简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Will Oil Price Reach US$190/Barrel?

Abstract:JP Morgan recently predicted that Brent Crude will hit US$190 per barrel by 2025, noting that crude oil is entering a bullish period as dropped production will be hard to resume.

WikiFX News (23 June) -JP Morgan recently predicted that Brent Crude will hit US$190 per barrel by 2025, noting that crude oil is entering a bullish period as dropped production will be hard to resume.

The company observed that the current over-supply on crude market will be completely reversed to supply-shortage in 2022, and with a possible gap of 6.8 million barrels/day, oil price may reach US$190 by 2025. Though the long term projection has little implication for short-term practice, it may still fuel bullish sentiment over crude oil in the current risk-on market.

As for fundamentals and relevant data, several OPEC countries allegedly decided to limit crude exportation earlier this week. Saudi cut its supply to some Asian buyers, while Iraq announced reducing exports by at least 15%. The International Energy Association(IEA) estimates in a report that crude oil demand will drop by 8.1 million barrels/day this year and weak demand wont completely recover until at least 2022.

WikiFX thinks that risk assets‘ trend doesn’t reflect the severe pandemic and gloomy economic outlook, and investors‘ optimistic about oil prices’ trend should also mind the risk of potential reversal.

The above information is provided by WikiFX, a world-renowned forex information query platform. For more information or to verify brokers qualification, please download the WikiFX App. bit.ly/WIKIFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Relationship Between the U.S. Presidential Election and Oil Prices

With COVID-19 still raging the whole world, fatal negatives have thrust global aviation and tourism on the edge of a precipice, but lose strengths in the face of international oil prices which keep climbing against the trend of economics.

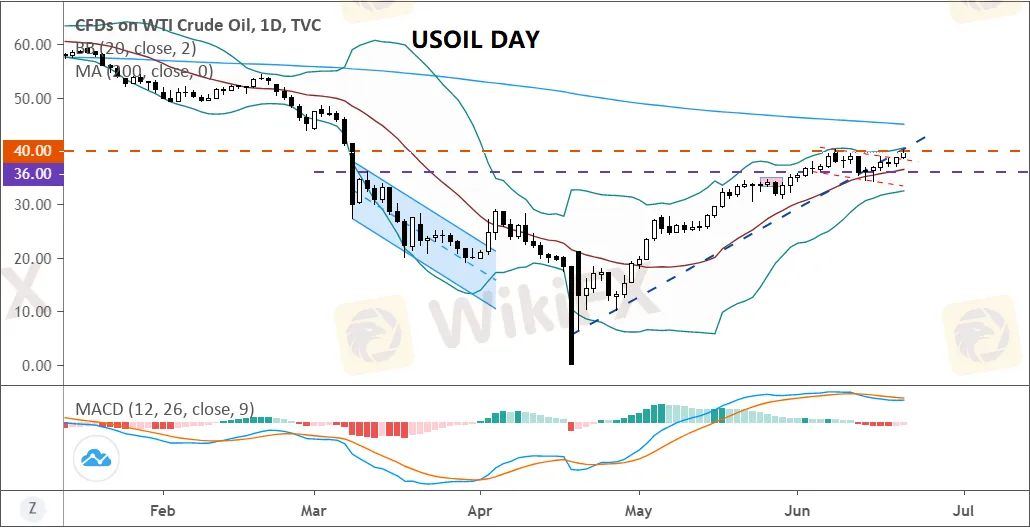

Crude Tests the 40 Level Again, Oil Prices Rise This Week

Recently, oil prices have repeatedly tested the 40 mark and encountered a resistance at 41.34. From a technical perspective, it is expected that oil prices this week will continue to rise.

US Oil Price May Rally After March

Since its last peak of US$63.27/ barrel on January 6th, US oil price has been down 68% so far, breaking the record in losing almost 50% in March.

Crude Oil Price Sinks 4.5% as Bullish Conviction Ebbs

Commodity traders sent oil prices plunging on Thursday as uninspiring crude inventory data reignited oversupply concerns, dealing the latest blow to bullish sentiment.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator