简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

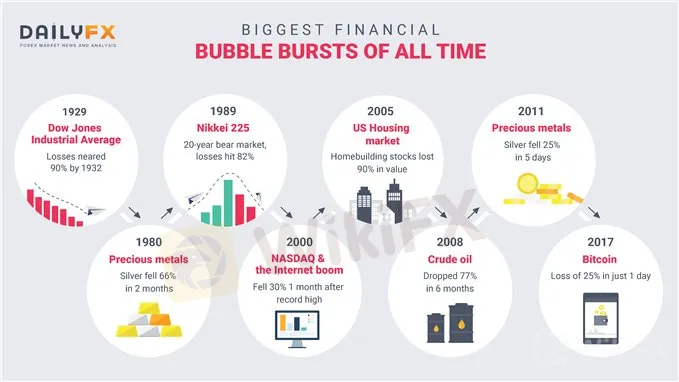

A Brief History of Major Financial Bubbles, Crises, and Flash-crashes

Abstract:Theres a rich history of financial bubbles and manias, varying in scale and economic impact. Read about major market bubbles and flash crashes all traders should know.

What you need to know about financial bubbles and manias

您需要了解的有关金融泡沫和狂热的信息

Throughout history there have been numerous speculative economic bubbles and manias. Some were relatively isolated events which held limited or no broad economic ramifications, while others resulted in a full-blown financial crisis or marked the end of important eras.

纵观历史,有许多投机性的经济泡沫和狂热。有些是相对孤立的事件,其影响有限或没有广泛的经济影响,而其他事件则导致全面的金融危机或标志着重要时代的结束。

In more recent times, flash-crashes have become another unusual but very different type of short-term threat to the marketplace as an unintended consequence of rapidly growing dependence on technology and algorithmic trading. Keep reading a brief history of bubbles and manias and how they impacted the trading landscape.

最近,闪电崩溃已经成为另一种不同寻常但却截然不同的短期市场威胁,这是对技术和算法交易的快速增长依赖的意外后果。继续阅读泡沫和狂热的简要历史以及它们如何影响交易前景。

What are Financial Market Bubbles and Manias?

什么是金融市场泡沫和狂热?

Bubbles and manias have been around as long as financial markets have, and for as long as human nature remains the same these episodes of severe market dislocations will continue to develop and unravel as they have in the past. Over and over.

只要金融市场存在泡沫和狂热,并且只要人性保持不变,这些严重的市场混乱事件将继续像过去一样发展和解开。一遍又一遍。

The history of bubbles begins in the 17th century. The first recorded market bubble – the Tulip mania – dates all the way back to 1636-1637, and yet after nearly 400 years we find ourselves today amidst the deflating of the Bitcoin bubble that reached its crest in December 2017. Of all the historical bubbles, only Bitcoins final blow-off stage rivaled that of the one seen during the Tulip craze, and in total from the beginning to the end only the Bitcoin bubble has exceeded it.

气泡的历史始于17世纪。第一个记录的市场泡沫 - 郁金香狂热 - 可以追溯到1636-1637,然而在经过近400年后,我们发现自己今天在比特币泡沫的缩小中于2017年12月达到顶峰。在所有历史泡沫中只有比特币的最后一次爆发阶段可以媲美郁金香热潮中看到的阶段,并且从开始到结束只有比特币泡沫超过它。

Indeed, a perfect example of how human nature in the marketplace remains unchanged despite all the advances in technology and availability of education and information to market participants. The asset type and reason behind the spectacular rise and fall are different, but the irrational behavior of market participants is nearly identical.

确实尽管技术的进步以及对市场参与者的教育和信息的可用性,这是市场中人性如何保持不变的一个完美例子。壮观兴衰背后的资产类型和原因是不同的,但市场参与者的非理性行为几乎相同。

The Tulip and Bitcoin bubbles are two of the more unusual occurrences given the type of ‘asset’ they are (were) and sheer magnitude of price appreciation. But along the way between the days of Tulips and Bitcoin there have been many instances of speculative bubbles and manias, of which some ended very badly for the broader financial markets and economy.

郁金香比特币泡沫是两种较不寻常的事件,因为它们是“资产”类型和价格升值的绝对数量。但在郁金香和比特币之间的过程中,出现了许多投机性泡沫和狂热的情况,其中一些对于更广泛的金融市场和经济而言非常糟糕。

In this article, the history of bubbles and manias has been segmented into two types, with the importance of the asset class to broader financial markets as the dividing factor. ‘Normal’ market bubbles, if you can call them that, are those which involved major markets (i.e. stock markets, commodities) and ‘abnormal’ market bubbles are those involving ‘niche’ markets with limited to no macro-impact.

In本文将泡沫和狂热的历史分为两类,其中资产类别对更广泛的金融市场的重要性作为分界因素。 “正常”的市场泡沫,如果你可以称之为那些,那些涉及主要市场(即股票市场,商品)和“异常”市场泡沫的市场泡沫是那些涉及“利基”市场的泡沫,其影响范围有限。

Looking for forecasts, trade ideas, and educational content? Weve got you covered on the DailyFX Trading Guides page.

寻找预测,交易想法和教育内容?我们已经在DailyFX交易指南页面上为您提供了支持。

Major Market Bubbles (10 years to the peak, 2 after)

主要市场泡沫(10)几年到高峰,2后)

2 Years After the Top

顶部后2年

Dow 1929 (led to the 1930s depression)

Dow 1929年(导致20世纪30年代萧条)

The first major developed-world bull market that led to excessive speculation and extreme valuations took place during the ‘roaring ’20s‘ and culminated in the 1929 top. While the gains during the decade leading up to the top were relatively tame by comparison to other major speculative bubbles, the fall-out was tremendous with the Dow Jones losing 89% from the top on September 3, 1929 to the trough on July 7, 1932. Along with the collapse of stock prices came the ’Great Depression, a recession which lasted over three and a half years and saw unemployment spike to nearly 25%.

第一个主要的发达国家牛市导致过度投机和极端的v在“咆哮的20多岁”期间发生了一次高潮,并在1929年的顶峰中达到高潮。虽然与其他主要投机泡沫相比,导致高层的十年期间的涨幅相对温和,但道琼斯指数在1929年9月3日从7月7日的低点下跌89%后跌幅巨大, 1932年。伴随着股市崩盘,出现了“大萧条”,这是一场持续了三年半以上的经济衰退,失业率飙升至近25%。

Precious metals 1980 (Marked the top of the70s inflation cycle)

贵金属1980(标志着70年代通胀周期的顶峰)

In what was one of the largest manipulations in market history, the Hunt brothers, sons of oil tycoon H.L. Hunt, attempted to corner the silver market. This helped drive the price of silver to a peak of $49.45 on January 18, 1980 from approximately $6 just a year earlier.

在市场历史上最大的操纵之一,亨特兄弟,石油大亨HL Hunt的儿子,试图垄断白银市场这有助于推动白银价格在1980年1月18日从一年前的约6美元上升到49.45美元的最高点。

In less dramatic fashion, during the same time-frame gold rose from about $225 per ounce to a high of $843 on January 21, 1980. Its worth noting, though, that gold rose a staggering 2300% over the 10 years leading up to the top.

在相同的时间范围内,不那么引人注目。 1980年1月21日,黄金价格从每盎司225美元上涨至843美元的高点。但值得注意的是,黄金价格在过去10年中上涨了惊人的2300%。

{17}

Silver

{17}

The fallout was significant, by the middle of 1982 silver declined all the way down to under $5, or 90% from the top, while gold traded to under $300, or -64% from the peak. While there weren‘t any significant negative macroeconomic ramifications, the top in precious metals came at the end of the ’70s spike in inflation and interest rates which havent been seen since.

后果是重要的到2008年中期,银价一路下跌至5美元以下,或从顶部下跌90%,而黄金价格从300美元跌至300美元以下,或从峰值下跌至-64%。虽然没有任何重大的负面宏观经济后果,但贵金属的顶部是在70年代通货膨胀和利率飙升之后出现的,此后一直未见过。

Gold

黄金

Nikkei 1989 (Led to the lost decade+)

Nikkei 1989(领导失去的十年+)

In the history of bubbles, this is one of the greatest stock market rises and declines of all time, not only due to its sheer size but because the Japanese market has failed to trade back anywhere near the record high since. The Nikkei topped on December 29, 1989 and lost 63% until August 1992 before stabilizing for a few years. From top to bottom, however, the index lost nearly 82% from 1989 to its eventual bottom which came in 2009 on the heels of the Great Financial Crisis.

在泡沫史上,这是其中之一最大的股票市场有史以来的上涨和下跌,不仅仅是因为其庞大的规模,而且因为日本市场未能在此后接近历史高位回落。日经指数在1989年12月29日突破,并在1992年8月之前下跌63%,然后稳定了几年。然而,从上到下,该指数从1989年下跌近82%至其最终底部在金融危机爆发之后,2009年就已经开始了。

In the wake of the decline, the Japanese economy suffered several recessions, and real estate valuations which were also driven to unsustainable heights during the boom plummeted as well. The fallout eventually led to the BoJ adopting a 0% interest rate policy in the late 90s and the development of quantitative easing, a policy which has largely been in place since.

在经济衰退之后,日本经济陷入了几次经济衰退,房地产估值也被推向不可持续的高度在繁荣期间也出现了暴跌。这一后果最终导致日本央行在90年代后期采取了0%的利率政策和量化宽松政策的发展,这一政策自那时起基本实施。

NASDAQ/Internet bubble 2000 (tech bubble burst)

纳斯达克/互联网泡沫2000年(科技泡沫破裂)

The 1982-2000 bull market in the U.S. culminated with technology and internet stocks spiraling upward during the back-half of the 90s. The NASDAQ rose from 743 in the beginning of 1995 to a height of 5048 on March 10, 2000. In manic-like fashion the index more than doubled during the final six months.

1982年至2000年美国牛市最终导致技术和互联网股票在后半期上涨。 20世纪90年代。纳斯达克从1995年初的743上升到2000年3月10日的5048高度。在狂躁时期,该指数在最后六个月内翻了一倍多。

When the NASDAQ eventually troughed in September 2002, 78% of its value was wiped away, and most shares of internet companies saw their prices plummet by 95% or more (out of business). The then technology-heavy S&P 500 was cut nearly in half. The economy fell into a recession during 2001 after experiencing the longest run of growth in U.S. history, spanning 10 years.

当纳斯达克最终在2002年9月遭遇挫折时,78%的价值被抹去,大多数互联网公司的股票价格暴跌95%或更多(停业)。当时技术密集的标准普尔500指数下跌近一半。经历了美国历史上持续10年的最长期增长后,经济在2001年陷入衰退。

Housing market bubble 2007 (led to the financial crisis)

住房市场泡沫2007(导致金融业)危机){/ p>

The housing and financials-driven bubble began in the 90s, but really took the baton from technology and internet stocks after the stock market top of 2000. Real estate prices and the valuations of homebuilders continued to rise as low interest rates fueled speculation in the real estate market.

住房和金融驱动的泡沫始于90年代,但在2000年股票市场上市之后真正接受了技术和互联网股票的接力棒。房地产价格和由于低利率助长了房地产市场的投机,房屋建筑商的估值继续上涨。

The bubble seen in homebuilding stocks isnt a direct reflection but rather a proxy for what was taking shape in the property market from the mid-90s up until the peak was reached.

房屋建筑股的泡沫不是直接的反映,而是从90年代中期开始直到达到峰值,代表房地产市场正在形成。

The S&P 500 Homebuilding Total Return Index eventually fell by 90% from its peak in July 2005 to its trough in November 2008. Its worth noting that the top in this sector came over two years before the top in the stock market, and in the end the bear market which began in housing forewarned the dangers which laid ahead for the broader economy and stock market.

标准普尔500住宅建筑总回报指数最终下降了90%它在2005年7月达到峰值,直到2008年11月的低谷。值得注意的是,这一领域的顶级产品在股市上市之前已经超过了两年,最终从房地产开始的熊市预警了未来的危险。对于更广泛的经济和股市而言。

Homebuilding stocks as a whole lost nearly 70% by late 2007 before the stock market topped. The result of the housing and stock market fall-out was the worst financial calamity since the Great Depression, earning the period from 2008 to 2009 the title of ‘The Great Financial Crisis’ (GFC).

2007年底之前,房屋建筑股票整体下跌近70%。住房和股市下跌的结果是自大萧条以来最严重的金融灾难,从2008年到2009年期间获得了“大金融危机”(GFC)的称号。

{31}

Crude oil 2008 (‘peak’ oil, collapsed during ‘GFC’)

{31}

The WTI crude oil bubble began in 1998 at a price of close to $10 per barrel, right around the cost of extracting it from the ground. The rise was persistent through 2007 before prices went vertical until the top in July 2008. The collapse was extremely fierce as the global economy crumbled during the Great Financial Crisis.

WTI原油泡沫始于1998年,价格接近每桶10美元,大约是从地面开采的成本。这种上涨持续到2007年,直到2008年7月价格垂直上升到最高点。随着全球经济在大金融危机期间崩溃,崩溃极为激烈。

From July 2008 to January 2009 oil fell precipitously from $145 to a trough of $35, or 77% in just over six months time. This makes the oil collapse one of the most abrupt of all major historical market bubbles.

从2008年7月开始2009年1月,石油价格从145美元急剧下跌至35美元的低谷,在短短六个月的时间内跌至77%。这使得石油崩溃成为所有主要历史市场泡沫中最突然的一个。

Precious metals 2011

2011年贵金属

This is the second of two major bubbles in the precious metals market, and while not as spectacular as the run-up to the 1980 top, it nevertheless still ranks as one of the bigger bubbles in the history of major markets. The bull market began in 1999 and picked up speed during the Great Financial Crisis before the end arrived in April 2011.

这是贵金属市场中两个主要泡沫中的第二个,虽然没有像1980年顶级泡沫一样壮观,但它仍然是历史上最大的泡沫之一主要市场牛市始于1999年,并在2011年4月结束前的大金融危机期间加速。

Silver

Gold peaked at a price of $1896 and silver at $43.25. By June 2013 gold was down by 35% and silver once again outshined the gold bubble on the downside by shedding 56% of its value. Both have traded lower since and at the time of this writing (December 2018) it is still unclear as to whether the bear market cycle is yet over.

Gold最高价为1896美元,白银价格为43.25美元。截至2013年6月,黄金价格下跌了35%,白银再次下跌了56%的价格,从而使黄金泡沫再次下滑。自撰写本文(2018年12月)以来,两者的交易价格都走低,目前尚不清楚熊市周期是否已经结束。

Gold

See the IG Client Sentiment page to find out how other traders are positioned and what it might say about future price fluctuations.

请参阅IG Client Sentiment页面,了解其他交易者的定位方式以及未来价格波动的含义。

Non-major market bubbles

非主要市场泡沫

Tulip Mania (1637)

Tulip Mania(1637)

This is the first recorded speculative mania in history, and one of the most famous due not only its magnitude, but ‘asset’ class. The price of traded tulips rose by an estimated 59-fold in about 16 months time before collapsing back to almost zero in just a few months.

这是历史上第一个有记录的投机狂热,其中最着名的一个不仅仅是它的规模,但'资产'类。交易郁金香的价格在大约16个月内上涨了大约59倍,然后在短短几个月内回落到几乎为零。

South Sea (1720)

南海( 1720)

The South Sea Companys stock was one of several shipping companies in the early 1700s to attract massive amounts of investor capital. Another famous bubble in this sector took shape in shares of Mississippi Company. The South Sea bubble saw over a 700% increase in its price in just six months, and from its peak in July 1720 the price declined by over 90% in only three months.

南海公司的股票是18世纪早期吸引大量投资者资本的几家航运公司之一。密西西比公司的股票形成了该领域的另一个着名泡沫。南海泡沫在短短六个月内价格上涨了700%,从1720年7月的高峰开始,价格在短短三个月内下降了90%以上。

Bitcoin (Modern day tulips)

比特币(现代天郁金香)

The cryptocurrency craze began in 2010 with Bitcoin, and saw a staggering rise from under $1 to nearly $20k by December 2017. However, in mania-like fashion, the majority of those gains came in less than a year, with the price rising from around $700 in January 2017 to its final price of around $19600 (the exact price depends on the exchange where it was traded).

加密货币的热潮始于2010年的比特币,到2017年12月,从1美元到1万美元的汇率急剧上涨。然而,在类似狂热的方式中,大部分都是收益来自不到一年,价格从2017年1月的700美元左右上涨到最终价格约19600美元(具体价格取决于交易的交易所)。

Without accurate prices from the Tulip days its hard to say with pin-point accuracy as to exactly by how much the Bitcoin bubble truly exceeded the Tulip mania, but by achieving literally millions of percent in returns from day one to the end (started at $0.06), does it really matter?

如果没有郁金香时代准确的价格,很难用精确的比特币说比特币泡沫真正超过郁金香狂热,但从第一天到结束的回报率实际上达到百万分之几(开始)这真的很重要吗?

It was massive and when it comes to market speculation this is indeed a testament to human nature not changing one bit in nearly 400 years. The fallout at the time of this writing has been around 82% over the course of about a year.

这是一个巨大的问题,当谈到市场猜测时,这确实证明了人性在近4个方面没有改变一点00年。写这篇文章时的影响在大约一年的时间里大约为82%。

Notable Flash-crashes

值得注意的Flash-崩溃

With market participants relying more and more on technology in the last 20 years or so, and the popularity of quantitative and algorithmic trading growing exponentially, flash-crashes have become a threat to financial market stability.

随着市场参与者在过去20年左右的时间里越来越多地依赖技术,以及定量和算法交易的流行呈指数增长,闪电崩溃已成为金融市场稳定性的威胁。

Even though technology and the people behind the machines take the blame, there is one commonality between the following examples of major flash-crashes – market duress. Not necessarily major duress, but enough that a signficant imbalance can occur in a vacuum of a liquidity.

尽管技术和机器背后的人都承担责任,但以下主要闪电崩溃的例子之间有一个共同点 - 市场压力。不一定是主要的胁迫,但足以在流动性的真空中发生显着的不平衡。

A bevy of orders from one side of the market comes in and simultaneously the other side effectively steps away and just like that you have a major air pocket. These air pockets, or liquidity vacuums, result in a sudden spike in price. And while they are only temporary the financial impact can be enormous for those caught in these unforeseen events.

来自市场一方的大量订单同时出现另一方有效地走开,就像你有一个主要的气袋。这些气袋或流动性真空吸尘器导致价格突然飙升。虽然它们只是暂时的,但对于陷入这些无法预料的事件的人来说,财务影响可能是巨大的。

{53}

S&P 500 E-mini futures – May, 6 2010

{53}

This was the flash-crash which effectively put them on the map, given how large and impactful it was. On May 6 the stock market was under a bit of stress when suddenly the S&P 500 E-mini futures collapsed by over 6% in about seven minutes before fully erasing those losses in the 10-15 minutes following.

这是闪电崩溃,它有效地将它们放在地图上,因为它有多大和有影响力。 5月6日,当标准普尔500指数E-mini期货突然在大约7分钟内暴跌超过6%,然后在10-15分钟内完全消除了这些损失之后,股票市场承受了一些压力。

There was a ‘fall-guy’ for this one, a trader was accused and found guilty of placing large sell orders which would get cancelled just before they would get filled. A strategy called ‘spoofing’. While the trader was found guilty of causing the flash-crash, these events dont happen out of thin air. They occur when the market is already in a fragile state.

这个人有一个“堕落者”,一名交易员被指控并被指控犯有大量卖单,这些卖单会在被填补之前被取消。一种叫做“欺骗”的策略。虽然交易员被认定犯了引发闪电崩盘的罪行,但这些事件并非凭空而来。当市场已经处于脆弱状态它们发生

USD/JPY – March 16, 2011

USD / JPY - 2011年3月16日

As mentioned before, loss of liquidity is a driving force here, and with regards to USD/JPY on March 16, 2011 this was especially the case. This event took place during the least liquid time of the day, just after the U.S. close. Not only was USD/JPY weak on the macro-front, trading at its worst levels on record, but more recently it had come under selling pressure in the wake of a massive earthquake and tsunami in Japan. Market conditions were in a fragile state when this particular liquidity-driven event hit. USD/JPY declined 3% in less than 10 minutes before recovering sharply.

如前所述,流动性的流失是这里的推动力,而就2011年3月16日的美元/日元而言,尤其如此。这一事件发生在美国关闭之后的最短时间内。不仅美元/日元在宏观方面表现疲软,交易价格创历史新高,但最近在日本发生大地震和海啸之后,它已经受到抛售压力。当这种特殊的流动性驱动事件发生时,市场状况处于脆弱状态。 USD / JPY在不到10分钟下降3%大幅回收之前。

U.S. Treasuries – October 15, 2014

US国债 - 2014年10月15日

The treasury flash-crash on October 15 unfolded after a month-long decline in yields, playing not long after the stock market had opened for the day. The shot lower in yields (higher bond prices) lasted only a few minutes in typical flash-crash style and the price move was immediately wiped away in the minutes to follow.

10月15日国库闪电崩盘经过长达一个月的收益率下跌后,在股市开盘后不久就开始了。收益率较低(债券价格较高)在典型的闪电崩盘风格中仅持续了几分钟,价格走势在接下来的几分钟内立即消失。

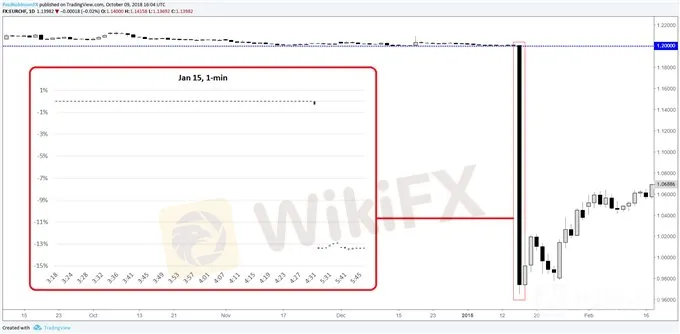

EURCHF – January 15, 2015

EURCHF - 2015年1月15日

Of the examples weve looked at, this is the lone flash-crash which was sparked by an abrupt fundamental event. The Swiss National Bank (SNB) announced on January 15th that they were no longer supporting the Swiss Franc vs. the Euro at 1.20, causing the floor a large number of market participants were leaning against to collapse.

在我们看过的例子中,这是由突发性基本事件引发的唯一闪电崩盘。瑞士国家银行(瑞士央行)于1月15日宣布,他们不再支持瑞士法郎兑欧元兑换1.20,导致大量市场参与者倾向于崩盘。

{62}

British Pound – October 6, 2016

英镑 - 2016年10月6日

The flash-crash in GBP/USD came about three months after ‘Brexit’ as the British currency continued to come under strong pressure. Similarly to USD/JPY this event occurred during an illiquid time of the day, after the U.S. session during early Asian trade.

闪光 - 由于英国货币继续受到强大压力,英国脱欧后三个月英镑/美元大跌。与USD / JPY类似,此事件发生在亚洲早期交易时美国时段之后的非流动时段。

The spike lower was very extreme, taking no more than a couple of minutes for GBP/USD to decline nearly 5%. The recovery in the minutes after wasnt as sharp as other flash-crash events, but a large portion of losses were recovered in the 20 minutes or so following.

飙升的下跌非常极端,只需一次英镑/美元几分钟下跌近5%。在几分钟内的恢复并没有像其他闪电崩盘事件一样明显,但是大部分的损失在20分钟左右的时间内恢复。

Dow futures – February 5, 2018

道指期货 - 2月5,2018年

Index futures have become increasingly thin over the years, with stock market volumes also declining significantly. This has made index futures extra fragile. This one flew under the radar in some respects, but nevertheless the sudden 4% drop in Dow futures in a 10-minutes window qualifies as a flash-crash. The recovery was equally as fierce.

多年来指数期货变得越来越薄,股票市场交易量也大幅下降。这使得指数期货变得非常脆弱。尽管如此,道琼斯指数期货在10分钟的时间内突然下跌4%,这可能是一次闪电崩盘。复苏同样激烈。

The other major US indices also underwent similar price swings, but not to the same degree as the Dow. There was no ‘malfunction’ so to speak which caused this, but the market at the time was under short-term stress prior to the event.

美国其他主要指数也经历了类似的价格波动,但与道指没有相同的程度。没有“故障”可以说导致这种情况,但当时市场在此次活动之前处于短期压力之下。

To conclude, going forward...

To总结,未来......

Financial bubbles, crises, and flash-crashes arent an everyday occurrence, but have been happening at a frequent enough rate in recent years that market participants should have familiarity with them.

金融泡沫,危机和闪电崩溃不是日常事件,但近年来市场参与者应该以足够频率的速度发生熟悉它们。

For additional reading on trading financial market volatility, check out this guide to the S&P 500 and VIX Index.

有关交易金融市场波动的更多信息,请查看标准普尔500和VIX指数的指南。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator