简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

VIX Curve Inversion: A Bad Omen For the S&P 500

Abstract:VIX Curve Inversion: A Bad Omen For the S&P 500

VIX Analysis and Talking Points:

Is Volatility Back on the Rise?

Record VIX Net Short Positioning

VIX Curve Inversion: Bad Omen for Equity Markets

See our quarterly forecast to learn what will drive prices throughout Q2!

Is Volatility Back on the Rise?

US equities have come under notable pressure throughout the week with the S&P 500 down over 2%. Consequently, this has coincided with a jump in the VIX (the fear gauge), which closed at its highest level since January after President Trump upped the ante against China, having tweeted that the US will raise the tariff rate to 25% from 10% on $200bln worth of Chinese goods.

VIX PRICE CHART: Daily Time-Frame (Aug 2018-May 2019)

Throughout 2019, US equities have enjoyed a period of subdued volatility with the VIX dropping over 40% since the December 2018 highs. In turn, this saw the S&P 500 gain over 17% to hit fresh record highs amid increased hopes of a trade deal, alongside a dovish pivot from the Federal Reserve, while recession fears had also receded. However, with the VIX back on the rise, this poses a threat to the relatively lofty levels in US equity markets.

Record VIX Net Short Positioning

Amid the latest surge in the volatility index, questions will be raised as to whether we will likely see a VIX blowout that we witnessed last February (full story) given the record short positioning in VIX futures. While positioning may be extreme on both outright net shorts (180k contracts) and as a ratio of open interest (40%), fears of a VIX blowout similar to that of February 2018 may be misplaced with open interest noticeably lower at 450k, from 650k back in early 2018. Alongside this, after last years event many inverse volatility ETPs had also been terminated, however, this does not rule out that volatility can be elevated.

VIX Curve Inversion: Bad Omen for Equity Markets

Following the rising trade war tensions between the US and China, the VIX futures curve has inverted. Typically, the VIX curve tends to be in contango, meaning that the curve is upward sloping with investors more uncertain about the longer-term outlook relative to the short term. However, amid the aforementioned trade war tensions, the front month is now trading above the second month by 63bps, leading to a VIX curve inversion (backwardation). This implies that equity investors are much more concerned in the short-term but given that the front month contract expires on May 22nd, this does suggest that higher volatility may not persist. That being said however, VIX curve inversions have preceded equity market routs, most notably when the curve inverted last year on February 2nd, the S&P 500 plunged over 6% in the following sessions,

DAILYFX TRADING RESOURCES:

See our quarterly forecast to learn what will drive prices through mid-year!

Just getting started? See our beginners guide for FX traders

Having trouble with your strategy? Heres the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Oil May Decline on Plunging Wall Street & Soaring VIX

On Thursday, the Wall Street saw a sharp drop ahead of the upcoming non-farm payrolls; The fear index (VIX), a popular measure of the stock market's expectation of volatility, largely rallied to an intraday high of 35.94% from 25.66%

Coronavirus investing strategy, how to trade next stock market crash - Business Insider

History shows that stocks are likely to return to their lows before a full recovery kicks in, the strategists said.

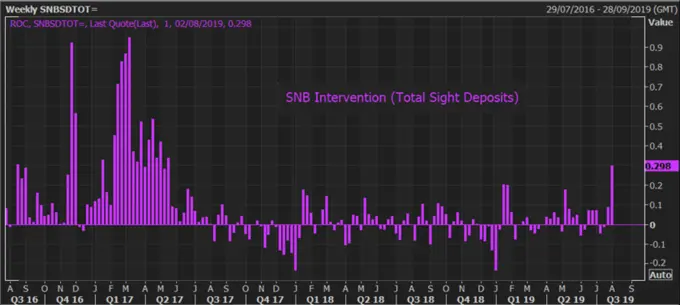

EUR/CHF Outlook: Beware of SNB Currency Intervention

EUR/CHF Outlook: Beware of SNB Currency Intervention

Goldman Sachs says "bond proxies" best bet amid trade war, growth fears

Investors should go for stocks "that have lagged their typical macro relationships the most relative to other bond proxies," Goldman Sachs said.

WikiFX Broker

Latest News

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Scam Alert: 7 Brokers You Need to Avoid

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

What Determines Currency Prices?

Why More Traders Are Turning to Proprietary Firms for Success

How to Use an Economic Calendar in Forex Trading

MC Markets Review 2025

T4Trade Enhances Forex Trading with Advanced Tools for 2025

Currency Calculator