简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Week Ahead - Top 5 Events: August Eurozone PMIs & EUR/USD Rate Forecast

Abstract:The August Eurozone PMI reports are due out on Thursday, August 22 at 09:00 GMT, and the data are expected to show a further moderation in growth.

Eurozone PMI Reports Overview:

The August Eurozone PMI reports are due out on Thursday, August 22 at 09:00 GMT, and the data are expected to show a further moderation in growth.

EURUSD remains in a symmetrical triangle, and it‘s too early to tell if it’s a continuation or a bottoming effort.

Retail traders have remained net-long since July 1 when EURUSD traded near 1.1366; price has moved 2.3% lower since then.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

08/22 THURSDAY | 09:00 GMT | EUR Eurozone PMIs (AUG P)

The preliminary August French, German, and Eurozone PMI surveys due on Thursday will likely shape the tone that outgoing ECB President Draghi deploys at the Fed‘s Jackson Hole Economic Policy Symposium. After all, with markets essentially discounting a coin flip’s chance of three rate cuts by the end of the year, every piece of data leading up to the September ECB meeting will be closely scrutinized. The forecast of 51.2 for the headline Eurozone Composite PMI would mark another shift lower in growth momentum, down from the 51.5 reading seen in July.

The past several weeks have produced disappointment on the Eurozone economic data front, at least when trying to take a look at economic data from an objective point of view. The Citi Economic Surprise Index for the Eurozone, a gauge of economic data momentum, is currently at -60.3; one month ago, it was at -8.5.

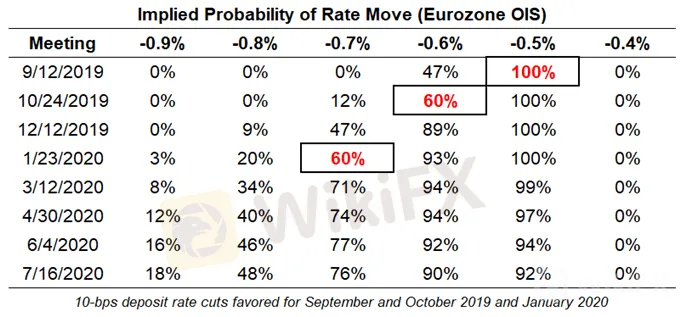

European Central Bank Interest Rate Expectations (August 21, 2019) (Table 1)

Overnight index swaps are currently pricing in a 100% chance of a 10-bps rate cut at the September ECB meeting. There is a 69% chance of a second 10-bps rate cut coming in October, while there is an 89% chance of the second 10-bps of rate cut at the December ECB meeting. Rates markets are pricing a third rate cut over the next 12-months coming in January 2020.

Its important to note that marketing pricing generally dictates that the ECB will only act on rates at meetings when it has a new SEP; although that is a relic of the Draghi-led Governing Council, which could change once Christine Lagarde takes over later this year.

Pairs to Watch: EURJPY, EURGBP, EURUSD

EURUSD TECHNICAL ANALYSIS: DAILY TIMEFRAME (JUNE 2016 TO AUGUST 2019) (CHART 1)

Despite EURUSD hitting a fresh yearly low on August 1, it now appears that the pair is attempting to consolidate in a symmetrical triangle following the break of the downtrend from the June and July swing highs. In a symmetrical triangle pattern, the bias is neutral as momentum is flat. Price has yet to close through the July 9/July 17 swing lows around 1.1203, so its too soon to say that the symmetrical triangle is not part of a continuation effort to new lows rather than a bottoming attempt. Traders will want to keep an eye on the charts over the next week for a breakout opportunity in EURUSD.

IG Client Sentiment Index: EURUSD Price Forecast (August 21, 2019) (Chart 2)

EURUSD: Retail trader data shows 65.0% of traders are net-long with the ratio of traders long to short at 1.86 to 1. In fact, traders have remained net-long since July 1 when EURUSD traded near 1.1366; price has moved 2.3% lower since then. The number of traders net-long is 2.6% lower than yesterday and 19.9% higher from last week, while the number of traders net-short is 1.1% higher than yesterday and 18.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

FX TRADING RESOURCES

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EUR/USD, EUR/JPY Rates Rebound Off Lows after September ECB Meeting

Euro rates have seen volatility around the September ECB meeting as outgoing President Draghi's alter ego “Super Mario” made an appearance.

FX Week Ahead - Top 5 Events: Q219 Eurozone GDP & EUR/JPY Rate Forecast

The Q2‘19 Eurozone GDP report is due out on Wednesday, August 14 at 09:00 GMT, and the data should only serve to further confirm the ECB’s desire to provide more stimulus in September.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator