简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Attention: USD May Fluctuate Due to FED Resolution

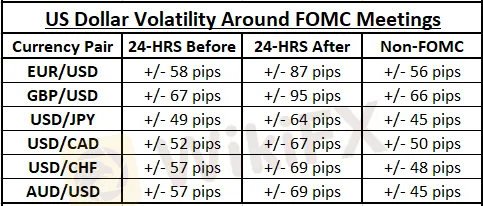

Abstract:The Federal Reserve’s interest rate decision to be announced at 18:00 GMT on Wednesday may expose dollar-linked currency pairs such as EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD to an above-average level risk of price fluctuations.

WikiFX News (10 June)-The Federal Reserves interest rate decision to be announced at 18:00 GMT on Wednesday may expose dollar-linked currency pairs such as EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD to an above-average level risk of price fluctuations. WikiFX reminds investors to pay attention to risks when trading USD.

The Fed‘s interest rate resolution has triggered sharp fluctuation of the US dollar in the past. The transaction data of the EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD since 2008 shows that the USD volatility before and after the Fed’s interest rate is sharper than usual. Therefore, forex investors should remain highly vigilant when the Feds resolution is made.

The Fed resolution is an important catalyst for fluctuations in the price of the US dollar. Forex investors should fully consider implementing strict risk management techniques when trading US dollars before and after the Fed interest rate resolution, such as tightening stop-loss level (up/down adjustments to stop loss) or reducing the size of positions.

The above information is provided by WikiFX, a world-renowned forex information query provider. For more information, please download: bit.ly/WIKIFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Oversold USD Puts a Rally on Track

Covid-19 kept raging the US, amid which the latest spate of economic data signaled a turn for the worse.

Fed's Upbeat Statements May Push USD Higher

The Federal Reserve Vice Chair Randal K. Quarles said in a recent speech that he was optimistic about the country's economic outlook, which could push the dollar higher in the short term and keep the dollar dominating non-USD currencies.

Unveil Reasons of USD Bounced up After Releasing Federal Reserve Board Minute

The US Dollar Index bounced up by around 1% after releasing the minute of Federal Reserve Board on 19 Aug, breaking the record high since this March.

A Tendency for Strong USD and Volatile Markets

Recently, markets seem to calm down as the U.S. stocks settled higher above early low and the VIX largely shrank 5 percentage points.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator