简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Growing Shorts Suggest AUD’s Bearish Outlook

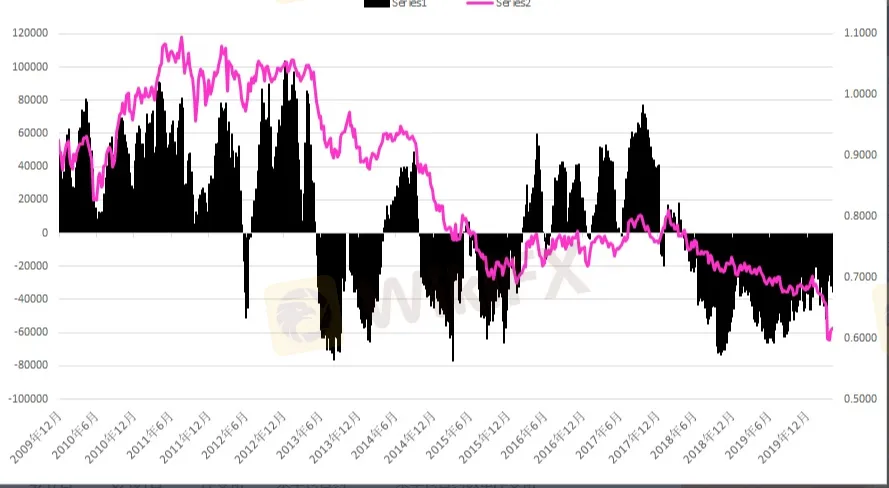

Abstract:According to data from the US Commodity Futures Trading Commission (CFTC), as of April 7, AUD speculative net short positions increased by 3,734 to 35,398 contracts, tripling from the level in mid-March.

According to data from the US Commodity Futures Trading Commission (CFTC), as of April 7, AUD speculative net short positions increased by 3,734 to 35,398 contracts, tripling from the level in mid-March. Among them, speculative long positions decreased by 832 to 26,583 contracts, while speculative short positions increased by 2,902 to 61,881 contracts.

Although the AUD has rebounded from its lowest point in 17 years, leveraged funds are still bearish about the currency, as Australia is heading for the first recession in decades and the unemployment rate is expected to rise in the coming months. With S & P downgrading Australia's credit rating, the chance that AUD may face another round of sell-off after the rebound is growing.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator