简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Took Path of Least Resistance on FOMC Minutes, AUD at Risk

Abstract:The US Dollar was jawboned by risk trends and the FOMC meeting minutes as the S&P 500 took the path of least resistance. AUD/USD may

The US Dollar had a rather mixed session on Wednesday, jawboned by risk trends and the FOMC meetings minutes. European equities aimed higher, led by gains in autos as the Euro Stoxx 50 closed +0.62%. This sapped the appeal of haven-linked assets such as the Greenback and the anti-risk Japanese Yen. Then, the minutes from Januarys FOMC meeting offered USD a boost, leaving it little changed by the end of the day.

Heading into the event, the markets priced out a hike by the end of this year after last month‘s relatively cautious Fed rate decision. Today, the details of the document reiterated some of policymakers’ concerns. However, there remained optimism about domestic economic conditions: a strong labor market and inflation being near their target.

Many Fed officials noted that they were unsure about what rate moves may be needed this year with some noting that further hikes could be appropriate. This may have been the cause of gains in USD as local front-end government bond yields rallied. Any signs of a possibility of a hike this year run counter to what the markets are anticipating. That alone may have caught some investors off guard.

Arguably, this is a by-product of a data-dependent approach which naturally creates uncertainty. What was more certain is that almost all Fed officials wanted to halt the runoff in the balance sheet later this year. Given that markets usually take the path of least resistance, that may have been why the S&P 500 soon pared its losses in the aftermath of the FOMC meeting minutes. This could bode well for equities.

Thursdays Asia Pacific Trading Sessio

Asia Pacific benchmark stock indexes may echo gains on Wall Street with S&P 500 futures pointing higher heading into Thursdays session. As such, the Japanese Yen could be vulnerable to losses ahead. Meanwhile the pro-risk Australian Dollar may have a hard time climbing if a local jobs report misses expectations. After all, economic data has been tending to underperform relative to expectations in Australia as of late.

Join me as I cover the Australian Jobs Report LIVE and the reaction in AUD/USD where I will also be looking at what could be in store for the Aussie next!

AUD/USD Technical Analysi

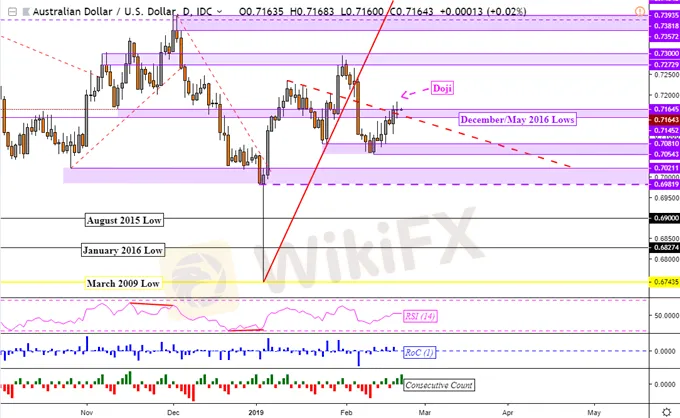

In its near-term uptrend from last week, AUD/USD has formed a Doji candlestick at its most recent peak under resistance at 0.71645. This is a sign of indecision which could precede a turn lower, especially if Australias employment data disappoints. This would place immediate support around 0.7081 to 0.7054.

AUD/USD Daily Chart

Chart Created in TradingView

US Trading Session Economic Event

Asia Pacific Trading Session Economic Event

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

WikiFX Broker

Latest News

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator