简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Eyeing 1.1150 Ahead of German and US Inflation Figures

Abstract:Eurozone confidence worsened in July as continued global uncertainties weigh heavily on investor sentiment. EURUSD volatile ahead of key inflation data to be released later today.

Talking Points:

EURUSD recovered some lost ground in the morning session ahead of US and German inflation figures

Eurozone confidence worsened in July as global uncertainties keep investors worried about risk

Key focus on US and German inflation figures for insight into upcoming Central Bank policy decisions

As the US dollar continues to rally on an expected dovish stance from the Fed, EURUSD will see some movement throughout the day as inflation figures will be released for both the dollar and the euro. The pair remained unsettled in the overnight session supported by weaker than expected French Q2 GDP, coming in at 0.2%, below expectations of 0.3%. The pair has been trading near 2-year lows on the back of USD strength which took the dollar index to two-month highs of 97.75.

EURUSD Q3 Forecast

But the euro regained some strength in the beginning of the morning session as the pair was pushing higher towards the 1.1150 barrier ahead of the latest round of Eurozone confidence data.

Both industrial and services confidence worsened in July leading to a decreased in the overall economic confidence within the Eurozone. Consumer confidence managed to pick up 0.6 points in July to -6.6 after dipping to -7.2 in June, well above its long-term average of -10.7 and moving closer to its highest level of -1.4 registered in May 2000. Economic confidence fell from 103.3 to 102.7 in the month of July, as continued trade wars, Brexit uncertainty and slowing growth keep investor confidence tilted to the downside.

Last week the ECB decided to leave rates unchanged in its July meeting, but it adjusted its forward guidance to reflect the growing need for a rate cut to happen. It mentioned that rates will be kept at current or lower levels until the first half of 2020, hinting that Mario Draghi is prepared to lower rates further into negative territory before he leaves office at the end of October, possibly taking the deposit rate to -0.5% with the likelihood of a tiered margin system to counteract the effects negative rates have on banks profitability. Special focus will be on inflation figures for the Eurozone which will be release on Wednesday, as a continued slump in prices will increase the likelihood of a rate cut happening at the next ECB rate decision meeting taking place on September 12.

Euro Forecast Trading Guide

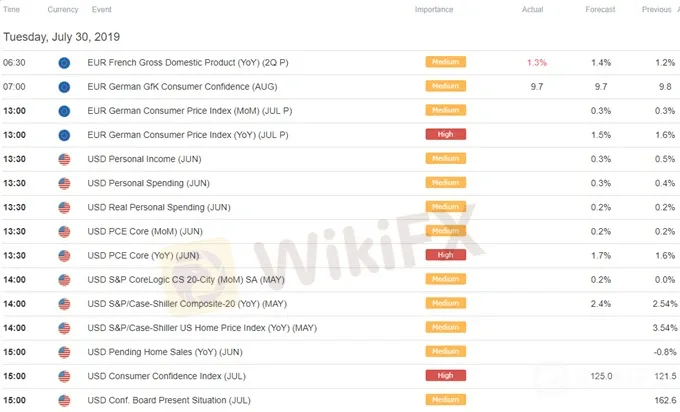

Main Drivers of the Day - German and US inflation data

Focus will shift towards German and US inflation figures released later today, where weaker than expected German data will see the euro face continued selling pressure. PCE data from the US will see some moves in the pair as a weaker reading will lead to some initial dollar weakness but that may be quickly corrected as lower inflation will further support the need for a rate cut from the Fed in their July meeting to be held tomorrow, which will provide a driver for USD.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Economic : Key Highlights

Today's news highlights global economic and market developments, including Biden's call for calm, China's economic performance, the attempted assassination of Trump, major corporate acquisitions, and international financial markets. Significant updates also include geopolitical dynamics, cultural trends, and sports achievements.

Global Economic and Market Developments: Key Highlights

Today's news highlights global economic and market developments. Key points include discussions on Biden's press conference, Nvidia and Tesla stock movements, US inflation cooling, China's grain production efforts, and major updates from companies like Apple and OpenAI. Global geopolitical dynamics and significant financial decisions in France and Chile round out the day's highlights.

Today's analysis: USD/JPY Rises Amid Yen's Historic Low and Limited Government Intervention

The Japanese Yen has reached a historic low, despite government intervention efforts. This has strengthened the US Dollar Index. USD/JPY hit a multi-decade high, driven by the Yen's weakness. Despite the overbought RSI, traders eye support levels at the 55-day (156.53) and 100-day (153.81) SMAs before challenging new highs.

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator