简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

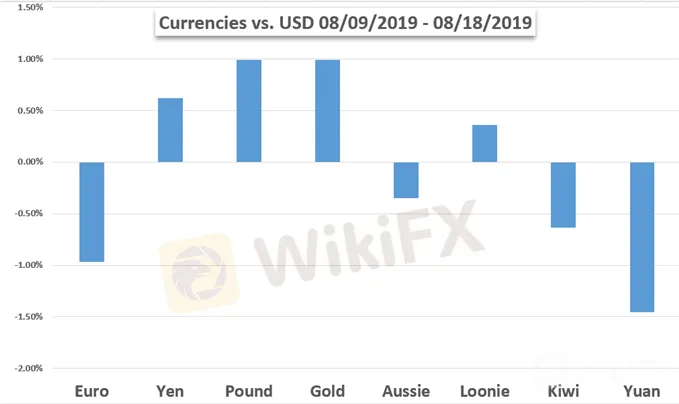

Trading Forecast: EURUSD and Dow Bearings Rest on Jackson Hole, Trump

Abstract:Scheduled event risk is starting to give way to sentiment and systemic fundamental concerns a prospect that threatens volatility at a time of year when quiet is supposed to prevail. Trade wars are finding guidance from headlines that President Trump regularly tops, while recession fears are tied more closely to

Scheduled event risk is starting to give way to sentiment and systemic fundamental concerns – a prospect that threatens volatility at a time of year when quiet is supposed to prevail.

Australian Dollar Bears Rule But May Not Turn Up Heat This Week

The Australian Dollar remains close to notable lows against its US counterpart and the market is still betting on aggressive rate cuts from the RBA

Sliding Crude Oil Can't Look to Jackson Hole For Price Support

Crude oil prices continue to drop as the economic data keep huge question marks glowering over likely demand levels.

US Dollar May Rise if Fed Minutes and Jackson Hole Spook Markets

The US Dollar may rise if the Fed meeting minutes and commentary at the Jackson Hole symposium spooks markets and boost demand for liquidity.

Sterling Price Weekly Forecast: Brexit Newsflow and Political Manoeuvres

Next weeks UK data vacuum will be filled by the latest political shenanigans with rumor and counter-rumor focusing on who is up to what, with who and why.

S&P 500, DAX Fundamental Forecast

The ominous sign stemming from the inversion of the US 2s10s provides yet another reminder that the global economic outlook is weakening.

Euro May Fall as ECB Easing Looms, Italy Flirts with Early Elections

The Euro may fall as dovish ECB meeting minutes and soft PMI data set the stage for easing in September while Italy flirts with early elections.

Chart Legend

Black = Oil (CL Futures)

Yellow = Gold (XAUUSD)

Green = USD (DXY Index)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FED meeting minutes strongly hint at a rate cut in September; US dollar index falls to new low this year!

The U.S. Bureau of Labor Statistics revised down the employment growth in the year ending in March by 818,000, an average monthly decrease of about 68,000, the largest downward revision since 2009. The substantial downward revision of employment data re-emphasized the severity and necessity of the U.S. employment problem, paving the way for a rate hike in September. Bearish for the U.S. dollar.

Breakthrough again! Gold breaks through $2530 to set a new record high!

Spot gold continued its record-breaking rally as investors gained confidence that the Federal Reserve might cut interest rates in September and gold ETF purchases improved. The U.S. market hit a record high of $2,531.6 per ounce

Historic Moment: Gold Surges Above $2,500 Mark, Forging Glory!

Boosted by the weakening of the US dollar and the expectation of an imminent rate cut by the Federal Reserve, spot gold broke through $2,500/ounce, setting a new record high. It finally closed up 2.08% at $2,507.7/ounce. Spot silver finally closed up 2.31% at $29.02/ounce.

What new signals does the Federal Reserve have? FED Governor Michelle Bowman reiterates the risk of inflation!

Fed Governor Bowman: There are upside risks to inflation, the labor market continues to strengthen, and a cautious attitude will be maintained at the September meeting. Boston Fed President Collins: If the data is as expected, it would be appropriate to start easing policy "soon". Inflationary pressure will slow down the pace of U.S. interest rate cuts, which will be bullish for the dollar.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Stock Market Trading Volume Drops by 97.58 Billion Naira This Month

Why does your mood hinder you from getting the maximum return from an investment?

Currency Calculator