简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/USD May be in for ECB Shock, GBP/USD Weakness Persists - US Market Open

Abstract:EUR/USD May be in for ECB Shock, GBP/USD Weakness Persists - US Market Open

MARKET DEVELOPMENT – EUR/USD May be in for Dovish ECB Surprise

市场发展 - 欧元兑美元可能出现在欧洲央行的惊喜

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

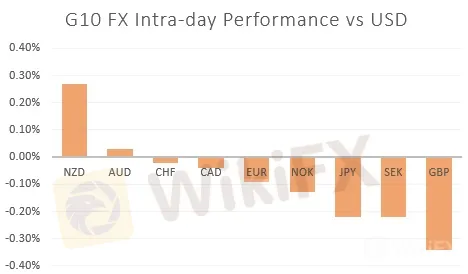

GBP: The Pound is on the backfoot to begin the week, down 0.3% against the greenback to trade at 1.2450. As markets await the likely appointment of Boris Johnson to be the next Prime Minister, resignations from several MPs are expected to be on the way in defiance of Boris Johnson potentially heading towards a no-deal Brexit, given his recent outlook. The outlook remains weak for GBP with the next PM seemingly likely to struggle to garner some cohesion in parliament, thus the odds of a snap-election are on the rise. EURGBP back towards 0.9000, holding for now and slightly stemming the drop in GBP, key support in GBPUSD situated at 1.24.

英镑:英镑本周开始回落,兑美元汇率下跌0.3%至1.2450。由于市场在等待鲍里斯·约翰逊可能被任命为下一任总理,因此考虑到他最近的前景,预计几位国会议员的辞职将无视鲍里斯·约翰逊可能走向无交易的英国脱欧。英镑的前景仍然疲弱,下一个看起来可能很难在议会中获得一些凝聚力,因此大选的可能性正在上升。欧元兑英镑回到0.9000,目前持有并略微抑制英镑的下跌,英镑兑美元的关键支撑位于1.24。

EUR: The Euro is braced for another dovish ECB meeting, which is once again managing to hold just above the 1.12 handle. Since Draghis sintra speech, there has been little signs of notable improvements within the Eurozone economy, therefore making entirely possible for a potential rate cut, as soon as this week. Currently, as it stands, markets are pricing in a 50/50 chance for a 10bp deposit rate cut at the July meeting, as such, a decision to do so could see EURUSD back at the low 1.11. However, with expectations split down the middle, there is a potential for a ECB sources leak in order to sure up expectations. At the same, eyes are also on EURCHF, which trades at its lowest level since July 2017 with the cross potentially set up for a break below 1.10. While the SNB are seen to typically move in lockstep with the ECB, given that interest rates are already deep in negative territory, there may be some limits to what the SNB can actually do in response to ECB easing, thus there is a risk of a sharp appreciation in the CHF, particularly if the equity markets roll-over on continued fears over trade wars.

欧元:欧元支持另一场温和的欧洲央行会议,该会议再次成功维持在1.12上方。自Draghis sintra演讲以来,欧元区经济内部几乎没有显着改善的迹象,因此本周就可能完全降息。目前,按照目前的情况,市场定价在7月会议上降低10个基点存款利率的可能性为50/50,因此,这样做的决定可能会使欧元兑美元回到1.11的低位。然而,由于预期中间分裂,欧洲央行的资金来源可能会泄漏以确保预期。同时,人们也关注欧元兑瑞郎,该汇率处于2017年7月以来的最低水平,其交叉盘可能突破1.10。虽然瑞士央行通常与欧洲央行一致,但考虑到利率已经处于负值区域,瑞士央行可能会对欧洲央行的宽松政策实际做出一些限制,因此存在风险瑞士法郎大幅升值,特别是如果股市因对贸易战的持续担忧而滚动。

{6}

Source: DailyFX, Thomson Reuters

{6}

IG Client Sentiment

IG客户端情绪

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

GemForex - weekly analysis

The Week Ahead: Will the FED pivot to the emerging dynamics?

GemForex - weekly analysis

European Central Bank under enormous pressure ahead of Fed rates

GemForex - EUR/USD

EURUSD Forecast: Vulnerability ahead of fresh EZ economic data, FOMC

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator