简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

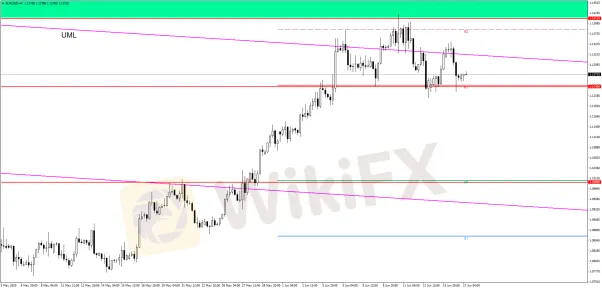

EUR/USD Near Key Resistance!

Abstract:EUR/USD is traded at 1.1271 level, but it seems undecided after another false breakout above the near-term resistance level. The pair is trapped between two important levels, so we have to have to wait for a valid breakout.

EUR/USD is traded at 1.1271 level, but it seems undecided after another false breakout above the near-term resistance level. The pair is trapped between two important levels, so we have to have to wait for a valid breakout.

Yesterday‘s USDX’s rebound has forced EUR/USD to drop again, the dollar was boosted by the US Retail Sales and Core Retail Sales data. Surprisingly or not, the Retail Sales indicator has increased by 17.7% in May, beating the 7.9% estimate, while the Core Retail Sales has registered a 12.4% growth, versus the 5.5% consensus.

Unfortunately, the US Industrial Production increased only by 1.4%, less compared to the 3.0% estimate, but the USD is struggling to stay higher versus its rivals in the short term.

It is very important to see what will really happen on the USDX, the index is traded at 96.98 level, a valid breakout above the S1 (97.36) level will confirm a further increase towards the upper median line (UML) of the descending pitchfork and will force the EUR/USD to resume the bearish movement.

A USDXs drop back to 96.00 psychological level, or even lower, will push EUR/USD towards fresh new highs in the upcoming period. Technically, the US Dollar Index seems strong enough to climb higher after the false breakdown below the 96.00 level and after the price has developed and confirmed a bullish engulfing pattern. You should know that the USDX is still under pressure as long as it stays below the upper median line (UML), so only a valid breakout from this descending pitchfork will announce a broader leg higher and the EUR/USD massive drop.

● EUR/USD Trapped Within A Minor Range

EUR/USD has failed once again to stabilize above the upper median line (UML) of the descending pitchfork signaling am exhaustion in the short term. A valid breakdown below the R1 (1.1243) and below the 1.1240, another lower low, will validate a further drop on the Daily chart. The next downside target is seen at the 1.1 psychological level, EUR/USD could approach this major support only if the USDX will resume its rebound.

The pair will confirm a further upside movement only if the price will make a valid breakout above the upper median line (UML) and most important above the R2 (1.1383) level. EUR/USD moves sideways between the R1 (1.1243) and R2 (1.1383) levels, it remains to see if this will be an accumulation or a distribution, a valid breakout from this range will give us a clear direction in the short term.

An upside breakout will signal a bullish momentum towards the R3 (1.1622) level, while a downside breakout will suggest selling, the PP (1.1005) could be used as a target.

● EUR/USD Head&Shoulders Pattern!

EUR/USD is developing a Head&Shoulder pattern on the H4 chart, another lower low, a drop below the 1.1212 could confirm this reversal pattern and a potential further drop in the short term. You can see that the pair has failed to reach and retest the R2 (1.1383) again signaling that the bears are strong in the short term.

If the H&S pattern will be confirmed, EUR/USD could register a 200 pips drop, towards the 1.1000 psychological level. The R1 (1.1243) - 1.1240 area represents a strong downside obstacle, so we have to wait for a valid breakdown before well consider going short.

A potential drop will be invalidated if the EUR/USD will climb above the 1.1353 high and if it will make a valid breakout above the R2 (1.1383) level.

Olimpiu Tuns

Olimpiu Tuns is a seasoned market analyst / trader / trainer on the financial markets with expertise in forex, cryptocurrencies, commodities, futures, options, index, CFD for more than 8 years. He is also a famous blogger in both technical and fundamental analysis, trading signals, trade setups, etc.

He has worked as a Market Analyst / Consultant for three major Brokerage companies, Admiral Markets, MultiBank Exchange Group and InstaForex (live webinars, market analysis, educational materials, video analysis, video tutorials, ghostwriting, content creator), as a Social Media Manager and as a Financial Markets & Crypto Analyst / Contributor for very important news portals/blogs (investing.com, benzinga.com, forexalchemy.com actionforex.com, countingpips.com), websites, educational platforms (Forex.Academy, Forex.Today), independent clients, etc.

Olimpiu Tuns currently works as a Financial Markets & Crypto Analyst / Signal Provider / Trader / Trainer.

WikiFX App is a third-party inquiry platform for company

profiles.WikiFX has collected 17001 forex brokers and 30 regulators and

recovered over 300,000,000.00 USD of the victims.

It, possessed by Wiki Co., LIMITED that was established in Hong

Kong Special Administrative Region of China, mainly provides basic

information inquiry, regulatory license inquiry, credit evaluation for

the listed brokers, platform identification and other services. At the

same time, Wiki has set up affiliated branches or offices in Hong Kong,

Australia, Indonesia, Vietnam, Thailand and Cyprus and has promoted

WikiFX to global users in more than 14 different languages, offering

them an opportunity to fully appreciate and enjoy the convenience

Chinese Internet technology brings. WikiFXs social media account as

below:

Facebook:

USA Area:https://www.facebook.com/WikiFX.US/

UK Area:https://www.facebook.com/Wikifx.UK/

Nigeria Area:https://www.facebook.com/WikiFX.ng

Twitter:

Areas where English is an official language:https://twitter.com/WikiFX_Eng

More details about how to download WikiFX App:

Please download WikiFX APP from links below or scan QR code :

iosAppStore: https://apps.apple.com/us/app/fxeye/id1402501387?l=zh&ls=1

Googleplay: https://play.google.com/store/apps/details?id=com.foreigncurrency.internationalfxeye

If you have any questions, please feel free to contact us at wikifx@wikifx.com

Worried about missing out latest trends in the volatile market? WikiFX ‘News Flash’ is here to help!

With 24-hour real-time update of forex market data by minute, you

can seize the opportunity of every bullish market! Bookmark the link

below and follow the market trends immediately!

UK Area:https://live.wikifx.com/uk_en/7x24.html

USA Area:https://live.wikifx.com/us_en/7x24.html

Nigeria Area:https://live.wikifx.com/ng_en/7x24.html

Wiki Forum Forum Function:

In order to help more investors, WikiFX has launched the WikiFX

Forum forum, which aims to provide urgently needed and professional

services to Nigerian forex investors.

The exposure function of “WikiFX Forum” includes the following features:

1: Allow investors who have been defrauded by illegal broker to complain directly in the forum (as shown in the screenshots)

As long as there is sufficient evidence, a review panel and an

executive team will contact the broker to discuss the complaint or

expose it directly through the media. Here are the exposure channels:

2: Block low score brokers from entering the forum

3: Monitor suspicious communication in real time, and directly spot and deal with suspicious fraud;

4: Negotiate with highly reliable brokers selected by WikiFX in the secure environment of WikiFX Forum.

WikiFX APP exposure channel: https://activities.wikifx.com/gather/indexng.html

Information page to understand forex scam and exposure channel: https://activities.wikifx.com/gather/indexng.html

Website exposure channel: https://exposure.wikifx.com/ng_en/revelation.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Series of Bad Messages May Lead to a Weak CAD| KOL Analysis•Jasper Lo

Affected by some unexpected bad messages this week, CAD is expected to weaken repeatedly and likely to have a complete sluggish trend in market.

WikiFX| Daily F.X. Analysis, July 2 |Arslan Ali Butt-KOL

WikiFX| Daily F.X. Analysis, July 2 |Arslan Ali Butt-KOL

No Consensus After EU Summit, Euro Still Under Adjustment Pressure| KOL Analysis•Jasper Lo

USDX saw the largest weekly increase in a month last week, gaining 0.54% over the whole week. Analysis pointed out that the second wave of coronavirus global outbreak boosted market risk aversion and made USD much sought after by investors, but in my opinion, the V shape rebound in US has been the main cause.

WikiFX| Daily F.X. Analysis, July 1 |Desmond Adeosun-KOL

WikiFX| Daily F.X. Analysis, July 1 |Desmond Adeosun-KOL

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator