简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Rebound Unravels as Fed Tames Bets for Rate Easing Cycle

Abstract:EURUSD may continue to consolidate over the coming days as the Federal Open Market Committee (FOMC) tames speculation for a rate easing cycle.

EUR/USD Rate Talking Points

EURUSD snaps the range bound price action from earlier this week even though US President Donald Trump tweets that the Federal Reserve is “too slow to cut,” and the exchange rate may continue to consolidate over the coming days as the Federal Open Market Committee (FOMC) tames speculation for a rate easing cycle.

EURUSD Rebound Unravels as Fed Tames Bets for Rate Easing Cycle

Fresh data prints coming out of the euro-area generated a limited reaction in EURUSD, but the updates to the Gross Domestic Product (GDP) report should keep the European Central Bank (ECB) on the sidelines as the growth rate climbs 0.2% q/q in the second quarter of 2019.

In contrast, the Federal Reserve may come under increased pressure to implement lower interest rates as President Trump insists that “the Fed is holding us back,” and it remains to be seen if the FOMC will reverse the four rate hikes from 2018 as the commander in chief goes on to say that “our economy is strong.”

However, fresh remarks from St. Louis Fed President James Bullard, a 2019 voting member on the FOMC, suggests the central bank is in no rush to implement a rate easing cycle as “macroeconomic outcomes are quite good for the United States.”

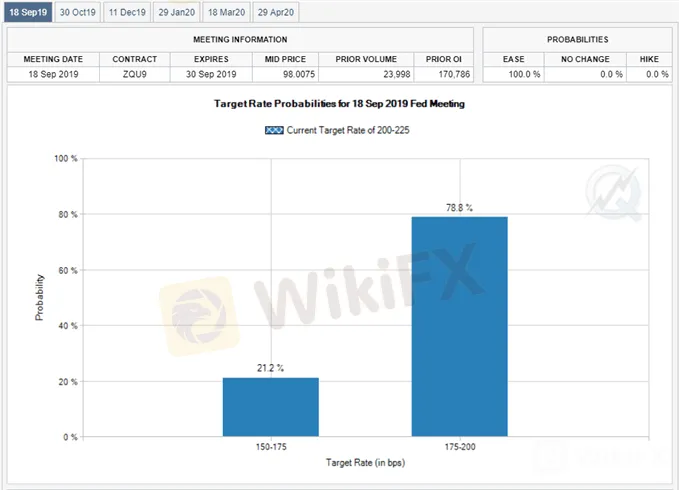

Keep in mind, Fed Fund futures still reflect a 100% probability for at least a 25bp reduction on September 18, but Fed officials may continue to tame bets for a rate easing cycle as “the economys not in recession.”

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/USD Rate Daily Chart

The broader outlook for EURUSD is clouded with mixed signals as the exchange rate clears the May-low (1.1107) following the FOMC rate cut in July, with the 1.1100 (78.6% expansion) handle no longer offering support.

The Relative Strength Index (RSI) highlights a similar dynamic as the oscillator fails to retain the bullish formation from earlier this year.

At the same time, the rebound from the monthly-low (1.1027) appears to have stalled following the string of failed attempts to close above the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement).

Lack of momentum to hold above the 1.1140 (78.6% expansion) region raises the risk for a move towards the 1.1100 (78.6% expansion) handle, with the next area of interest coming in around 1.1040 (61.8% expansion).

For more in-depth analysis, check out the 3Q 2019 Forecast for Euro

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

Crude Oil Prices at Risk if US Economic Data Cool Fed Rate Cut Bets

Crude oil prices may fall if upbeat US retail sales and consumer confidence data cool Fed rate cut bets and sour risk appetite across financial markets.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Currency Calculator