简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex Economic Calendar Week Ahead: Fed Meeting, New Zealand GDP, Australia Jobs & More

Abstract:Three central bank meetings are on the calendar over the coming week, including the Federal Reserve and the Bank of Japan.

FX WEEK AHEAD OVERVIEW:

外汇周前概述:

The September Fed meeting on Wednesday is the most important central bank meeting of the week; on Thursday, the Bank of Japan may wait longer to enhance its easing measures and the Bank of England will remain on hold until there is clarity around Brexit.

周三9月美联储会议是最重要的本周银行会议;周四,日本央行可能会等待更长时间以加强其宽松措施,英格兰银行将保持不变,直至英国脱欧问题明确。

The antipodean currencies are in focus this week, with the Q219 New Zealand GDP report and the August Australia jobs report due between Wednesday and Thursday.

本周,货币成为焦点,第二季度新西兰GDP报告和8月澳大利亚就业报告将于周三至周四公布。

Retail trader positioningsuggests that the US Dollar be facing a choppier trading environment in the runup to the September Fed meeting.

零售交易员定位表明美元在9月份美联储会议期间面临更加崎岖的交易环境。

{6}

09/18 WEDNESDAY | 12:30 GMT | CAD Consumer Price Index (AUG)

{6}

Volatility in energy markets during August likely can be blamed for any near-term downswing in price pressures, as the upcoming Canada inflation report will show. At approximately 11% of GDP, the energy sector and therefore the performance of oil prices tend to have outsized influences on Canadian economic data.

正如即将出台的加拿大通胀报告所显示的那样,8月份能源市场的波动可能可归咎于价格压力的近期下滑。约占国内生产总值的11%,能源部门以及因此油价的表现往往对加拿大经济数据产生过大影响。

Accordingly, a Bloomberg News surveys consensus forecasts suggest a softening in price pressures. Headline August Canada inflation due in at 1.9% from 2.0% (y/y), while the monthly reading is due in at -0.2% from 0.5% (m/m). It still holds that movement in energy markets will guide the Canadian Dollar and inflation all the same.

因此,彭博新闻调查的共识预测表明价格压力减弱。标题8月加拿大通胀率从2.0%(同比)下降1.9%,而月度数据应从0.5%(月比)下降至-0.2%。它仍然认为,能源市场的走势将引导加元和通胀一路走来。

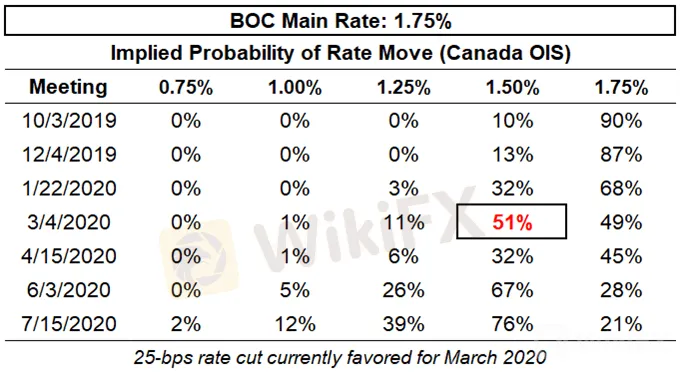

BANK OF CANADA INTEREST RATE EXPECTATIONS (SEPTEMBER 13, 2019) (TABLE 1)

加拿大银行利率预期(2019年9月13日)(表1)

G10 currencies central banks have seen their easing expectations drop in recent weeks; the Bank of Canada is no different. As such, soft inflation data may be otherwise dismissed. Traders should keep expectations low for a policy change from the Bank of Canada any time soon; the odds for additional stimulus have moved sharply lower in recent weeks. Four weeks earlier, overnight index swaps were pricing in only a 66% chance of a 25-bps rate cut in October; now, odds of an October rate cut are 10%.

G10货币中央银行见过他们的最近几周放松预期;加拿大银行也不例外。因此,软通胀数据可能会被驳回。交易者应该很快就会对加拿大银行的政策变化保持低预期;最近几周,额外刺激措施的可能性大幅下降。四周前,隔夜指数掉期价格在10月份降息25个基点的可能性仅为66%;现在,10月降息的可能性是10%。

Pairs to Watch: EURCAD, CADJPY, USDCAD

需要关注的对象:EURCAD,CADJPY,USDCAD

Even though Fed Chair Jerome Powell has said in recent months that the Fed would “act as appropriate” if needed, the dramatic rise in US Treasury yields suggests that there is a strong feeling among market participants that the Fed will not be as aggressively dovish when it meets this coming Wednesday.

尽管美联储主席杰罗姆·鲍威尔近几个月已经表示美联储将在必要时采取“适当行动”,但美国国债收益率的大幅上涨表明,市场参与者强烈认为美联储不会那么积极地温和。它将在即将到来的星期三举行。

FEDERAL RESERVE INTEREST RATE EXPECTATIONS (SEPTEMBER 13, 2019) (TABLE 1)

联邦储备利率预期(2019年9月13日)(表1)

Now, Fed funds futures continue to price in a 100% chance of a 25-bps rate cut at the September Fed meeting. Odds of a 50-bps rate cut have rebounded since Thursday, September 12 (a 25-bps rate hike is no longer more likely than a 50-bps rate cut). Meanwhile, odds of another 25-bps rate cut by December have dropped to 68% - down from 76% on Thursday, September 12.

现在,联邦基金期货继续以9月美联储会议降息25个基点的100%的可能性定价。自9月12日周四以来,50个基点降息的可能性已经反弹(加息25个基点不再比降息50个基点更可能)。与此同时,12月再降息25个基点的可能性已降至68% - 低于9月12日周四的76%。

Pairs to Watch: EURUSD, USDJPY, Gold, DXY Index

值得关注:欧元兑美元,美元兑日元,黄金,DXY指数

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FX Week Ahead - Top 5 Events: August Canada Inflation Report & USD/CAD Rate Forecast

The August Canada inflation report (consumer price index) is due on Wednesday, September 18 at 12:30 GMT.

USDCAD Rebound Unravels Ahead of Fed Symposium Amid Sticky Canada CPI

USDCAD pullbacks ahead of the Fed Economic Symposium as Canadas Consumer Price Index (CPI) comes in stronger-than-expected in July.

Gold Price Consolidation Sets Stage for Rally to Fresh 2019 Highs

Despite rebounds in higher beta assets and higher yielding currencies alike, gold prices have maintained their elevation. Stability in the face of adversity bodes well for the future.

Gold Prices Maintains Sideways Range Despite Plunge in Gold Volatility

With 2019 Fed rate cut odds at their lowest level since May 30, measures of volatility have dropped, and in turn, lower yielding currencies and safe haven assets have suffered.

WikiFX Broker

Latest News

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

The Rise and Risks of Forex Signal Apps: An In-Depth Analysis

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Currency Calculator