简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

XAU/USD: What to Look for in the Next Step

Abstract:Through what has been analyzed, gold price in long-term is still in the uptrend. However, in order for gold to continue to rise up in the coming time, in author’s point of view, it still needs a further adjustment to leverage the future growth.

I. Market evaluation (Fundamental Analysis)

- The very first rule of gold is that the price has always increased whenever a crisis occurred so far. There are many reasons for the price to go up, such as trade struggles, inflation, climate change, etc. and whether these impacts are more or less, they are all the premises to leverage gold prices.

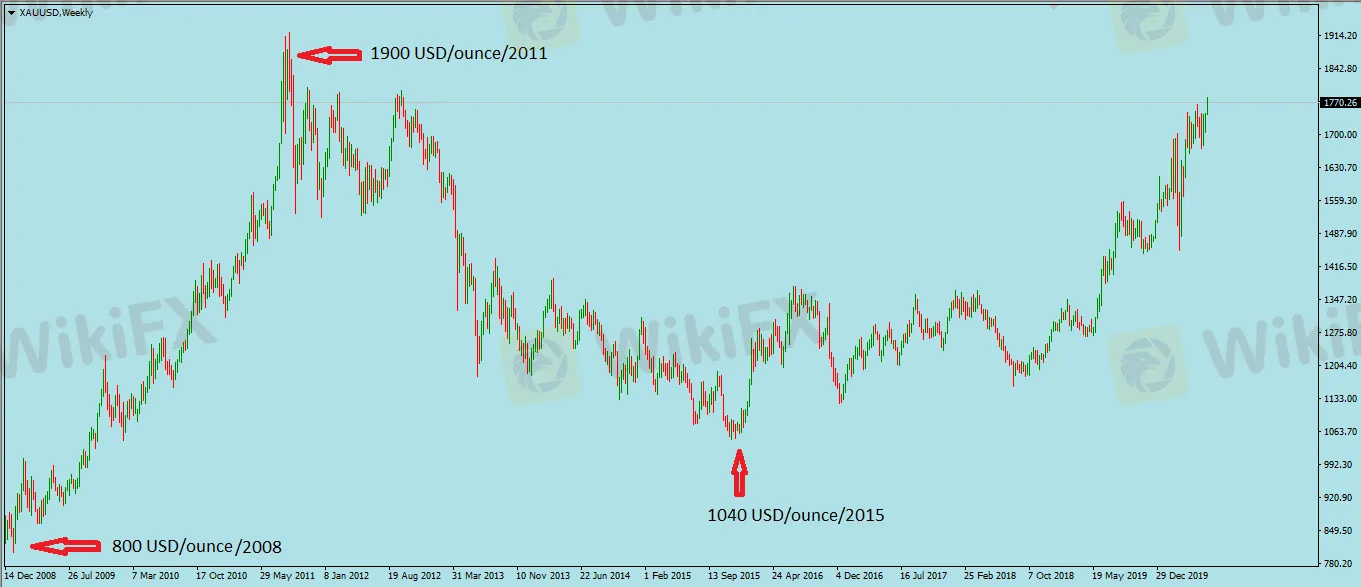

- In the last half of century, gold price has experienced 2 very strong increases. The first round was when governments gave up the policy of controlling gold price and eased the ban on private ownership of gold, happening around 1970. The price of gold then seemed like a long-term repression that had the opportunity to launch, in the exactly same time when economic and political points are more volatile, creating a “gold rush” speculation, price soared from 35 USD/ounce to 800 USD/ounce in 1980.

- It was a time when gold prices were at their peak, and from there began to go down after central banks sold out tons of gold. By 1999, each ounce of gold cost only 250 USD. - The downtrend then ended when European central banks agreed to coordinate in selling gold to stabilize this precious metal price. China also expanded the object of people allowed to own gold, the amount of buying back increased. Exchange-traded funds (ETFs) - which represent gold-holding investors - also create favorable conditions for people to hold the bullion.

- Also from 2003 to 2011, the annual demand for gold has increased from about 2,600 tons to more than 4,700 tons, pushing prices up to a peak of 1,900 USD/ounce in 2011, then hindered market demand. As a result, the price has dropped to only 1040 USD/ounce by the end of 2015 and early 2016, from then until 2019, when central banks started lowering interest rates, dragging government bond yields down, gold become more attractive to investors.

So the question now is whether gold (XAU/USD) will continue to increase in 2020-2021 or not? And what factors will play the main role?

1. Economic Instability

Thanks to special physical properties, gold is both a special commodity and a currency to store and trade. Since ancient times, gold has always played an important role in the economy, with the role of real assets used to reserve, whenever the world economy is unstable, people will rush to buy gold. The reason is that when the economy is difficult and unpredictable, doing businesses will become more struggling, other high-risk investment channels, declined securities, devalued currencies, etc. gold is considered as the most convenient safe haven asset. Great buying demand will push gold price up.

2. US – IndexBecause the currency US dollar acts as an international payment currency, and the world price of gold is also traded in US dollar, so the relative value of gold is expressed in US dollars. Therefore, when the USD depreciates, it means that gold price increases and vice versa.

3. Gold SupplyBecause gold is also a commodity, its price also changes according to the law of supply and demand. There are three factors that change the world's gold supply.

· First, the nation's gold reserves policyIf one or several countries decide to buy gold to store in large quantities, the world gold price will increase and vice versa. Therefore, monitoring the world's news regarding gold trading policies of major central banks will be good for predicting gold prices.· Second, the influence from the gold trading of large fundsCurrently there are a number of large funds holding huge amounts of gold. Every movement of these big players will has a strong influence on world gold prices. In particular, these funds have launched fund certificates to attract many speculative investors into this market.These funds include:- IMF: holds about 3,100 tons of gold- SPDR Gold Trust: This is considered the largest gold investment fund in the world. This fund currently holds about 768 tons (2019).· Third, the world gold production/mining

The countries known for having the largest gold mining output in the world are China, Australia, Russia, USA, South Africa and Canada. Every time the mining output in these countries declines, it will cause world gold prices to rise and vice versa.

Since the Covid-19 pandemic began to spread from the beginning of 2020, putting the world into a deep crisis, companies filed for bankruptcy are increasing, unemployment rate goes up day by day. In addition, those lockout policies to limit the widespread of Covid-19 epidemic have caused a decline in exports, forcing the world's central banks to launch bailouts for their economy. In the US, for example, the US Federal Reserve has launched a $ 2,000 billion bailout package, leading to a decline in bond yields and an increase in the risk of inflation, which has slipped prices for other assets and currencies.

- However, the pandemic situation is still quite complicated in the present context, the second wave has come back in quite a lot countries and territories, plus the widespread situation is quite unpredictable, for example, Australia and several US states have reported a spike in new cases of virus infection as well as Latin America or India, the second largest consumer of gold bullion in the world.

- From the beginning of the year until now, gold price has increased by 15% and is currently traded at 1,750 USD/ounce the recent peak is reported in 2011 when gold was priced at 1,900 USD/ounce.

- The epidemic has caused some of the world's largest gold factories to cease operations due to a government lockout policy, leading to the scarcity of gold so that gold price has skyrocketed.

Adding all the factors, selling gold in the present time is no different from fighting against the market. When the crowd is looking for a place to ensure their assets are safe, given the instability of the world economy.

II. Technical Analysis

1. Monthly Frame:

· Looking at the monthly chart, we can see when the MA50 crossed the MA200 and up to the present time the two MA lines are still rising and there has been no sign of decline even though there was a correction but it was not significant.

· After the peak price in 2011 1,900 USD/ounce (1), then the price was adjusted and tested again at the price of 1,799 USD/ounce (2) before going down and create a wedge (3) and breakout model at 1,344 USD/ounce (4), the current price is very close to the resistance area of 1,799 USD/ounce (2), this is still a big question whether gold will break the resistance or not? (Figure 1)

2. Weekly Frame:

· In this time frame, two moving averages have formed the Golden Cross pattern when the MA50 crossed above MA200 (1) after a period below MA200. The Golden Cross model is a very important model in the financial market as the 50-week short-term average of prices surpasses the previous 200-week average price signaling a very long uptrend. That is the evidence for the price broke up from 1,267 USD/ounce to 1,770 USD/ounce. (Figure 2)

· After gold has adjusted to 1,450 USD/ounce (2) and broke through to 1,760 USD/ounce accumulated in the region of 1,658 USD/ounce to 1,760 USD/ounce (3) in the past 2 months. Besides, increasingly higher bottoms create a premise to leverage a breakout to the peak in 2011 - 1,900 USD/ounce, this price level is absolutely possible.

Figure 2

Moreover, the current price is forming wave 5 in the Elliot wave and there is no sign of peaking (Figure 3).

Figure 3

III. Summary

Through what has been analyzed, gold price in long-term is still in the uptrend. However, in order for gold to continue to rise up in the coming time, in authors point of view, it still needs a further adjustment to leverage the future growth.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Will Gold Shine Brighter in 2025?

Gold is poised for significant gains in 2025, with experts predicting its price to climb between US$2,900 and US$3,000 per ounce or potentially higher. Analysts attribute this optimistic outlook to sustained gold purchases by central banks, ongoing geopolitical tensions, declining global interest rates, and persistent economic uncertainties. These factors, coupled with gold’s status as a hedge against inflation, underline the precious metal’s appeal in volatile times.

Exness Lowers XAUUSD Spreads by 10% for Better Gold Trading

Exness reduces XAUUSD spreads by 10%, offering professional traders, investors, and analysts improved gold trading conditions with lower costs and better reliability.

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

KVB Market Analysis | 29 August: Gold Price Recovers as Market Eyes US Rate Cuts and Geopolitical Tensions

Gold prices (XAU/USD) rebounded on Thursday after dipping below $2,500 per ounce. Expectations of US interest rate cuts and ongoing political and geopolitical tensions are boosting demand for gold, as lower rates reduce the opportunity cost of holding the non-yielding metal.

WikiFX Broker

Latest News

Will Gold Prices Continue to Rise Due to Trump’s Tariffs?

Why the Federal Reserve Is So Important

Boerse Stuttgart Digital Secures EU-Wide MiCAR Crypto License

SEC Fines Vanguard $106 Million Over Misleading TRF Tax Disclosures

Swiss Population Strongly Opposes Abolition of Cash, Philoro Study Reveals

Oil Prices Continue to Rise Due to Sanctions

Currency Calculator