简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Learn how to use the Bollinger line to accurately grasp the buying and selling points in 3 minutes

Abstract:Everyone wants to make money in forex and to make an accurate and correct technical analysis of forex, and then decide whether to buy or sell in order to get a positive return. Bollinger bands(BOLL) can help you buy and sell accurately, so how to use it?

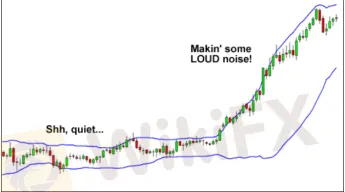

Bollinger Bands, the invention of John Bollinger, is used to measure a markets volatility and identify “overbought” or “oversold” conditions. This little tool tells us whether the market is quiet or loud. When market is quiet, the bands contract and when market is loud, the bands expend.

It can be seen from picture that the Bollinger Bands is a chart that is displayed over the price. When the price is stable, the bands are close. When the price moves up, the bands spread apart. The upper and lower bands measure volatility, or the degree in the variation of prices over time. The volatility bands automatically adjust according to changing market conditions.

Bollinger Bands are typically drawn as three lines:

l An upper band A middle line A lower band

Most charting programs default to a 20-period, which is fine for most traders, but you can experiment with different moving average lengths after you get a little experience applying Bollinger Bands.

The concept of standard deviation (SD) is just a measure of how spread out numbers are. If the upper and lower bands are 1 standard deviation, this means that about 68% of price moves occurred recently are CONTAINED within these bands. If the upper and lower bands are 2 standard deviations, this means that about 95% of price moves occurred recently are CONTAINED within these bands.

As you can see, the higher the value of SD you use for the bands, the more prices the bands “capture”. You can try out different standard deviations for the bands once you become more familiar with how they work. Honestly, you don‘t need to know most of this stuff to get started. We think it’s more important that we show you some ways you can apply the Bollinger Bands to your trading.

The Bollinger Bounce.

If you said down, then you are correct! As you can see, the price settled back down towards the middle area of the bands.

What you just saw was a classic Bollinger Bounce. The reason these bounces occur is because the Bollinger bands act like dynamic support and resistance levels.

The longer the time frame you are in, the stronger these bands tend to be. Many traders have developed systems that thrive on these bounces and this strategy is best used when the market is ranging and there is no clear trend. You only want to trade this approach when prices are trendless. So be mindful of the WIDTH of the bands.

Avoid trading the Bollinger Bounce when the bands are expanding, because this usually means the price is not moving within a range but in a TREND! Instead, look for these conditions when the bands are stable or even contracting.

Bollinger Squeeze

The “Bollinger Squeeze” is pretty self-explanatory. When the bands squeeze together, it usually means that a breakout is getting ready to happen. If the candles start to break out above the TOP band, then the move will usually continue to go UP. If the candles start to break out below the BOTTOM band, then price will usually continue to go DOWN.

Looking at the chart above, you can see the bands squeezing together. The price has just started to break out of the top band. Based on this information, where do you think the price will go?

This is how a typical Bollinger Squeeze works. Setups like these don‘t occur every day, but you can probably spot them a few times a week if you are looking at a 15-minute chart. There are many other things you can do with Bollinger Bands, but these are the two most common strategies associated with them. Go ahead and add the indicator to your charts and watch how prices move with respect to the three bands. Once you’ve got the hang of it, try changing up some of the indicators parameters.

WikiFX

App is a third-party inquiry platform for company profiles.WikiFX has

collected 17001 forex brokers and 30 regulators and recovered over

300,000,000.00 USD of the victims.

It, possessed by Wiki Co., LIMITED that was established in Hong

Kong Special Administrative Region of China, mainly provides basic

information inquiry, regulatory license inquiry, credit evaluation for

the listed brokers, platform identification and other services. At the

same time, Wiki has set up affiliated branches or offices in Hong Kong,

Australia, Indonesia, Vietnam, Thailand and Cyprus and has promoted

WikiFX to global users in more than 14 different languages, offering

them an opportunity to fully appreciate and enjoy the convenience

Chinese Internet technology brings. WikiFXs social media account as

below:

Facebook:

USA Area:https://www.facebook.com/WikiFX.US/

UK Area:https://www.facebook.com/Wikifx.UK/

Australia Area:https://www.facebook.com/WikiFX.au

Nigeria Area:https://www.facebook.com/WikiFX.ng

Twitter:

Areas where English is an official language:https://twitter.com/WikiFX_Eng

More details about how to download WikiFX App:

Please download WikiFX APP from links below or scan QR code :

App Store: https://apps.apple.com/us/app/fxeye/id1402501387?l=zh&ls=1

Google Play: https://play.google.com/store/apps/details?id=com.foreigncurrency.internationalfxeye

If you have any questions, please feel free to contact us at wikifx@wikifx.com

Worried about missing out latest trends in the volatile market? WikiFX ‘News Flash’ is here to help!

With

24-hour real-time update of forex market data by minute, you can seize

the opportunity of every bullish market! Bookmark the link below and

follow the market trends immediately!

UK Area:https://live.wikifx.com/uk_en/7x24.html

USA Area:https://live.wikifx.com/us_en/7x24.html

Nigeria Area:https://live.wikifx.com/ng_en/7x24.html

Australia Area:https://live.wikifx.com/au_en/7x24.html

Wiki Forum Forum Function:

In order to help more investors, WikiFX has launched the WikiFX

Forum forum, which aims to provide urgently needed and professional

services to Nigerian forex investors.

The exposure function of “WikiFX Forum” includes the following features:

1: Allow investors who have been defrauded by illegal broker to complain directly in the forum (as shown in the screenshots)

As long as there is sufficient evidence, a review panel and an

executive team will contact the broker to discuss the complaint or

expose it directly through the media. Here are the exposure channels:

2: Block low score brokers from entering the forum

3: Monitor suspicious communication in real time, and directly spot and deal with suspicious fraud;

4: Negotiate with highly reliable brokers selected by WikiFX in the secure environment of WikiFX Forum.

WikiFX APP exposure channel: https://activities.wikifx.com/gather/indexng.html

Information page to understand forex scam and exposure channel: https://activities.wikifx.com/gather/indexng.html

Website exposure channel: https://exposure.wikifx.com/ng_en/revelation.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator