简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Asia Stocks Wobble as Trump-Kim Summit Cut Short, S&P 500 at Risk

Abstract:Asia stocks wobbled as sentiment remained fragile, Nikkei 225 futures aimed lower after the Trump-Kim summit was abruptly cut short. S&P 500 futures hint of

Asia Pacific Markets Wrap Talking Point

Asia equities aim lower as sentiment wobbled, Trump-Kim summit cut short

Australian Dollar declines on soft Chinese manufacturing PMI data, Yen u

S&P 500 futures hint of a top as all eyes are on the US GDP data release

Find out what retail traders equities buy and sell decisions say about the coming price trend!

On Thursday, most Asia Pacific stocks fell. Equities continue struggling to achieve significant gains in the aftermath of what has arguably been the most progress made in US-China trade talks yet. Recent developments have been keeping the mood muted such as geopolitical tensions between India and Pakistan and testimony from US Trade Representative Robert Lighthizer, who poured some cold water on trade negotiations.

Japan‘s Nikkei 225 declined over 0.3% heading into the close, kept down by most sectors. China’s Shanghai Composite fared roughly a similar fate. South Koreas Kospi was one of the worst performers, falling over 0.5%. According to newswires, Trump-Kim summit talks were abruptly changed for reasons that have not been made clear yet at the time of this writing.Nikkei 225 futures aimed lower on the news.

The New Zealand Dollar remained under pressure following multiple disappointing local confidence data. Meanwhile, the Australian Dollar aimed lower following dismal Chinese manufacturing PMI data, giving up earlier gains on a strong domestic private capital expenditure report. The anti-risk Japanese Yen and Swiss Franc aimed cautiously higher.

Over the remaining 24 hours. all eyes will be on delayed US GDP. The first estimate of economic growth in the fourth quarter is expected to slow to 2.2% q/q from 3.4% in Q3. Lately, local economic data has been tending to increasingly underperform relative to economists expectations, opening the door to a downside surprise. If this is the case, it would underpin slowing global growth concerns.

S&P 500 Futures Technical Analysi

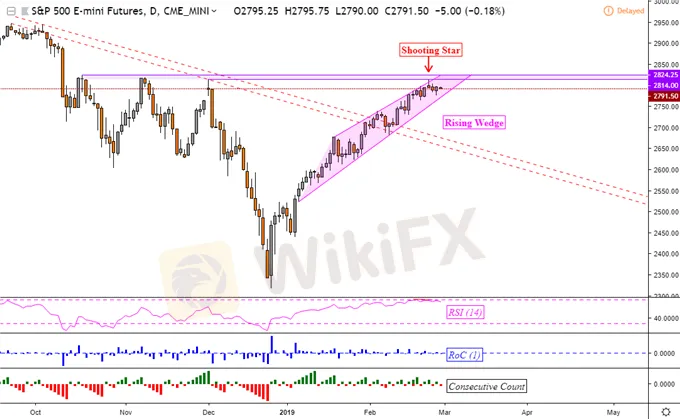

Looking at S&P 500 futures shows multiple warning signs that a turn lower that could come ahead. Recently, prices stalled after the formation of a Shooting Star candlestick amidst fading upside momentum. In addition, a rising wedge pattern has been brewing since about the beginning of this year. This is a bearish formation that, with confirmation, can precede a descent. Otherwise, near-term resistance is between 2824.25 to 2814.00.

S&P 500 Futures Daily Chart

Chart Created in TradingView

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Wolf Capital Exposed: The $9.4M Crypto Ponzi Scheme that Lured Thousands with False Promises

Confirmed! US December non-farm payroll exceeded expectations

Spain plans 100% tax for homes bought by non-EU residents

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

400 Foreign Nationals Arrested in Crypto Scam Raid in Manila

Currency Calculator