简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Criteria for Currency Pairs Selection Before You Start the Market Analysis

Abstract:The biggest mistake made by many traders over the years is that they will trade whatever currency pairs appearing in front of them.

The biggest mistake made by many traders over the years is that they will trade whatever currency pairs appearing in front of them. Right after logging in their accounts, they will straightaway perform the technical analysis only by viewing 2 or 3 graphs of currency pairs.

Unfortunately, when the graphs do not fulfill their expectation, they will start to claim what just happened is a 'FAKE BREAKOUT', or a 'FAKE REJECTION'. Indeed, it happens when they ignore the important criteria for choosing a currency pair in trade, which will eventually cause a great loss to their tradings.

Life is full of CHOICES. Even when it comes to foods, the more nutritious ones with higher quality are selected because they offer us a healthier life. And of course, we will avoid the foods that are harmful to our health. It means that we must be very picky in choosing foods whenever we want to eat. Hence, not all the foods in front of us are worth eating.

Similarly, this is what we should do while we are trading. We must have a WHY criteria for CHOOSING a certain currency pair. If the broker offers us 30 currency pairs, it is not necessary for us to trade all them in random circumstances. This is simply because the movement & volatility of each pair is not the same. Thus, the most important thing we need to do before analyzing the market is to screen all the currency pairs offered to us. I repeat, ALL the currency pairs.

IMPORTANT TIPS AS A GUIDE TO CHOOSE A CURRENCY PAIR

1. Choose a movement range that fits your capital strength.

2. Prioritize the currency pair with a clear movement.

3. Prioritize the currency pair which you traded yesterday.

Alright, let's take a look at each of the above tips.

First: Choose aMovement Range that Fits Your Capital Strength

One of the features that distinguish one currency pair from another is its daily trading range. The higher the range of a currency pair, the more vulnerable it is to a massive risk in trading, and vice versa. New traders are encouraged to start the trades with a low range of currency pairs so that they are not exposed to a huge loss.

You can measure the graphs of daily trading range movement by measuring the length of D1 candlestickand considering the lowest price andthe highest price. You can click on the crosshair and measure the range from LOW to HIGH on that daily candlestick.

Usually, the average movement is calculated within 2 weeks or as much as 10 D1 candlesticks.

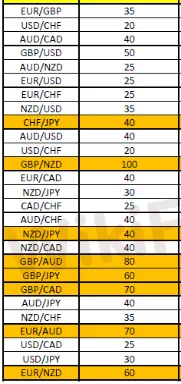

Here is an example of a range reading that I have made in the last few months. This range needs to be checked over time as it changes with the seasons. But the change does not happen every day. Probably, the changes occur biweekly.

Second: Prioritize the Currency Pair with aClear Movement

Each broker offers 20 to 30 currency pairs to be traded. To make it easier for you to analyze the market, you are encouraged to choose a currency pair with clear movements and easy to read.

If the currency pair is performing sideways movements, please ensure the formed candlesticks arrangement is very thin and flat. Meanwhile, if the movement is based on trending, please make sure that the latest wave formed is from clear curves.

Please refer to the diagram below as a guide.

Movements as shown in the diagram below will make it difficult for us to identify the latest trends of the graph since it does not show a significant direction. The graph moves into a group of zones and seems to have no direction.

If we enter the trade here, it will keep you stuck because the market is not moving in one direction. When we fail to identify the trend, we are prone to make the wrong entry.

Try to get easy-to-read movements as the diagram shown below. The curves produce a 1-way wave which clearly indicatesthat the graph is moving towards a trend.

The graph movements appear to be balanced at where the range from HIGH 1 to HIGH 2 is almost similar to the range from LOW 1 to LOW 2. This clearly indicates that the market moves freely and the trend is dominated by the SELLER.

Once we have the trend reading (for example, downtrend), the next step is to simply look for a slightly high price as the best place to SELL.

When we can easily identify trends, we will find it easier to get a profitable entry, and the tendency to make entry errors is lower.

Third: Prioritize the Currency Pair Which You Traded Yesterday

List the currency pairs that you traded today, so as to review next days response of the graph movement on the currency pairs .

This is because you will find it much easier to readtoday‘s graph by taking yesterday’s graph responseas your guide. Besides, it is easier for you to read graphs that you have analyzed rather than the graphs that you have not analyzed for a long time.

Sometimes, we can still use the graphs set up yesterday to continue trading now. For example, when we are setting up todays graph, we must verify whether the latest graph movement is a response to yesterday's graphs .

Conclusion

The three criteria above are guidelines about what you need to notice. They canevaluate on a currency pair, thus youcanchoosethe pair to be traded accordingly.

After screening the currency pairs firstly, it will allow you to narrow your focus on what you need only. You need to apply the same strategy when you start your analysis. Your analytical work will be easier if you focus on the currency pair that clearly sees the movement. Currency pairs with vague movements are ignored at first.

Simple quote to describe this is:

IF THERE IS A SIMPLE WAY FOR MAKING PROFIT,

WHY YOU STILL WANT TO CHOOSE A COMPLICATED WAY?

Hopefully, the knowledge in this article will benefit you.

Keep following my writing for more powerful articles, knowledge sharing and tips in the future.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Influencer-Led $232M Crypto Scam Exposed in South Korea

Currency Calculator