Score

PFD

United Kingdom|10-15 years|

United Kingdom|10-15 years| https://www.pfd-nz.com/en

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

PFD-Real

Influence

C

Influence index NO.1

India 3.87

India 3.87MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

Influence

C

Influence index NO.1

India 3.87

India 3.87Contact

Licenses

Licenses

Licensed Entity:PACIFIC FINANCIAL DERIVATIVES LIMITED

License No. 28944

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 7 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United Kingdom

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed PFD also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

pfd-nz.com

Server Location

United States

Website Domain Name

pfd-nz.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

0001-01-01

Server IP

45.55.139.38

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Mark Wynon VICKERMAN

Director

Start date

2021-06-21

Status

Employed

PACIFIC FINANCIAL DERIVATIVES LIMITED(New Zealand)

Joseph Wilhelmes VAN WIJK

Director

Start date

2016-03-01

Status

Employed

PACIFIC FINANCIAL DERIVATIVES LIMITED(New Zealand)

PAUL FRANCIS LOUIS

Secretary

Start date

2011-06-08

Status

Employed

PACIFIC FINANCIAL DERIVATIVES LTD(United Kingdom)

Company Summary

| PFD Review Summary | |

| Founded | 1999 |

| Registered Country/Region | New Zealand |

| Regulation | FMA |

| Market Instruments | Spot foreign exchange, spot metals, spot crude oil, commodities, CFDs (contracts for difference), indices, and CFD contracts on futures |

| Leverage | 1:300 (PFD Trader) |

| EUR/ USD Spread | 0.2 pips for EUR/USD |

| Trading Platforms | MT4 |

| Minimum Deposit | None |

| Customer Support | Live chat, phone, email, Twitter and Facebook |

What is PFD?

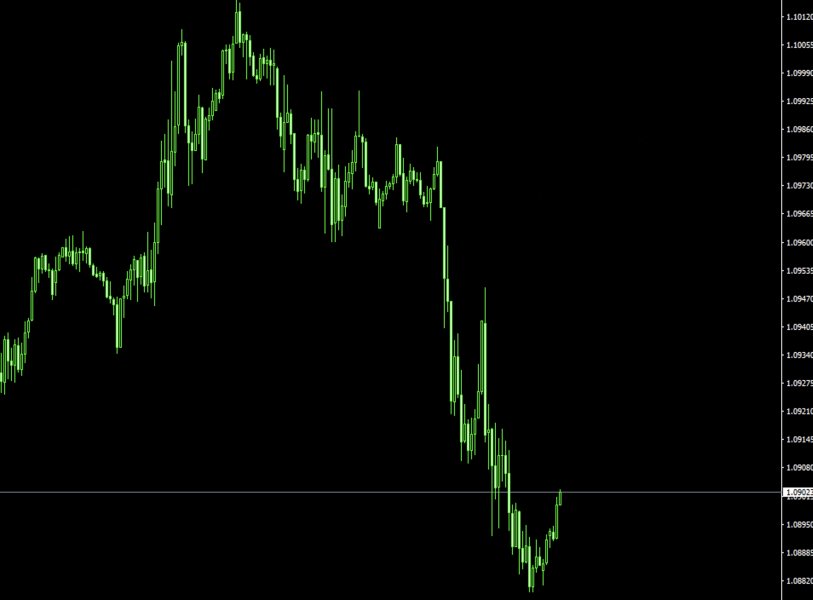

PFD, also known as Pacific Financial Derivatives Trading Limited, is a company that was founded in 1999 and is registered in New Zealand. It is regulated by the FMA in New Zealand. PFD offers various financial instruments for trading.The leverage offered for the PFD Trader account is 1:300. PFD utilizes the popular MT4 trading platform.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Pros:

- PFD is regulated and authorized by the Financial Markets Authority (FMA) in New Zealand, providing a certain level of reliability and confidence to traders.

- Founded in 1999, PFD has many years of industry experience, which can indicate their expertise and knowledge in the financial markets.

- They offer a wide range of trading instruments including spot foreign exchange, spot metals, spot crude oil, commodities, CFDs (contracts for difference), indices, and CFD contracts on futures, allowing traders to diversify their investments and take advantage of different market opportunities.

- PFD provides the widely-used MetaTrader 4 (MT4) platform, which is known for its advanced charting capabilities, automated trading features, and a large community of traders.

- Live chat support is available, offering instant assistance and resolving queries in real-time.

Cons:

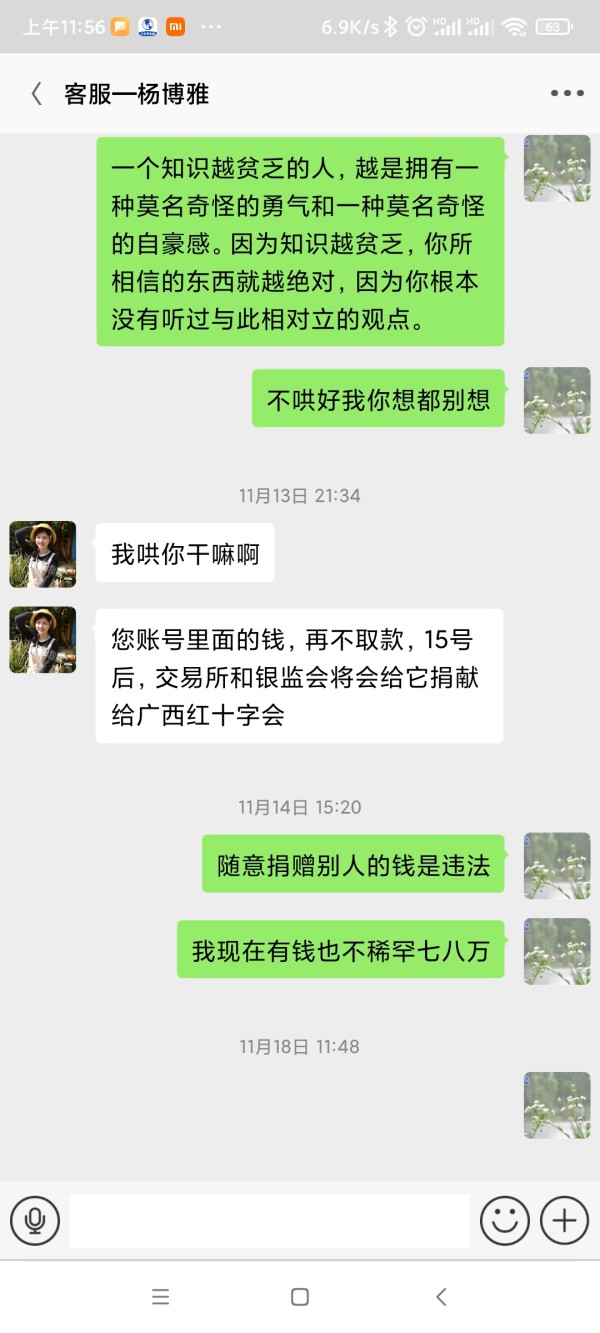

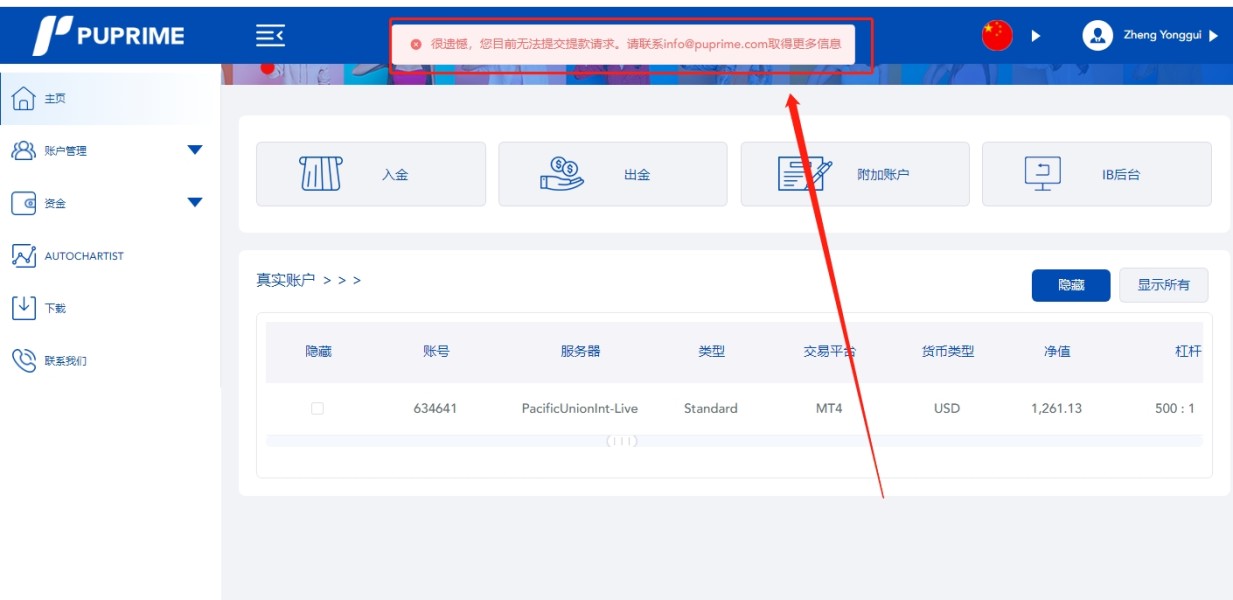

- There have been reports of scam and withdrawal issues associated with PFD, which can raise concerns about the reliability and trustworthiness of the broker.

Is PFD Safe or Scam?

PFD is licensed by the Financial Markets Authority (FMA) under the Straight Through Processing (STP) License No.28944. However, there have been negative reports about difficulties with withdrawals and potential scams associated with PFD. It is important for traders to be aware that all investments come with some level of risk, and it is crucial for them to conduct their own research and carefully evaluate their options before investing.

Market Instruments

PFD (Pacific Financial Derivatives) offers trading instruments across different asset classes, providing clients with various options for investment and trading.

- Spot Foreign Exchange (Forex): PFD allows clients to trade spot forex, which involves buying and selling currency pairs at the current market price. Forex trading provides opportunities to speculate on the fluctuations in exchange rates between different currencies.

- Spot Metals: PFD offers trading in spot metals, which typically includes popular precious metals like gold (XAU), silver (XAG), platinum (XPT), and palladium (XPD). Clients can take positions in these metals, speculating on their price movements.

- Spot Crude Oil: PFD provides trading opportunities in spot crude oil, enabling clients to speculate on the price movements of popular crude oil contracts, such as Brent Crude Oil (UK Oil) and West Texas Intermediate (US Oil).

- Commodities: PFD facilitates trading in various commodities that can include agricultural products (like corn or wheat), energy products (such as natural gas or heating oil), and other commodities like sugar, coffee, or cotton. Clients can take positions based on their views on the future price movements of these commodities.

- CFDs (Contracts for Difference): PFD offers CFD trading, which involves speculating on the price movements of various financial instruments without owning the actual assets. This can include CFDs on stocks, indices, commodities, and other financial instruments.

- Indices: PFD allows clients to trade contracts based on stock market indices like the S&P 500, FTSE 100, NASDAQ, or Nikkei 225. These contracts enable investors to take positions on the overall performance of a specific stock market index.

- CFD Contracts on Futures: PFD provides access to trading CFD contracts based on futures contracts across different asset classes. These futures-based CFDs allow clients to trade on the future price movements of assets like commodities, currencies, or indices.

Account Types

PFD offers three different account types for investors: the PFD Trader account, the PFD Pro account, and the PFD ProPlus account.

PFD Trader account:

This account type is primarily designed for new or novices investors who wish to start trading with low capital. It provides a commission-free trading environment with no minimum deposit requirement.

PFD Pro account:

This account type is well-suited for intermediate traders who need higher leverage and ECN pricing. It also offers commission-free trading with access to a wide range of instruments and tools. There is no minimum deposit requirement for this account type.

PFD ProPlus account:

This account type is designed for professional traders and requires a minimum initial deposit of $1,000. It offers institutional grade liquidity with ECN pricing and a wide range of trading tools and instruments. This account type also includes the option of using the PFD Islamic account, which adheres to the principles of Islamic finance and is compliant with Shariah law.

Islamic account:

PFD offers an Islamic account, also known as a swap-free account, that adheres to the principles of Islamic finance.In an Islamic account, overnight interest charges, known as swap or rollover fees, are not applied to trades held overnight.

Leverage

PFD (Pacific Financial Derivatives) offers varying levels of trading leverage based on the account types available to its investors.

For the PFD Trader account and the PFD Pro account, traders can access a maximum leverage of up to 1:300. This level of leverage allows investors to control a larger position size in the market with a smaller amount of capital, potentially amplifying both gains and losses.

In contrast, the PFD ProPlus account features a slightly lower maximum leverage of up to 1:100. While still providing significant trading flexibility, this level of leverage may be more suitable for traders who prioritize risk management and seek a more conservative approach to their trading activities.

Spreads & Commissions

PFD has three types of accounts: PFD Trader, PFD Pro, and PFD ProPlus, each with different spreads and commissions.

The PFD Trader account does not charge any commission but has higher spreads, starting at 0.5 pips for EUR/USD, 0.6 pips for GBP/USD, and 0.9 pips for AUD/USD.

The PFD Pro and PFD ProPlus accounts charge a commission of $1 per side/standard size lot and have lower spreads; for the PFD Pro account, spreads start at 0.2 pips for EUR/USD, 0.5 pips for GBP/USD, and 0.8 pips for AUD/USD, while for the PFD ProPlus account, spreads start at the same levels but with additional trading benefits.

| Account Type | Commission (per side/standard size lot) | Spread for EUR/USD | Spread for GBP/USD | Spread for AUD/USD |

| PFD Trader | None | 0.5 pips | 0.6 pips | 0.9 pips |

| PFD Pro/ PFD ProPlus | $1 | 0.2 pips | 0.5 pips | 0.8 pips |

Trading Platforms

PFD extends its trading platform offerings to clients through the widely recognized MetaTrader 4 (MT4) platform. The platform lineup includes options such as PFDTrader (MT4), PFDPro (MT4), PFDProPlus, Multi-Terminal, MAM (Multi-Account Manager), and FIX API, delivering a range of functionalities suitable for various trading strategies and account management requirements.

Specifically, PFDPro (MT4) stands out as a solution designed to empower users with the unique features of the MetaTrader 4 platform while offering enhanced capabilities, including the management of multiple forex trading accounts simultaneously. This feature proves beneficial for account managers and traders seeking a practical and efficient way to oversee multiple accounts, enabling streamlined account management and trading activities.

Furthermore, the inclusion of offerings such as Multi-Terminal, MAM, and FIX API demonstrates PFD's commitment to addressing the needs of different trading styles and account management preferences, reflecting a holistic approach to client support and technology innovation within the trading environment.

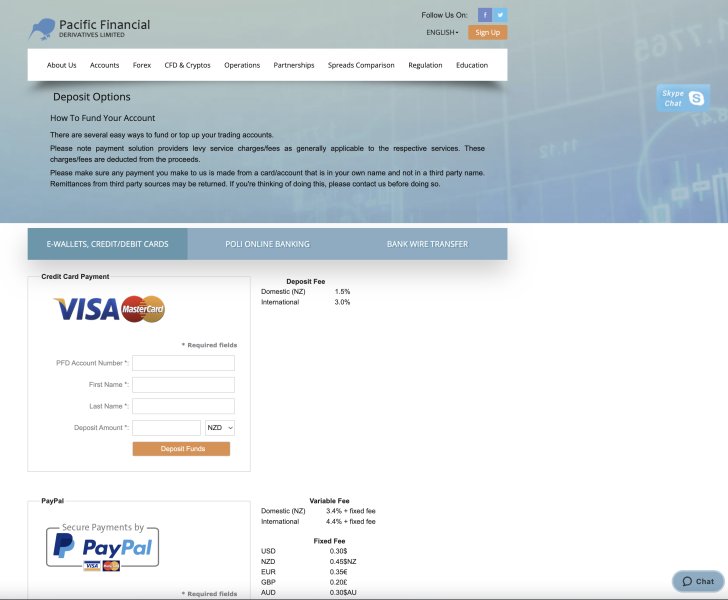

Deposits & Withdrawals

PFD (Pacific Financial Derivatives) offers a range of deposit and withdrawal methods to cater to the needs of its clients. For deposit transactions, clients can utilize popular e-wallets such as VISA, Mastercard, and PayPal, New Zealand POLI internet banking payments and bank wire transfer options.

When it comes to international clients, specific fees and commissions apply to certain deposit methods.

| Method | Deposit Fees/Commissions | Withdrawal Fees/Commissions |

| VISA/Mastercard (International) | 3% commission | No fees |

| PayPal | 4.4% fixed fee + applicable transaction fees | |

| NETELLER (International) | 3.2% fee (minimum $1) + $0.29 fee per transaction | |

| New Zealand POLI internet banking | 1% fee per transaction, capped at a maximum of US$3 | |

| Wire Transfer | N/A |

User Exposure on WikiFX

Please ensure that you thoroughly examine the information provided on our website regarding reports of withdrawal difficulties and scams. We strongly advise traders to carefully assess the associated risks of trading on an unregulated platform. Prior to engaging in any trading activities, we recommend checking our platform for relevant information. In the event that you come across any fraudulent brokers or have personally experienced such unfortunate incidents, kindly inform us through the Exposure section. Your cooperation is highly appreciated, and our team of experts will make every effort to address and resolve the issue.

Customer Service

PFD offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have. It's a convenient and effective communication channel that can improve customer satisfaction and increase sales.

Customers can visit their office or get in touch with customer service line using the information provided below:

Continual 24 hour support from 10:00 am Monday New Zealand time (11:00 PM Sunday London time, 6:00 PM Sunday New York time) through 10:00 am Saturday New Zealand time (11:00 PM Friday London time, 6:00 PM Friday New York time)

Telephone: +64 9 632 0129/ 100/121

Email: info@pfd-nz.com

Address: Level 8, Swanson House,12- 26 Swanson St., Auckland Central 1010, New Zealand

Moreover, clients could get in touch with this broker through the social media, such as Twitter and Facebook.

Conclusion

PFD is a New Zealand-based forex broker that offers a range of trading instruments, including forex, commodities, and indices, through the MetaTrader 4 platform. The company has been operating for many years and is regulated by the FMA in New Zealand. While the broker has some positive aspects, such as a variety of trading instruments, an established reputation, and MT4 platform support, it also has some concerns, including reports of scam and withdrawal issues. Hence, it's important for traders to make sure to research and understand the specific terms, conditions, and risks of PFD before engaging with the company's products and services.

Frequently Asked Questions (FAQs)

| Q 1: | Is PFD regulated? |

| A 1: | Yes. It is regulated by FMA. |

| Q 2: | How can I contact the customer support team at PFD? |

| A 2: | You can contact via telephone: +64 9 632 0129/ 100/121, email: info@pfd-nz.com, Twitter and Facebook. |

| Q 3: | What platform does PFD offer? |

| A 3: | It offers MT4. |

| Q 4: | What is the minimum deposit for PFD? |

| A 4: | The minimum initial deposit to open an account is free. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 10-15 years

- Regulated in New Zealand

- Straight Through Processing (STP)

- MT4 Full License

- Regional Brokers

- High potential risk

Comment 11

Content you want to comment

Please enter...

Comment 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Mr. Rolex

Portugal

I deposited via card on this broker and after a few trades I immediately realized market manipulation and decided to withdraw my money, To my surprise they didn't follow AML rules and requested a different withdrawal method instead of returning my money to the card. This is a fraud broker and a money laundering. stay away

Exposure

2023-12-01

kujyesun

Hong Kong

Pacific Finance scam our money on the ground of refund, freeze our account and ask you to pay.

Exposure

2022-12-27

神经蛙9539

Hong Kong

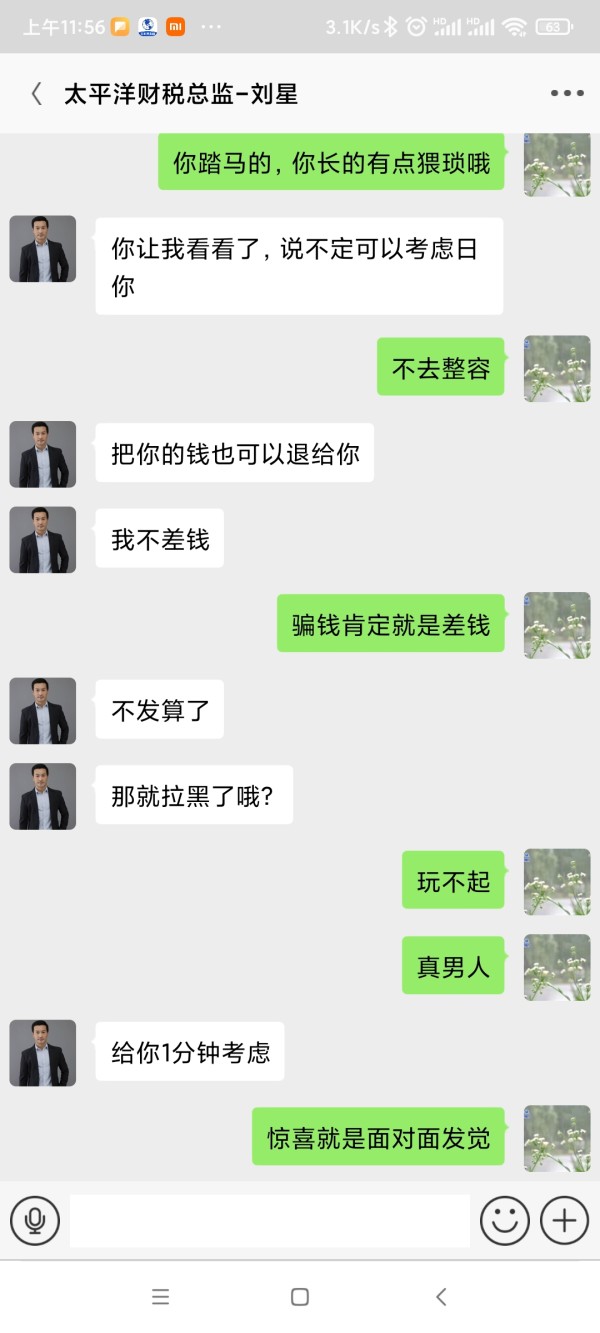

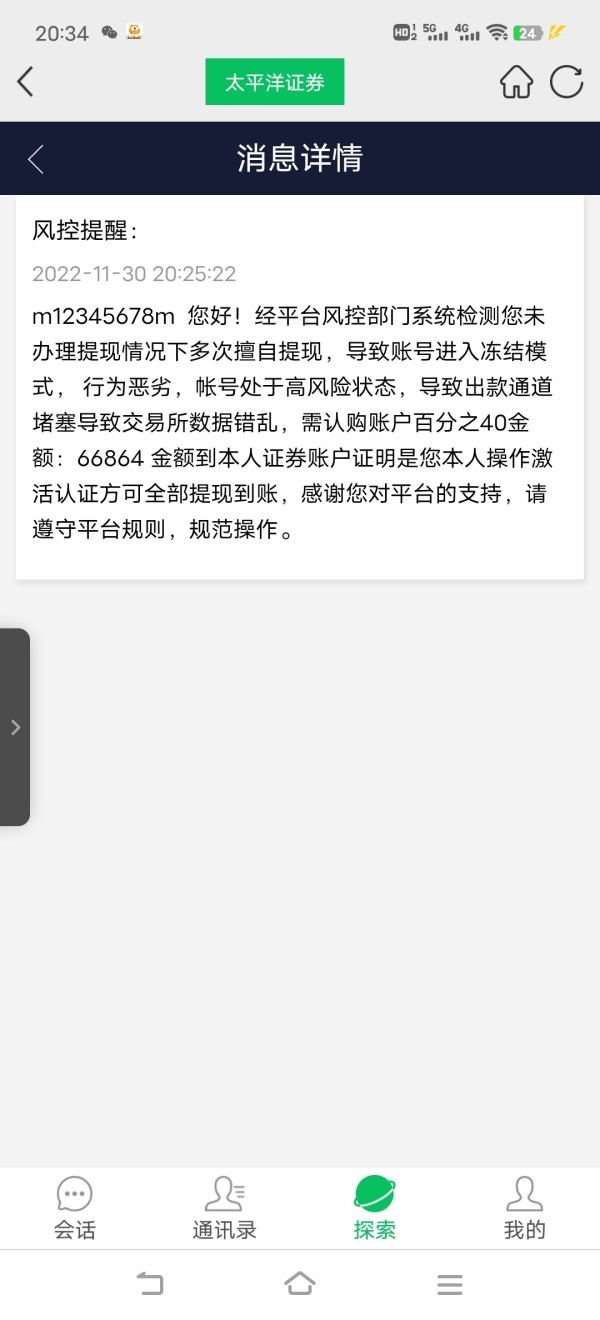

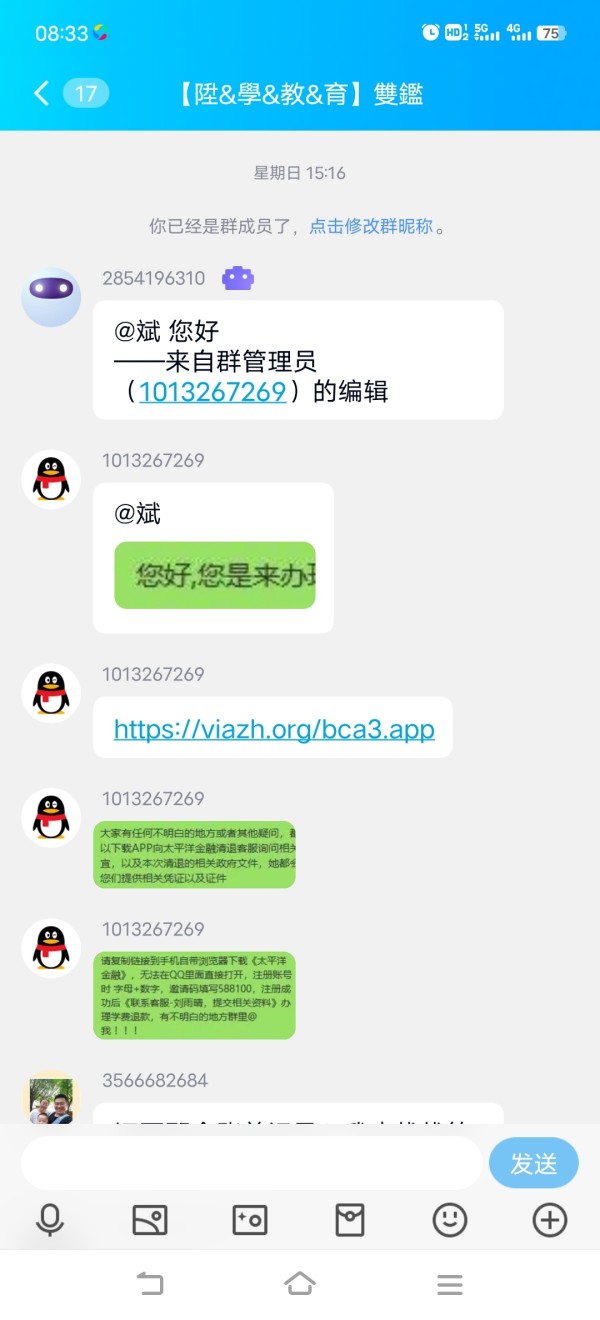

Inducing to join a group to buy securities on the grounds of refunding tuition fees, and keep asking you to deposit on the ground of inappropriate operation. In the end, you are not allowed to withdraw money and use the risk control as an excuse, and you have to remit money before you can withdraw cash. I just beg you to return my principal, I beg you

Exposure

2022-12-01

FX3338312173

Hong Kong

I invested 3,000 US dollars and lost more than 1,700 US dollars, and there are more than 1,200 US dollars left, and the platform does not withdraw it. Working hard to save money to trade in foreign exchange. Not just the loss, they do not withdraw the remaining funds. Fraud platform.

Exposure

2022-04-27

继续前行

Hong Kong

My friend has three accounts and none of these accounts have been allowed to withdraw funds.

Exposure

2021-06-08

Resurgam·'

Hong Kong

The withdrawal was adopted. But customer service told me that the bank said I didn’t have enough turnover so I should pay 50,000 for three times to improve my turnover. The withdrawal was returned. Now I just want my principal back. My family has been ruined because of this thing. I will be sent to prison if I can’t get my principal back. I beg you to return my principal.

Exposure

2020-09-03

FX3099448177

Hong Kong

I failed to withdraw my fund because of API abnormal. Once, my large amount of deposit was withheld by the facade website directly. All its certificate are fake. It is easy to establish a website by a foreign server.

Exposure

2020-01-07

FX3998489464

Hong Kong

The withdrawal is unavailable because of abnormal account inspected by risk-management system.Once, deposited large amount of fund and it was all deducted by the website.This website is a facade without credit and certificates.Its registration is located abroad, as well as its server.Without regulation, it goes unpunished.

Exposure

2019-11-30

一窍不通

Hong Kong

The website was disabled.

Exposure

2019-10-27

彭韵菲

Taiwan

The platform of Pacific Finance is quite good, and I have traded on it twice. Especially foreign exchange currency pairs are very good to trade, no additional commissions are charged, only spreads are charged. The execution speed of the order is also very fast, and the withdrawal is also very timely. This platform is a rare and reliable foreign exchange trading platform.

Positive

2022-12-13

FX1037547299

Venezuela

So far I think that the service provided by this company is satisfactory for me. I can trade currencies, precious metals, commodities, etc. There are some transaction costs, but not too high, which is acceptable. After all, a forex trading company is not a charity.

Positive

2022-11-24