简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.S. Adds 4.8 Million Jobs, Above Forecasts, Before Virus Pickup

Abstract:The rebound in the U.S. labor market accelerated in June as the economy reopened more broadly, before a pickup in coronavirus cases that puts additional gains in jeopardy.

The rebound in the U.S. labor market accelerated in June as the economy reopened more broadly, before a pickup in coronavirus cases that puts additional gains in jeopardy.

The June jobs report reflects a snapshot of mid-month conditions after a flurry of rehiring -- particularly at restaurants and retailers -- but before reopenings screeched to a halt amid rising virus cases around the country. That could slow or stall the rate of improvement in the labor market, with implications for President Donald Trumps reelection chances, as well as for the extension of a U.S. stock-market rally following the best quarter since 1998.

U.S. stocks opened higher following the data. Treasuries and the dollar were lower.

A separate report from the Labor Department showed initial applications for unemployment insurance in regular state programs fell by less than expected, to 1.43 million, in the week ended June 27. Continuing claims -- or claims for ongoing unemployment benefits in state programs -- rose slightly to 19.3 million in the week ended June 20.

Economists had forecast payrolls to rise by 3.23 million -- the median in a range of 500,000 to 9 million -- and an unemployment rate of 12.5%.

“Were still coming off extremely high levels of unemployment, but every step counts,” said Jennifer Lee, senior economist at BMO Capital Markets.

What Bloombergs Economists Say

“The upward surprise in the June jobs report demonstrates that economic fundamentals remain strong enough to facilitate a relatively robust recovery once Covid-19 is under control. However, in the near term, the positive signal somewhat fades given the recent sharp acceleration in new virus cases and the looming income cliff stemming from the expiration of augmented unemployment benefits this month.”

-- Yelena Shulyatyeva, Andrew Husby and Eliza Winger

Read more for the full reaction note.

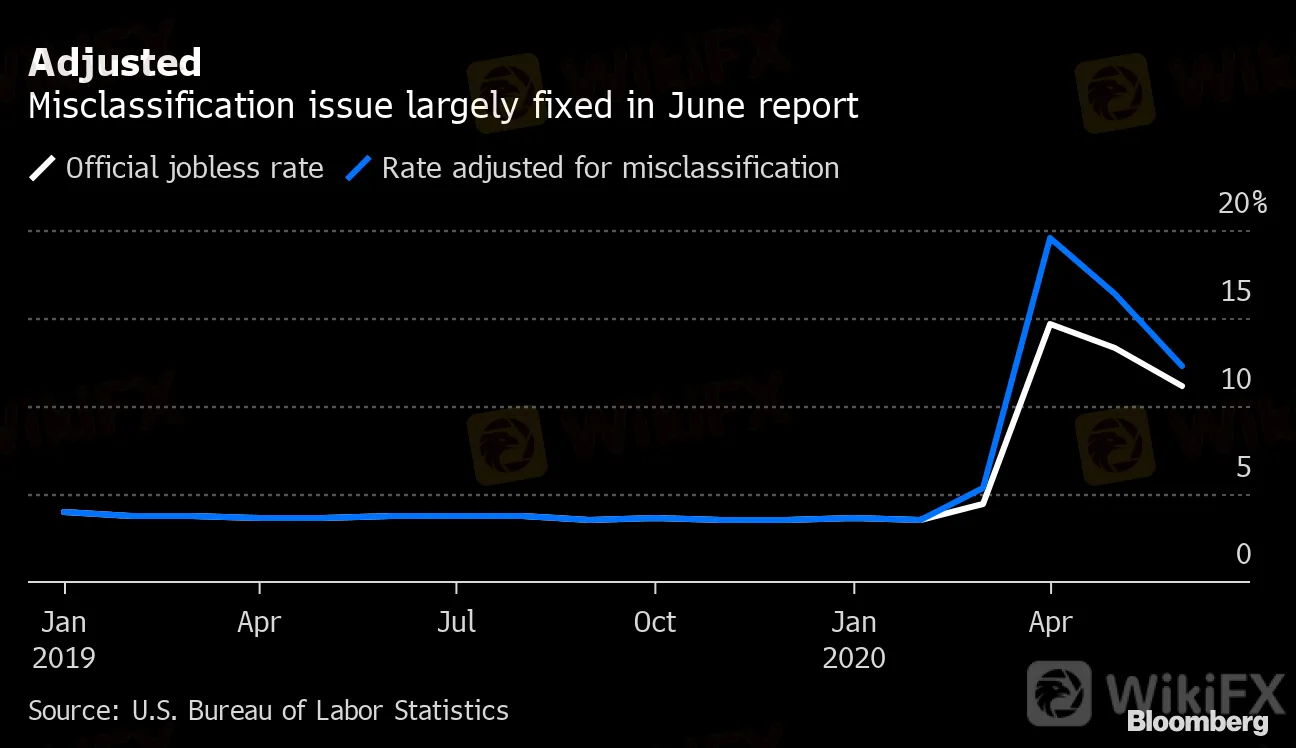

The Labor Departments Bureau of Labor Statistics has largely fixed a problem that resulted in respondents being misclassified as employed when they should have been labeled as unemployed. Adjusted for the errors, the June unemployment rate would have been about 1 percentage point higher than reported -- or 12.3%, compared with an adjusted 16.4% in May. “The degree of misclassification declined considerably in June,” BLS said.

A resurgence in virus cases has complicated the picture, leading states across the country to reverse or halt reopening efforts in hopes to slow the spread. That‘s already led some rehired workers to get laid off once more. Paired with the coming expiration of the federal government’s extra $600 in weekly unemployment benefits, the economy could take another hit in the months ahead.

In addition, the weekly figures show the number of Americans claiming jobless benefits remains extremely elevated, posting the first increase in state programs in four weeks.

Adjusted

Misclassification issue largely fixed in June report

Source: U.S. Bureau of Labor Statistics

The increase in payrolls was led by leisure and hospitality and retail, illustrating the effect of the easing of business restrictions. Health care also saw increases as doctors‘ and dentists’ offices reopened.

It‘s a “little more disconcerting that we’re not seeing broad-based gains across industries,” BMOs Lee said.

Read more:

Whats on the Table for Next Round of U.S. Virus Relief

U.S. Jobless-Claims Figures Inflated by States Backlog-Clearing

Virus Threat Grows in U.S. Where Millions Lost Health Coverage

Coronavirus Resurgence Threatens Fragile U.S. Economic Recovery

Black Americas Jobs Gap Makes Case for Keeping Extra Benefits

State government payrolls fell by another 25,000 -- the fourth straight decline -- as budget situations grew more dire amid falling tax revenues.

Key Numbers

Unemployment among minorities and women remained worse than among White Americans and men. The Black unemployment rate fell to 15.4% from 16.8%, while it declined to 10.1% from 12.4% among White Americans. Hispanic unemployment dropped to 14.5% from 17.6%.

Meanwhile, the household survey showed more than 2.8 million Americans permanently lost their job in June, a 588,000 increase from a month earlier that was the biggest since the start of 2009. While the total number is the highest in six years, the figure bears watching for more systemic damage to the labor market caused by the pandemic.

Average hourly earnings fell 1.2% from the prior month, reflecting job gains among lower-paid workers, following a 1% drop in May. Wages were up 5% from the year before, as employment in lower-paid sectors remains well below year-earlier levels.

The average workweek fell to 34.5 hours from 34.7 hours in May.

The U-6 rate, also known as the underemployment rate, also fell to 18% in a sign of positive momentum for the economy. Unlike the headline unemployment rate, also known as the U-3 rate, it accounts for those who quit looking for a job because they were discouraged about their prospects and those working part-time but desiring a full workweek.

A mass of Americans left the labor force after economic shutdowns led to widespread layoffs, but those people have started to come back. The labor force participation rate, or the proportion of the working-age population that is either working or actively looking for work, rose to 61.5% from 60.8% the prior month, though thats the still far shy of where it was in February -- at 63.4%.

The increase in participation reflected a rise of 1.7 million people in the labor force.

— With assistance by Matthew Boesler, Edith Moy, Chris Middleton, Sophie Caronello, Olivia Rockeman, and Maeve Sheehey

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Will Gold Prices Continue to Rise Due to Trump’s Tariffs?

Why the Federal Reserve Is So Important

Boerse Stuttgart Digital Secures EU-Wide MiCAR Crypto License

SEC Fines Vanguard $106 Million Over Misleading TRF Tax Disclosures

Swiss Population Strongly Opposes Abolition of Cash, Philoro Study Reveals

Oil Prices Continue to Rise Due to Sanctions

Currency Calculator