简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Asia Stocks Follow Wall Street Response to FOMC, FTSE 100 Eyes BoE

Abstract:Like the reaction to the Fed, Asia Pacific stocks traded mixed. The ASX 200 fell as a jobs report reduced dovish RBA expectations. GBP/USD and FTSE 100 eye the BoE, Brexit saga.

Asia Pacific Markets Wrap Talking Points

Asia stocks traded mixed, like S&P 500 reaction to FOMC

ASX 200 fell as local jobs report reduced dovish RBA bets

GBP/USD, FTSE 100 eye Bank of England and Brexit saga

Find out what retail traders equities buy and sell decisions say about the coming price trend!

Asia Pacific markets lost most of their upside momentum heading into the European trading session. This followed a decidedly more dovish Fed rate decision which resulted in a mixed reaction on Wall Street. In the end, the S&P 500 closed to the downside as markets balanced a pause in tightening with pessimistic economic projections.

Japan‘s Nikkei 225 rallied as much as 0.6%, but then trimmed gains heading towards the close. China’s Shanghai Composite fared better, with gains sustaining above 0.5%. South Korea‘s KOSPI traded little changed. In Australia, the ASX 200 was down over 0.4%. This may have been due to February’s Australian jobs report.

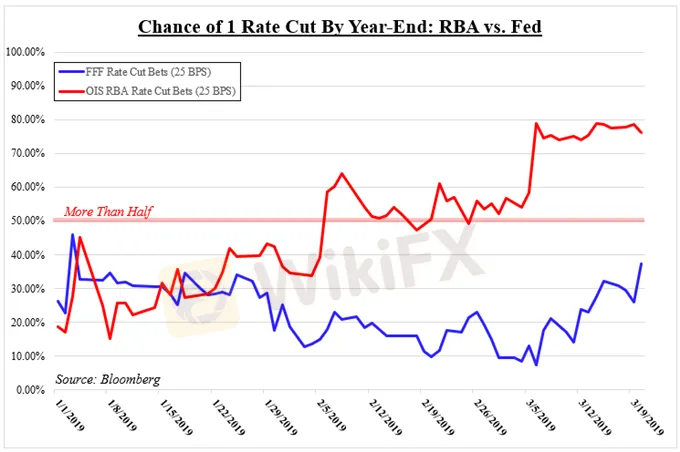

Despite a rather lackluster outcome, where the nation added fewer jobs as the unemployment rate fell for potentially the wrong reasons, AUD/USD soared with rising front-end government bond yields. This reflected ebbing RBA rate cut bets, which bodes ill for Australias benchmark stock index. With that in mind, it will probably take significantly more dismal local economic data to revive dovish expectations (see chart below).

S&P 500 futures are little changed as markets now face the Bank of England monetary policy announcement. Given the reaction today to the Fed, it is unclear what a more cautious central bank could mean for equities. Meanwhile, lets not forget that GBP/USD and FTSE 100 are also overshadowed by the ongoing Brexit saga which has lately taken a toll on it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator