiCA Regulations

AI Fraud Awareness Campaign: "We're Not All F**ked"

How to Use Financial News for Forex Trading?

GMO-Z com Securities Thailand to Cease Operations in 2025

Oil Prices at $90 to $100 Could Push Philippines Inflation Beyond Target

Do More Liquid Currencies Yield Higher Profits?

Currency Calculator