简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

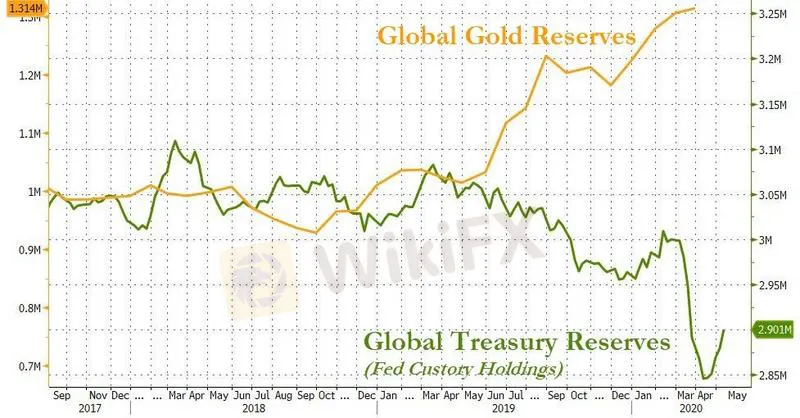

Overseas Investors Are Selling off US Bonds

Abstract:According to the latest US Treasury International Capital report, overseas investors sold off a US$299.3 billion of US Treasury bonds during the bond market's rally in March, breaking the record of monthly sell-off.

May 23rd, from WikiFX News.According to the latest US Treasury International Capital report, overseas investors sold off a US$299.3 billion of US Treasury bonds during the bond market's rally in March, breaking the record of monthly sell-off.

The sell-off wave in US Treasury bonds shows that overseas banks and companies are selling dollar-denominate assets to obtain US dollars.

The 10-year US Treasury yield fell to a historical low of about 0.32% in March, and closed at 0.64% last Friday. In March, China dropped U.S. Treasury holdings by US$10.7 billion from that of February to US$1.0816 trillion, the first time in the year to reduce US T-bond holdings. China has been the world's second largest holder of US bonds since last June.

Up to the same month, Japan was still the top overseas holder of US bonds. Its holdings increased by US$3.4 billion from February to US$ 1.2717 trillion, growing for the third consecutive month and ranking the world's first since June last year.

Thomas Simons, senior money market economist at Jefferies LLC, said that with the global market crash in March, global companies are accessing revolving line of credits from the bank, leading to the surge of dollar demands.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

ED Exposed US Warned Crypto Scam ”Bit Connect”

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

Currency Calculator