简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Breakout Triggers Overbought RSI Reading

Abstract:Gold prices may continue to gain ground over the coming days as the Relative Strength Index (RSI) flirts with overbought territory.

Gold Price Talking Points

黄金价格谈判点

The recent breakout in the price of gold appears to be gathering pace as Federal Reserve officials respond to the shift in U.S. trade policy, and the precious metal may continue to gain ground over the coming days as the Relative Strength Index (RSI) flirts with overbought territory.

随着美联储官员对美国贸易政策的转变做出回应,近期黄金价格的突破似乎正在加快步伐,由于相对强弱指数(RSI)与超买区域调情,贵金属可能在未来几天继续上扬。

{2}

Gold Price Breakout Triggers Overbought RSI Reading

{2}

Gold extends the rally from late last week as the Trump administration plans to impose a 5% tariff on all goods coming from Mexico, and the precious metal may continue to benefit from the current environment as the weakening outlook for global growth puts pressure on the Federal Open Market Committee (FOMC) to alter the forward guidance for monetary policy.

由于特朗普政府计划对来自墨西哥的所有商品征收5%的关税,黄金延续了上周末的涨势,随着前景的减弱,贵金属可能继续受益于当前的环境全球经济增长给联邦公开市场委员会(FOMC)带来压力,要求改变货币政策的前瞻指引。

Recent comments from St. Louis Fed President James Bullard, a 2019-voting member on the FOMC, suggest the central bank will change its tune over the coming months as the committee “faces an economy that is expected to grow more slowly going forward, with some risk that the slowdown could be sharper than expected due to ongoing global trade regime uncertainty.”

圣路易斯联储主席詹姆斯布拉德最近的评论,2019年 - 联邦公开市场委员会(FOMC)的投票成员表示,随着委员会“面临预期的经济发展,央行将在未来几个月内改变态度由于持续的全球贸易体制不确定性,有一些风险表明经济放缓可能会比预期更加严重。”

As a result, Mr. Bullard insists that “a downward policy rate adjustment may be warranted soon to help re-center inflation and inflation expectations,” and the central bank may show a greater willingness to switch gears later this year especially as Fed Fund futures reflect a greater than 90% probability for a December rate-cut.

因此,布拉德先生坚持认为“可能很快就需要下调政策利率以帮助重新定位通胀和通胀预期”,并且央行可能表现出更大的意愿在今年晚些时候转会,尤其是作为联邦基金期货反映12月降息的可能性超过90%。

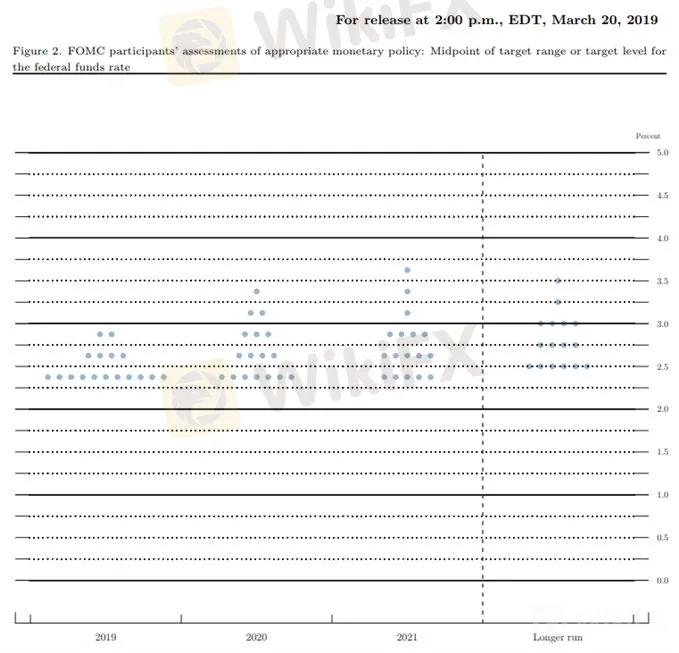

With that said, it remains to be seen if Chairman Jerome Powell & Co. will continue to forecast a longer-run interest rate of 2.50% to 2.75% as the U.S. economy shows little to no signs of an imminent recession, but the fresh updates to the Summary of Economic Projections (SEP) may heighten the appeal of gold if Fed officials highlight a lower trajectory for the benchmark interest.

据说,主席杰罗姆鲍威尔还有待观察由于美国经济几乎没有出现即将到来的经济衰退迹象,但公司将继续预测2.50%至2.75%的长期利率,但经济预测摘要(SEP)的最新更新可能是他如果美联储官员强调l,黄金的吸引力会增强基准利益的轨迹。

In turn, the shift in U.S. trade policy may continue to drag on risk-taking behavior, and the flight to safety may keep gold prices afloat ahead of the Fed meeting on June 19 as the precious metal negates the head-and-shoulders formation from earlier this year.

反过来,美国贸易政策的转变可能会继续拖累风险承担行为,而向安全的转移可能会使金价继续上扬美联储6月19日会议的结果是贵金属否定了今年早些时候的头肩形态。

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

注册并加入DailyFX货币策略师David Song LIVE获取机会讨论潜在的交易设置。

Gold Price Daily Chart

黄金价格每日图表

The broader outlook for gold is no longer mired by a head-and-shoulders formation as both price and the Relative Strength Index (RSI) break out of the bearish trends from earlier this year.

由于价格和相对强弱指数(RSI)脱离了今年早些时候的看跌趋势,黄金的广阔前景不再受到头肩形态的影响。

The recent string of higher highs and lows keeps the topside targets on the radar as the price of gold clears the Fibonacci overlap around $1315 (23.6% retracement) to $1316 (38.2% expansion), with a break/close above the $1328 (50% expansion) to $1329 (50% expansion) region raising the risk for a move towards $1340 (61.8% expansion).

最近的一些高点和低点保持顶部由于黄金价格清除斐波纳契重叠1315美元(23.6%回撤位)至1316美元(扩大38.2%),突破/收盘价高于1328美元(50%扩大)至1329美元(扩大50%)区域提高了向1340美元(扩大61.8%)的风险。

Recent developments in the RSI suggest the bullish momentum is gathering pace as it flirts with overbought territory, but the indicator may flash a textbook sell-signal over the coming days should the oscillator cross below 70.

近期RSI的发展表明看涨势头正在加速,因为它调情超买区域,但如果振荡器超过70,该指标可能会在未来几天闪现教科书卖出信号。

For more in-depth analysis, check out the 2Q 2019 Forecast for Gold

更深入分析,查看2019年第二季度黄金预测

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Gold Analysis: Steady Prices Amid Key Economic Data

Gold prices remain steady as investors anticipate Federal Reserve Chairman Jerome Powell’s upcoming speech and the U.S. Non-Farm Payrolls data. Geopolitical tensions and economic uncertainties continue to support safe-haven demand for gold, while higher U.S. yields exert downward pressure. Key economic events this week include JOLTs Job Openings, ADP Employment Change, and the Non-Farm Payrolls report.

Gold Supported by Weak U.S. Data and Inflation Concerns

Gold prices are buoyed by weak U.S. economic data, reduced Fed rate hike expectations, and ongoing geopolitical tensions. The precious metal is set for its third consecutive quarterly gain, with upcoming U.S. inflation data being closely monitored.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator