Score

Japan Bond

Japan|15-20 years|

Japan|15-20 years| https://www.bb.jbts.co.jp/en/index.html

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Japan 7.27

Japan 7.27Contact

Licenses

Licenses

Licensed Entity:日本相互証券株式会社

License No. 関東財務局長(金商)第136号

Single Core

1G

40G

1M*ADSL

- The current information shows that this broker does not have a trading software. Please be aware!

Basic Information

Japan

JapanUsers who viewed Japan Bond also viewed..

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Genealogy

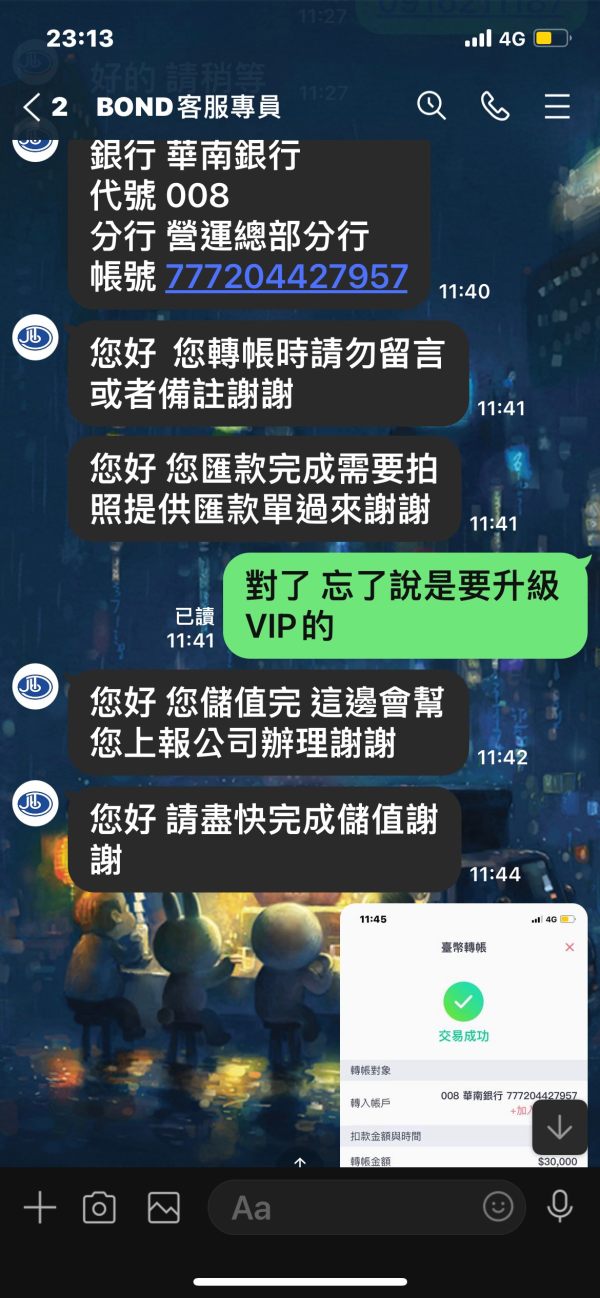

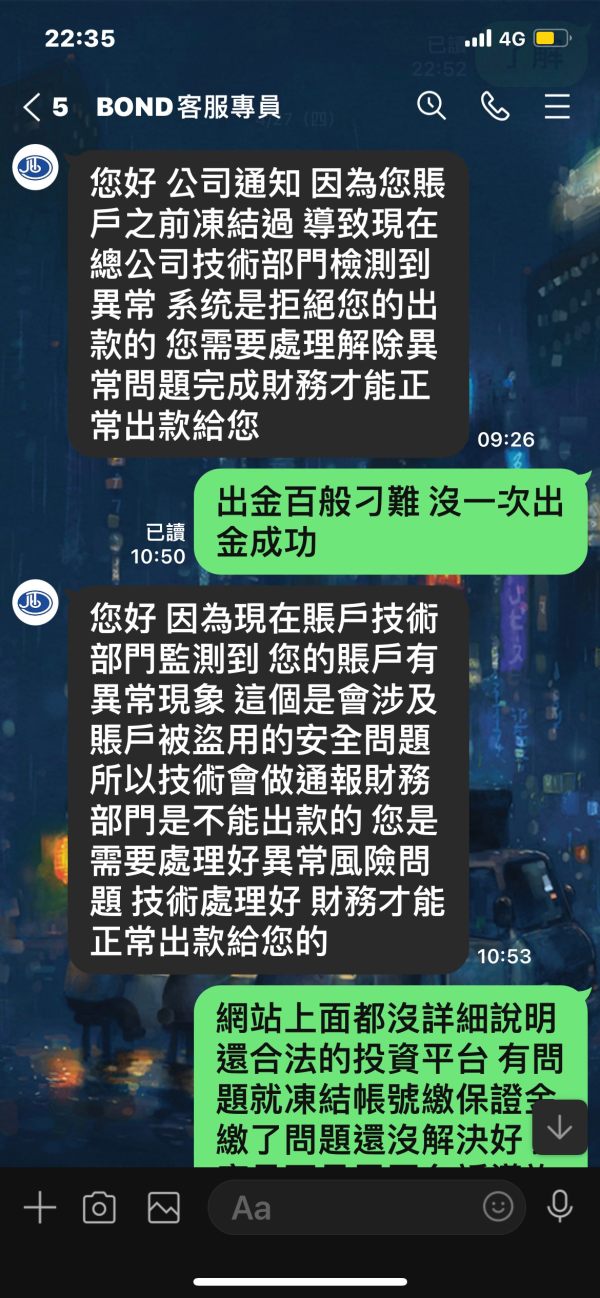

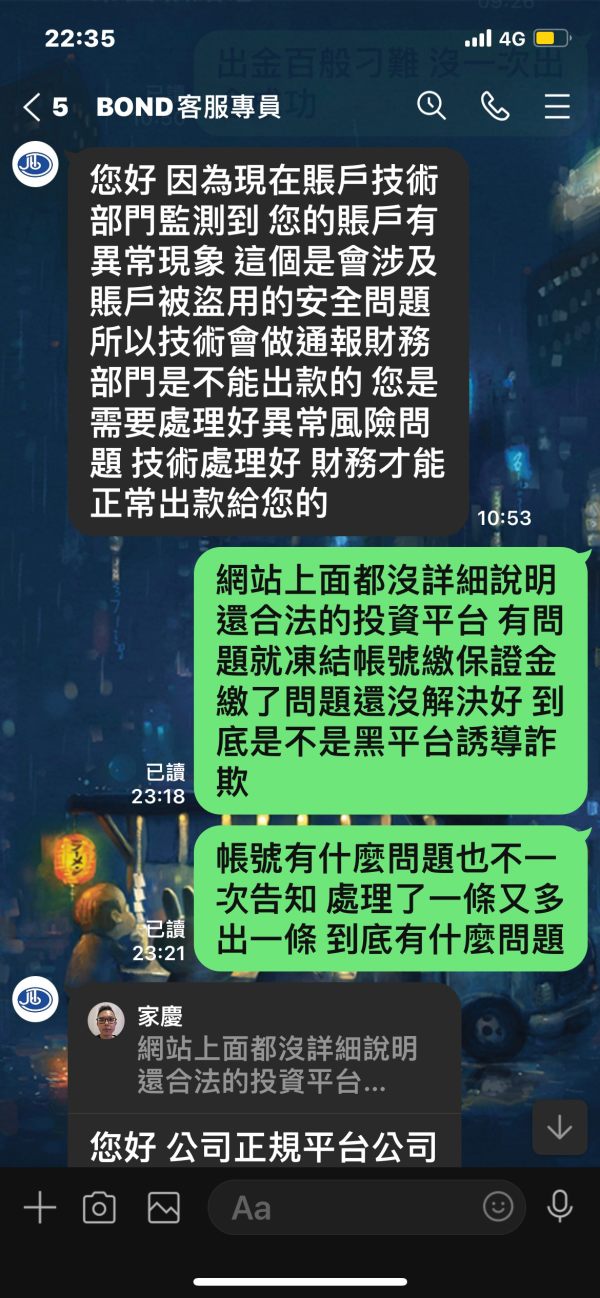

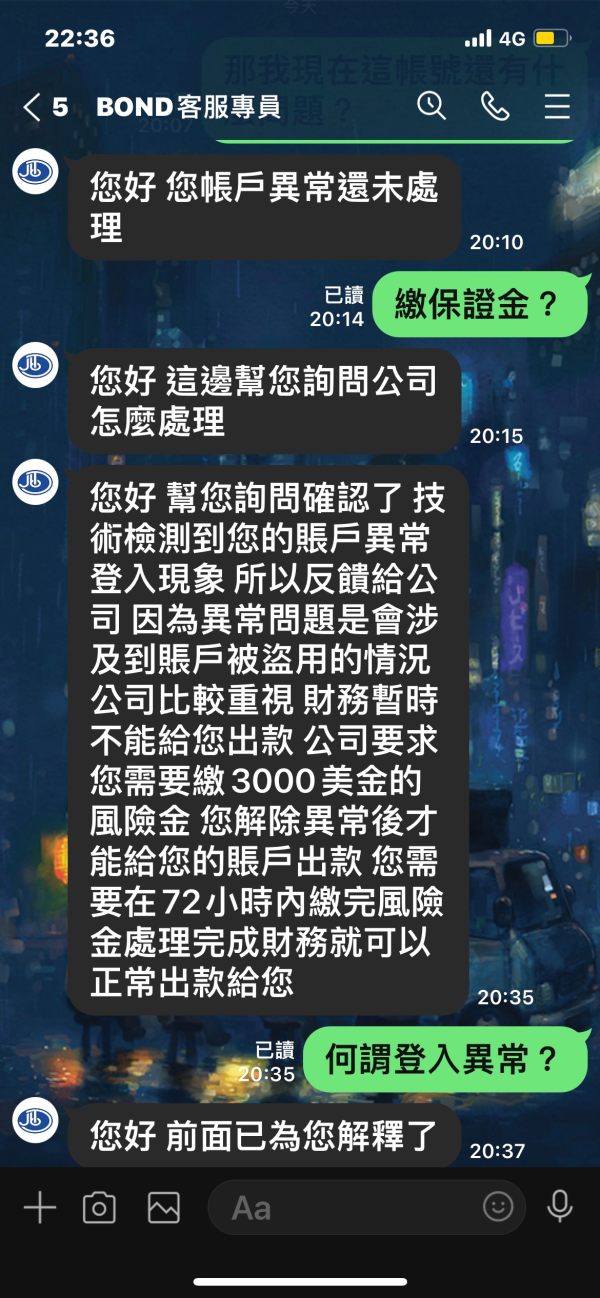

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Feature | Information |

| Company Name | Japan Bond Trading Co. |

| Registered in | Japan |

| Regulated | FSA |

| Years of Establishment | 15-20 years |

| Trading Instruments | Securities, Bonds |

| Account Types | Standard, Institutional |

| Trading Platform | Dedicated Terminals, Internet-Based Platforms |

| Deposit and Withdrawal Method | Bank Wire Transfer, Credit Card, Debit Card, Electronic Wallet |

| Customer Service | Mail, online form |

Overview of Japan Bond

Japan Bond Trading Co., Ltd. is a longstanding financial investment company headquartered in Tokyo, Japan. Since its inception in 1973, the firm has specialized in inter-dealer brokerage services covering a diverse range of bonds, from government and municipal to corporate bonds. The company's extensive experience and expertise in the field are underpinned by the regulation of the Financial Services Agency of Japan (FSA), bolstering its credibility and trustworthiness in both the domestic and international markets.

The company has continually evolved to meet market demands, evident from its efforts such as introducing an electronic trading platform as far back as 1986 and adjusting its settlement processes to facilitate quicker trades. Japan Bond has successfully maintained its prominence in the inter-dealer bond market through a steadfast commitment to transparency, reliability, and advanced technology.

Is Japan Bond Legit or a Scam?

Japan Bond has been operating for over 50 years and is regulated by a credible financial authority, the Financial Services Agency (FSA) of Japan. Its longevity in the financial sector and its compliance with a well-respected regulatory body both indicate that the company is legitimate and not a scam. Nevertheless, as with any financial investment, it's crucial for prospective clients to perform their own due diligence, such as looking into the firm's financial statements or seeking opinions from current users. Regulatory oversight is a strong indicator of a company's legitimacy, but it should not be the sole criterion when selecting a financial partner for trading.

Pros and Cons

| Pros | Cons |

| Long-standing reputation | Limited information about minimum deposits and leverage options |

| Regulatory oversight | Geographical limitations |

| Diverse services | Primary focus on domestic bonds |

| Technological advancements |

Pros:

Long-Standing Reputation: Founded in 1973, Japan Bond has been around for decades, proving its reliability and experience in bond trading.

Regulatory Oversight: Being regulated by the Financial Services Agency (FSA) in Japan adds an extra layer of security and trustworthiness for traders.

Diverse Services: From inter-dealer brokerage to bond and repo trading services, the firm offers a comprehensive suite of services, catering to different investment needs.

Technological Advancements: With its electronic trading platform, BB Super Trader, Japan Bond offers real-time market data, automatic execution, and other advanced features for a more seamless trading experience.

Cons:

Limited Information: The absence of details about minimum deposits and leverage options might make it difficult for potential clients to fully assess the suitability of the platform for their trading needs.

Geographical Limitations: While the company is a significant player in the Japanese bond market, its appeal and services might be limited for traders outside Japan due to its primary focus on domestic bonds.

Market Instruments

Japan Bond specializes in a narrow but deep market segment: bond trading. This focus allows the company to provide an expertly curated platform for trading various types of bonds, including government bonds, corporate bonds, municipal bonds, and even other financial instruments such as repos. Because bonds are considered relatively safer compared to other financial markets like equities or forex, Japan Bonds concentration in this field attracts a certain type of investor looking for lower-risk financial instruments. However, prospective traders should still conduct their own due diligence and risk assessment before diving into bond trading, despite its relatively lower risk profile.

Account Types

Japan Bond Trading Co. distinguishes itself by offering two specialized account types tailored to different kinds of traders: the Standard and Institutional accounts.

The Standard Account caters primarily to individual traders, be they novices or those with a reasonable level of experience. What sets this account apart is its user-friendly access to the BB Super Trade platform, an intuitive yet robust trading environment suitable for a wide range of financial instruments. Users also get real-time market data, which is crucial for making informed trading decisions. Another strong point is the availability of research and educational resources.

The Institutional Account, on the other hand, is engineered for financial institutions and professional traders who require more than just the basics. In addition to the features provided in the Standard Account, this account type offers the advantages of higher leverage and lower spreads. High leverage can be particularly beneficial for traders looking to capitalize on small price movements in the market, while lower spreads mean reduced trading costs, thereby maximizing profitability.

How to Open an Account?

While the specific steps to open an account with Japan Bond are not mentioned in publicly available information, generally such processes require a form of identification, proof of residence, and possibly, a minimum initial deposit. As this information is not publicly disclosed, potential clients should contact the company directly via phone or their website to inquire about the account-opening process. Given that Japan Bond is a regulated entity, it is likely that they follow strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, so prospective clients should be prepared to provide necessary documentation.

Spreads & Commissions

Details concerning spreads and commissions are also not made public on Japan Bond's website. Spreads and commissions are crucial factors that directly affect the profitability of traders. These costs can significantly eat into profits or exacerbate losses, so the lack of transparent information may be a significant drawback for some potential clients. To get accurate details, one would need to reach out to Japan Bond's customer service for this specific information.

Trading Platform

Japan Bond boasts an electronic trading platform known as “BB Super Trader,” introduced in 1986. This platform is a cornerstone in the Japanese Government Bond (JGB) trading market, offering various advanced features such as automatic trade execution, real-time market data distribution, and customization according to the user's order management system. The trading terminal, known as Bond Trading Terminal (BTT), offers a FIX interface for better integration with other trading tools. These features make the platform highly adaptable and efficient, catering to both novice and seasoned traders alike.

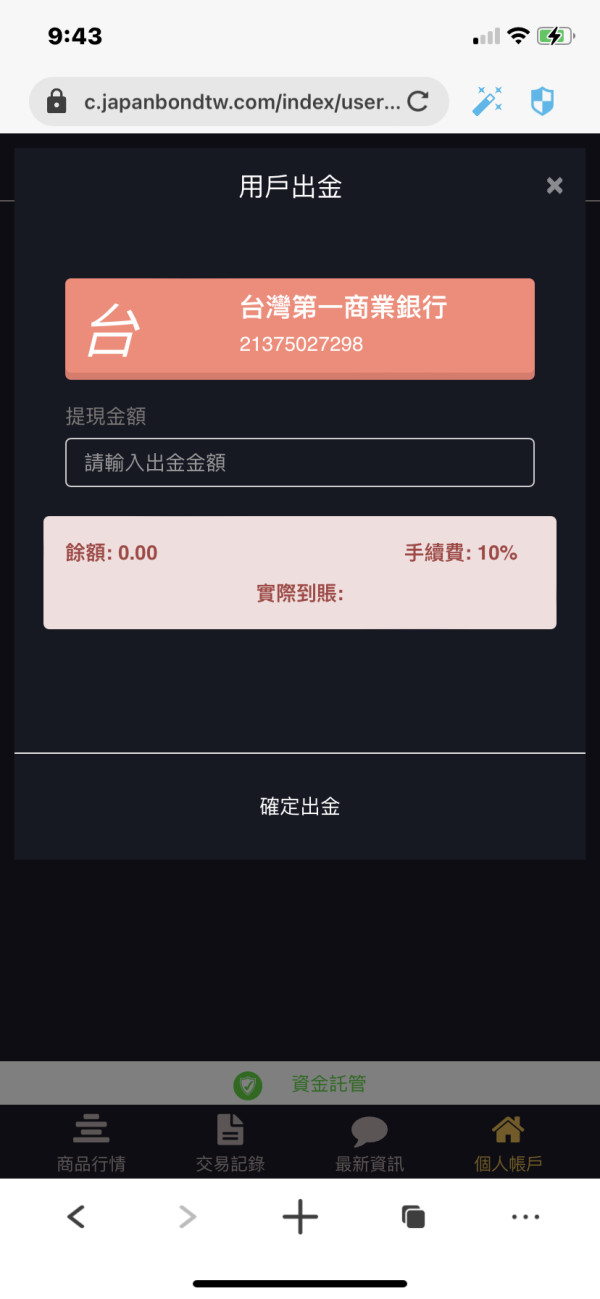

Deposit & Withdrawal

When it comes to fund management, Japan Bond Trading Co. ensures flexibility and convenience by accepting a multitude of deposit and withdrawal methods.

Bank Wire Transfer

This is often the go-to method for large transactions. It is secure but may take several days for the funds to be credited to your trading account.

Credit and Debit Cards

These are suitable for traders who want to deposit or withdraw funds quickly. The process is usually instant, but it may involve small transaction fees.

Electronic Wallet

For those who seek speed and minimal costs, electronic wallets offer a viable alternative. They enable quick transactions and are generally accepted globally.

Customer Support

While the company provides a general phone line :+81 3-6260-7676, and an online inquiry form for customer support, the level of customer service quality is not publicly rated or reviewed. However, given Japan Bond's longstanding reputation and regulatory oversight, one could reasonably expect their customer service to be both professional and responsive. Details about the availability of support—whether 24/7 or during market hours—are also not disclosed, and prospective clients should inquire directly for this information.

Brokers Comparison

| Feature | Japan Bond | IronFX | OctaFX |

| Regulatory Body | FSA Japan | FCA, CySEC | CySEC |

| Trading Instruments | Bonds | Forex, CFDs, Stocks | Forex, CFDs, Crypto |

| Trading Platform | BB Super Trader | MetaTrader 4, 5 | MetaTrader 4, 5, cTrader |

| Customer Support | Phone, Online Form | Phone, Chat, Email | Phone, Chat, Email |

Educational Resources

Japan Bond Trading Co. provides comprehensive educational resources enhancing the understanding of the bond market for both industry professionals and the general public. These resources cover a wide range of topics including basic bond market concepts, trading processes, price structures, and detailed analyses of market trends. They also introduce insightful research studies conducted by experts in the field. Moreover, they offer regular market commentary, seminars, and workshops that provide in-depth knowledge about the dynamic bond market. These educational resources contribute significantly to promoting transparency and market literacy among all market participants and stakeholders.

Conclusion

Japan Bond has been a crucial player in Japan's inter-dealer bond market for over 50 years. Its longevity and regulatory oversight make it a reputable and trustworthy platform. However, the lack of transparency in some critical areas, such as account types, leverage options, and costs, may pose challenges for potential clients. For those specifically interested in bond trading within the Japanese market, Japan Bond offers a specialized and technologically advanced platform.

FAQs

Q: What types of trading accounts does Japan Bond Trading Co. offer?

A: The company offers two account types: Standard for individual traders and Institutional for professional and institutional traders. Both accounts provide access to a range of trading instruments and platforms.

Q: What trading platforms are available for use?

A: Japan Bond Trading Co. provides interactive trading tools through dedicated terminals and internet-based platforms, designed for real-time communication of prices and other relevant market data.

Q: How reliable are the bond prices offered by Japan Bond Trading Co.?

A: The company's bond prices are generated in a deep market, making them highly reliable. These prices are widely used for both trading and research purposes by market participants and institutions.

Q: Are the bond prices available for international markets?

A: Yes, the bond prices, including BB JGB Closing Prices, are widely disseminated in both domestic and overseas markets through information vendors.

Q: Who typically uses Japan Bond Trading Co.'s services?

A: The company's network includes securities companies, banks, and other financial institutions primarily involved in the inter-dealer bond market.

Q: What are BB JGB Closing Prices?

A: BB JGB Closing Prices are computed and released by Japan Bond Trading Co. and serve as reference values for daily bond trading and for calculating the net asset value of investment trusts.

Keywords

- 15-20 years

- Regulated in Japan

- Retail Forex License

- Medium potential risk

Comment 2

Content you want to comment

Please enter...

Comment 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now