简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Price Boosted as Middle East Tensions Escalate

Abstract:Crude oil is pushing back towards levels seen two week ago as political uncertainty in the Middle East continues to dominate short-term price action.

Crude Oil Price Chart and Analysis:

Middle East tensions ratchet higher.

US puts EU, Japanese car tariffs on hold for 6 months.

The Brand New DailyFX Q2 2019 Trading Forecast and Guides are Available to Download Now!!

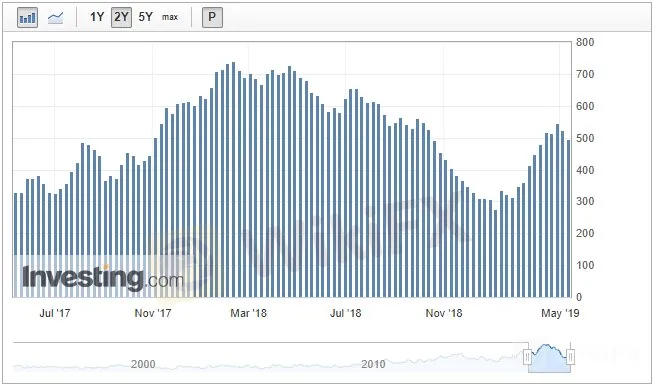

CFTC Crude Oil Speculative Net Positions

How to Trade Oil: Crude Oil Trading Strategies & Tips.

Increased tension between the US and Iran in the Middle East continues to underpin the price of oil as fears grow of supply disruptions and outages. On Wednesday the US issued a travel warning and ordered all non-emergency diplomatic staff to leave Iraq after four ships were attacked of the UAE cost earlier in the week. In addition, a drone attack on a Saudi pipeline was claimed by Houthi rebels, stoking fears further.

Also Wednesday, the US said that it would be delaying its proposed auto tariffs on EU and Japanese cars for six months, sparking a brief risk-on rally. Trade wars continue to dominate global markets and while the US and China remain at loggerheads, any cessation or suspension of trade tariffs elsewhere will be welcomed by markets and investors.

The crude oil price chart remains positive in the short-term with short-term resistance at $72.16/bbl. and $72.80/bbl. attainable targets. A close above these levels would leave the April 24 high at $74.84/bbl. the next target and would take prices back to highs seen over seven months ago. Support is provided by the 38.2% Fibonacci retracement level at $70.56/bbl. before $68.65 and the 200-day moving average at $67.65/bbl. come into play.

Crude Oil Daily Price Chart (July 2018 – May 16, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on crude oil – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.comor via Twitter @nickcawley1.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Commodity prices Surge as Geopolitical Tension Rise

he market saw muted activity as both the U.S. and the U.K. observed public holidays in yesterday's session. The dollar index (DXY) edged lower, failing to hold above the 104.50 level. This decline comes as the market anticipates signs of cooling U.S. inflation ahead of the PCE reading due on Friday. Meanwhile, the U.S. Securities and Exchange Commission (SEC) announced a reduction in Wall Street settlement times, aiming to complete transactions in a single day.

【MACRO Alert】Long weekend air travel in the United States is becoming a new trend! Meanwhile, the US dollar recently turned net short for the first time!

According to survey data, this year, many American travelers are opting for air travel over traditional road trips during the Memorial Day long weekend, marking an upward trend! On the other hand, bullish sentiment on the US dollar is beginning to retreat, turning net short for the first time in six weeks!

Market Focus on Earnings Report

As we head into the second quarter earnings report season, the U.S. equity market is poised to capture significant attention. Recent geopolitical events, particularly the unconfirmed reports of an explosion in Iran's third-largest city last Friday, have injected volatility into commodities prices and bolstered the appeal of safe-haven assets like the U.S. dollar and Japanese Yen.

US Dollar Soars on Higher Yields and Bank of England No-Go. Where to for USD?

US Dollar, Bank of England, Treasuries, OPEC+, Crude Oil, Japan - Talking Points

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

The Impact of Interest Rate Decisions on the Forex Market

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

STARTRADER Spreads Kindness Through Ramadan Campaign

How a Housewife Lost RM288,235 in a Facebook Investment Scam

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

The Daily Habits of a Profitable Trader

Currency Calculator