简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD: Implied Volatility at 6-Week High as Traders Await ECB

Abstract:Overnight implied volatility on EURUSD forex option contracts exploded to its highest level since Jan 23 as currency markets prepare for potentially formidable price action.

EURUSD IMPLIED VOLATILITY – TALKING POINT

EUR traders gear up for volatility ahead of the European Central Banks interest rate decision slated for 12:45 GMT tomorrow

Remarks from ECB President Mario Draghi will likely dictate the size and direction of price actio

DailyFX provides a variety of trading resources found in our free Forex Education Center.For additional insight on currencies and the global markets, download the free DailyFX Top Trading Opportunities in 2019 Forecast

The overnight implied volatility on EURUSD forex option contracts exploded to its highest level since January 23 as currency markets prepare for potentially formidable price action. EURUSD traders are likely anticipating the European Central Banks rate review and follow-up commentary from President Mario Draghi to cause substantial price swings in the currency pair.

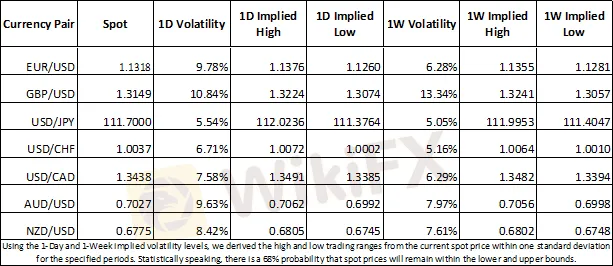

CURRENCY MARKET IMPLIED VOLATILITY AND TRADING RANGE

Although the ECB looks set to reiterate its zero-interest rate policy, the Eurozone‘s head central banker may signal further willingness to support the bloc’s economy as downbeat data continues to disappoint. A tone that is interpreted as relatively dovish could put pressure on the Euro and send the currency to multi-week lows against the USD.

UPCOMING EURUSD DATA RELEASES AND EVENT RISK

Visit the DailyFX Economic Calendar for a full list of data releases and event risks that impactUSD, GBP, CAD, JPY, AUD, CNY, EUR, CHF, NZD and MXN currencies.

Markets will also eye final readings on Eurozone employment and GDP numbers. Fresh job data out of the US in addition to the countrys consumer credit report should is likely on the radar as well.

EURUSD CURRENCY PRICE CHART: 4-HOUR TIME FRAME (JANUARY 30, 2019 TO MARCH 06, 2019)

EURUSD spot prices evidently coiled into a symmetrical triangle pattern between the currency pair‘s February high and low. A breakout would suggest a continuation of the longer-term downtrend. EURUSD’s one-day trading range derived from overnight implied volatility implies that prices will likely remain between the 1.1376 and 1.1260 handles.

Additional Insight:

EURUSD Rate Forecast – Bearish Series Brings 2019 and 2018 Low on Radar

EURUSD Holds Support Ahead of ECB; USDCAD Rallies to Two-Month High

---

Written by Rich Dvorak, Junior Analyst for DailyFX

Follow on Twitter@RichDvorakFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

EUR/USD is mixed to bearish, influenced by resistance levels and upcoming data. GBP/USD is bullish with the pound at four-month highs on positive UK data and hawkish BoE comments. EUR/GBP remains volatile, reflecting diverging economic conditions in the Eurozone and the UK.

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

European trading is subdued due to the U.S. holiday, with the euro benefiting from weak U.S. data. The pound rises ahead of the UK election, supported by market sentiment. ECB President Christine Lagarde's comments on interest rates support the euro. Overall, mixed sentiment prevails with cautious trading expected. Key economic events include Eurozone retail sales, Germany's industrial production, and UK services PMI.

Rate Rumble: RBNZ, BoC, and ECB Take Centre Stage

The New Zealand central bank maintain its benchmark interest rate at 5.50% as expected during its previous meeting. While there was no surprise of the central bank paused rates, the less hawkish tone was a surprise as 23% of the market surveyed by Reuters predicted an interest rate hike. In February, the rate of consumer price growth in the United States picked up pace with the reading came in at 3.2%, surpassing expectations of 3.1% for underlying inflation.

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator