简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Longer Wait Ahead for Turkish Rate Cuts After Inflation Reversal

Abstract:Turkey‘s central bank surprised by raising its inflation projections for the end of this year by more than a percentage point, a sign it won’t rush to resume interest-rate cuts after a two-month pause.

Turkey‘s central bank surprised by raising its inflation projections for the end of this year by more than a percentage point, a sign it won’t rush to resume interest-rate cuts after a two-month pause.

Consumer-price growth will finish the year at 8.9%, compared with a previous forecast of 7.4%, Governor Murat Uysal said Wednesday in Ankara as he unveiled the third quarterly inflation report of 2020. The forecast implies that Turkeys policy rate -- currently at 8.25% -- will be negative for the rest of the year when adjusted for inflation.

Its the first time this year that the central bank increased its price outlook for 2020. Restrictions imposed to stop the coronavirus are hurting supply chains and driving inflation higher, according to Uysal.

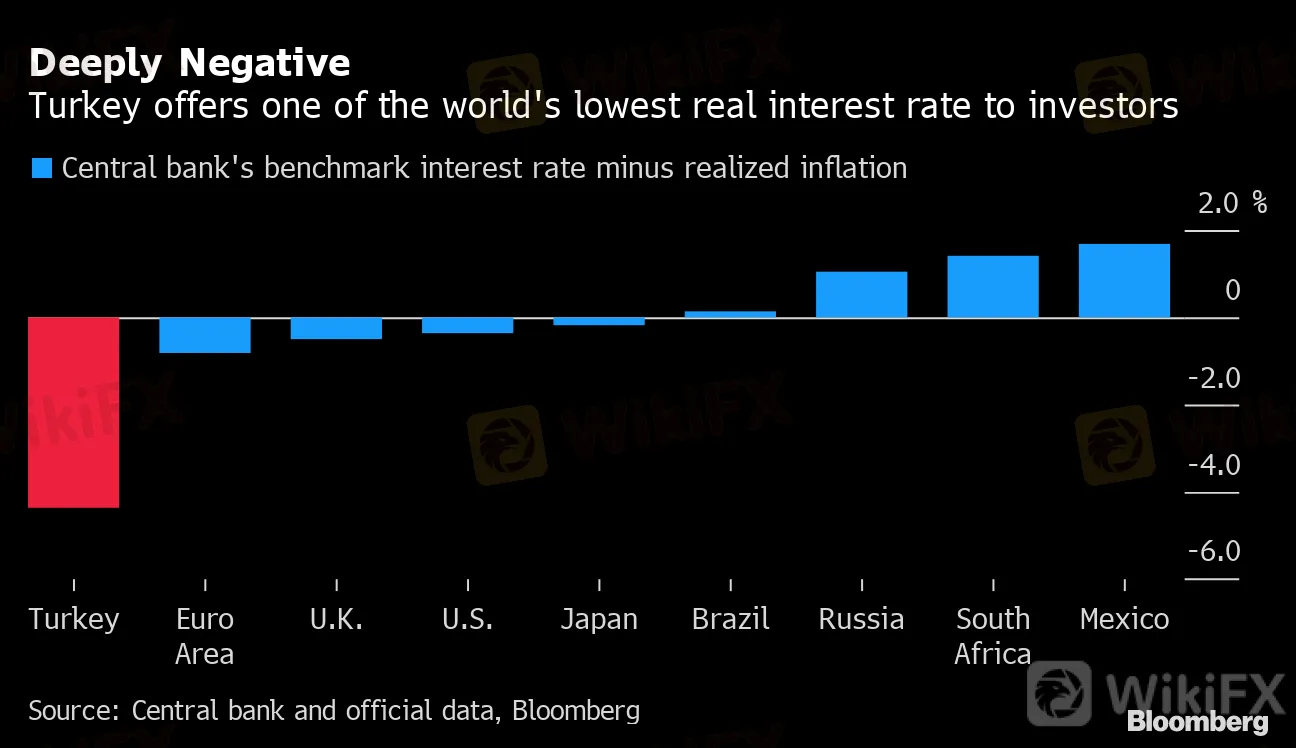

Deeply Negative

Turkey offers one of the world's lowest real interest rate to investors

Source: Central bank and official data, Bloomberg

Less favorable prospects facing Turkey could mean a longer wait before the central bank resumes an easing cycle that delivered 1,575 basis points of rate cuts in nine consecutive steps since last July. More caution may be warranted now that Turkeys inflation-adjusted borrowing costs are among the lowest in the world while state lenders unleash credit and policy makers inject liquidity by scooping up government bonds.

“Our current monetary-policy stance is in line with the inflation outlook,” Uysal said.

| What Our Economists Say... |

|---|

| “The latest forecast revision was surprising. It indicates that inflation will remain above the policy rate for the rest of the year. With the central bank governor previously looking to provide a ‘reasonable’ rate of real return for investors, the room to ease further is all but non-existent.”-- Ziad Daoud |

Turkey is among several major emerging economies where central banks have recently turned more cautious or moved slower than anticipated in lowering rates. With the lira again coming under pressure in recent days, policy makers may also opt to hold off on easing for longer to avoid leaving the currency even more exposed.

The lira extended losses during the briefing and traded 0.4% weaker against the dollar as of 1:09 p.m. in Istanbul. It was among just three currencies in emerging markets to depreciate on Wednesday and had the worst performance of the group.

Stimulus, Lira

A combination of credit stimulus, currency depreciation and a recovery in energy costs has reversed a deceleration in prices and stoked a pickup in inflation from May.

Annual price growth accelerated for a second month in June to 12.6%. A decline in inflation will start from July, according to Uysal.

Most economists until recently still saw rates falling further this year. But sentiment has started to turn: Barclays Plc changed its call and now sees borrowing costs on hold for the rest of the year, while analysts from JPMorgan Chase & Co. to Goldman Sachs Group Inc. say rates will have to rise soon.

Turkeys central bank projects inflation will reach 6.2% by the end of 2021, an upward revision from 5.4%

End-2020 food inflation is estimated at 10.5%, compared with 9.5% previously

The central banks 2020 average oil price forecast was raised to $41.6 per barrel from $32.6

| Survey ofExpectations | GovernmentEstimate | Central BankProjection | OfficialTarget | |

|---|---|---|---|---|

| Year-end 2020 | 10.2% | 8.5% | 8.9% | 5% |

| Year-end 2021 | 6% | 6.2% | 5% |

The central bank has never met the 5% inflation target since its introduction in 2012. President Recep Tayyip Erdogan, who advocates an unorthodox theory that high rates cause rather than curb inflation, fired Uysals predecessor a year ago for not easing policy.

“We see Turkeys monetary policy as historically ineffective at managing inflation,” S&P Global Ratings said in a report last week. “The central bank has faced increasing political pressure in recent years, which we consider impairs its effectiveness, often by delaying timely responses to rising inflation.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator