简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Global Economic Recession and the Risks Facing Emerging Markets

Abstract:Due to the coronavirus global outbreak and the consequent lockdown measures, the world’s economy is struggling in a chaos. World Bank estimates that despite many countries are gradually restarting production and business activities, the world is still facing the worst recession since the Second World War.

Due to the coronavirus global outbreak and the consequent lockdown measures, the worlds economy is struggling in a chaos. World Bank estimates that despite many countries are gradually restarting production and business activities, the world is still facing the worst recession since the Second World War.

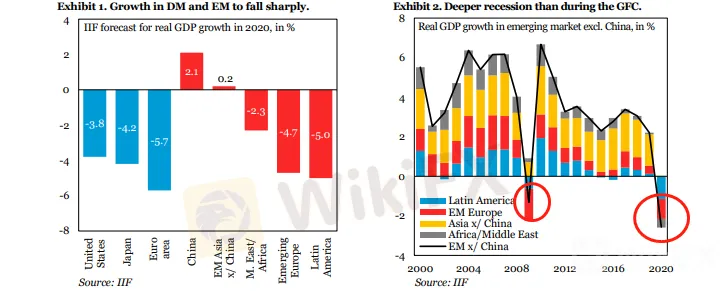

In the latest Global Economic Prospects released on Monday, June 8th, World Bank noted that the global GDP is expected to decline 5.2%, with a 7% shrinkage in developed economies; The contractions in US, the Eurozone and Japan are estimated to be 6.1%, 9.1% and 6.1% respectively, while emerging market and developing economies may expect a 2.5% decline.

World Banks Global Economic Prospects

In this challenge inflicted by the coronavirus upon the whole mankind, the numerous risks such as debt crisis, capital outflow and currency crisis facing emerging markets and developing economies underlined their inherent vulnerability comparing with developed countries.

The United Nation pointed out in Aprils 2020 Financing for Sustainable Development Report that countries that are home to billions are threatened with debt crisis, their economy at the brink of a breakdown. There has been Argentine which announced postponing repayment of 10 billion public debts, and countries such as Saudi Arabia, Brazil and Chile are struggling to make ends meet. South Africa and Turkey among other countries are also in heavy debt.

UN 2020 Financing for Sustainable Development Report

To cushion the economic shock of coronavirus, emerging markets followed suit the US Federal Reserves rate cut and infinite QE. A dozen of emerging market countries including India, Brazil and Turkey have made several rounds of rate slash, reducing the local currency rate to record low.

As the local currencies eventually lose their investment appeal through heavy depreciation, international capital flow began to flee emerging markets. Data from the Institution of International Finance(IIF) shows that year to date, over US$100 billion international capital have withdrawn from emerging markets, tripling the outflow of the same period during the financial crisis.

Data source: IIF

The frequent and intensive capital outflow not only squeezes out the economic vitality of emerging market, but also leads to the plunge in local stock, bond and forex markets; the falling asset price in turn accelerates international capitals escape in fear of potential risks, and eventually the emerging markets will be trapped in the vicious circle of “ local currency depreciation-capital withdrawal-asset depreciation-capital retreat- further depreciation of local currency”.

As the leading forex media in the industry, WikiFX integrates industry news, forex forums, complaint exposure, platform query and other functions. Download WikiFX App to access essential global finance updates anywhere at anytime. https://bit.ly/3ajawKO

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator